Kameleon007

Liberty Latin America (NASDAQ:LILAK, NASDAQ:LILA) is a cable and mobile operator in Puerto Rico, Chile, Panama, Costa Rica, and the Caribbean, and also owns an extensive subsea and terrestrial fiber optic cable network that connects over 40 markets in the region. The company was spun out of cable giant Liberty Global (LBTYK) a few years ago, where under previous management it acquired and grossly overpaid for Cable & Wireless Communications (C&W). While C&W has some great cable and fiber assets, it was also a poorly run turnaround, and as the incumbent telephone company in many of its markets, it faced years of declining fixed and mobile phone revenue even as the cable side of the business was growing nicely.

The stock went into an extended swoon as a result, which only got worse when Hurricane Maria devastated Puerto Rico in September 2017 – though operations there have since fully recovered – and then collapsed when Covid struck. The company was forced to raise capital in a rights offering, and then, just when long suffering shareholders thought it couldn’t get any worse, they experienced massive over competition in their Chilean subsidiary, perhaps destroying most or all of the value in what had been a gem of a business for many years. Almost everything that could go wrong at LILAK, did. The sole, shining exception being M&A. That’s worked pretty well, but they aren’t seeing the benefits of it yet. In 2022, all they have are merger related expenses and no synergies… But that’s about to change.

FCF guidance and share-based comp

Like many companies, LILAK does not subtract share based compensation [SBC] from its FCF guidance. That guidance is $220 million, which would be almost $1 a share on a $6 stock! But, alas, the SBC here is a really big part of the total, at $120 million. If we deduct the SBC, FCF guidance is actually more like $100 million. That’s the number I use here.

As an aside, you might wonder what the heck is up with this level of SBC. All I can say here is that LILAK is a part of John Malone’s empire, and that’s how he does it. It’s worked really well for a really long time, so while one might consider it to be a red flag elsewhere, here it’s probably OK. Regardless, I will simply deduct the SBC from FCF guidance, and use $100 million of FCF as the starting point.

Slide 8 makes some bold claims

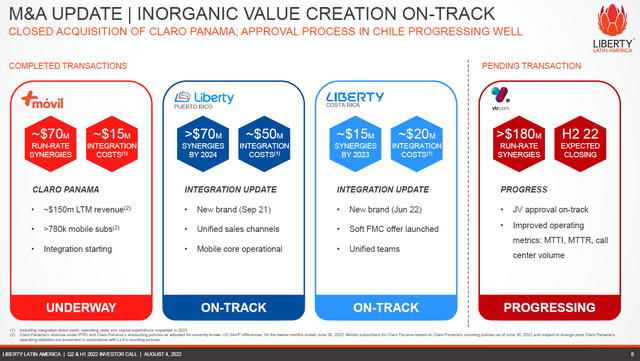

Here it is in all its glory, slide 8 from the Q2 2022 investor presentation. The slide shows the financial impact of 3 transactions that have been completed and one that is awaiting final regulatory approval. Just take a moment to drink in the numbers that are listed here. This is a stock that has 225 million shares, trades at ~$6, and is guiding to ~$100 million of FCF in 2022, or $0.44 a share. Now let’s add up all those numbers on slide 8!

LILAK is absorbing $15 million of integration costs in Panama in 2022, but expects to generate $70 million in synergies by 2025. That’s an $85 million increase, just from block and tackle integration. Panama is only 50% owned by LILAK, but still, that’s $42 million coming to them in 2025, relative to 2022.

Then in Puerto Rico it’s $50 million of integration costs in 2022 that will become $70 million of synergies in 2024. From minus $50 million to plus $70 million, a total of $120 million. They own 100% of that business. Costa Rica is also expected to realize full synergies in 2024, that’s $35 million, of which LILAK owns 80%, or $28 million. Put together, that’s $148 million more FCF in 2024 than in 2022.

The transaction depicted on the right awaits regulatory approval. They will merge their Chilean subsidiary, VTR, into a JV, which they will then own a 50% interest in. There are $90 million of synergies coming to them, indirectly, by 2026. That’s $180 million in total synergies, in which LILAK will own a 50% share. VTR is currently burning about $100 million of cash per year. They are spending heavily on CAPEX, and there’s just a ton of debt, none of which is recourse to LILAK itself. The hope is that the competitive situation in Chile will improve eventually, and by 2026 the 50% share of the JV might be valuable.

But never mind 2026. The $100 million cash burn will vanish in 2023, and all that debt will simply disappear into the JV and no longer be on LILAK’s books. This will effectively de-lever LILAK, and add back $100 million of FCF that VTR is currently burning. And that will happen in 2023.

So that’s:

- $100 million of FCF in 2022

- plus $100 million in 2023

- plus $148 million in 2024

- plus $42 million in 2025

- plus a 50% interest in a JV that may be worth something in 2026

After taxes that’s $350 million in 2025, assuming no growth, and assuming no contributions from the JV. At the current 225 million share count, this works out to $1.55 a share. The share count is coming down, and the actual FCF/share is likely to be $1.75 or more.

The share count will decline

The company is currently deploying 100% of FCF for share repurchases, and I expect that to continue. The company can plausibly buy back $600 million of shares through the end of 2024, which at the current sub $6 price would allow them to repurchase almost 45% of the 225 million shares outstanding. At an average purchase price of $15 – two and a half times the current price – that’s still enough to buy 40 million shares, and reduce the share count to 185 million. I will assume 200 million shares for the rest of this article.

A quick word on leverage

LILAK has guided to a leverage target of between 3.5x and 4.5x. The company is currently 4.5x levered, with an average debt tenor of 5.5 years at a fixed rate of 5.7%, as you can see on page 9 of their Q2 2022 earnings release.

When VTR is moved into the JV they will be unloading over $1.4 billion of net debt, and giving up adjusted OIBDA – here I’m just annualizing 1h 2022 – of $170 million. In other words, they are unloading an entity that’s over 8x leveraged. Pro-forma for this transaction, leverage will decline to 4.2x.

Next, add in all the OIBDA from synergies. That’s ~$150 million by 2024 and then another ~$40 million in 2025. That pushes leverage below 3.9x in 2024 and below 3.8x in 2025.

The company is levered at the upper end of its target today, but including the items from slide 8, it goes to slightly under-levered by 2024. No debt paydown or organic growth is needed. If the company grows even a few percent per year, leverage would hit 3.5x some time in 2025.

“Insanity”: CEO Balan Nair presents at Goldman Sachs

LILAK’s CEO, Balan Nair presented at Goldman Sachs, and it was eye opening. Nair begins the GS call by making an obvious point. LILAK’s business in Puerto Rico [LPR] is healthy and growing, and a reasonable valuation on LPR suggests that business alone is worth more than the current market cap of LILAK. At an 8x EV/EBITDA multiple, LPR would be worth in excess of $5 billion. After subtracting ~$2.5 billion of net debt, LPR is worth $11 a share. Since US cable operators trade above an 8x multiple, and LPR is entirely US based, this is not exactly a hard case to make! We can be more conservative and still make the same case. Even at a 7x multiple, LPR is worth more than all of LILAK.

Puerto Rico is a great business for us… if you NPV the cash flow that we generate there, and it’s about a $600 million EBITDA business… you should come to a number between 8 and 9 turns on that business… but Puerto Rico alone, even at 7 turns, is worth more than my whole company combined. Essentially… you get the rest of my business for free: Panama, our subsea business, Chile… all the Caribbean islands. It’s… insanity.

(Emphasis mine)

Secular growth is coming

LILAK has visible long term growth prospects in most geographies, notably in Puerto Rico, Panama, and Costa Rica. But at least some growth everywhere. This claim was not in debate 5 years ago, but they’ve had a lot of trouble in the interim. First in turning around the acquired C&W businesses, then the pandemic, and then hyper-competition in Chile, have all served to thwart this narrative in recent years. Those headwinds may be at an end, and secular growth might be coming. Here’s what Nair had to say:

I break my business out into 2 buckets. One is our high growth business, high single digit/low double digit growth. And the stabilized business… a lot of the Caribbean islands that are not going to grow very much… 2%-3%… it’s not going to grow much, but it doesn’t require a lot of capital, it’s all duopolies, and it generates a ton of cash… Then we’ve got a bunch of pretty high growth businesses… in Panama, Costa Rica, Jamaica, the Caymans, the Bahamas, Puerto Rico… in 3 years Chile would be in there as well.

This works out to long-term mid-single-digit OIBDA growth, not including the near-term boost from M&A synergies through 2025. LILAK as a growing business is likely to command a high multiple, perhaps 20x FCF. This would be a meaningful upside to the investment thesis, resulting in a 2025/26 price target in excess of $40 instead of $30.

Good long-term prospects in Chile

LILAK’s Chilean subsidiary VTR, and América Móvil’s Chilean subsidiary Claro, have agreed to merge and form a 50-50 JV. VTR was for a long time LILAK’s best business, but the good times there attracted lots of cheap capital, and the region went from only 3 operators to 6. Pricing power has been utterly destroyed as a result, and losses are mounting for all 6 operators in the region. The JV comes with substantial synergies, and if there’s also a lessening of the current hypercompetitive conditions, it’s not hard to see Chile being worth $10 a share to LILAK if things go well by 2025/26.

The JV is awaiting approval later this year, and if approved will consolidate the region to 5 players, of which the JV and KKR will operate the two largest. LILAK has guided to $180 million of annual cost synergies, but Nair revealed during the call that they are going to blow past the guidance number. The 3 smaller players will be in a hopeless position, and more consolidation is probably coming.

VTR also has very large derivatives gains due to hedges on interest rates and currency. The debt is trading at just over 50 cents on the dollar, but Nair was clear that the plan is to address the debt both through the realization of synergies, but also hinting very strongly that the derivatives gains may be used to repurchase much of the debt at a large discount. Importantly, the company has no meaningful debt due until 2027, it’s all fixed rate, and none of the debt at VTR is in any way recourse to the rest of LILAK. Here’s what Nair had to say:

The future of Chile is really bright… this joint venture with Claro has tremendous upside that’s not captured today… and it’s just the beginning of consolidation… there will be more coming… in 3 years Chile is going to be a lot different than it is today…

Chile has been our best business for the longest time. Things started to go south in October of 2019 when the social unrest happened… the challenge in Chile is structural, and there’s two parts to the structural issue… after the social unrest, the Peso dropped dramatically… that’s one challenge… you lose about 30% in US dollars… secondly, we are the largest broadband market holder, we have today 31% market share… there are 6 operators, and there’s only one fishing pool to get [share] from… we’ve held that 31% at a significant cost to us.

Essentially what we’ve done is we’ve just taken price reductions all across the board to hold market share… in March and April I decided… to take our prices down… close to the lowest… and just in the month of March we grew 100,000 RGU’s… why did we take our price back up if we were having such success?… we can play the price game… but it’s… very destructive to the whole market…

we think there’s more consolidation [coming]… today there’s no pricing power for anybody. At some point in the future that may come back. And if it comes back this thing’s just gonna pop.

In response to a question about whether the JV could participate in further consolidation in Chile:

On the fixed side there should be room

Nair reveals that LILAK tried to buy Claro from América Móvil, but the latter was too optimistic about the long term prospects to agree to anything other than a JV:

we are very bullish on Chile, and our partner is too. If they weren’t, they would have just sold us the business…

They are lowballing the synergy guidance in Chile

publicly we said $180 million plus. I tell you, we are going to blow past that…. [if] you NPV the synergies it’s a billion dollars plus…

Balan addresses leverage at VTR, which looks to be in the range of 5 to 5.5x to start with. He makes it very clear that they have a huge derivatives gain, no exposure to VTR debt at the rest of LILAK, and won’t need to restructure at VTR. Nair also hints very strongly that they may use the derivatives gain to repurchase debt at VTR, which currently trades at ~50 cents on the dollar, as a path to help them de-lever.

We’re going to naturally de-lever… within 24 months or so… we are very disciplined on our debt. We silo everything so there’s no cross contamination… secondly… we hedge everything. We have hardly any exposure at all currency wise, or even rate wise… when you look at Chile… we are sitting on significant derivatives value… once the JV is closed we can decide what to do with that… derivative value alone de-levers things quite a bit, where the debt is trading… the debt is not going to be an issue for either company… there are no covenants on the debt… we have no debt exposure until 2027/28… in Chile the derivatives are so much in the money right now… if we decide to snap our fingers, $300 million…

(Emphasis mine)

The value of the Chilean JV

It wasn’t that long ago that VTR was doing $400 million of OIBDA, more than double the current level. VTR is currently burning $100 million of FCF, but the $180 million of synergies will easily offset this. Then, if competition abates back to where it used to be, that adds more than another $200 million from VTR alone. This works out to perhaps $150 million payable as a dividend from the JV to LILAK each year, starting in e.g. 2026, if things go well.

An annual dividend of 75 cents a share might justify a $10 valuation just for their share of the JV. That’s if things go well. We don’t know for sure that they will, and the value of the JV needs to be considered with that in mind. But that’s still a huge upside for a stock priced today at $6.

Currency Risk:

Nair points out that, unlike most EM businesses, LILAK is mostly free of currency risks:

After our transaction in Chile, we are about 75% US dollars. So it’s not like a typical Latin American business.

What happened on the subsea asset sales?

LILAK management badly hurt its reputation with some investors over the past year when they strongly suggested that they might be able to sell their subsea cable business at a very high price, perhaps $7 or even $10 a share. This is an infrastructure business with $230 million of EBITDA, or about 15% of LILAK’s total. However, LILAK had to tell investors the sale was not on the table after all, despite having hinted so strongly about it, and now we know why. It turns out they had not one, but two offers, and both fell through, as neither buyer was ultimately able to get funding

This is one that’s tormented me for a while. The board is mostly on the page of “why are you even think about selling this business?” It’s a huge cash generative business… It’s all US dollars, all long term contracts… it’s the only resilient network in the market… a couple of board members asked me to test the market… it’s a very high bar for me to want to sell… fortunately or unfortunately, when we did put it out to market, we had a couple of bidders that hit that bar… one of them was a SPAC… the second wanted to do it, but the debt market closed down on them… in John Malone’s Liberty world, everything is for sale… I’m not holding my breath, but if they come back at the same number, then yeah, we’ll sell the business…

Nair comments on price increases

Nair got a question on the recent acquisition in Panama. Panama is a growing geography that operates in USD, and is very attractive for this reason. However, the region suffered from too much competition, with 4 mobile operators. LILAK has just reduced that to 3 by acquiring Claro Panama from América Móvil, and has guided to $70 million of synergies. LILAK owns ~50% of the Panama subsidiary, with the government as its partner for the other 50%.

The weakest remaining operator, Digicel, has decided to exit the market, creating a duopoly in the region, which would be extremely favorable to LILAK for obvious reasons. Balan noted that although they would have pricing power, they would not exercise it, at least not for the foreseeable future. This is almost certainly designed to please regulators, and to potentially preserve the duopoly. Here’s what he said.

There’s a law in Panama that prevents going from 3 to 2 [mobile operators]… we are down to two fixed [broadband] operators and 3 mobile operators… revenue [upside] depends on what happens with Digicel… if the government is so inclined, we would love to make it a two player market in mobile… it would [increase pricing power], but… we don’t take price increases in our company… I don’t approve price increases… price increases make you lazy… growing revenue by volume… and controlling costs… that’s how we run our businesses. Now, there will come a time some years ahead I may take a price increase, but we haven’t done it in the last couple of years and we don’t see price increases…

Early 2023 FCF guidance

Although not technically guidance, and open to interpretation, Nair makes it very clear that 2023 FCF will not be low.

I think next year we’re going to guide to a number I think people are going to like. I think our guidance on FCF from here on people are just going to like it.

Nair comments about the stock price, and the buyback

clearly there’s a disconnect right now… a huge dislocation in our [stock] price versus where we think the value should be, which is why… we are aggressively buying back stock… John Malone told me dislocation is sometimes not a bad thing. You take advantage of it… that’s where we are today… right now it’s really hard to beat the IRR’s on my stock buyback.

Risks to the thesis

There are any number of ways the apple cart could be upset at LILAK. Probably the 3 that worry me the most are these:

- In the short term, they will probably close on the Chilean JV, but there’s a risk that they won’t. VTR’s debt is non-recourse to LILAK, so ultimately that gives them a strong hand in negotiating with creditors. But it will be ugly, and without the synergies they will have a much harder time making it work, even over the longer term. Worst case would be just walking away from VTR entirely, but what an ugly public spectacle that would be. Far better if they can just close on the JV, get VTR completely off of LILAK’s books, and then go from there.

- The extreme competition in Chile might repeat itself in some other geography. There’s no sign that this is happening today, but it might happen again. It’s certainly possible. Just how big a problem this would create depends on the details, but it could be anywhere from manageable to crippling.

- LILAK operates in some challenging geographies. If the region experiences tough times, the alternative to organic growth isn’t necessarily flat, it could also be declining. LILAK’s value is very sensitive to organic growth, and equally sensitive to negative organic growth.

Valuation

LILAK is generating ~$100 million of FCF today. After adding in the nearly $300 million of pre-tax FCF coming to them once they’ve digested their M&A, fully taxed FCF should be ~$350 million by 2025. The company is aware of this, and is using all FCF for share repurchases. The share count is coming down, and FCF per share is likely to exceed $1.75 in 2025.

As a base case, it might trade at 15x FCF – fully taxed FCF, where we treat SBC properly as an expense – and if it did, the share price would be $26.25 on that basis alone. That assigns zero value to the Chilean JV, which is far too conservative. A reasonable case can be made for LILAK’s stake in the JV to be worth as much as $10/share, but even at $5 that pushes LILAK’s price to $31.25 at some point in 2025 or 2026. That’s up ~5x from the current ~$6 in 3 or 4 years. The actual number could easily be higher or lower than that, but $31 seems like a reasonable base case estimate to me.

Conclusion

The bulls on LILAK have been wrong for a long time and have zero credibility with investors. This has created an environment where pessimism is inevitable, but at this point the numbers just scream at you. CEO Balan Nair agrees, and at a recent conference flat out promised that investors would be pleased with 2023 FCF guidance, called the current stock price “insanity”, and promised to take advantage of it with buybacks.

In my base case, LILAK is a $30+ stock at some point in the next 3-4 years. That’s up 5x from the current ~$6 price. That’s assuming no organic growth, and depends only on them executing basic block and tackle integration. And if the business ever grows – it used to, once upon a time – it could easily have a lot more upside than that.

The price is absurd, and the stock should be bought.

Be the first to comment