jetcityimage/iStock Editorial via Getty Images

Shares of Pitney Bowes Inc. (PBI) seem to have been in terminal decline for a very long time. Share price is down ~66% over the past decade, and has dropped just over 14.5% over the past year. I am a bargain shopper, so this underperformance has put the company on my radar. The recent Ecommerce performance has me downright intrigued, and the 3% dividend yield sealed the deal. I’ve got to review this company. In this article, I’m going to try to determine if it makes sense to buy shares at current prices. I’ll make this determination by looking at the financial history here, and by looking at the stock as a thing distinct from the underlying business. Also, as my regular readers might guess, I’m going to write about potential opportunities with short put options here.

I imagine you’re a busy crowd, dear readers, and for that reason, I’ll offer you my thoughts on this name in this, the “thesis statement” paragraph. This is in case you missed the title of this missive, and sailed past the summary bullet points above, and landed on this second paragraph of my article. If you don’t like spoilers, and want to uncover the treasures of my narrative as they emerge, I would recommend skipping this paragraph. If you’re still here, I’m assuming you’re ok with me spoiling the surprise, so don’t complain at me afterwards if you feel as though I ruined the excitement for you. I think we have sufficient evidence that Pitney Bowes is turning around to buy the shares at the moment. Although I don’t expect much of an increase anytime soon, I think the dividend is reasonably well covered. The absence of an increase on the horizon is fine, I think, because the current 3% yield is more than fine in my estimation. Most importantly, the shares are trading at a very pessimistic level, suggesting the potential for strong upside as the market begins to digest anticipated positive surprises. Lastly, the short puts I recommend below yield ~7.5% at a strike price nearly 40% below the current market. You’ll have to read on to get the specifics of that trade, which obviously calls into question the point of this “thesis summary” paragraph.

Financial Snapshot – “Green Shoots” Abound

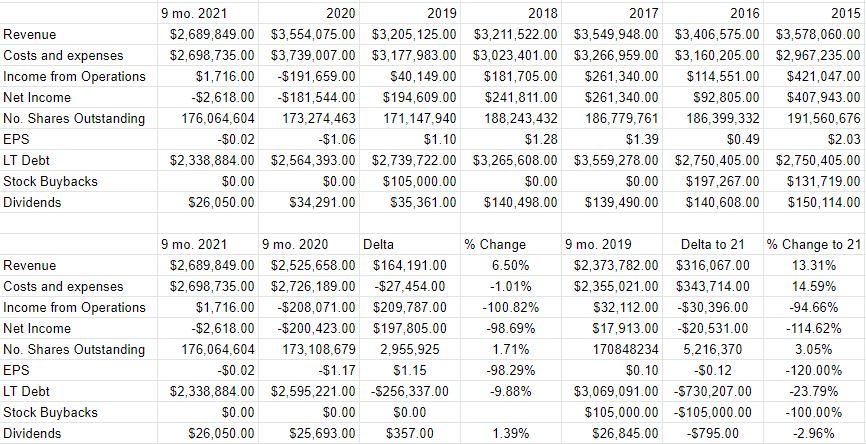

I was surprised by the number of positives I found when reviewing the long-term financial performance here. For instance, after declining ~9% between 2017 and 2018, and slightly again in 2019, revenue has turned up. Additionally, share count has actually declined at a CAGR of ~1.26% over the past seven years. Finally, the capital structure has improved nicely in that time, with long-term debt down at a CAGR of ~2.43%. There may even be some cause for optimism on the earnings front. When we compare the first nine months of 2021 to the same period in 2020, we see that revenue was ~6.5% higher, and net income swung from a massive loss of ~$200.4 million to a loss of just over $2.5 million.

You may recall that 2020 was, uh, “unique”, though dear readers, and comparisons to that year may be of limited use. The same story emerges when we compare the first nine months of this year to the pre-pandemic 2019, though. Revenue in 2021 is ~13.3% higher, and net income is ~$18 million greater.

I think the CFO’s most recent comments are both accurate and encouraging:

…when we compare this year’s third quarter to the third quarter of 2019, in other words, pre-Covid, our 2021 revenue grew over 10%.

Later on the same call, when talking about Ecommerce revenue, she stated

If you compare this quarter to third quarter of 2019, revenues for the Ecommerce segment are up over 40%. Said another way, we kept the vast majority of the revenue gains we experienced post Covid.

This suggests to me that we should anticipate continued improvements from the business.

The Dividend Is Reasonably Sustainable

I have a confession to make, dear readers. I actually like accrual accounting. I do. Like many things I like, I know it’s not perfect, but it’s a very powerful tool. I’ve admitted some weird things about myself on this forum over the years, and this is definitely one of the weirdest. When it comes to trying to work out the sustainability of a given dividend, though, I need to eschew my beloved accrual accounting and think only in terms of cash and cash flow generation. Specifically, when I’m trying to work out whether a dividend is likely to be sustained, grow, or be cut, I like to think in terms of cash flow generating capacity, relative to contractual obligations. The greater the delta between the amount of cash on the balance sheet and the average cash from operations on the one hand and contractual obligations on the other, the better. I’ve taken the liberty of clipping the size and timing of future contractual obligations from the latest 10-K and have reproduced it here for your enjoyment.

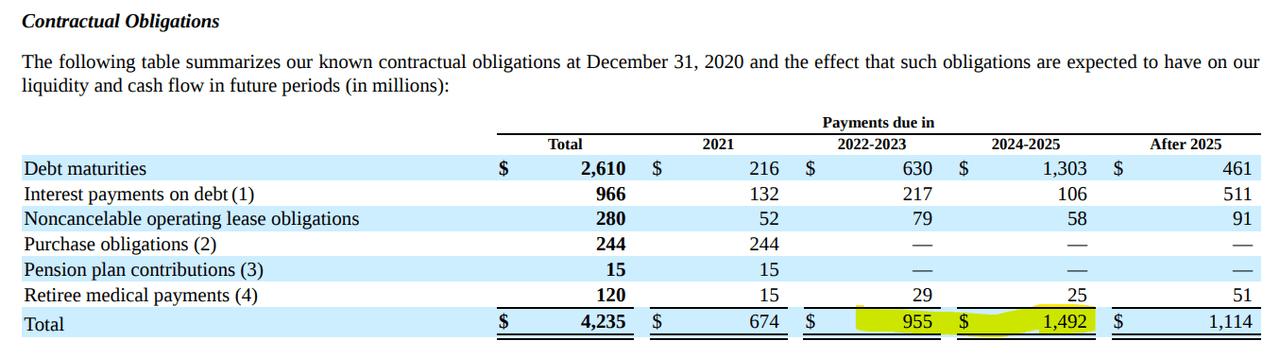

The table below reveals that the period 2022-2023 will see the company spending ~$955 million, and in the period 2024-2025, they will spend ~$1.5 billion. I’m making a simplifying assumption and dividing each of these in half, so I’m assuming the company will spend $477.5 million in each of 2022 and 2023, and will spend $750 million per year in the two years after that.

Pitney Bowes Contractual Obligations

According to the latest 10-Q, the company has about ~$743 million in cash and short-term investments. Additionally, over the past three years, they’ve generated an average of ~$304.8 million in cash from operations. All of this suggests to me that the dividend is reasonably well covered, though I don’t expect much of a dividend increase given the significant outflows in 2024 and 2025. The fact that I don’t expect an increase isn’t a problem given the current attractive yield.

Taking the above into account, I’d be very happy to buy this business at the right price.

A Select History of Pitney Bowes Financials Pitney Bowes Investor Relations

The Stock

Some of you who follow me regularly know that it’s at this point in the article where I become a total buzzkill and sour the mood by going on about the fact that a great company can be a terrible investment at the wrong price. I’ll defend my discipline by pointing out, again, that the more you pay for a stock, the lower will be your subsequent returns. Rather than try to demonstrate this point abstractly, I’ll use Pitney Bowes stock itself to prove it. The people who bought way on November 12, 2021 are sitting on a 17.5% loss today. The people who bought virtually identical shares about 5 weeks later are up just under 3.6%. Not much really changed in the business over that 5-week span in my view, so the 20% swing in returns comes down entirely to price paid. This is why I try to avoid overpaying for a stock, and insist on buying cheap.

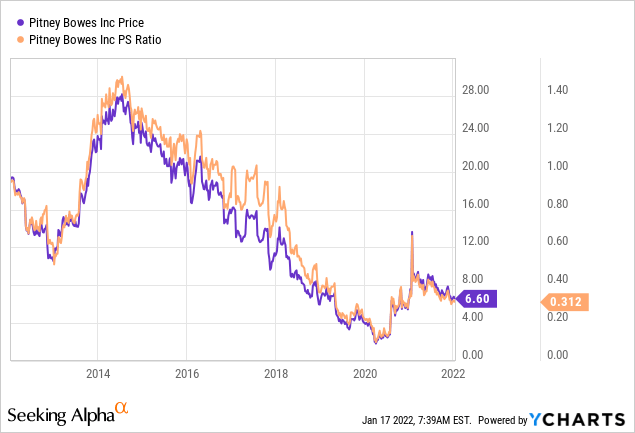

I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. With that in mind, we see that the market is paying very near a decade low for $1 of Pitney Bowes sales, per the following.

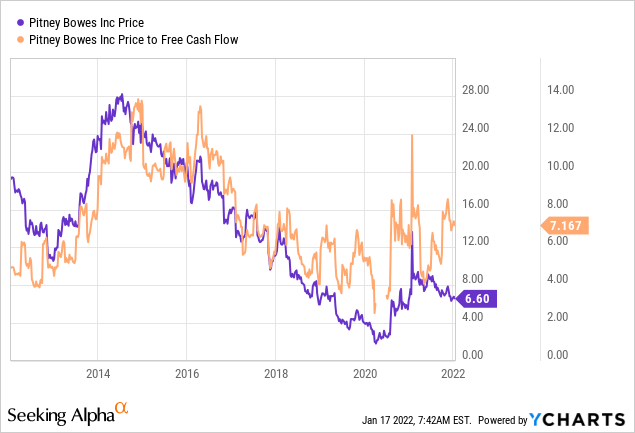

The story is more mixed when looking at price to free cash flow. The stock is certainly cheaper than it was for the 2014-2017 period, but I’d characterise the current valuation on this basis as “middling.”

In addition to simple ratios, I want to try to understand what the market is currently “thinking” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his great book that I can’t recommend highly enough “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “assuming” about a given company’s future growth. This involves isolating the “g” (growth) variable in a fairly standard finance formula. Applying this approach to Pitney Bowes at the moment suggests the market is forecasting a growth rate of ~-.8% for this business going forward, which I consider to be nicely pessimistic. Given all of the above, I’ll be buying these shares at the current price.

Let’s Not Forget About Options

In addition to buying shares at the current price, I want to sell some puts on the name because I think these are also a great way to “play” this name. In my view, short put options represent a “win-win”, and so they’re too compelling to pass up in my view. To refresh your memories, dear readers, I consider these “win-win” trades because the results are very good no matter the outcome. If the puts expire worthless, I’ll simply pocket the premium, which is a positive. If the shares drop below the strike price, I’ll be obliged to buy at a price that I predetermined is acceptable to me, so that’s also a positive.

At the moment, I’m willing to sell the January 2023 Pitney Bowes puts with a strike of $4. These are currently bid at $.30, which works out to a 7.5% yield on cash. If the share price remains above $4, I’ll simply collect my 7.5% return. If the shares drop 39% from the current (already cheap) price, I’ll be obliged to buy at a net price of ~$3.70. Holding all else constant, that represents a 5.4% dividend yield. Being “forced” to buy at this price is also very acceptable to me.

I now need to indulge the tendency toward being a “buzzkill” that I didn’t get to engage in earlier. Now that you’re hopefully all very excited about the prospects of a “win-win” trade, it’s time for me to engage in my sadistic tendency to deflate your bubble by writing about risk. The reality is that every investment comes with risk, and short puts are no exception. We do our best to navigate the world by exchanging one pair of risk-reward trade-offs for another. For example, holding cash presents the risk of erosion of purchasing power via inflation and the reward of preserving capital at times of extreme volatility. The risks of share ownership should be obvious to readers on this forum.

I think the risks of put options are very similar to those associated with a long stock position. If the shares drop in price, the stockholder loses money, and the short put writer may be obliged to buy the stock. Thus, both long stock and short put investors typically want to see higher stock prices.

Puts are distinct from stocks in that some put writers don’t want to actually buy the stock – they simply want to collect premia. Such investors care more about maximizing their income and will be less discriminating about which stock they sell puts on. These people don’t want to own the underlying security. I like my sleep far too much to play short puts in this way. I’m only willing to sell puts on companies I’m willing to buy at prices I’m willing to pay. For that reason, being exercised isn’t the hardship for me that it might be for many other put writers. My advice is that if you are considering this strategy yourself, you would be wise to only ever write puts on companies you’d be happy to own.

In my view, put writers take on risk, but they take on less risk (sometimes significantly less risk) than stock buyers in a critical way. Short put writers generate income simply for taking on the obligation to buy a business that they like at a price that they find attractive. This circumstance is objectively better than simply taking the prevailing market price. This is why I consider the risks of selling puts on a given day to be far lower than the risks associated with simply buying the stock on that day.

I’ll conclude this rather long discussion of risks by looking again at the specifics of the trade I’m recommending. If Pitney Bowes shares remain above $4 over the next twelve months, investors will simply pocket the premium and move on. If the shares fall in price, investors will be obliged to buy, but will do so at a price ~39% lower than the current level. Both outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” You may think it is strange to conclude a discussion of risk by writing about the fact that these things reduce risk. Yes, it is. This is neither the first nor will it be the last time that my writing could be characterised as “strange.”

Conclusion

I think Pitney Bowes is an intriguing turnaround story, and I think the shares now represent great value. I think the very least an investor can expect is a 3% yield from the reasonably secure dividend here. I think management is doing everything it can to turn the company around, and those efforts are showing results. Additionally, there have been positive financial trends that have been in place for years. Most importantly, the market is rather pessimistic in spite of these positive developments. I think it makes sense to take advantage of that fact by buying while “price” is still significantly below “value.” Finally, I think short puts represent a particularly attractive play here.

Be the first to comment