Buy the dip. Not French onion, the dip in these picks! z1b

Co-produced with Treading Softly.

There is a theory that the market is always efficient. Proponents believe that investors cannot readily beat the market, as once they receive information, it has already been priced into the share price of the company in question.

It seems like an excuse for chronic underperformance or market-meeting returns instead of market-beating returns.

I do believe in a reversion to mean, this is frequently where a high-flyer will succumb to gravity and return to its historical premium or discount. Likewise, gravity will pull up a fallen security back to its proper place if there has been no material change.

Interestingly, if a security is flying high or irrationally fallen down, then the ideals contained in the belief of an efficient market are moot. You cannot have all information factored into the price AND irrational price movements.

So how do these price movements occur? Sentiment.

When information is received, investors react – often before processing and understanding what they’ve learned. So that the initial reaction to buy or sell can ripple through the market. The reversion to mean occurs when level-headedness returns.

So today, I want to look at two very sentiment-beaten securities which are primed for better futures and larger dividends. These are opportunities worth buying, holding, and adding to as we look forward to future movements.

Let’s dive in.

Pick #1: NLY – Yield 16%

Since Q3 earnings, the trend in Annaly Capital Management, Inc. (NLY) turned around and has been on an uptrend. For investors who have held through the substantial downswing we’ve seen in agency MBS, this is welcome news.

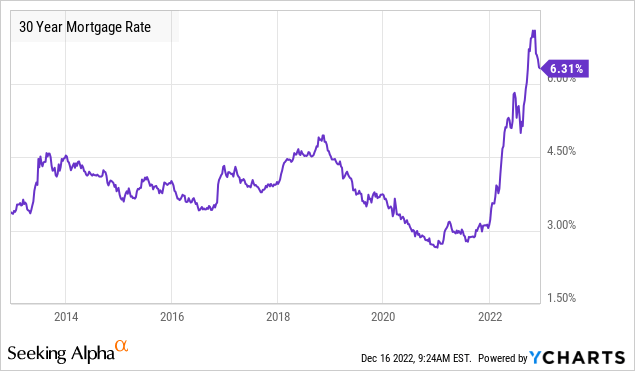

The headwind that NLY has been facing has been rising mortgage rates. Which reached multi-decade highs at 7%, but have since pulled back.

At its core, NLY owns mortgages. The mortgages that NLY owns are guaranteed by the “agencies,” Fannie Mae and Freddie Mac, so they don’t carry any default risk. However, when mortgage rates go up, that means the value of mortgages goes down, just like any other fixed income.

For much of the year, MBS has “underperformed” Treasuries, this means that MBS prices have fallen faster than U.S. Treasury prices have declined. This is brutal for NLY’s book value because NLY is long agency MBS, and short U.S. Treasuries as a hedge. With any pair trade, when your long position falls more quickly than your short position, the total value declines.

Since October, this situation has reversed, and MBS prices have started a significant recovery. Source.

The 50-day moving average (the blue line) has started going up for the first time all year. Agency MBS has responded favorably to news of slowing inflation and from the prospect that the Fed might pivot within the next six months.

The actions and the predictions of what the Fed will do should continue to impact MBS prices and therefore have an impact on NLY’s price. Since Q3 earnings, the trend has been bullish, but an unexpectedly hawkish Fed could have another adverse impact on price.

Importantly, it will not harm NLY’s earnings. NLY invests in mortgages, and higher mortgage rates mean that NLY is receiving more money. Rising rates are negative for the value of currently owned mortgages, but it is a positive for future returns on new mortgages.

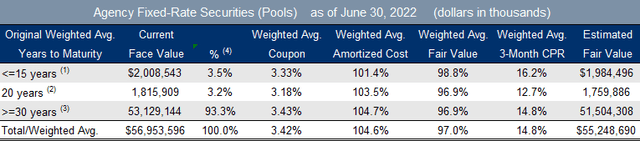

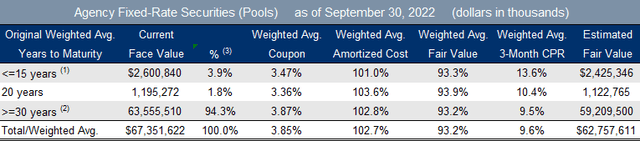

NLY positioned itself to “buy the dip,” and that is what it did. From June 30th through September 30th (which, in hindsight, we know was two weeks from bottom MBS prices), NLY acquired over $10 billion in face value of debt.

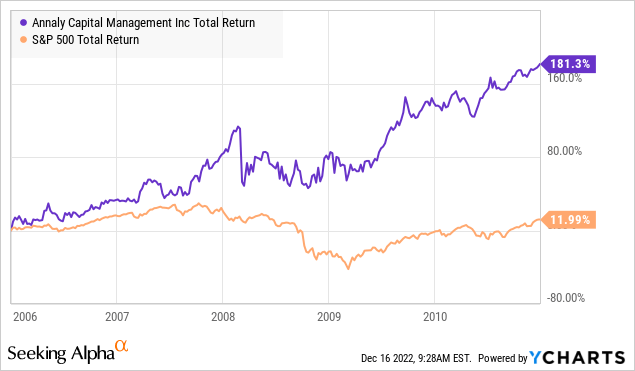

NLY is investing at the highest mortgage rates it has seen since 2006-2008. A period that led to exceptional and extended outperformance of the S&P.

We didn’t believe that the Fed would make the same mistakes it made going into the Great Financial Crisis. We thought the Fed would have a lighter touch and would be more cautious.

We thought wrong, the Fed has been far more hawkish than it was leading into 2008. It is on its way to hiking into an inverted yield curve for an unprecedented second time, even as evidence of a coming recession is building. This is bad news for a lot of Americans and for most stocks in the market. For NLY, it means that it could be sitting at the beginning of an unprecedented boom as a recession occurs, and a strong Dovish pivot in response would be the ideal scenario. The perfect storm occurred in 2008, the Fed seems intent on brewing another one.

In our original article on NLY way back in 2019, we wrote:

It is a true example of an investment that is truly counter-cyclical. In other words, it performs very well in bear markets but tends to underperform in bull markets.

With recent declines, we believe now is the time to invest in this potentially powerful hedge. We can reasonably expect market-matching performance as the bull market enters its twilight and in 2-5 years, whenever the bear market starts, we can expect it to experience price and dividend growth as the rest of the market pulls back.

At that time, we were fearing a recession in a couple of years, but that recession and bear market never happened. COVID created a truly new and unique situation that was somewhat “recession-like” but lacked the features we typically see. Most notably, “risk” assets flourished, with investors dumping tons of capital into meme stocks, cryptocurrencies, and Growth stocks with negative earnings.

Now here we are, on the eve of another recession. NLY’s performer as a hedge that will underperform in bull markets as we’ve had but will outperform in a recessionary bear market still serves a vital role in our portfolio. The unprecedented hiking cycle of the Fed has created far more pressure on fixed-income and has created conditions for a historic rebound. The Fed can ignore a weakened economy for a while. It ignored inflation for a very long time, but it can’t ignore it forever. When the recession comes, we want NLY in our portfolio.

Pick #2: EPR, Yield 8%

EPR Properties (EPR) was flying high in 2022 on the back of a dividend hike and the continued recovery of its business. In early August, it was one of the few companies that were solidly green year-to-date.

Then Cineworld filed for bankruptcy.

Investors panicked and sold, running for the hills!

In August, as the news that Cineworld might file bankruptcy was reported, we wrote:

Yet because this risk was brought to the forefront of investors’ brains, we can expect that sentiment towards EPR will be generally bearish until there is some clarity from Cineworld. If/when Cineworld actually files for bankruptcy, we could see another impact on EPR’s price. In the coming weeks, we could see a fantastic buying opportunity for EPR.

The last bankruptcy EPR dealt with was Children’s Learning Adventures in 2018. EPR management provided clear and upfront guidance throughout the process and it resulted in a decline in price for a brief period, but the dividend kept climbing. It was mostly a psychological distraction. EPR’s management is top-notch and they will be able to deal with whatever issues Regal presents. The bottom line is that the properties are essential to the business and are cash-flow positive at the property level.

It is too early to “back up the truck” now. We are lowering our buy under on EPR to reflect our expectations of this headwind, however, we do not anticipate risk to the dividend, and we expect to hold EPR through Cineworld’s reorganization.

This proved to be prophetic, as EPR’s price did continue to come down, and declined below our adjusted “buy under” price. Since October, it has been climbing back up. At earnings, EPR confirmed that it had received both October and November rent payments, as Cineworld continues to pay rent through the bankruptcy process. As a result, EPR actually raised its guidance for 2022.

Cineworld continues to make progress toward resolving its bankruptcy and is expected to have a resolution in the first half of next year. By the time Q4 earnings come around, EPR should have a very good handle on the total impact of the bankruptcy. So far, we have observed Cineworld rejecting three leases owned by EPR in Staten Island, NY, South Richmond, TX, and Wichita, KS. The fate of these properties remains unknown, as EPR will have the option to bring in a new tenant or sell the properties, this is a fraction of EPR’s 173 theater properties.

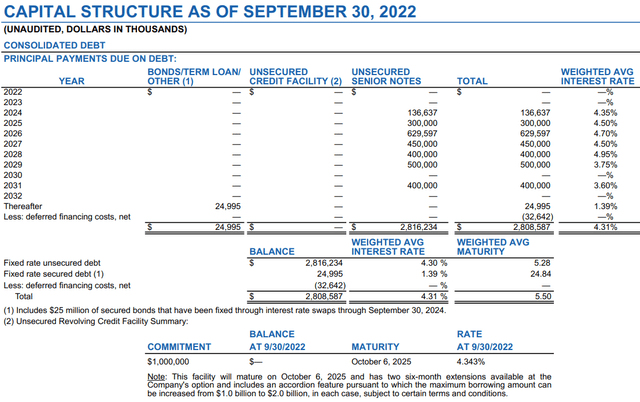

EPR is in a very good financial position, with no balance on its $1 billion revolver and no debt maturing until 2024. Source

This provides ample room for EPR to avoid being forced to refinance at high-interest rates. While also ensuring EPR has substantial liquidity to pursue its acquisition plans or to deal with any issues stemming from the Cineworld bankruptcy.

EPR is in the “experiential” properties business, these are properties where people go to do things. They are also the properties that were hit hardest in a world where people were avoiding public spaces. Despite the unexpected and unusual headwinds, EPR came out on the other side with a strong balance sheet and without diluting common shareholders.

While the market worries about short-term issues, we are happy to buy the dip and add more shares of EPR.

Conclusion

With EPR and NLY, we have the opportunity to enjoy higher-than-normal yields all while benefitting from the negative sentiment surrounding these two misunderstood companies.

These high-yield opportunities are paying dividends supported by the performance of their portfolio of holdings – either leases or Mortgage-backed securities.

I’ve long been an income investor and found that buying the downtrodden can lead to large sums of income and great future rewards. I do not gamble and bet the farm on any one investment. I hold over 42 individual investments in my portfolio, all of which pay me large dividends.

This way, I can hold through sentiment swings, buy the dips, trim as needed on highs, and continue enjoying my hobbies. This holiday season, many of your friends and families may have strained budgets from their spending choices and gift-giving. Perhaps the best gift you can give is showing them how they can benefit from the market – regardless of the method of doing so.

I happen to think income investing is the easiest and low-stress means to get big paychecks from the market without heavy lifting.

Be the first to comment