CHUNYIP WONG

Real estate private equity firm Bridge Investment Group (NYSE:BRDG) shares have declined nearly 50% year-to-date and are off nearly 16% since November 30, the day before Blackstone (BX) announced it was gating redemptions on its popular non-traded REIT (BREIT). While Bridge does have a meaningful component of retail investor money, unlike BREIT, it does not offer monthly/quarterly liquidity. Rather the capital is locked up for several years (discussed below).

Following the dramatic sell-off, I find Bridge shares to be very attractive trading at just 12x current after-tax fee related earnings, a sizable discount to larger private equity firms. Further the company has ample growth opportunities ahead (discussed below) and stock offers a generous 8% dividend yield.

Background/Overview

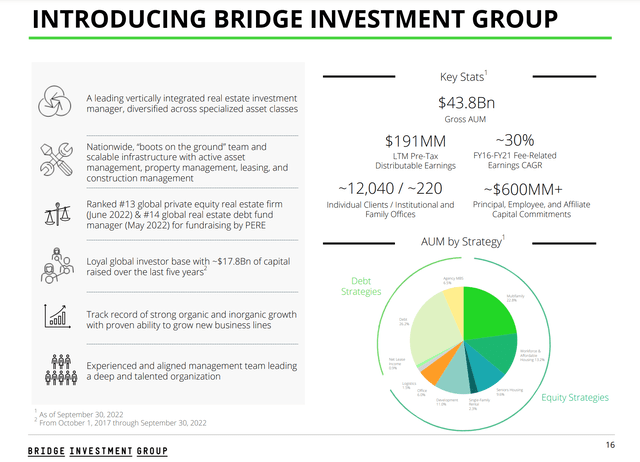

Overview (Investor Presentation)

Founded in 2009, real estate private equity firm Bridge Investment Group came public in July of 2021 at $16 per share. As shown above, the company is primarily focused on multifamily and workforce/affordable housing (subsidized apartments) and offers both debt & equity strategies. On a gross basis, the company manages nearly $44 billion in assets (included the debt on the properties) with fee paying assets under management just under $17 billion.

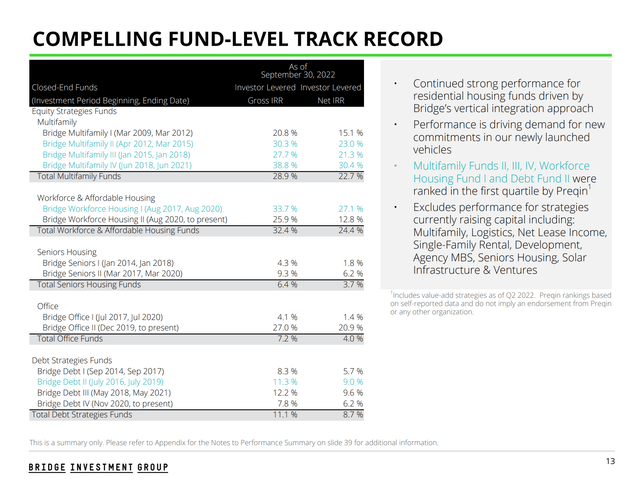

Investment Track Record (Investor Presentation)

As shown above, Bridge has produced excellent results for investors in its multifamily and workforce strategies with several of its multifamily strategies ranking in the top quartile of competing funds. Bridge’s success has helped the company to attract significant inflows (shown below) and grow fee paying assets under management from $10.2 billion at the end of 2020 to nearly $17 billion today.

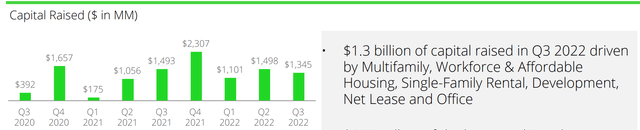

Capital Raised (Investor Presentation)

The growth in assets under management has led to a doubling of recurring management fees. Unlike non-traded REITs which are subject to outflows in skittish markets, 76% of Bridge’s capital is locked up for 5+ years.

Further, unlike mutual fund managers whose fees are subject to declines with equity markets, Bridge’s fees are based on committed capital ensuring a steady stream of recurring management fees for years to come. Recurring management fees are calculated as a fixed percentage of committed capital – unlike the fees earned by managers of publicly traded equities which can vary widely based on share prices, Bridge’s fees are earned based on the amount invested.

Growth Opportunities

Beyond its core multifamily and workforce housing funds, Bridge has recently launched new fund strategies including:

- Logistics/Industrial Real Estate

- Net Lease Real Estate

- Single Family Homes Real Estate

- Solar /energy infrastructure

- Ventures – fund to invest in real estate technology

In addition, the company has looked to expand its distribution capabilities, most recently tying up with KB Asset Management in what management believes could be over $1 billion in new assets under management.

Bridge also benefits from having significant amount of dry powder which can be opportunistically deployed. With the transaction market for commercial real estate market stalled, it has become a buyer’s market for those with available capital as management recently discussed:

Dry Powder & Opportunity (BRDG 3Q22 conference call transcript (Seeking Alpha))

Deploying capital in a buyer’s market should help Bridge to maintain a strong investment performance record and continue to attract new assets (and generate fees). As an asset class, US commercial real estate is gigantic so there really is no limit on Bridge’s growth potential. As long as Bridge is able to I expect the company should be able to continue to grow fee paying assets under management 8-12%.

Valuation

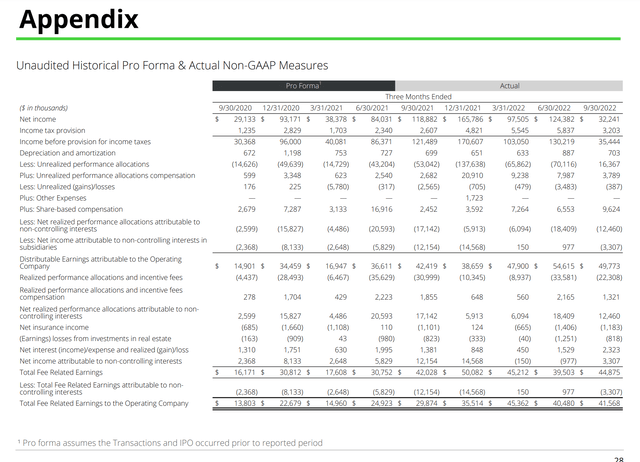

Bridge’s reporting is somewhat cumbersome – here is their slide which shows Fee Related Earnings for the last 9 quarters:

Fee Related Income (Investor Presentation)

As you can see Fee Related Earnings have held up well even as transaction income (fees related to the purchase/sale of assets within a fund) have slowed along with the broader transaction multifamily market. The bulk of the revenue earned by Bridge is related to recurring management fees based on committed capital.

Annualizing fee related income earned in 3Q, deducting taxes (assuming a 24% rate, more conservative than current rate) and dividing by 121 million shares outstanding (assuming full conversion) gets me to $1.04 in after-tax fee related earnings per share. At $12.60 per share, this implies that Bridge trades at just 12x after-tax fee-related earnings. There is another $1-2 of after tax carry (performance fees due) attributable to shareholders. Deducting these implies that Bridge trades at less than 11x fee-related earnings.

While 2023 will likely be a difficult fund raising year for Bridge given the tepid appetite of allocators for new real estate private equity investments, over the long term it is likely that Bridge will resume its growth trajectory (along with the industry). Assuming 0 growth new assets in 2023 and 10% asset growth in 2024 and 2025 (this well below the 20% recorded in 2019-22), I estimate after tax fee related earnings of $1.25+ in 2025. Applying an 18x multiple (a 20% to Blackstone which is Bridge’s best comp) and adding in $1.50 of after-tax accrued performance fees (but giving no credit for ongoing performance fees) gets me to a total value of $24 per share or 90% upside.

Risks

1. While Bridge has a very stable income profile based on sticky assets and fees, it is categorized as an alternative asset manager. Alternative asset manager shares are volatile, owing to the cyclical performance fee component.

2. Founded in 2009, Bridge has a limited history and there is less information about the company than more established firms like Apollo, KKR, and Blackstone.

Conclusion

At just 12x current after-tax fee related earnings Bridge shares are too cheap for what I view to be a durable and growing stream of cash flows. Looking out a few years I see the potential for the stock to nearly double while investors collect an 8% dividend yield along the way.

Be the first to comment