z1b

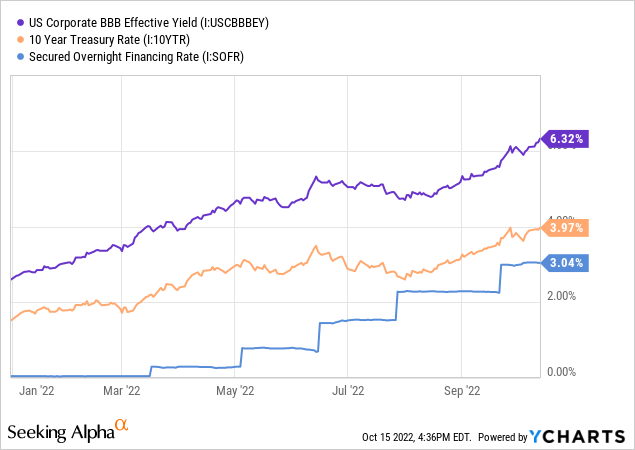

Rates up, REITs down.

That seems to be the name of the game when interest rates are on the rise. And unless you live off the grid in the Alaskan wilderness, you’re probably aware of the fact that interest rates have risen substantially this year as the Federal Reserve moves swiftly (and belatedly) to combat high inflation.

No matter what benchmark you use to measure businesses’ cost of debt, it’s clear that the days of ultra-low-cost debt are over, at least for now.

Given the fact that REITs have to pay out at least 90% of their taxable income as dividends, most of them do not have substantial amounts of retained cash flow. Thus, they constantly need to raise more capital in order to expand their real estate portfolios. The REITs with long lease terms and little contractual/organic rent growth are especially dependent on capital raising for growth purposes.

REITs’ net debt to EBITDA ratios tend to fall in the range of 4x to 6x, while debt to total capitalization tends to be between 30% and 50%.

As such, when interest rates rise, REITs usually drop for three reasons:

- Higher interest expenses will incrementally rise as existing debt matures and is refinanced at higher rates.

- Newly obtained debt will come at a higher cost, reducing the return on investments into new properties (all else being equal).

- Higher bond yields gradually draw investors toward bonds and away from REITs (and other stocks) because of the greater degree of safety.

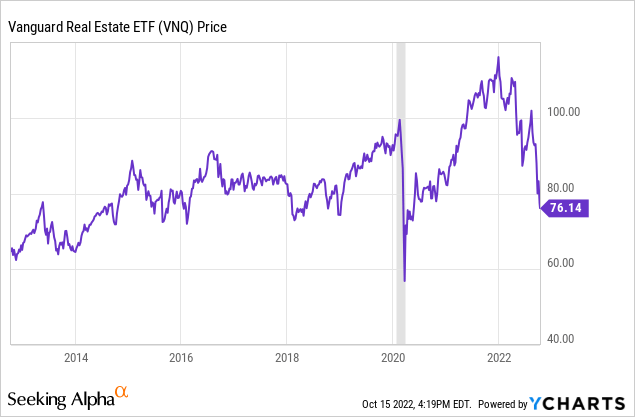

Hence the ~3% drop in REIT prices this year:

This huge selloff has dragged the Vanguard Real Estate ETF (VNQ) all the way back down near COVID-19 era lows. Though it’s undeniable that rising interest rates are a headwind for REITs, we think this selloff is way overdone, for multiple reasons:

- Interest rate movements, just like the economy more broadly, are cyclical. They rarely ever go straight up or straight down for multi-year periods without significant retracements along the way.

- REITs are more resilient to rising interest rates than most investors think. Most of them have spent the last few years of low interest rates to refinance and extend their debt maturities.

- As history has repeatedly shown, what matters more to REITs’ fundamental performance than rising interest rates is rising rent rates. Rents continue to rise for most forms of commercial real estate.

This major selloff has granted a rare opportunity for investors to pick up shares of solid yet severely oversold REITs. In what follows, we highlight two of them.

1. Armada Hoffler Properties (AHH)

AHH owns a diversified portfolio of Class A real estate properties concentrated on the East Coast, namely the Mid-Atlantic and Southeastern regions. Currently, most of the REIT’s properties are clustered in Maryland and Virginia, but management plans to increase exposure to the faster-growing Sunbelt states of Florida, Georgia, and the Carolinas.

The company also has an active development platform with a large pipeline of properties being developed right now. For the most part, the kinds of properties AHH likes to develop are mixed-use centers like the Town Center at Virginia Beach, pictured below.

Armada Hoffler Properties

This center features 14 separate property parcels with office space, retail and restaurant stores, and multifamily units. These live-work-play environments are attractive to residential and commercial tenants alike in a self-reinforcing cycle. Commercial tenants want to set up shop and lease office space where the people are, and people want to live close to where their workplace and shopping/dining opportunities are.

AHH’s occupancy is extremely high at 97.3%, and though the market doesn’t seem to like its office exposure, this real estate type actually enjoys the highest occupancy rate of 97.9%.

And the whole portfolio is enjoying strong rent growth right now. By growing rents and tamping down on expense growth as much as possible, AHH was able to deliver the following same-store NOI growth rates in the last quarter:

- Retail: 7.5%

- Office: 2.5%

- Multifamily: 12.5%

- Overall: 7.4%

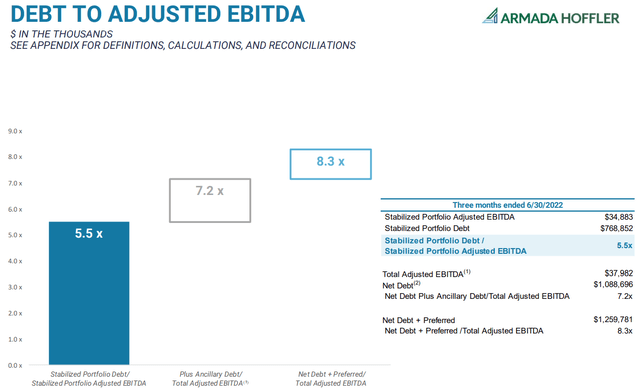

The primary hang-up about AHH for most investors pertains to debt. The REIT does carry a moderately high amount of debt, plus preferred equity.

AHH Q2 Presentation

However, in recent months, management has made great strides in extending its debt maturities and fixing its rates out as far as possible. They’re being very proactive in preventing their debt and interest rate cap maturities to significantly raise interest expenses.

As such, we think investors have much less to worry about as far as AHH’s balance sheet is concerned than the market seems to think.

AHH currently trades at a price to normalized FFO of 10x and a price to AFFO of 12x. We think that under normal circumstances, AHH is worth at least 50% more than its current stock price. While you wait to see that upside, you can enjoy a well-covered 6.3% dividend yield.

2. Whitestone REIT (WSR)

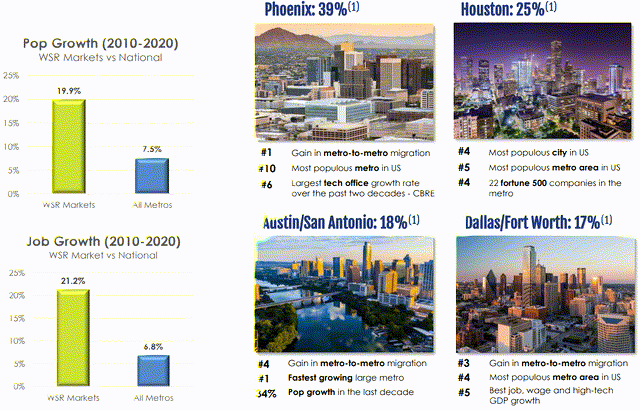

WSR is a retail REIT that owns well-located retail properties concentrated in five Sunbelt markets: Phoenix, Houston, Dallas/Fort Worth, Austin, and San Antonio.

WSR Q2 Presentation

These markets boast some of the fastest population and job growth in the nation. Numerous corporations, perhaps most notably Tesla (TSLA), have moved their headquarters and/or operations to Texas in recent years for its business-friendly tax and regulatory environment.

In the last quarter, WSR managed to hike its rents by 20% on renewal leases and 16% on new leases.

That’s strikingly strong rent growth!

Moreover, most of WSR’s leases are triple net, which means that tenants are responsible for all property maintenance, insurance, and taxes. Meanwhile, these leases also feature average annual rent escalations of around 3%. That offers some embedded rent growth while protecting WSR from inflationary expense growth.

And yet, despite well-located shopping centers in some of the best markets in the nation, rising occupancy, and rapid rent growth, WSR’s stock price is down ~40% from its pre-pandemic levels. Why?

Debt.

WSR had a net debt-to-EBITDA ratio of 7.9x in the second quarter. Moreover, until mid September, the majority of WSR’s debt matured in the next two and a half years, creating significant refinancing risk and uncertainty.

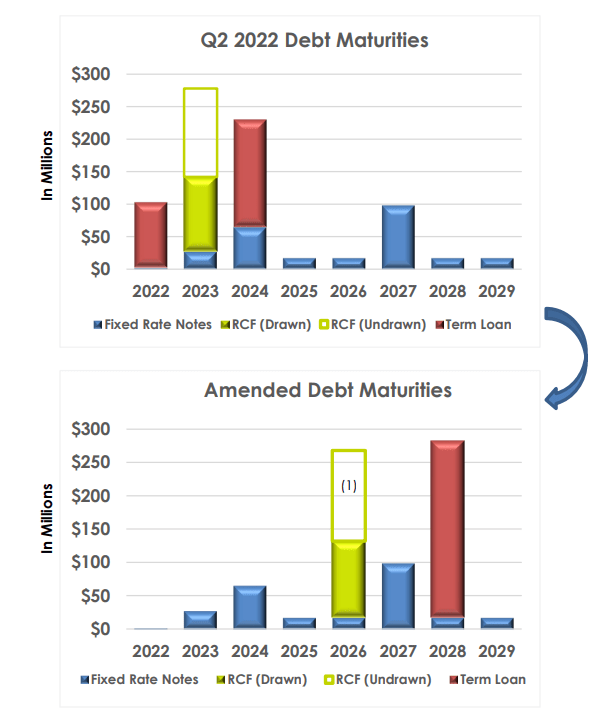

However, that uncertainty is now gone, as WSR recently amended and extended its $515 million credit facility and associated term loan, changing the REIT’s debt maturity schedule from the top chart to the bottom chart:

WSR September Presentation

As you can see, the vast majority of WSR’s debt maturities are now weighted toward the back half of the 2020s, with enough capacity on WSR’s line of credit to pay off the entirety of its remaining debt maturities for the next three years, if it so chooses.

After this transaction, WSR’s new weighted average interest rate on debt sits at 4.65%. That number certainly went up with the recast of the credit facility and term loan, but by no means was it devastating.

WSR’s balance sheet has now been significantly de-risked, and yet the market still shuns the stock. Compared to the expected 2022 FFO per share of $1.00, WSR trades at a price to FFO of about 9x. That implies zero growth going forward, when in actuality, WSR is growing strongly.

As for AHH, we think WSR has at least 50% upside to fair value, and while you wait for that upside to come, you can enjoy WSR’s 5.2% dividend yield that comes with a very low payout ratio under 50%.

Bottom Line

Perception is reality, and unfortunately for some REITs like AHH and WSR, negative perceptions from the investor community can take time to fade and for the reality of their fundamental strength to shine through.

Though rising interest rates and a probable 2023 recession pose headwinds, REITs always rebound strongly coming out of market downturns, and we do not believe this time will be an exception. AHH and WSR are great buying opportunities today for high income and 50%-plus upside potential.

Be the first to comment