Very recently I published an article “COVID-19: The Black Swan” which had a rather bearish and negative tone and showed why COVID-19 could be the black swan, which is sounding the death knell for the global economy. I argued that the coronavirus is hitting an already weakening economy and that the consequences could be severe. After the article was written, we also saw the Fed’s emergency rate cut and a lowering of the federal funds rate by 50 basis points.

(Source: Pixabay)

Now, on Wednesday’s very early morning (obviously, the times are back where a time stamp seems to be important as in the hours or few days between writing and publishing an article a lot can change), the S&P 500 (SPY) is trading 11.3% below the all-time high, the Dow Jones Industrial Average (DIA) is trading 12.3% below its high and the Nasdaq 100 (QQQ) is trading 11.6% below its all-time high. It is mostly the coronavirus that has led to this correction, and it is extremely difficult to predict how steep this correction will be.

In my opinion, this is still not a major buying opportunity as stocks are still overvalued and it seems likely we will see steeper declines. But we don’t know if we see steeper declines in the next few weeks, in a few months from now, or not before 2021 or 2022. It is extremely difficult to time the market, and there are a few stocks which got hit hard in the last few days and/or have already declined during the last few months and are trading at lower valuation multiples right now.

And if the overall stock market should continue to decline, these are all stocks that are paying a rather high dividend in the meantime. And as these eight stocks are fairly valued in my opinion (when using a 10% discount rate), the stocks should yield about 10% over the long run and should therefore be a reasonable investment – even if we might get better prices in the next few weeks (which will be annoying for those that bought at higher prices, but doesn’t make it a bad investment).

Two aspects are important:

- The preferred reader for this article is the long-term investor. If you are investing for the medium term (meaning several months up to a few quarters in this case), you could very well end up with selling all these stocks with a loss in a few months or maybe a year from now as further declines are likely. But as some of these stocks have already declined in the mid double digits since the highs, further declines might not be so steep. And if these stocks decline further, chances are high that they will rebound quickly.

- I tried to pick high-quality companies with long-term growth potential, a solid business model and in some cases even a wide moat. And as these stocks are trading at a fair value in my opinion, they should be good, long-term investments. And when investing over the long-term, the quality of the business is more important than timing. Buying at extremely low prices can lead to high returns, but over the long run, it is extremely difficult to beat the performance of great high-quality businesses.

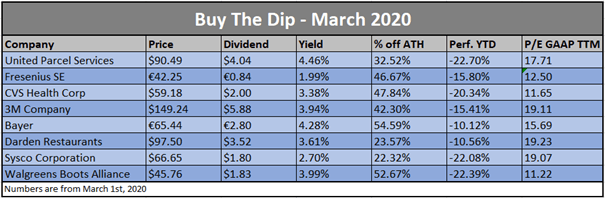

(Source: Own work)

United Parcel Service (UPS)

United Parcel Service was founded in 1907 and is one of the biggest US distribution companies. It provides letter and package delivery, specialized transportation, logistics and financial services. The company is operating internationally and is providing its service in over 200 countries. Over the long term, the core business of UPS seems to be protected pretty well by a wide economic moat that is resulting from a dense and complex distribution network, which is hard to match for any new competitor – especially in the United States. And despite additional competition from new potential entrants like Amazon (AMZN), UPS can probably increase its revenue with a stable pace – especially as the overall market will continue to grow.

When considering the stock price during the last two decades, UPS was not a great investment as it was outperformed by the S&P 500 since 2000. Until a few years ago, UPS performed more or less similar with the S&P 500 and for some periods even outperformed the index, but in the last few years, UPS could not hold up with the performance of the S&P 500 anymore. First of all, past performance is not an indicator for future performance and UPS seems to be fairly valued right now (when calculating with a 10% discount rate). Second, UPS is especially interesting for its dividend as the company is paying a quarterly dividend of $1.01, resulting in a dividend yield of almost 4.5% right now. According to its own investor presentation, the company had a stable or growing dividend for almost 50 years, which is demonstrating stability, and for those investors seeking a high passive income, the stock could be interesting.

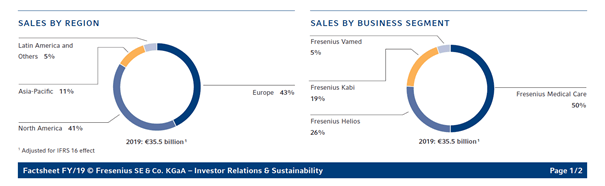

Fresenius SE is a global healthcare group that operates in more than 100 countries around the globe, but most of the company’s revenue is generated in Europe (about 43% of total revenue) and North America (about 41% of total revenue). The Fresenius group is operating four different business segments. Fresenius Vamed manages projects and provides services for hospitals and other healthcare facilities worldwide, but in 2019 the segment contributed only 5% to total revenue. Fresenius Helios is Europe’s largest private hospital operator in Germany and Spain and contributed about 26% to total revenue last year. Fresenius Kabi is specialized in lifesaving medicines and technologies for infusion, transfusion and clinical nutrition and although it contributed only 19% to overall revenue, it is the second most important segment for the Fresenius group as it contributes more than 25% of total EBIT due to high margins. The most important segment is Fresenius Medical Care (FMS), which is trading on the New York Stock Exchange as well as Frankfurt Stock Exchange since 1996 and Fresenius SE owns about 31% of the company. Fresenius Medical Care is the world leader in treating people with chronic kidney failure. Fresenius Medical Care is responsible for 50% of revenue and 50% of EBIT.

(Source: Fresenius Investor Factsheet)

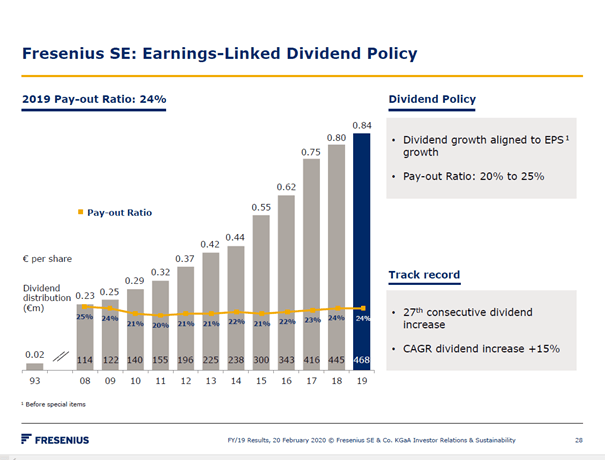

Fresenius does not really have a high dividend yield (about 2% right now), and among the eight stocks in this list, it has the lowest dividend yield. But it is the only dividend aristocrat listed in the German DAX-30 and recently reported the 27th consecutive dividend increase. For fiscal 2019, Fresenius will pay out €0.84 per share as annual dividend, which is in line with the company’s dividend policy to pay out between 20% and 25% of its earnings. The CAGR for the dividend since 1993 was 15%.

(Source: Fresenius Investor Presentation)

In the last earnings call, management was quite positive about the future, and not only did Fresenius Helios show continued stabilization in Germany and strong growth in Spain, but the growth targets for the years until 2023 were also confirmed and the guidance for the full-year 2020 is for sales to grow between 4% and 7% in constant currency, and net income is expected to grow between 1% and 5% in constant currency.

And Fresenius seems to be fairly valued right now, and when using the company’s own guidance for the next few years and 5% growth till perpetuity (which are conservative numbers considering the past performance of Fresenius), we get an intrinsic value of €63. In case of Fresenius SE, I actually followed my own advice and bought the dip last Friday and purchased shares for €42.

CVS Health Corp (CVS)

CVS Health is a pharmacy retailer with about 10,000 stores, and with CVS Caremark, the company is also one of the big pharmacy benefit managers in the United States. In November 2018, CVS acquired Aetna, a healthcare insurance company. However, investors seemed to be very pessimistic about the acquisition and have sent the stock down in the last few years. The pessimism probably stemmed in part from the resulting goodwill and debt levels due to the acquisition. Due to a goodwill impairment charge, CVS also had to report a loss in 2018 (GAAP numbers).

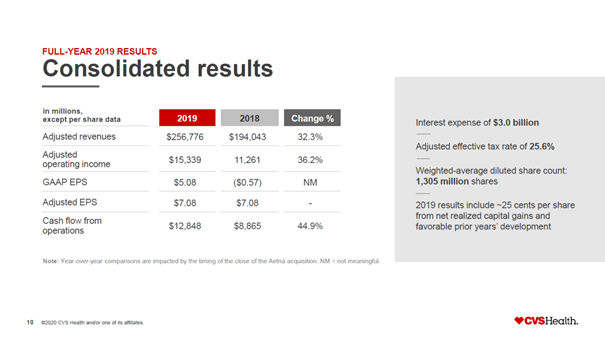

(Source: CVS Investor Presentation)

But for the full-year 2019, CVS could report high growth rates (due to the Aetna acquisition). Adjusted revenue increased 32.3% and adjusted operating income increased 36.2%. Cash from operations increased even 44.9% compared to 2018 while adjusted earnings per share stayed flat in 2019 compared to 2018. Of course, CVS won’t be able to repeat similar growth rates. For 2020, management is expecting adjusted EPS growth to be in the low single digits. For 2021, management is expecting mid-single-digit growth, and from 2022 going forward, management is expecting growth to be in the low double digits. And even when using very cautious long-term growth rates (low-to-mid single digits), CVS seems undervalued at this point.

CVS is also paying a quarterly dividend of $0.50, which will not be raised for the next quarters as management is focusing on paying down debt, but with a dividend yield above 3% and the prospect of dividend increases from 2022 going forward, this stock is also interesting for dividend investors.

3M Company (MMM)

My second purchase in 2020 – aside from Fresenius SE – was 3M Company in the week before the panic due to the coronavirus hit the markets. 3M Company is one of the stocks on my marketplace watchlist and was mostly in the news in the last few days for producing the masks that would be needed in case of a pandemic. But 3M’s business is very diversified, and these masks are only responsible for a small part of revenue and therefore won’t have a huge effect on overall results. Aside from personal protection products, 3M distributes among other items transportation safety products, medical and surgical supplies, tapes, adhesives, sponges, high-performance cloths or drug delivery systems. 3M reports in four different business segments – safety & industrial, transportation & electronics, healthcare and consumer.

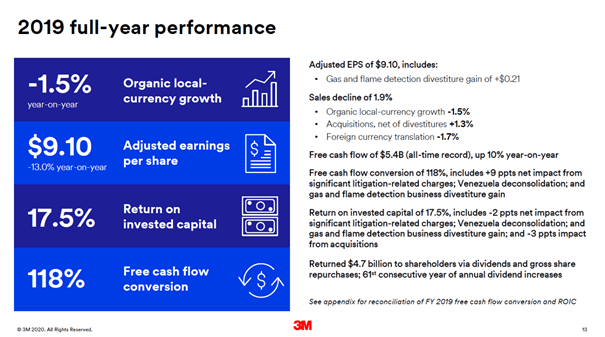

3M Company has already been struggling in the last few quarters and is already trading 40% below its all-time high. When looking at the 2019 full-year performance, organic local-currency growth was negative with a decline of 1.5% YoY. Adjusted earnings per share declined 13.0% YoY to $9.10. And 3M is also affected by economic downturns and will probably see sales decline further if the economy cools off.

(Source: 3M Company Investor Presentation)

Although 3M currently struggles a little bit, I am confident that it will perform quite well over the long run. Not only could 3M report the 61st consecutive year of annual dividend increases, which is demonstrating high levels of stability, but also with a dividend yield of almost 4% and the long history of dividend increases, the stock is definitely interesting for every dividend investor. And since 1980, 3M Company increased its revenue about 4.4% annually on average, net income increased about 5% on average, and due to share buybacks, EPS grew at an even higher rate (more than 6% on average since 1990). And as 3M can rely on its wide economic moat, which is based on patents, on branding and on switching costs as well as economies of scale, we can expect above-average growth and similar growth rates than in the past. And although I don’t know if the stock has reached its bottom yet (it might fall a little more), it is already fairly valued in my opinion.

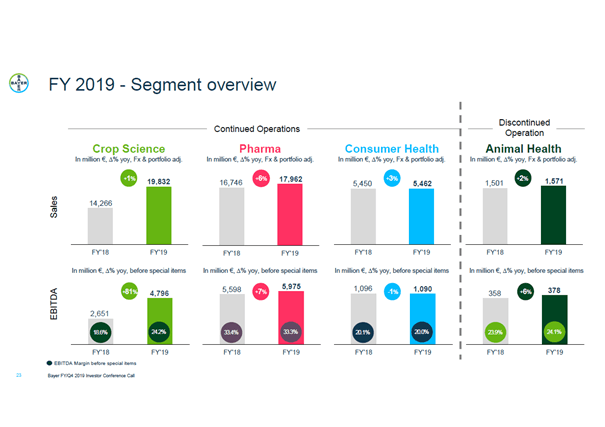

Another company which is ranking rather high on my personal watchlist is the German pharmaceutical and life sciences company Bayer. In 2019, it was mostly in the headlines for the takeover of Monsanto and the following lawsuits. After the acquisition of Monsanto, the number of plaintiffs claiming they have been exposed to glyphosate-based products manufactured by Bayer’s subsidiary Monsanto increased to over 13,000. These plaintiffs are claiming that they have been exposed to Roundup and suffer personal injuries resulting from exposure to these products, including non-Hodgkin lymphoma (NHL) and multiple myeloma and seek compensatory and punitive damages. And while these lawsuits are still going on and are still posing a big threat to the company, in the headlines, the topic is not so present any more and the still stable results of Bayer are moving in the spotlight once again.

For the full year 2019, sales increased 19% to €43,545 million (mostly due to portfolio adjustments) and the core EPS increased 14% to €6.40. Free cash flow declined 9% to €4,214 million, but was better than the company’s own guidance for 2019 (expectations saw FCF between €3 billion and €4 billion). The guidance for 2020 sees sales growing 3-4% and the core EPS growing between 9% and 13% to the range between €7.00 and €7.20. Free cash flow is expected to grow about 19% to €5 billion.

Bayer, which calls itself a life science company, is actually quite diversified and operating in three different business segments. The fourth segment, animal health, was acquired by Elanco Animal Health (ELAN) and will no longer be a part of Bayer. The first segment is “crop sciences” (which includes Monsanto, and even if Bayer should run in trouble with this segment, there are two more segments contributing to overall results). But crop sciences could grow about 39% for the full year (1% growth when using the portfolio adjusted numbers) and even the highly controversial herbicides sub-segment could report 6.2% growth YoY in the fourth quarter. The pharmaceuticals segment is selling products for cardiology as well as specialty therapeutics in the areas of oncology, hematology and ophthalmology. For the full year, this segment could grow 6% (portfolio adjusted numbers). And finally, the consumer health segment, which is selling nonprescription over-the-counter medicines, cosmetics and self-care solutions and could report 3% growth (portfolio adjusted).

(Source: Bayer Investor Presentation)

Bayer can also be called a recession-proof business as both the pharmaceutical segment as well as the consumer health segment are selling rather essential products, which the consumer needs at any time. We mentioned above that the lawsuits are still posing a huge threat to Bayer, but at current valuation levels, these threats are definitely priced in the stock at this point. In May 2019, I wrote an article in which I calculated the intrinsic value in two very pessimistic scenarios. In one I assume that Bayer has to pay a fine of €25 billion and the intrinsic value was still €53.44 (10% discount rate).

Darden Restaurants (DRI)

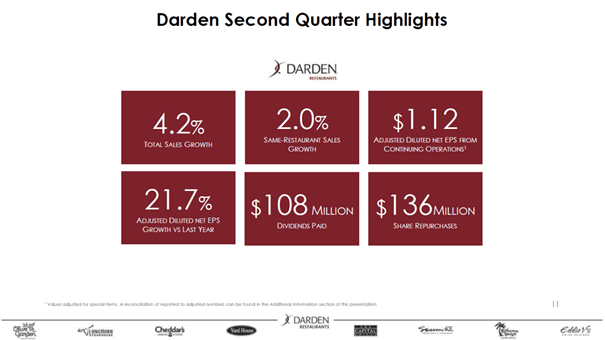

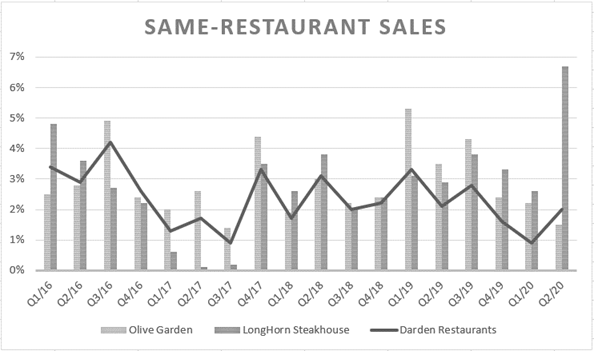

Another company that was hit hard in the last few days is Darden Restaurants. In the last few days, the stock dropped from over $120 to about $95 reflecting a more than 20% decline. Darden Restaurants owns and operates full-service restaurants in the United States and Canada. Aside from its most famous brand, Olive Garden, it is also operating restaurants under the brands LongHorn Steakhouse, Yard House, The Capital Grille, Bahama Breeze and a few others. In total, it is operating about 1,800 restaurants and about 70 restaurants operated by independent third parties through development and franchise agreements located in the United States, the Middle East, and Latin America.

(Source: Darden Restaurants Investor Presentation)

In the last few quarters, Darden Restaurants was still reporting solid results with sales growing 4.2% in the second quarter and same-restaurants sales growing 2.0%. The adjusted diluted net earnings per share growth was even 21.7% compared to the same quarter last year. When looking at the past few years, Olive Garden and the LongHorn Steakhouse (the two most important brands) could increase same-restaurant sales between 2% and 3% in most quarters (in some quarters even 4-5%). Additionally, Darden Restaurants can also grow by acquiring new businesses like it did with Cheddar’s Scratch Kitchen in 2017 and of course by opening new restaurants. And Darden Restaurants has been buying shares for quite some time. In total, 6% annual growth for the bottom line seems to be realistic and even when assuming a free cash flow decline in the near future due to a potential recession, the fair value of Darden Restaurants should be above $100, and with a dividend yield of 3.5% and 15 years of dividend growth, the stock is also interesting for dividend investors.

(Source: Own work based on earnings releases)

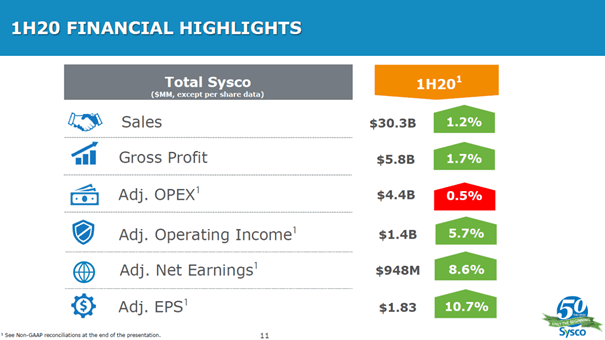

Sysco (SYY)

Sysco Corporation is operating in a similar industry as Darden Restaurants. While Darden Restaurants is mostly operating restaurants, Sysco Corporation markets and distributes a range of food and related products primarily to the foodservice industry, but also to the food-away-from-home industry in the United States. Among the products it distributes are frozen foods like meats and seafood, but also fully prepared entrees or fruits and vegetables as well as desserts. Additionally, it supplies various non-food items, including paper products like napkins, plates and cups. Sysco was founded 50 years ago – in 1969 – and is operating about 325 distribution facilities today.

(Source: Sysco Investor Presentation)

When looking at the current numbers, Sysco seems to be struggling a bit. For the first half of 2020, sales growth was only 1.2% and gross profit grew 1.7% in the same time frame. While Sysco clearly struggled to grow the top line, the bottom line looks better: adjusted net earnings still grew 8.6% with adjusted earnings per share even growing 10.7%. And although Sysco is struggling right now, I am pretty confident the company will be fine over the long run. When looking at the revenue growth over the last 20 years, Sysco shows not only high levels of stability, but it also reported a CAGR of 6.39%, which is pretty solid. When looking at the last decade, the CAGR is still 5.46%. For the years to come, we can assume about 4-5% revenue growth as a realistic number, and an additional 1-2% growth for the bottom line could stem from share buybacks. When calculating with these numbers, Sysco is almost fairly valued right now (at this point, it might still be about 10% overvalued when calculating with a 10% discount rate). And we should not expect extremely high and impressive growth rates from Sysco in the coming years, but the company will perform with high levels of stability and consistency in my opinion.

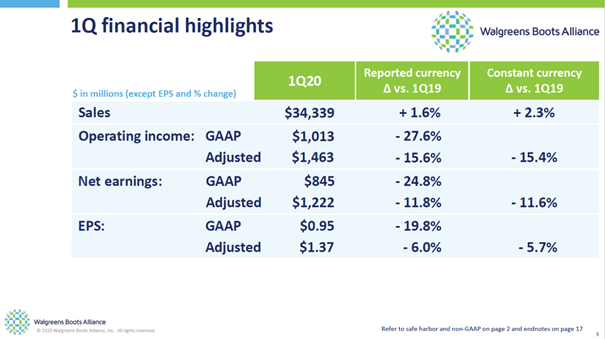

Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance is another company that seems to be struggling a little bit right now. When looking at the last quarterly results, it is probably hard to get investors excited. While sales growth was still in the low single digits, operating income, net earnings as well as earnings per share declined in the double digits.

(Source: WBA Investor Presentation)

But despite the current struggle of Walgreens Boots Alliance, the company has a long and successful history and is a global leader in retail and wholesale pharmacy. Together with the companies in which it is invested in, it has over 18,750 stores in 11 countries as well as one of the largest global pharmaceutical wholesale distribution networks with over 400 distribution centers delivering to more than 240,000 pharmacies. Walgreens Boots Alliance was formed in December 2014 after Walgreens purchased the 55% stake in UK and Switzerland-based Alliance Boots that it did not already own. When looking at the past performance (in this case, the last four decades), Walgreens Boots Alliance increased revenue with a CAGR of 12.21% and net income with a CAGR of 12.92%. And although growth rates slowed down to about 7-8% during the last decade, Walgreens still seems to be a solid business. For 2020, management is expecting adjusted EPS to stay more or less flat, but after 2020, adjusted EPS is expected to grow in the mid-to-high single digits again (according to second quarter 2019 earnings presentation).

In my article about Walgreens Boots Alliance and CVS Health Corp, I calculated an intrinsic value for Walgreens with very cautious assumptions like stable free cash flow in 2020 and 2021 and 5% growth from 2022 till the end of the next decade. For perpetuity, I assumed 3% annual growth, and these assumptions led to an intrinsic value of $67 (using a 10% discount rate).

Conclusion

In my opinion, we are still closer to the peak of the market than we are to the cyclical bottom, but these eight stocks are more or less trading close to their fair value (or even below) and can be good long-term picks for long-term investors. We should keep in mind that we could face a much steeper correction as a global downturn and recession might be upon us, and in such a scenario, these stocks will also decline. But as long-term investors, it shouldn’t be a problem if we have to sit through one or two years of lower stock prices – over the long run, these companies should be good investments.

If you enjoyed the article and are searching for similar companies as in the article, please check out my marketplace service: Moats & Long-Term Investing.

In the marketplace I will cover wide-moat companies like in this article, but will provide weekly updates as well as extensive research on these companies. Additionally, I will also cover small-cap companies in my marketplace. Subscribers also get access to a watchlist of companies and extensive background information on wide economic moats.

You can also take advantage of a free trial offer.

Disclosure: I am/we are long CVS, MMM, FSNUF, ELAN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment