Prostock-Studio/iStock via Getty Images

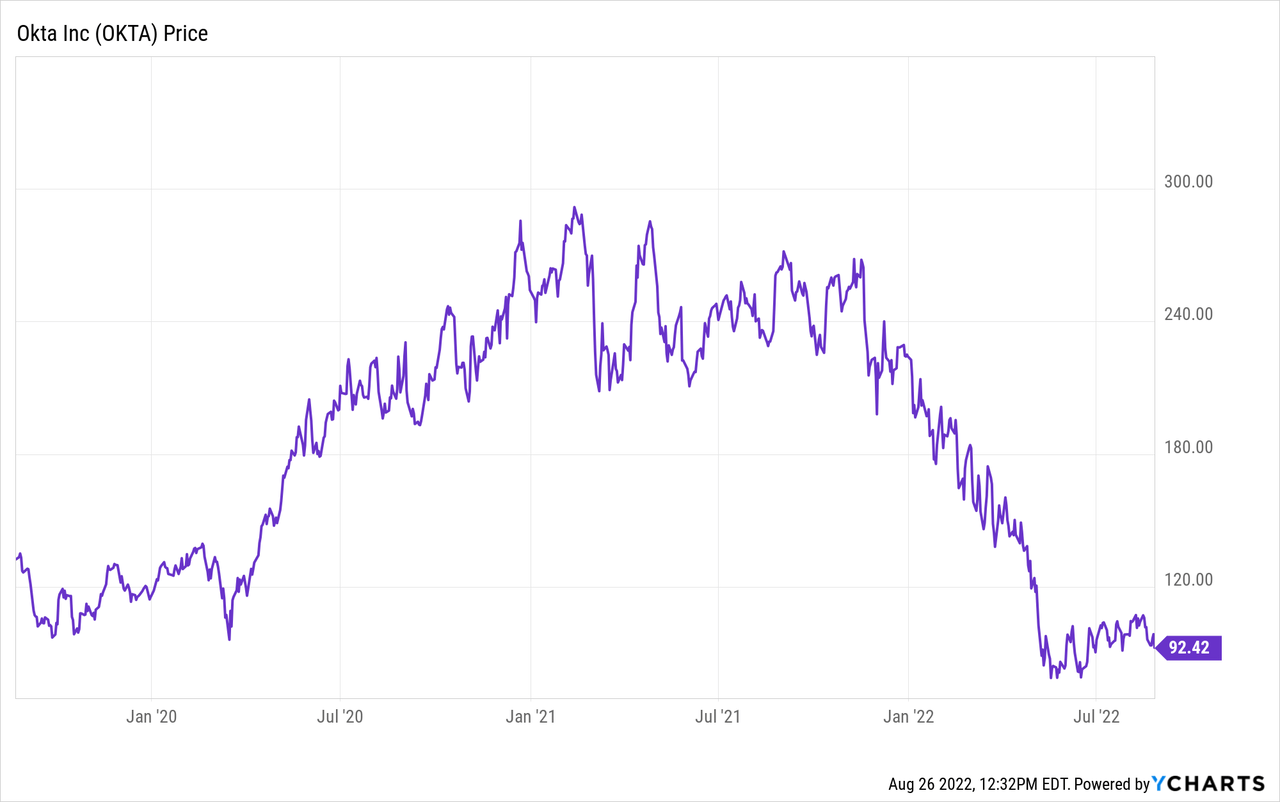

Okta (NASDAQ:OKTA) is set to report earnings on Wednesday August 31st after the market close. While the company previously posted what was initially received as a quarter of vindication, the stock has since given up all of those gains. I doubt that the stock will return to all-time highs any time soon, but the valuation reset across the tech sector has led this top tier tech stock to trade at compelling valuations. The cheap valuations in the tech sector have persisted for nearly a year now, but long term investors may be finding the ongoing weakness to be a protracted buying opportunity.

OKTA Stock Price

After bouncing slightly after reporting earnings on June 2nd, OKTA has since fallen back to pre-earnings levels – just in time for the next earnings release.

The stock remains 69% lower than all-time highs. I last covered OKTA in June where I discussed why the stock was a buy after the strong earnings report. I had anticipated that report to be the mark of a bottom and the last chance to buy OKTA at reasonable valuations. The recent price weakness has given investors yet another opportunity to add this high quality tech stock to their growth portfolios.

OKTA Stock Key Metrics

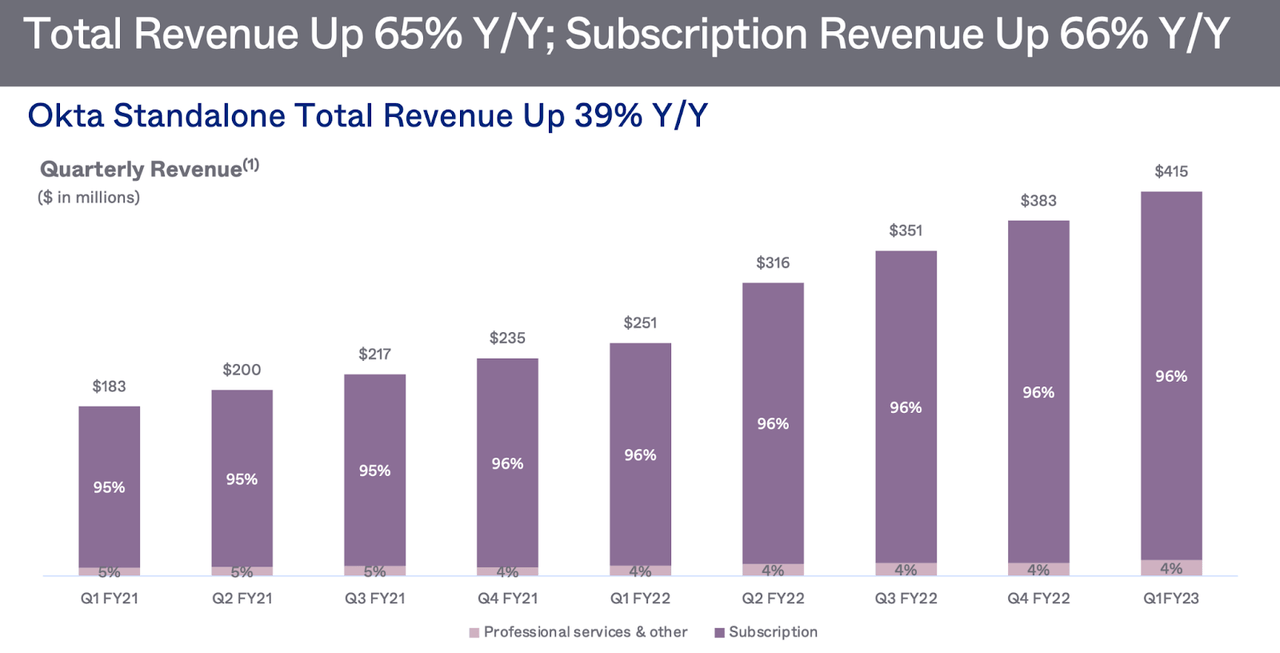

OKTA’s latest quarter showed strong growth in spite of macro-headwinds and the company’s security breach, with revenue growing 39% on a standalone basis.

Q1FY23 Presentation

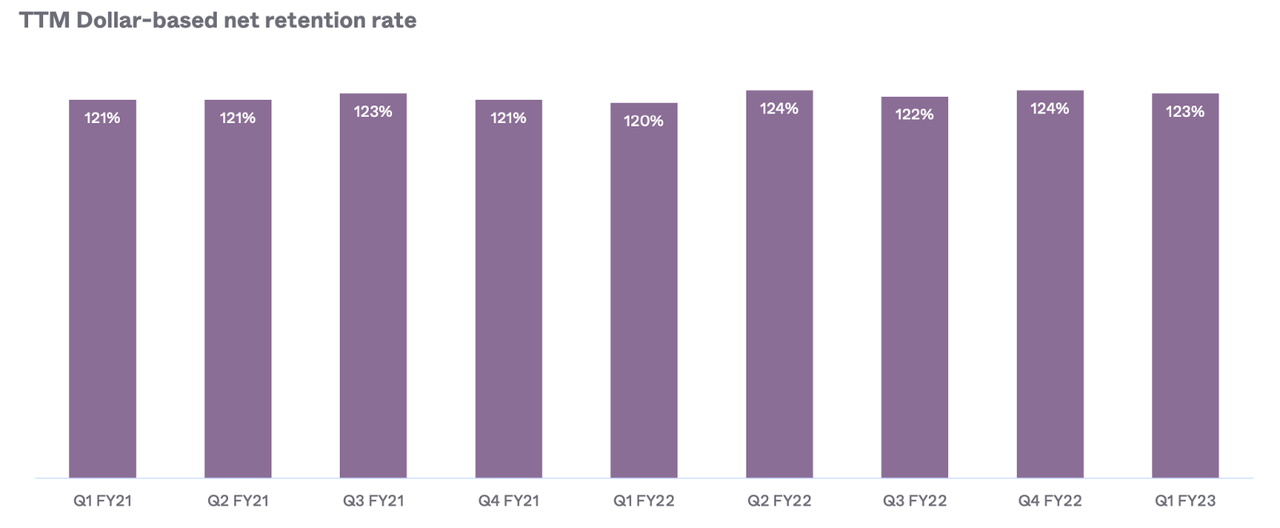

That growth was powered by the 123% dollar-based net retention rate. The high dollar-based net retention rate, even after the company laps tough pandemic comparables, has typically been a justification for a premium multiple (that premium has evaporated).

Q1FY23 Presentation

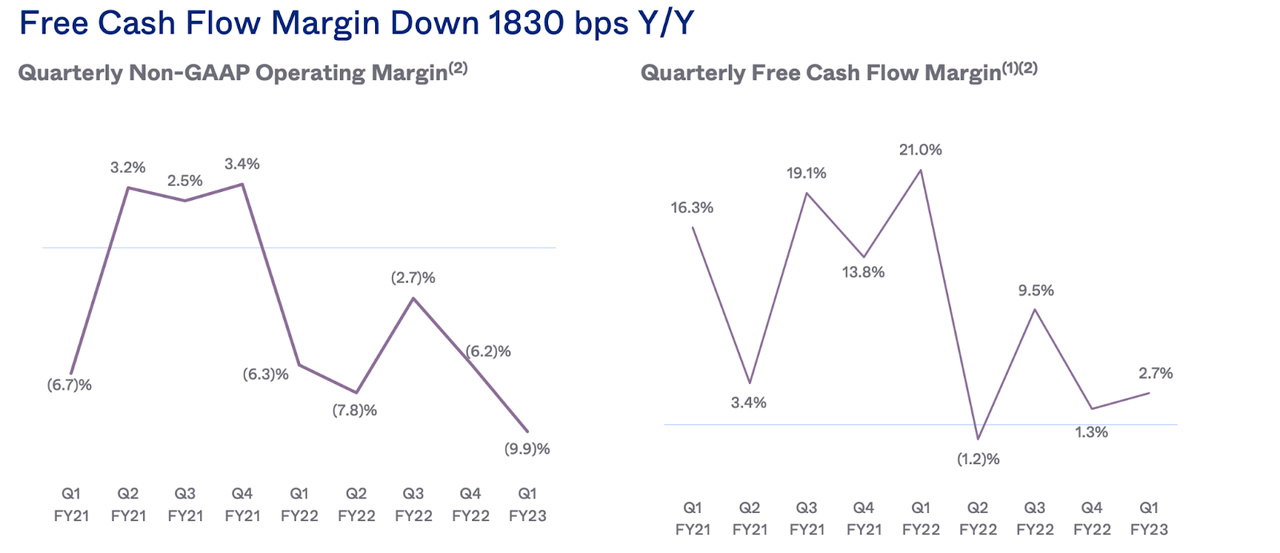

OKTA is not yet profitable on a GAAP basis, but due to pre-payment of deferred revenues it is already slightly free cash flow positive.

Q1FY23 Presentation

OKTA ended the quarter with $2.5 billion of cash versus $2.2 billion of debt. The company’s net-cash balance sheet and reasonable cash flow profile help to reduce the financial risk amidst tightening macro conditions.

Will OKTA Beat Earnings?

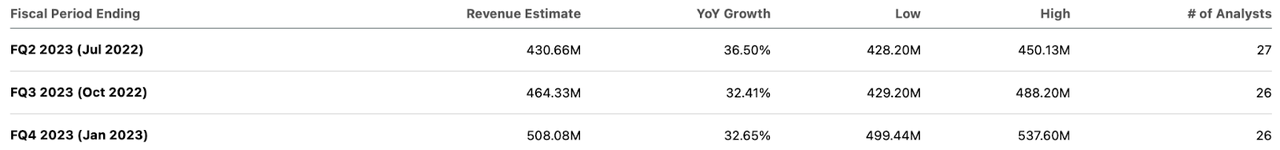

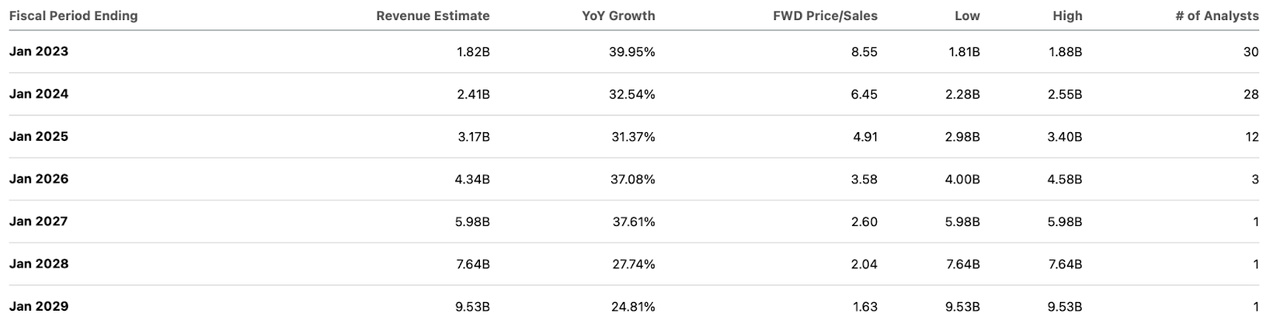

Consensus estimates call for around $430.66 million in revenues in the next quarter, with estimates ranging between $428.2 million and $450.13 million. Full-year consensus estimates stand at $1.818 billion.

Seeking Alpha

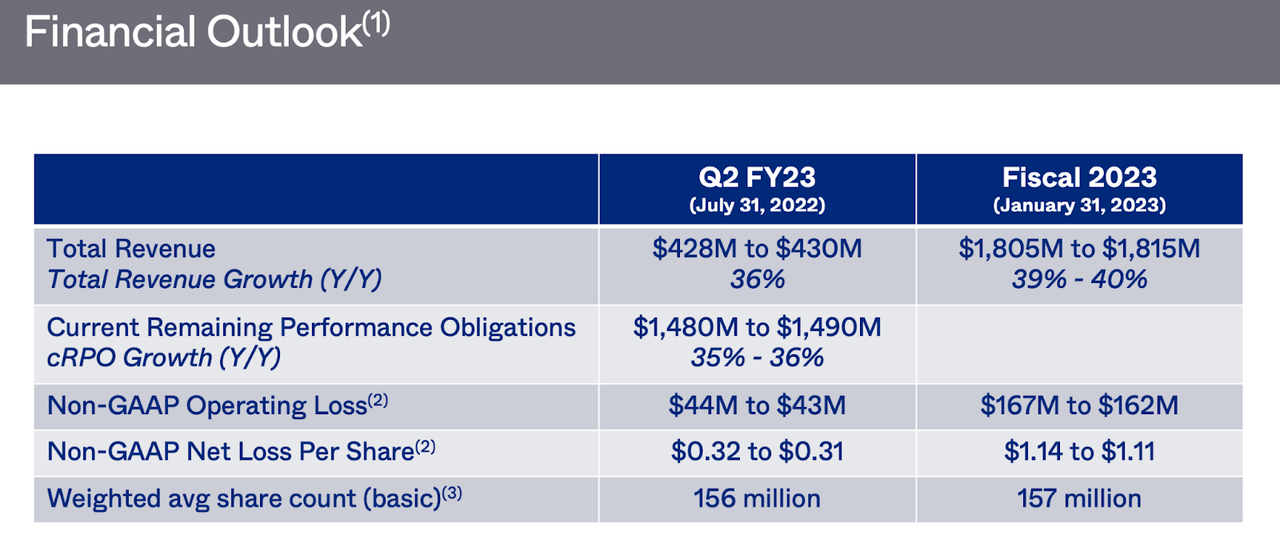

OKTA had previously guided for up to $430 million in next quarter revenues and $1.815 billion in full-year revenues.

Q1FY23 Presentation

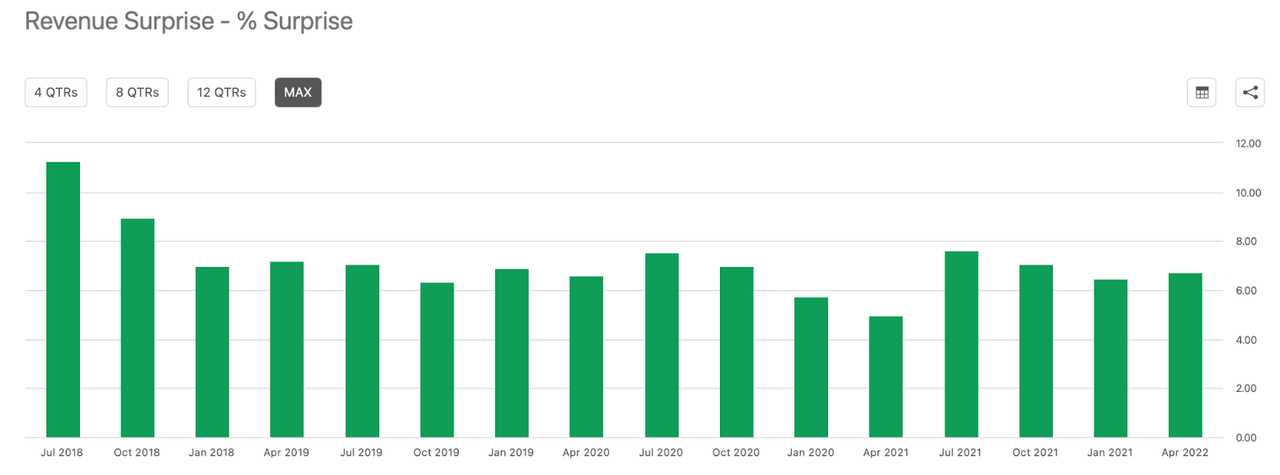

Consensus estimates are higher than that likely due to OKTA’s long history of beating on revenues.

Seeking Alpha

That said, I would not be surprised if OKTA “merely” meets expectations, missing on consensus estimates, due to the difficult macro environment.

Is OKTA Stock A Buy, Sell, Or Hold?

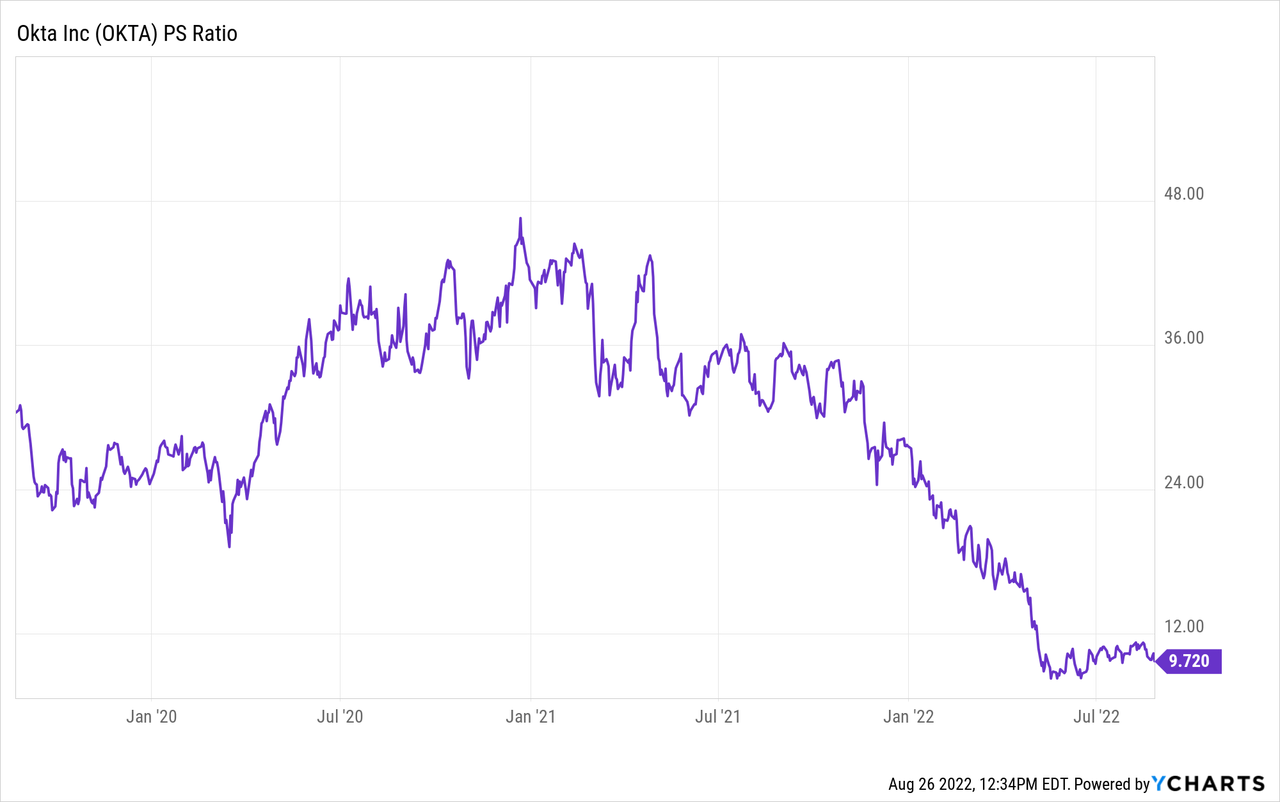

The tech crash and the company’s security breach earlier this year have led to a vicious valuation reset in the stock. This is a stock that typically traded at more than 30x sales during the pandemic.

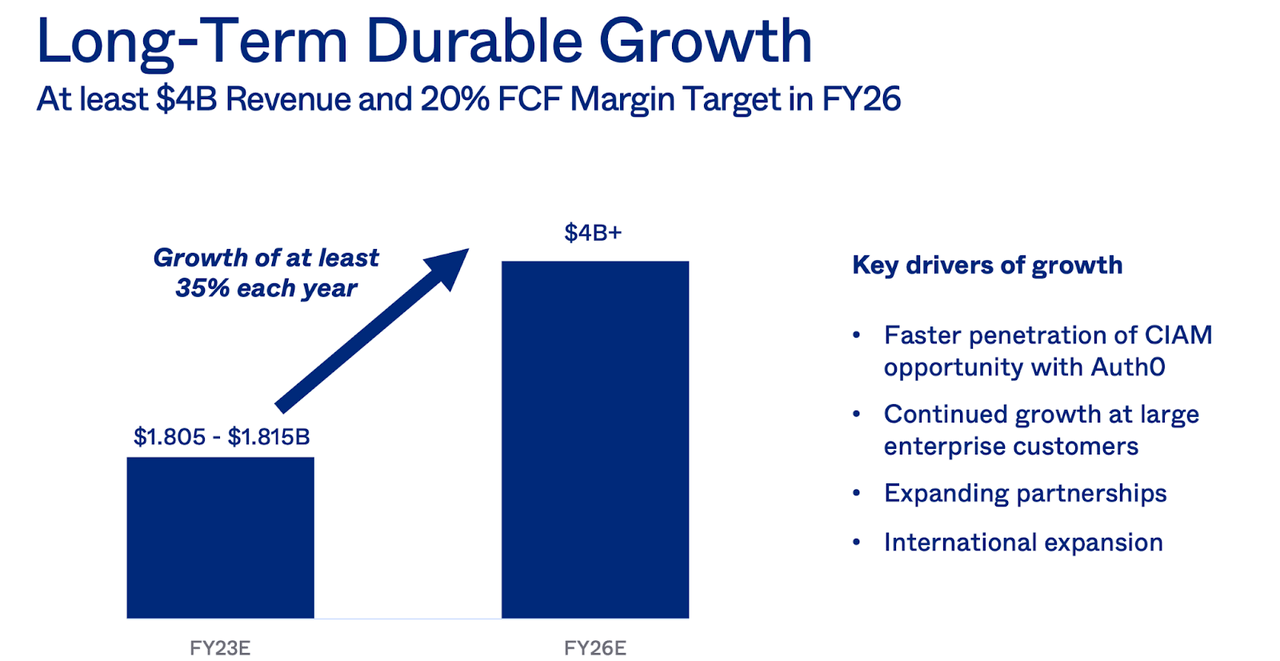

The stock shouldn’t have traded that high, but this is a good moment to remind ourselves of why the stock traded so high in the first place. OKTA’s identity solutions are mission-critical for any cloud application. This is a company with a seemingly highly visible growth outlook and it doesn’t hurt that management has given long term guidance of at least 35% each year through fiscal 2026.

2021 Investor Day

Consensus estimates call for $4.34 billion of revenue in fiscal 2026, which I note is slightly less than the $4.45 billion implied by the “at least 35% annual growth” target set by management.

Seeking Alpha

With the stock trading at just 8.5x forward sales, the company could miss on that outlook and still be a strong investment. I could see the company sustaining 30% net margins over the long term. Assuming the company only hits $4 billion in 2025 (implying 30% compounded growth), generates 28% growth exiting 2025 and trades at a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at 12.6x sales, or a stock price of $301 per share by the end of 2025. That represents 48% annual returns over the next three years.

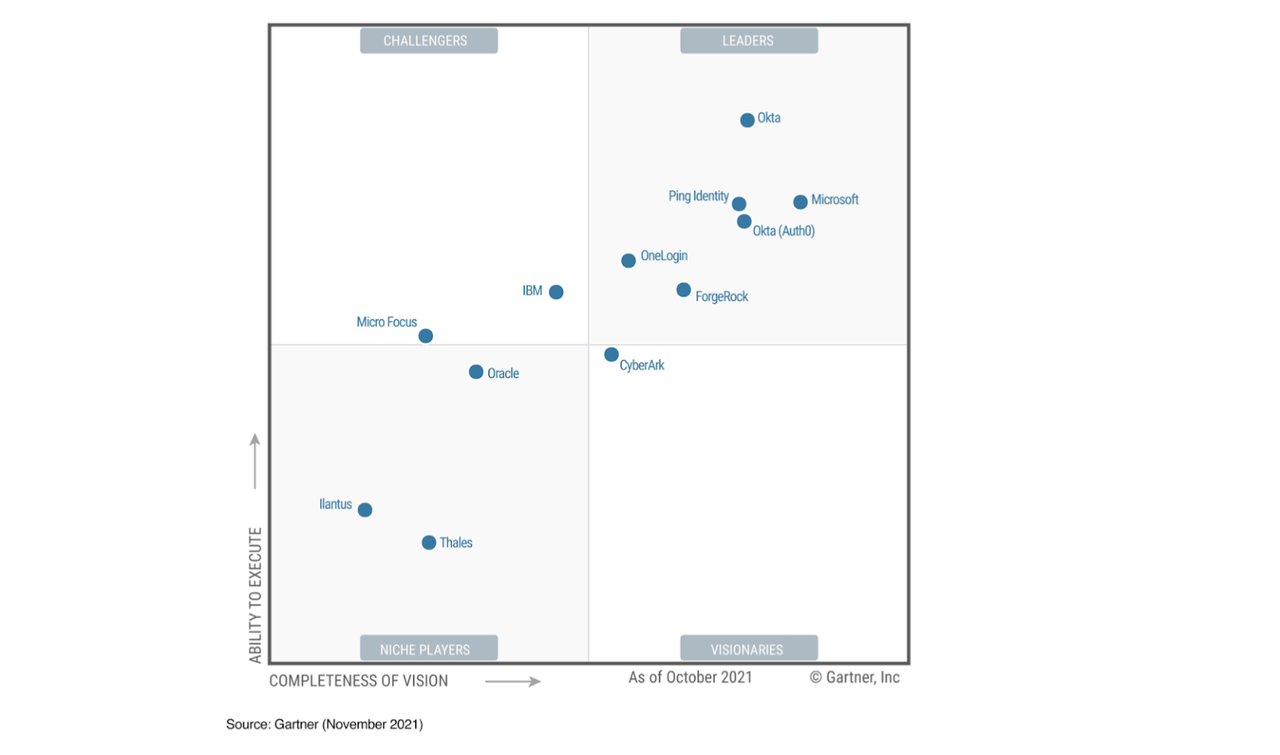

A key risk that emerged this year is that of the security breach. On the conference call, management noted that they did not see “any quantifiable impact” and that they had talked to over 400 customers after the issue. While their near term results appear to show minimal impact as a result of the breach, in my experience the negative consequences of such incidents can show themselves only several quarters after their occurrence. Another risk is that of competition. Not only does OKTA need to sustain strong growth rates to justify its valuation, it also needs to realize operating leverage for eventual profits. I view OKTA to still be the top operator in the sector, but it is competing against many competitors including mega-cap tech giant Microsoft (MSFT).

Okta

There is the risk that competition eventually leads to a pricing war, threatening both long term growth rates and profit margins. OKTA will need to continue innovating and its task may be even harder than before due to the security breach. Still, the stock is too cheap here and I wouldn’t be surprised if a lot of the projected returns prove to be front-end weighted as the stock could regain its previous premium multiple. I rate the stock a strong buy as a core position in any tech allocation.

Be the first to comment