Abu Hanifah

Thesis

On October 6th, Bluerock Residential Growth REIT, Inc. (NYSE:BRG) shares will be exchanged for $24.25. in addition, shareholders will each receive 1 share of the newly created Bluestone Home Trust (BHM) for each share of BRG. Based on the current trading price of BRG, this implies a per share price of about $21 for each share of BHM.

BHM will own a collection of single-family homes across high-growth markets in the U.S. Looking at the expected NOI and other balance sheet considerations, I expect the standalone BMH shares to be worth at least $31 per share.

BHM filed its final registration statements last week. With the deal expected to close in the very short term and the final details being filled in on the registration statement, it’s time to take a closer look.

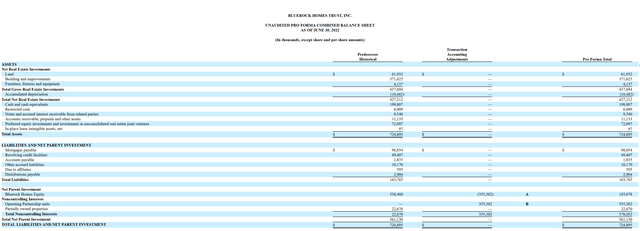

Examining the balance sheet

BHM’s primary asset is single-family homes. However, unlike most REITs, they have a net cash position. This is because they are in the process of acquiring new investments. They also have debt and equity investments in other real estate ventures.

For the rest of the analysis, I’m going to value everything other than the real estate assets as they appear on the balance sheet. This seems reasonable given they are financial instruments. You might argue we should mark down some of their debt and equity investments to be conservative, and you could if you wanted to, but it’s not material to the final valuation.

If you were feeling lazy, you could also value the real estate as it appears on the balance sheet. Normally, I think real estate assets are not properly represented on the balance sheet, but since all of these properties were acquired in 2019 or later, the BHM balance sheet representation is more accurate than normal.

If you did want to just use the balance sheet equity as a representation of value, we’d get a value of 49.59 per share. That’s over twice the implied price of the newly created entity BHM. But, let’s take a closer look at the property portfolio.

Valuing the single-family home portfolio

BHM will own 2194 single-family homes. Many of these were recently purchased and/or renovated. Some of them are still being renovated or are in the process of being leased up. The portfolio generated $9.3M in rental income all of 2021 and has already generated $14.5M in the first 6 months of 2022.

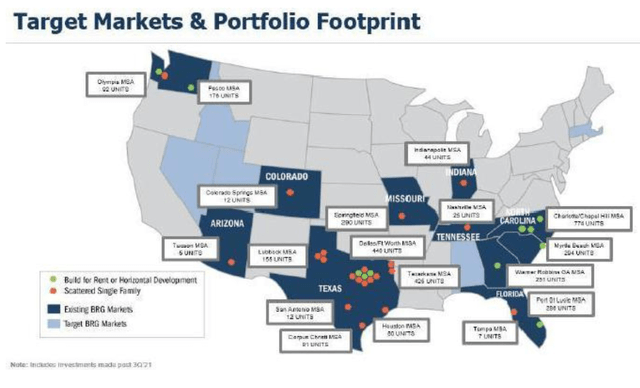

Map of BHM properties (BHM registration statements)

To determine the normalized rental income, I assume that all current renovations are completed and all properties that are newly purchased or under renovation are leased up to 90% capacity. I believe this is a conservative assumption based on the historical performance of BRG properties.

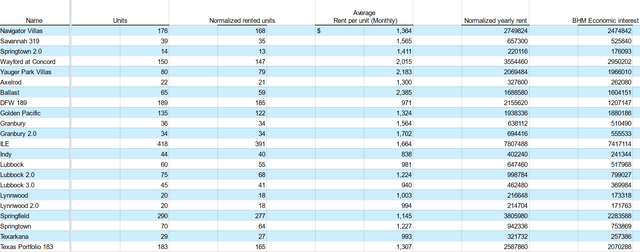

Normalized rent estimate per property (Author’s work)

If we add up BHM’s economic interest in the normalized rent for all of the above properties, we get $29.1M in annualized rent. This seems reasonable based on the first 6 months of 2022.

Based on historical performance and peer comparisons, I expect they’d convert 55% of rent to NOI. That gives us an NOI of $16M.

Using NOI and cap rate is a standard way to estimate value in real estate, and I like using it as a way to estimate property value here since we are valuing the company’s unleveraged real estate holdings. The question is, what is a reasonable cap rate for these homes? I’ve come up with three different cap rates to use as a range for valuation.

First, public peers comp. I’ve identified American Homes 4 Rent (AMH) and Invitation Homes (INVH) as similar, albeit larger, public peer comps, both trade at an implied cap rate of 4.5% based on TTM NOI divided by enterprise value. My next method is looking through online home investor forms for expected cap rates in these markets. This is not a very scientific method, but I think it provides a different perspective. My takeaway was that for a quality property, a 5.5% cap rate is a good benchmark.

Finally, I’m going to use 30-year average mortgage rates as a proxy for the cap rate. Mortgage rates are currently 6.5%, although it has been trending up so I’ll round up to 7% here to be conservative. We can also look at what BHM’s current market cap implies about the housing portfolio. If we assume that everything else on the balance sheet is correctly valued, the housing portfolio is worth $104M. This implies a 15% cap rate for the housing portfolio.

| Cap rate source | Cap rate | Portfolio value |

| Public comps | 4.5% | $367M |

| Private buyer | 5.5% | $292M |

| 30yr mortgage rate | 7% | $229M |

| Implied price | 15% | $104M |

Equity structure

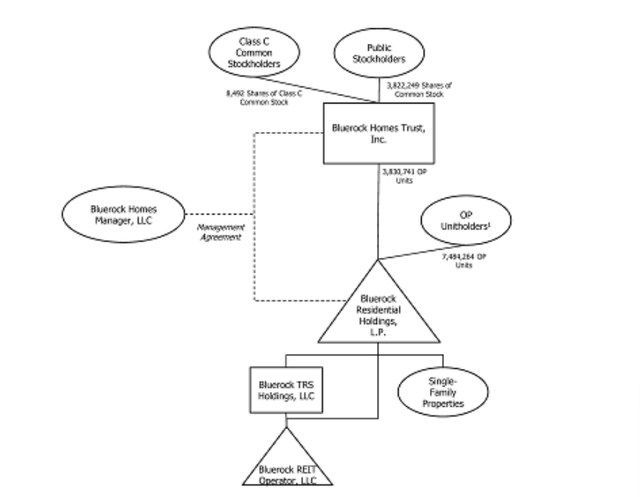

The equity structure is a little complicated. After the spinoff, there will be 6 different classes of equity interest in the REIT. Only one of these will be publicly traded.

- Class A common shares. These are the basic shares that will trade on the NYSE. 3,822,249 shares are outstanding.

- Class C shares. These are the same as the Class A shares for economic purposes. They are convertible into Class A common shares at the owner’s discretion. They won’t trade on the open market, when combined with OP or LTIP units they can be worth up to 50 votes. 8,492 shares are outstanding.

- OP Units. These have the same economic interest as Class A shares and can be exchanged for Class A shares. They won’t trade on the open market. They have no voting rights unless combined with class C shares. 4,142,089 units are outstanding.

- C-OP Units. These are the same as OP units except they exchange into C shares.

- LTIP units. For distributions, these will be the same as economic interest as OP Units. However, for liquidation purposes, they will start with a value of zero. When the partnership assets are revalued any additional equity will be assigned to LTIP units first. Once the LTIP units reach parity with all other OP units they can be exchanged for OP units. 3,342,175 LTIP units are outstanding.

- C-LTIP units. The same as LTIP units except that are exchanged for C-OP units.

BHM Corporate structure (BHM registration statements)

For the purposes of evaluating economic interests, we can treat all 6 classes as equal. Technically, LTIP units are inferior until they are converted to OP units. But for simplicity’s sake, we can just consider them equal.

An important thing to note here is that only 3,342,175 of the 11,315,005 shares will be publicly traded. That’s only about 30% of the economic interest available as float.

Watching the insiders

After the spinoff, insiders will own 15.9% of the total economic interest in the newly created BHM. This is up significantly from 6.5% of the economic interest in BRG. The increase in ownership interest is mostly due to an increase in the LTIP units owned by insiders. So, Insiders are using the spinoff as an opportunity to greatly increase their ownership. Although, they are doing it in a way that doesn’t involve open market buying.

Insiders have been pretty quiet with open market purchases since the deal was announced, with a net increase of 450 shares owned due to open market trading.

Management

The newly created BHM will be externally managed, while the old BRG was internally managed. This is an interesting choice, since externally managed equities are usually not viewed favorably by investors. BRG was previously externally managed but moved to be internally managed in 2017. The main reason given for moving from externally managed to internally managed was having total stockholder equity of over $500M. The newly created BHM is expected to have total stockholder equity of $183M. I suspect this is the reason for becoming externally managed once again, although I haven’t been able to find any definitive communication on the topic.

The external management fee consists of a 1.5% base fee on the total equity, including both the publicly traded equity and non-traded equity interests. The second part is an incentive fee which is equal to 20% of any adjusted funds from operations (“AFFO”) yield over 8% on the price of the NAV at spinoff plus any additional equity that is raised. The management fee seems tilted towards the manager to me. Since AFFO isn’t a true GAAP metric, it can be more easily manipulated. I’m also not sure why they choose to remove retained earnings from the incentive fee. Interestingly, 50% of the management fee will be paid in LTIP units rather than cash. This concern is somewhat mitigated by the fact that insiders own such a large economic stake in the actual business.

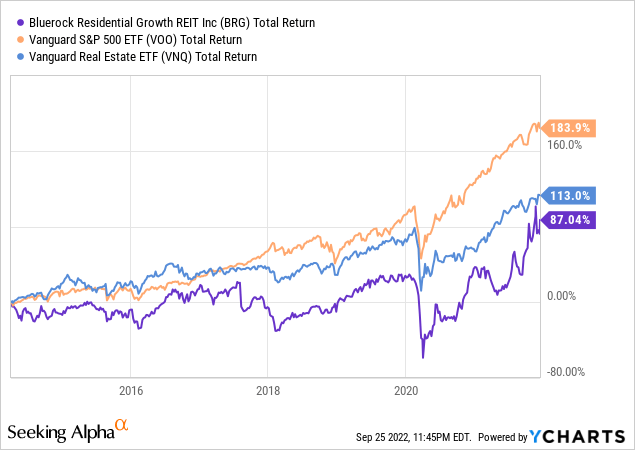

In terms of the actual people running the business, they are the same as before the spinoff. They are essentially the same group as when BRG IPOed in 2014. Comparing the total return BRG to the Vanguard S&P 500 ETF (VOO) and the Vanguard Real Estate ETF (VNQ), BRG under-performed from IPO to just before the merger announcement. Although I do give them credit for being willing to sell out, and if you give them credit for their sale to BlackRock (BLK), they outperformed VNQ and were similar to SPY since inception.

Risk – Spinoff selling pressure

Buying right before the spinoff adds the risk that the stock may come under non-fundamental selling pressure directly after the spinoff. This stock has several characteristics that will make it unattractive to larger institutional investors.

With only 3 Million shares publicly traded and a current implied price of $21 per share, the stock currently has an implied float of $63M, which is much too small for any large investor.

External management is generally not viewed favorably by investors. Especially investors that originally bought a stock that was internally managed and are now being issued shares in an externally managed security.

With mortgage rates surging, there are a lot of headlines about a downturn in the housing market. Spinoffs are generally not popular, so when combined with a potentially out-of-fashion asset, we could see outsized selling.

I think that the current valuation is attractive enough to outweigh these downsides. I trust the cheapness of the stock will eventually be realized, but I wouldn’t be surprised to see it sell off further first.

Risk – Single-family housing

With mortgage rates spiking, housing prices are being put under pressure. Single-family home prices have started to drop in the past two months. CHM bought most of its houses in 2020 and 2021. In hindsight, some of those prices may end up looking like buying at the top of a housing cycle.

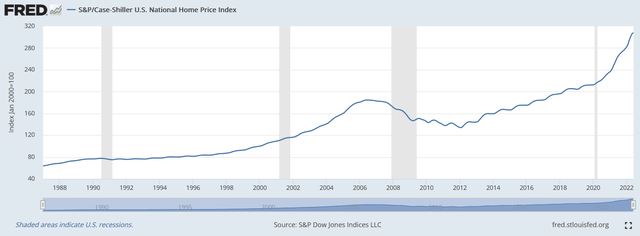

However, I believe there are some mitigating factors here. Even if U.S. housing prices are due for a correction, we only need to zoom out to see that single-family homes have been a steady long-term investment. Single-family homes in the U.S. have been a great asset class to own. We are buying with enough of a discount that even a moderate housing correction should still see us fare well in the long run.

Case Shiller housing price index (US St. Louis FRED)

In addition, higher mortgage rates should make renting more attractive than buying. Asking rent was up year-over-year and month-over-month in August. I would guess that the overall value of the portfolio in terms of cap rates goes up in the short term. But they should still be able to fill their houses and collect rent. The average rent on their units is in the $1000-2000 a month range, which is an area that young people who are priced out of owning could flock to.

Valuation

There are a few different ways to value the business. I believe that the most accurate is valuing the housing portfolio based on cap rates and the rest of the balance sheet without modification. If we value the housing portfolio using a 7% cap rate, the BHM shares are worth $32.08 per share. This implies that current BRG shares should be worth $28.26, or about a 5.7% upside from today’s closing price. Considering there is a little over a week until the deal closes, that is a great return.

I’ve also estimated the FFO for the portfolio based on expenses for the first 6 months of 2022. I’ve also counted the company’s expected mortgage interest payments against FFO. With these assumptions, I calculated an FFO of $4.3M on a forward basis. Based on peer evaluations of P/FFO of 22, this would value the housing portfolio with its mortgage debt at $96M. If I then add the rest of the balance sheet at value, excluding the mortgages, the implied total company value at $328M, or $29.01 per share.

You could also convince me that BHM should trade at a discount to its peers because of its likely liquidity issues and external management structure, but a 50% discount is far too much.

I didn’t spend much time looking at the real upside scenarios. In the upside scenario, I think the stock could be in the $40-50 share range based on public peer comp valuation on NOI. This would require the management to use its remaining cash to purchase more single-family homes in an accretive manner. If done correctly, this would allow the company to be more easily comparable to its other public peers and likely lead to a healthy dividend yield.

Final thoughts

Given the upside, time range, and near certainty of closing the deal, at this point, I’ve taken an outsized position in BRG. I expect to get most of my money back when the deal closes on the 6th. If BHM comes under selling pressure after the spin, I may look to add to my position post-spinoff.

I didn’t touch on it in this article, but the spinoff will be a taxable distribution. This means that the fair market value of the stock immediately after spinoff will determine how much tax is owed. In general, everyone’s tax situation is different, so I won’t give advice here, but I believe holding BRG shares in a tax-advantaged account is generally favorable.

Be the first to comment