Robert Way

Thesis

BYD (OTCPK:BYDDY) stock has lost approximately 30% since news surfaced that Warren Buffett cut his stake in BYD’s H shares, first from 20.04% to 19.07% and then from 19.07% to 18.8%. While there might be multiple potential reasons why Buffett has decided to trim his stake, the market is worried that the famed value investor sees no value anymore.

In my opinion, investors should not read too much into Buffett’s action (in this specific case). Reflecting on BYD’s amazing fundamentals and business potential leads me to believe that Warren Buffett sold his stake too early. Personally, I argue BYD is materially undervalued, as I calculate a fair implied share price of $66.50.

A Car Manufacturing Giant In The Making

BYD, which stands for Build Your Dreams, is a China-based holding company that has become a leading manufacturer of new-electric vehicles (short: NEV). But BYD also operates other segments, including: a competitive EV batteries business, that accounts for an estimated 10% of global manufacturing capacity; a unit dedicated to photovoltaic technology; and a manufacturing arm that produces and assembles mobile handset components and other related products.

Supercharged Growth

During the past few years, BYD has enjoyed supercharged growth – both with regard to the company’s top- and bottom line. Notably, from 2018 to 2021, revenues surged from $19.7 billion to $32.6 billion, which implies a 3-year CAGR of almost 18%. Over the same period, net income expanded by 13% CAGR to $524 million. Cash from operations increased seven-fold: From $1.4 billion in 2018 to $9.8 billion in 2021.

BYD’s strong growth does not show any signs of slowing. In fact, from April to the end of June, despite a very challenging macroeconomic backdrop for China’s economy, BYD generated revenues of $12.7 billion. This implies a growth rate of about 68% as compared to the same period one year prior. Respectively, net income jumped to $457 million versus $117 million in Q2 2021. And in August 2022 alone, BYD reported NEV sales of 174.9k units, which represents a +185% year-over-year growth versus August 2021 (Source: Bloomberg Intelligence).

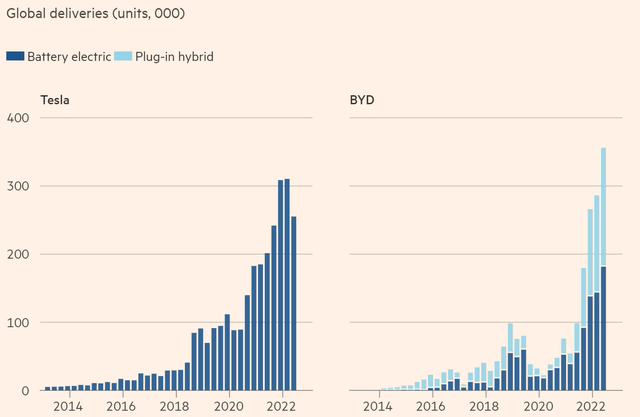

More NEV Deliveries than Tesla

BYD bulls, myself included, like to point out that in the first half of 2022, BYD delivered more NEV cars than Tesla (TSLA): 641,000 cars for BYD versus 564,000 for Tesla.

True, BYD cars, available starting from $15,000, are much cheaper than Tesla’s. Moreover, Tesla’s cars are ‘battery electric’ only, while BYD also sells ‘hybrid plug-ins’. This, however, shouldn’t render BYD’s achievement less notable.

More Growth Ahead

According to Bloomberg Intelligence Research (as of 03 September 2022), the electric vehicles market in China is expected to sustain a compounded annual growth rate of about 25% until 2025. And, reflecting on BYD’s attractive value-to-price proposition, I believe the company is well positioned to ride the tailwind of an expanding market while also taking market share. Consequently, greater 30% market growth for BYD should not be a stretched assumption, in my opinion.

Former General Motors (GM) executive Michael Dunne said about BYD:

They are looking increasingly like the Toyota of China’s electric vehicle industry.

Also, analysts believe that BYD will see sustained high growth rates well through 2024. According to consensus data compiled by Bloomberg, expectations indicate that BYD could achieve revenues of $134 billion in 2025, which would represent a CAGR of more than 30% – in line with my own personal assumption. Also, for 2025, net income is estimated between $3.5 billion to $5.2 billion, with the average anchored at $4.8 billion.

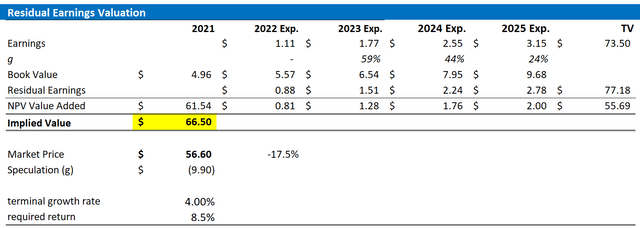

Target Price Estimation

To estimate a stock’s fair implied share price, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With regard to my BYD valuation, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on BYD’s cost of equity at 8.5%.

- To derive BYD’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate after 2025, I apply 4%, which is arguably very conservative (one percentage point higher than estimated nominal global GDP growth).

Given these assumptions, I calculate a base-case target price for BYD of $66.50/share (almost 20% upside).

Analyst consensus; author’s calculation

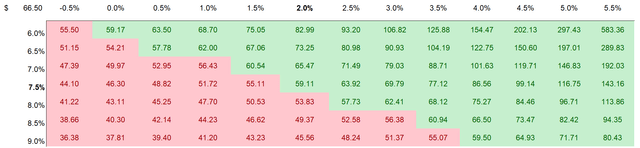

Notably, my bullish price target is not a reflection of a specific combination of growth and cost of capital. In fact, please find below a sensitivity analysis that supports different assumption.

Analyst consensus; author’s calculation

Risks

Investors who are buyers of BYD should consider a few risks. Most notably, BYD is based in China and generates its sales almost exclusively within China. Accordingly, the ongoing economic challenges in China, including the real estate crisis, zero-covid policy, and slowing economic growth will add a transitory headwind to BYD’s near-term outlook. Moreover, although the CCP currently acts favorably toward EV companies, this may change in the future – as the tide turned quickly on leading tech/internet giants. Investors should also consider that competition in the EV space is heating up, as new start-ups (NIO (NIO), XPeng (XPEV), Lucid (LCID), Baidu (BIDU)) and legacy car markets (Volkswagen (OTCPK:VWAGY), General Motors, Toyota (TM)) are pushing into the market. As a consequence, the EV business might be less attractive from an economic perspective, despite a strongly growing market. Finally, since Warren Buffett has started selling parts of his stake in BYD, investor confidence remains depressed. If Buffett would continue selling, I think it is likely that the BYD share price will experience more downward pressure.

Conclusion

Investing in China is not for everyone, reflecting on international tensions, Covid-19 lockdowns in major Chinese cities, and a slowing economy. But objectively, the risk/reward for investing in BYD is very attractive. In my opinion, BYD’s deep vertical integration can support a fast production ramp-up that allows the carmaker to take market share in one of the fastest-growing markets of the next decade. Moreover, BYD is valued attractively, as I calculate a base-case target price of $66.50/share.

Be the first to comment