Torsten Asmus

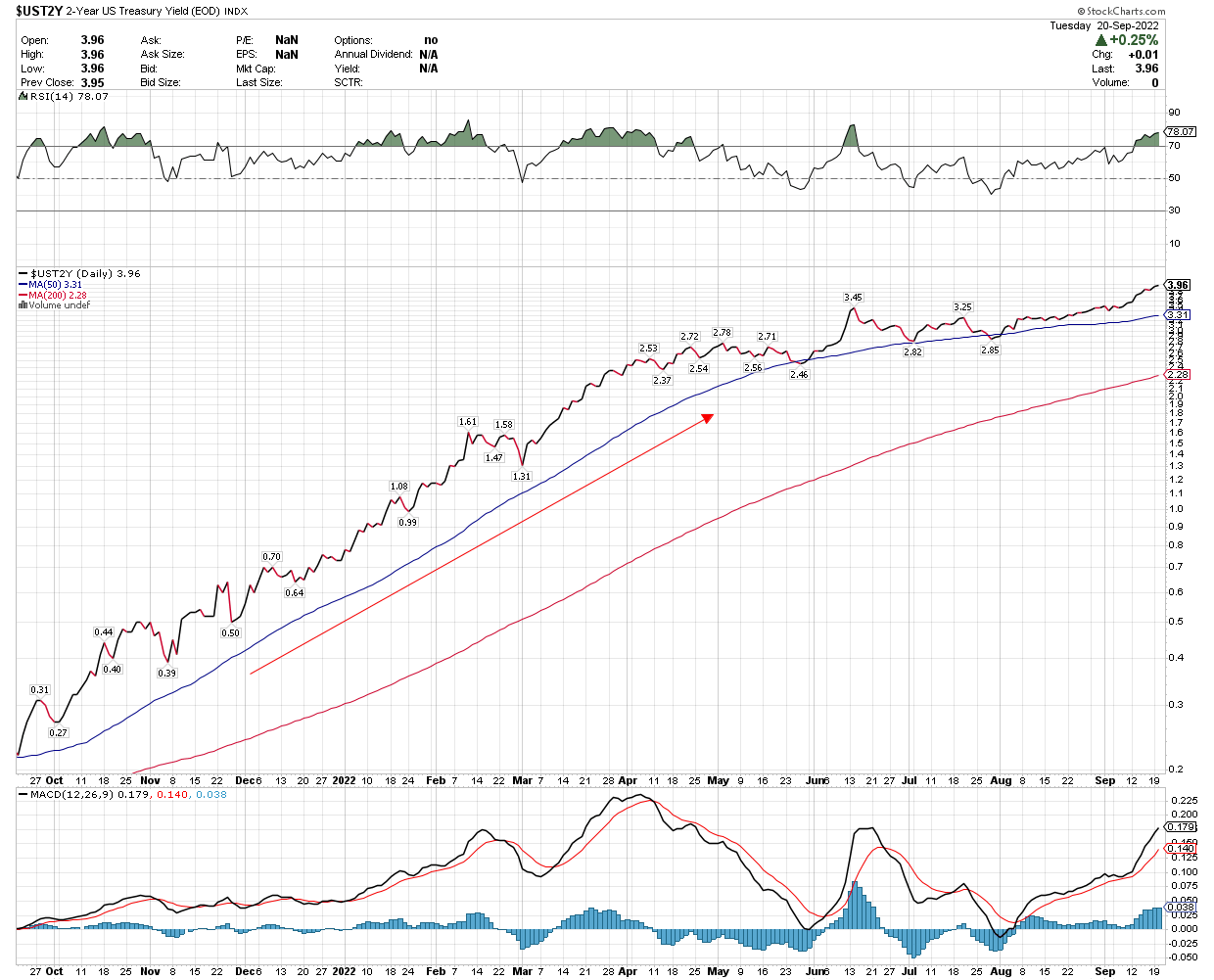

It was risk off one day before the Fed announces its rate-hike decision, with both stock and bond prices falling over concerns about the size of today’s interest-rate increase, as well as the central bank’s forward guidance. Interest rates at both the short- and long-end of the curve continued to climb to decade-plus highs, with the 2-year Treasury yield touching 4%, while the 10-year rose to 3.57%. I think the Fed is most likely to increase the Fed funds rate by 75 basis points today to 3%, but I doubt that guidance for future rate increases, which will be displayed on an updated “dot plot,” will show a more aggressive path than the market is expecting. I also think we will see a forecast for slower growth and a modest rise in unemployment from the Fed, which is consistent with the soft landing it hopes to achieve. In my view, that presents an investment opportunity in the bond market.

Finviz

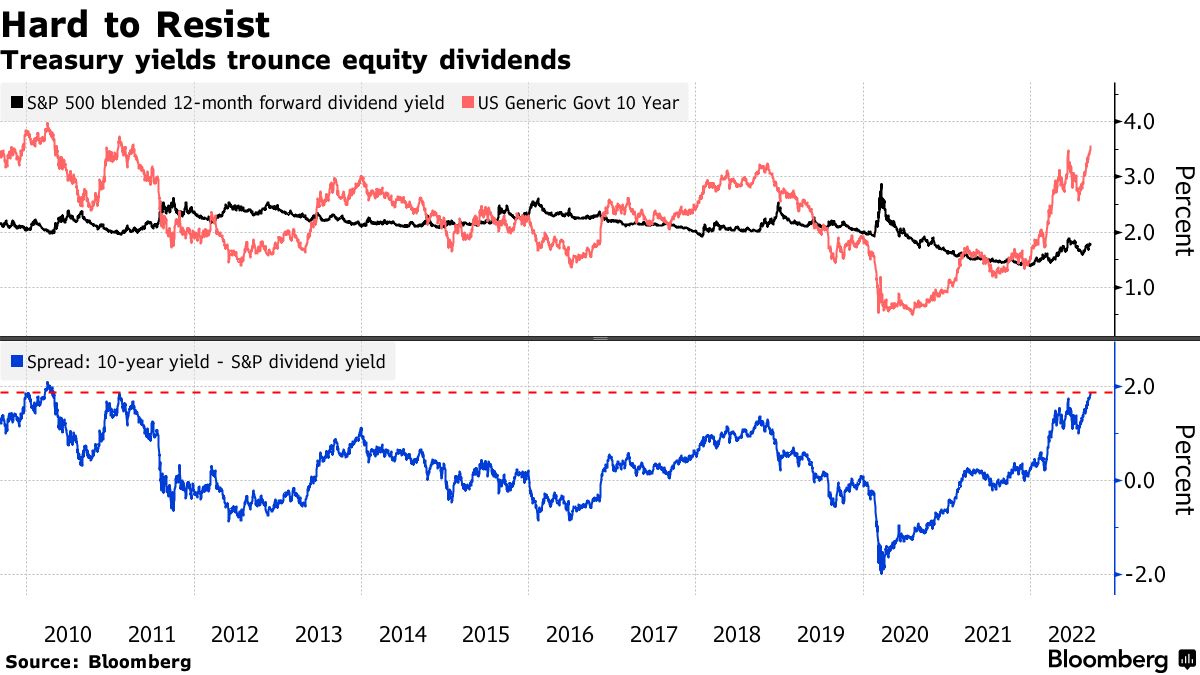

The bond market has already done most of the heavy lifting for the Fed in terms of tightening financial conditions. The 2-year yield at 4% reflects where investors see the Fed funds rate over the coming 12-months, while the 10-year yield has more than doubled since January, driving mortgage rates above 6%. For the first time in years, bond yields are attractive on a risk-reward basis with the income produced by common stocks. At the same time, a slower rate of growth in the economy combined with a declining rate of inflation in the months ahead should put downward pressure on yields. I think we are very close to a peak in rates at the short end, while not far from it at the long end.

Bloomberg

The Fed funds futures market has the highest odds of a 4.25% terminal rate by the end of this year, which is 25 basis points above the 2-year yield, but it shows a 4% rate at the end of next year. That suggests the Fed cuts rates by 25 basis points at some point during the second half of next year. Regardless, the bond market has already priced in these aggressive moves.

I think the Fed can accomplish its goal with a Fed funds rate of less than 4%, and that we will see enough progress on the inflation front to allow it to stop short of that level. If not, I think the odds are that it overtightens and is forced to cut rates by more than 25 basis points next year. Either way, the 2-year Treasury with a yield of 4% is a very attractive risk-free return with no interest rate risk if held to maturity. This is especially true if the stock market averages produce negligible returns, as monetary policy normalizes.

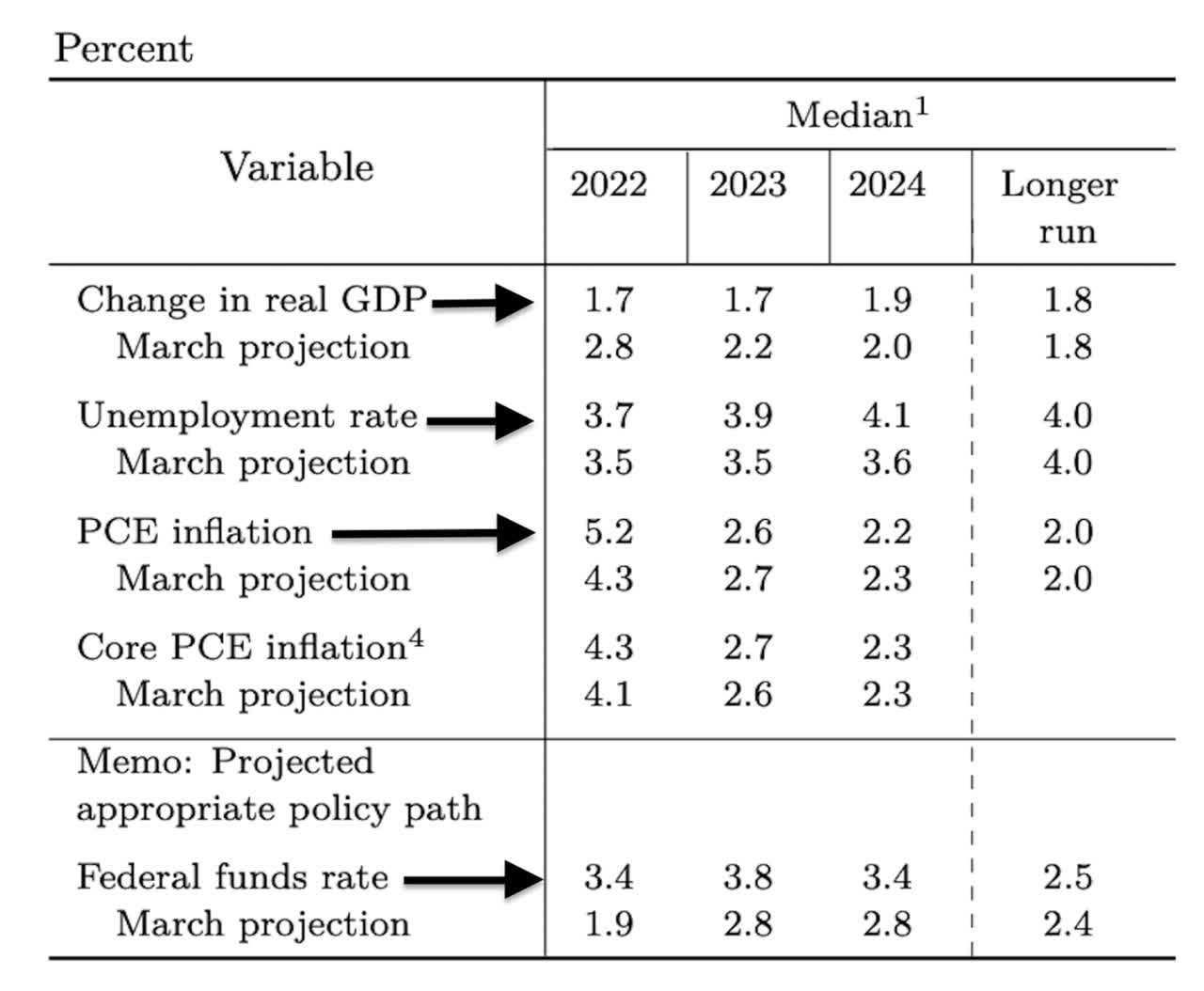

Stockcharts

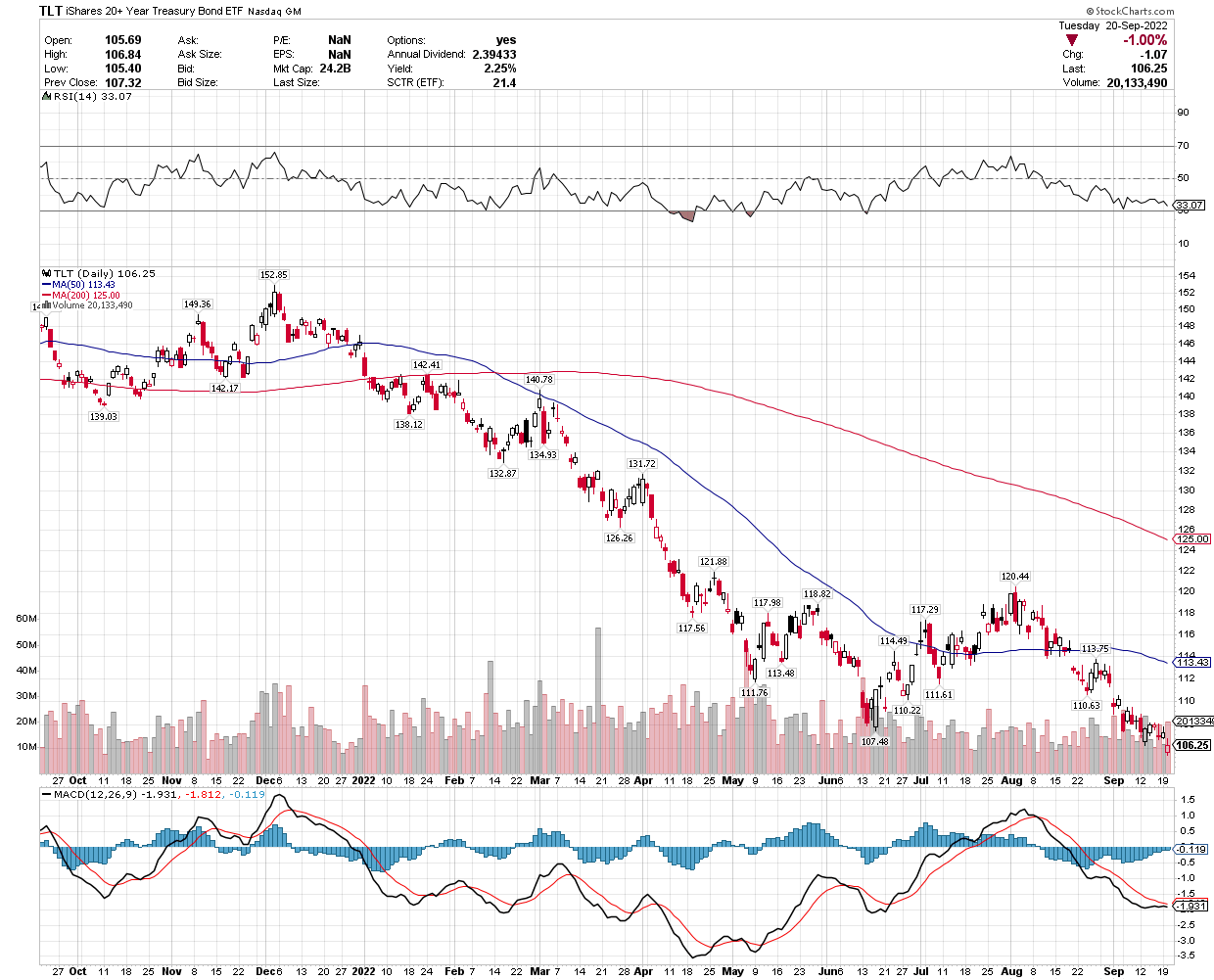

The increase in long-term yields may also be peaking on the basis that the rate of economic growth slows significantly under tighter financial conditions. The opportunity in long-term bonds is likely to be more of a trade than an investment because it is impossible to predict where rates will be 3-5 years from now. As well, the increase in supply of bonds from quantitative tightening will put upward pressure on yields. Yet on a short-term basis, we could see long-term yields drop, which would result in higher bond prices. The Fed will update its economic outlook from the data in the chart below presented in June. I expect we will see a lower GDP outlook and higher unemployment, which should push yields lower.

Federal Reserve

Additionally, if the Fed overtightens and runs a greater risk of recession, there will be even more downward pressure on yields. I think that makes long-term Treasuries a buy at current levels on a 6-12 month basis. The iShares 20+ Year Treasury Bond ETF (TLT) is the ideal vehicle for this investment strategy.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment