z1b

Co-produced by Austin Rogers for High Yield Investor

The United States is the largest producer of oil and natural gas in the world. Add in Canada, and we find that North America is the world’s biggest supplier of fossil fuels.

Now, that fact may not seem like that big of a strength in an era in which record heatwaves and deleterious weather anomalies have pushed governments and private actors to invest increasingly in green energy solutions. Indeed, renewable energy is projected to account for ~95% of the world’s new power production capacity over the next five years.

However, what has been proven recently by Europe’s desperate search for adequate fuel supplies for the winter and California’s need to restrict power usage is that fossil fuels will be needed to supplement renewable energy for a long time to come. Renewables simply aren’t ready to fully replace existing infrastructure yet.

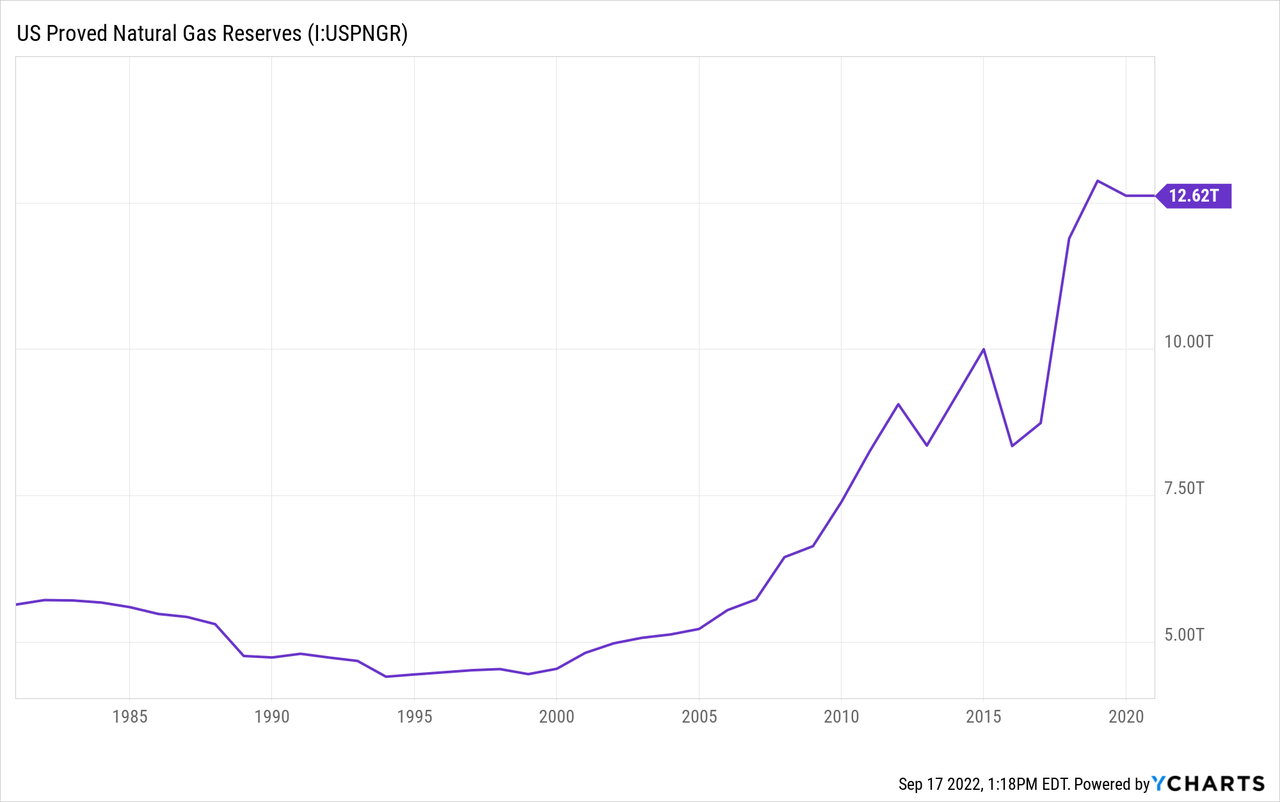

This is especially true for natural gas, which plays a major role in powering the utility and industrial sectors of the economy. And the United States has ample proven natural gas reserves. In fact, over the last 20 years, US nat-gas reserves have roughly tripled.

Currently, terminal facilities are being built to export gas from North America as well to import it into markets around the world such as Europe, China, India, and Africa. These facilities virtually ensure that global demand for North American natural gas will remain strong for many years, if not decades, to come.

At High Yield Investor, we are very bullish on US natural gas, and our favorite way to express this bullishness is through midstream gas infrastructure owners (ENFR, AMLP, MLPX, MLPA).

Below we explain our thesis.

Natural Gas: Essential For Prosperity

Everything in our modern world runs on energy. That statement is so obvious as to be trite, but it bears thinking about.

Though most people would probably agree at this point that the goal of carbon emission reduction is good and worthy of pursuing vigorously, few people think that it should be pursued so aggressively as to forcibly reduce our access to power. Few people, for instance, think that rolling blackouts are an acceptable sacrifice in order to lower carbon emissions. Likewise, few people like the idea of being told when they can or can’t charge their electric vehicles.

It is important to recognize that humanity’s progress, prosperity, and productivity is built on an energy and electricity supply that is abundant enough to meet our needs and desires.

As such, even as renewables are rolled out across developed nations the world over, the reliability and dispatchability of natural gas will continue to be high demand as a critical supplement.

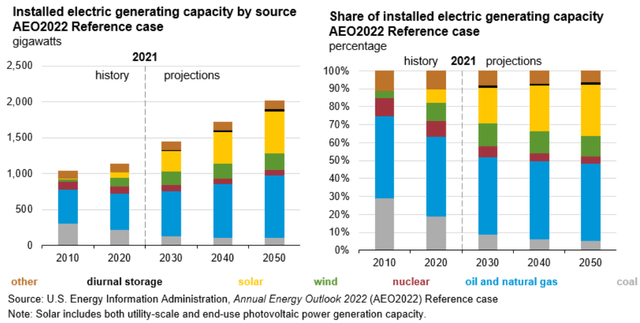

Notice, for instance, that while the Energy Information Administration forecasts renewables growing their generation capacity faster than any other source of electricity in the coming decades, they still see natural gas holding its ground as a share of the total mix.

Energy Information Administration

In the last 15 years, coal’s share of electricity generation has declined from roughly 50% to 20%, while natural gas’s share has increased from 15% to over 40%.

And though the increasing rollout of paired battery storage facilities along with new solar power generation assets should diminish demand for natural gas peaking plants to some degree, the EIA clearly does not foresee this having a big impact on natty gas’s overall share of electricity production in the next three decades.

The situation is virtually identical in Europe. As gas supplies from Russia have diminished this year, it has become abundantly clear that renewables are nowhere near ready to fill the gap and won’t be for a long time.

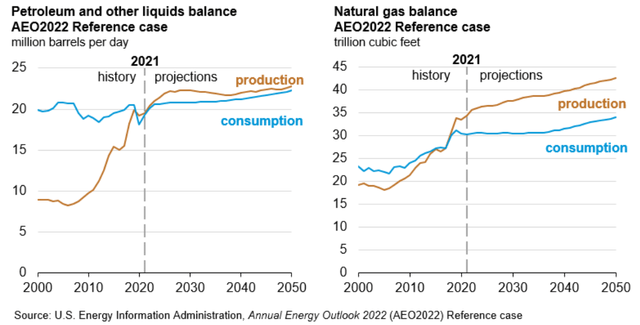

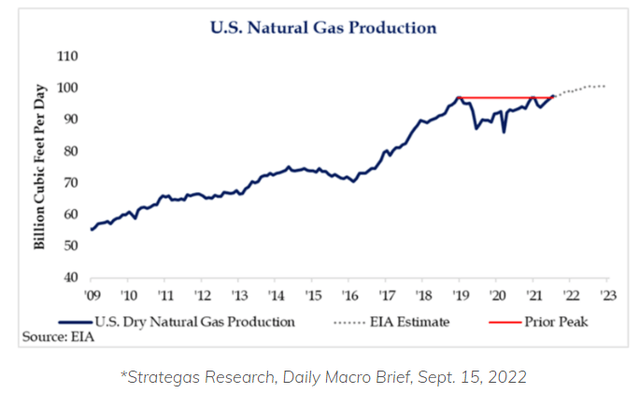

Hence why the Europeans have turned to their friends in North America for help. This should continue to support growth in US natural gas production to new highs, as the Energy Information Administration predicts.

This is a logical decision for Europe and other developed countries looking to reduce their overall carbon emissions, because natural gas is a cleaner burning fuel than coal or oil. That’s what makes it the perfect “bridge fuel” to use as the world steadily moves toward net zero carbon emissions.

Though many coal plants are being shuttered permanently, some are being converted to burn gas instead. This, along with continued use of the expansive existing gas-fired power infrastructure in the US and elsewhere, is what gives the EIA confidence that gas production will continue to rise in the decades ahead.

Energy Information Administration

You might notice a gap between the EIA’s projection of future gas production and consumption. That is because the EIA is only measuring US consumption of gas. But the US will continue to produce more gas than we use, because the difference will be exported to other countries.

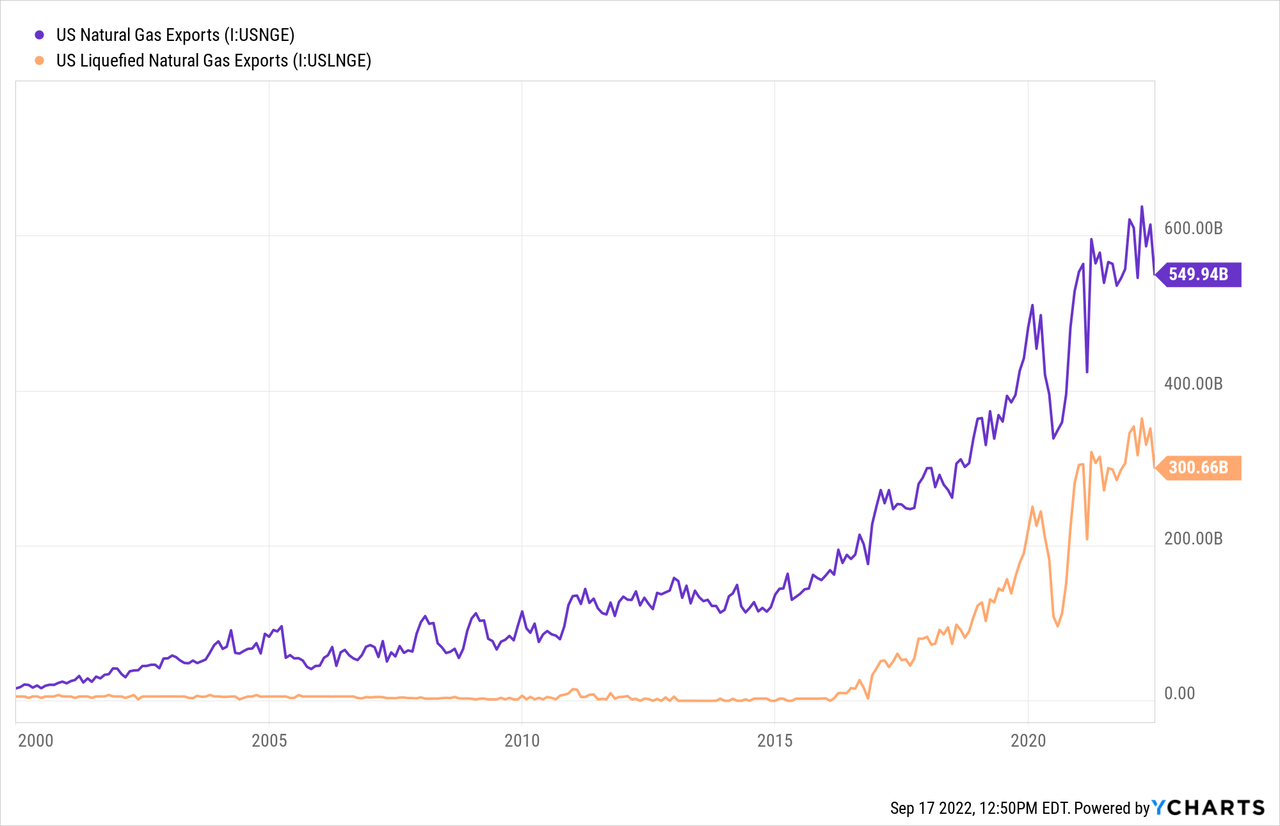

In fact, the surge in US gas exports has already begun. Around 2016, gas exports began to soar, fueled primarily by the increase in liquified natural gas (“LNG”) exports.

The dip you see this year is primarily caused by the fire at the Freeport LNG terminal, owned mostly by ConocoPhillips (COP). Once that facility is back up and running at full capacity later this year, the growth in US gas exports should continue on its previous upward course.

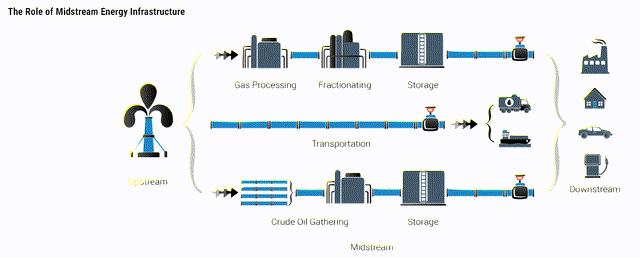

Our favorite way to play this growth in production and exportation of North American natural gas is the midstream sector. This is the “middle” portion of the energy industry wherein fossil fuels are transported, stored, processed, and shipped overseas via terminals.

Long-term take-or-pay contracts dominate company revenues in this sector, which makes cash flows more stable than those in the upstream or downstream segment of energy. While midstream companies lose out on some of the upside when commodity prices are high, they are also protected from most of the downside when commodity prices and throughput volumes are low.

What’s more, since the oil and gas glut of the mid-2010s, these companies have by and large become very disciplined and conservative capital allocators. Balance sheets have dramatically improved, and growth has become largely self-funded with operating cash flow. This makes midstream dividends safer than they ever have been.

Two Top Picks

At High Yield Investor, we hold several midstream stocks with significant natural gas exposure. While we will save a discussion of our specific holdings in the space for our members, we will highlight two examples of attractively priced, natty gas-focused midstream stocks right now.

1. Enterprise Products Partners (EPD)

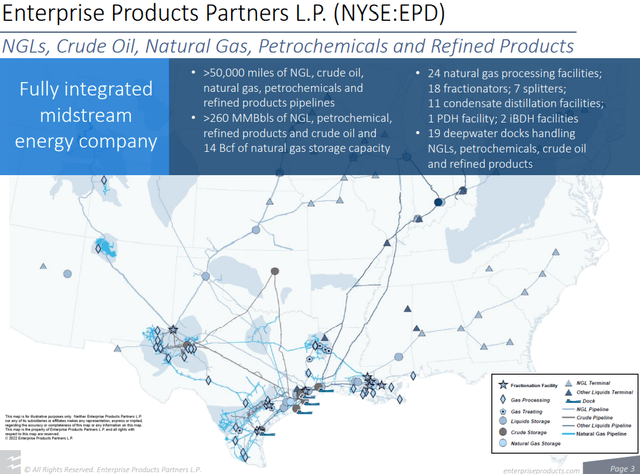

EPD’s portfolio of pipelines, storage, processing facilities, and liquids terminals is one of the largest in North America, concentrated primarily on the Gulf Coast but with major interstate pipelines reaching all across the country.

EPD has several major things going for it.

- First, it has heavy insider ownership with management and the founding Duncan family owning around one-third of the company. This fundamentally aligns interests between management and shareholders.

- Second, perhaps as a result of the first point, management has an excellent track record of capital allocation with 12% average returns on invested capital over the last decade.

- Third, EPD’s ~7.4% dividend yield is well-protected with a 72% TTM FCF payout ratio, not to mention the company’s 24-year dividend growth streak.

- Fourth, EPD boasts peer-leading balance sheet strength with a BBB+ credit rating and a leverage ratio of 3.1x TTM EBITDA.

- Fifth, EPD enjoys a very strong position in natural gas liquids (different than LNG) and petrochemicals, which are heavily used for plastics production and in-home heating and cooking in developing countries.

While EPD does not do as much in LNG directly, it does have plenty of natural gas pipelines and processing facilities that are tangentially involved in the process of increasing LNG exports.

2. Kinder Morgan (KMI)

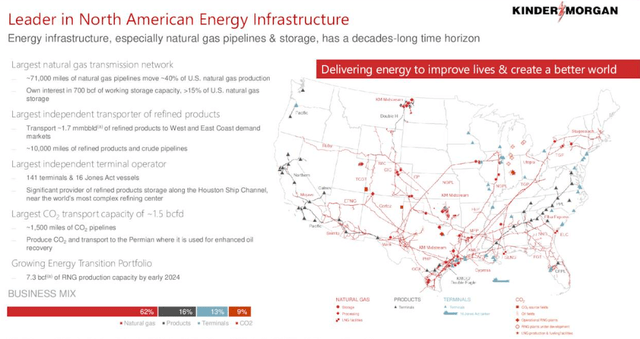

Like EPD, KMI owns an extensive portfolio of primarily natural gas-oriented pipelines, storage facilities, and processing plants.

Compared to EPD’s slightly over 50,000 miles of pipelines, KMI’s pipeline network reaches ~71,000 miles and moves roughly 40% of US-produced gas. This focus on natural gas virtually ensures that KMI’s pipelines transport gas that will ultimately become exported LNG, even if KMI does not engage in LNG exports directly.

While KMI’s balance sheet is a slightly lower quality than that of EPD, it still enjoys a BBB credit rating and a net debt to 2022 EBITDA of 4.3x. The company has self-funded its dividends and capital expenditures for the last six years while growing its dividend and occasionally engaging in share buybacks.

KMI’s 6.2% dividend yield is also well-protected with a low payout ratio of 48% based on distributable cash flow. This leaves plenty of room for the dividend to keep rising for many years to come.

Bottom Line

Our confidence in the long-term prospects for US natural gas production translates into a similar confidence in gas-focused midstream stocks like EPD and KMI. They may not enjoy as much upside as companies directly involved in LNG exportation, like Cheniere Energy (LNG) and Tellurian (TELL), but they promise greater stability and higher dividend yields.

Be the first to comment