CreativaImages

The Market Is Cautious Heading Into The FOMC’s Decision Week

The market heads into the Fed’s blackout period before its highly anticipated December FOMC meeting pressor on December 14, as Fed Chair Jerome Powell updates the committee’s median terminal rate and its revised dot plot moving ahead.

With November’s CPI reading preceding Powell’s press conference on December 13, the FOMC will have an excellent opportunity to look into November’s inflation reading. As such, the market’s buying momentum has stalled decisively as the market awaits the Fed’s rate decision, as the recent recovery has likely already priced in a 50 bps hike in December.

Despite that, Fed watchers reflect an outside chance of a 75 bps hike (23% probability as of November 6). As such, there remains a slim possibility of a post-CPI rally if the inflation readings are discernibly lower than anticipated.

November’s CPI Print Could Still Be A Significant Hurdle

However, the Cleveland Fed’s most updated forecasts suggest that the upcoming inflation print (including core) could remain stubbornly high.

Notably, it predicts a CPI print of 7.40% YoY, with core inflation (less food and energy) rising by 6.26%. Therefore, the forecasts suggest a lower print than October’s headline figure of 7.7%.

However, core inflation is expected to remain sticky, in line with October’s 6.3% metric. As such, we assess that investors need to be realistic about a Fed pivot in H1’23, even as it could be heading into a data dependency phase in 2023. We believe a critical factor to watch is how the 5Y breakeven inflation could trend from here.

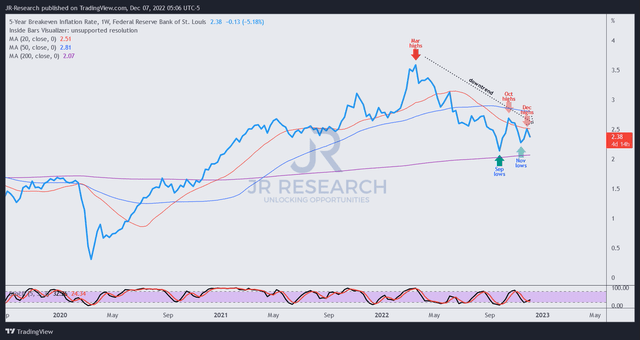

5Y Breakeven inflation rate chart (weekly) (TradingView)

Our analysis of the current 5Y breakeven inflation rate suggests it has been making higher lows since September. However, the general trend since its March highs remains firmly in the downtrend, although the market doesn’t expect the inflation rate to fall below 2% over the next five years.

Hence, we believe the market is cautiously positioned into next week’s pivotal releases, which could shape the market’s near-term directional bias.

Moreover, we believe the underlying market indicators have been pointing to a pullback over the past two weeks. Hence, the market seems ready to force a steeper selloff as it awaits the CPI reading and the Fed’s decision.

Market Likely Priced In A 50 Bps Hike

While we don’t think investors should short-sell the S&P 500 (SP500) (SPX), we urge investors to be cautious about adding at the current levels. The Dow Jones (DJI) has also rallied into a bull trap, which doesn’t augur well for its near-term buying upside. The NASDAQ (NDX) continues to lag behind the SPX and the DJI as investors poured into less expensive value stocks at the market’s October lows.

However, we remain constructive over those lows. The risks of a recession in 2023 have been well-established and likely anticipated by the market. Edward Yardeni also highlighted in a recent commentary:

If the economy is in for a hard landing next year, it would be the most widely anticipated recession ever. The Philly Fed’s survey of forecasters, the WSJ’s survey of economists, and even the Misery Index that reflects the sum of unemployment and inflation rates point to a recession. … But we think this time is different. There’s been no broad-based credit crunch, liquidity is ample, consumer incomes are growing, multi-family housing remains strong, capital spending does too, and fiscal stimulus has been gushing. Real GDP shouldn’t contract in such an environment but grow, slowly but surely. We’re in the soft-landing camp. – Yardeni Research November 29 briefing

Still, investors should not ignore the significant risks of the Fed remaining in the restrictive zone for longer than expected, which could result in a significant recession.

The Fed’s James Bullard, a voting member on the 2022 FOMC, also suggested that investors shouldn’t understate the Fed’s hawkish stance. He reiterated his stance (before the blackout period) that “the Fed needs to at least reach the bottom of the 5% to 7% range to meet policymakers’ goal of being restrictive enough to stamp out inflation near a four-decade high.”

Earnings Estimates Going Back Up

Industry analysts have started to revise their earnings estimates for the S&P 500 upward for 2023, seeing a more constructive environment in H2’23. Accordingly, the revised forward estimates suggest that the SPX last traded at an NTM P/E of 17.1x.

Relative to the SPX’s 10Y average of 17.7x, we postulate that its valuation is relatively well-balanced but with near-term risks skewed to the downside at the current levels.

Despite that, we gleaned that analysts have already downgraded their earnings estimates for the SPX through November, aligning with the weaker operating performances in Q3 and relatively weak guidance for Q4.

Still, FactSet data from 1997 to 2021 suggests that analysts overestimated SPX’s earnings projections by an average of 2% (excluding outlier years). Hence, we believe investors must apply an appropriate margin of safety in their modeling.

Therefore, we believe it’s appropriate for investors to be cautious at these levels as they wait for a resolution from the pivotal data points next week, given the remarkable recovery from October lows.

Be the first to comment