Mike Coppola/Getty Images Entertainment

I have been explaining to investors that the odds of the U.S. Federal Trade Commission approving the Microsoft (MSFT) + Activision Blizzard Inc. (NASDAQ:ATVI) merger are lower than most expect. I suggested that the morning of the announced transaction it would be the high-water mark for ATVI price (it reached $90+ in the premarket) as Wall Street digested the difficult antitrust environment for Big Tech players after Democrats took control of Washington politics in 2021.

With a current quote of $79 vs. a bid value of $95 in cash for each ATVI share ($69 billion in total), analysts and investors are not quite sure the transaction will be completed. I personally place the odds of a final takeover approval by U.S. regulators under 50%, perhaps closer to 25%.

It has been reported a deal breakup fee of up to $3 billion will be paid to Activision if the FTC and Department of Justice refuse to allow another Big Tech merger that would necessarily consolidate the gaming industry and reduce competition. So, here’s what I am projecting will transpire, and how I plan to take advantage of a failed bid situation.

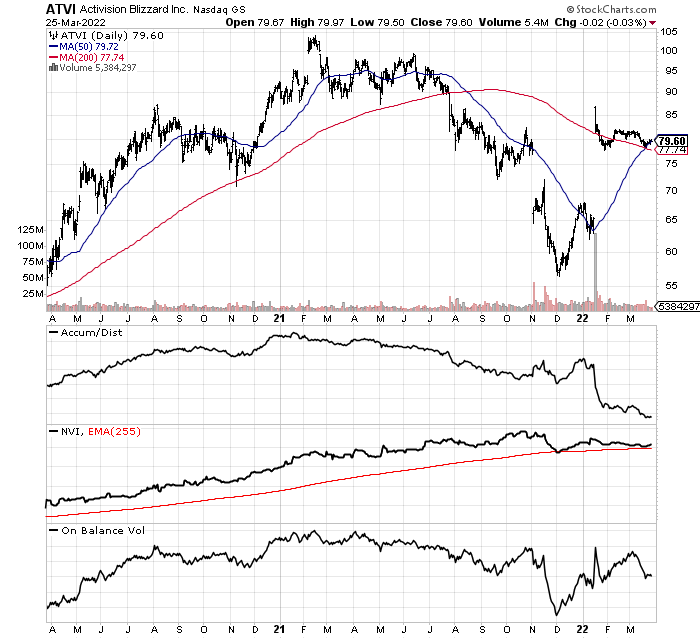

2-Year ATVI Chart, StockCharts

Good Chance FTC Says No

Seeking Alpha author Kevin Mackie posted an excellent piece last week here, going through all the blocked merger deals since 2021 from the Department of Justice and FTC. The current 16% price discount to the offer bid is clear testament by itself to investor fears that the MSFT/ATVI transaction will not be completed.

A February 1st Seeking Alpha recap of a Bloomberg article summarized some of the regulatory hurdles for the transaction,

The review of Microsoft’s blockbuster deal to acquire Activision Blizzard will be up to the Federal Trade Commission and not the Justice Department … a discouraging sign for the deal’s prospects.

That’s because the FTC under Lina Khan – previously a vocal critic of big tech – has acknowledged taking an aggressive stance against dealmaking.

In recent years the FTC and DOJ have come to agreements about dividing responsibilities to review antitrust concerns over major deals. And the FTC has sued to block two big ones so far: Nvidia’s deal to buy Arm Ltd., and Lockheed Martin’s proposed purchase of Aerojet Rocketdyne Holdings.

The review will examine the combination of Activision Blizzard’s robust game portfolio with Microsoft’s hardware, and consider whether Microsoft could hurt rivals by limiting access to Activision’s biggest games (these would include the annual best-seller Call of Duty series as well as World of Warcraft).

More bad news came out last week, when the FTC made requests for additional information from the companies, restarting the clock on its review process. It would appear from this development that a quick approval is not in the cards, and may be the biggest signal yet that the deal will not be approved in the end.

Q3 2021 Earnings Presentation

Potential Sell-Off Creates Opportunity

What happens if the government says the deal cannot proceed? With thousands of investors and arbitrage players betting on the merger transaction, a rejection of the combination would definitely hurt demand for Activision shares. I am thinking the immediate stock price reaction might be a drop under $70 per share as merger arbitrage players sell en masse, to a level closer to its $65 quote before the Microsoft offer was made public.

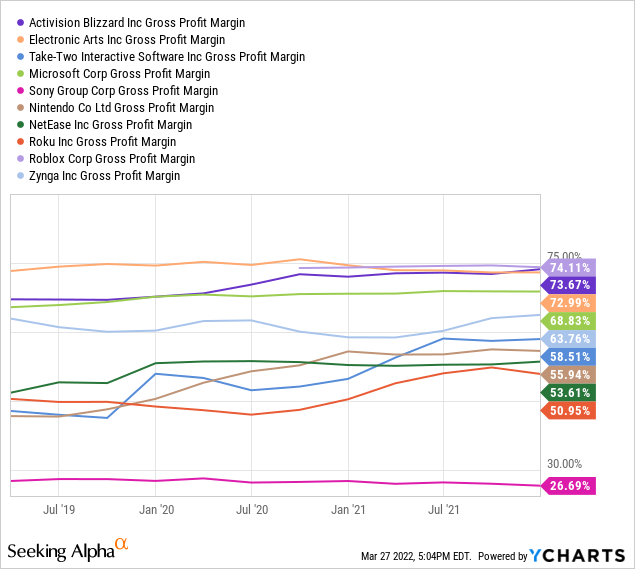

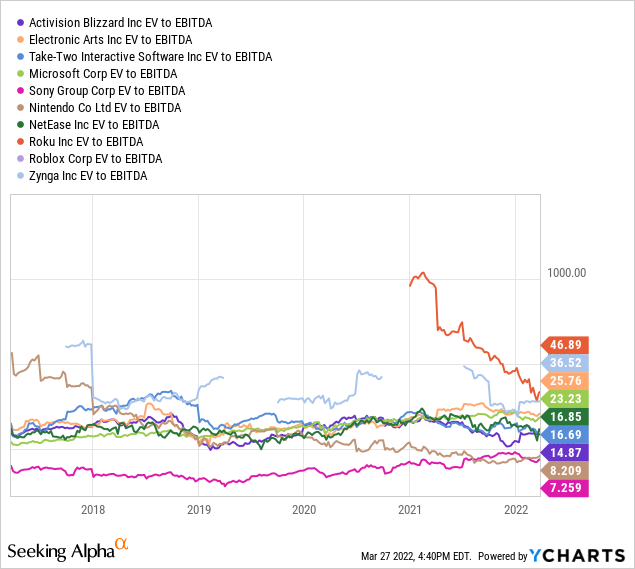

However, the $3 billion breakup windfall would be a welcome development for a standalone Activision setup. This sum is equal to or better than a great year of operating income. Below is a chart of super-high gross margins on sales, looking at the manufacturing expense for games vs. revenues generated. I am graphing a comparison over three years vs. a list of major gaming peers and competitors. The biggest names in the field include Electronic Arts (EA), Take-Two (TTWO), Microsoft, Sony (SONY), Nintendo (OTCPK:NTDOF) (OTCPK:NTDOY), NetEase (NTES), Roku (ROKU), Roblox (RBLX), and Zynga (ZNGA).

YCharts

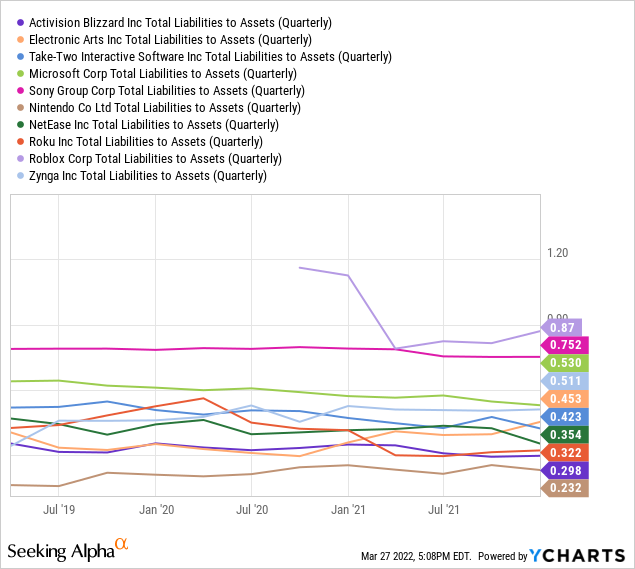

A second chart highlights the low liability to asset financial setup for the business. The company already runs one of the stronger balance sheets in the gaming industry. At the end of December, Activision Blizzard held $10.4 billion in cash and $12.5 billion in total current assets vs. just $3.6 billion in debt and $7.5 billion in total liabilities.

YCharts

A large cash infusion would also jump earnings well above current estimates. A cash payment from Microsoft in the $2-3 billion range would effectively allow the company to repay most of its debt.

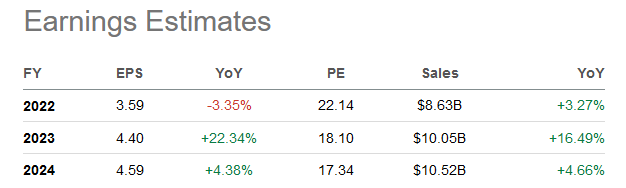

Seeking Alpha Table – March 28th, 2022

Lower Quote = Better Valuation

In addition to nicely improved income and cash flow numbers, enterprise value calculations would see a similarly positive bump from fewer net liabilities, with the huge cash windfall. All told, the already decent valuation picture would become something of a bargain buy idea if the stock quote falls and the extra cash is quickly put to good use.

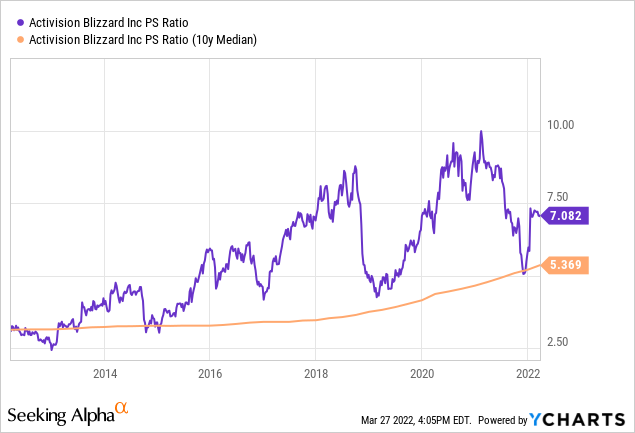

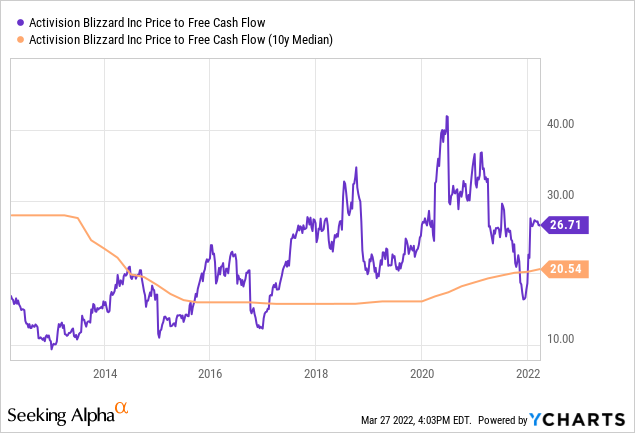

I have drawn 10-year charts of price to trailing sales, free cash flow, and book value, with decade median averages of each fundamental valuation ratio. Again, a lower price will reduce each calculation close to or below long-term averages, while ongoing free cash flow is pumped with the extra unallocated capital check from Microsoft.

YCharts YCharts YCharts

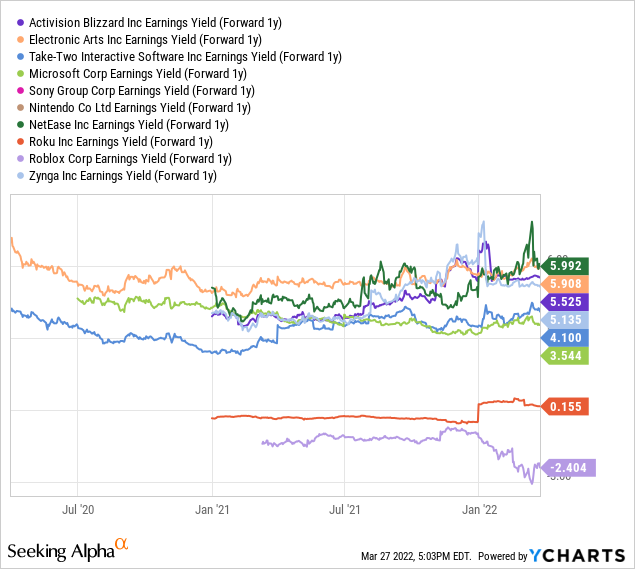

Future earnings yields would also find their way higher than current estimates. Below is a projection of 1-year earnings yield vs. peers and competitors. A deal breakup fee and lower stock quote could easily propel ATVI’s income yield well above 6% for smart investors on a failed transaction development.

YCharts

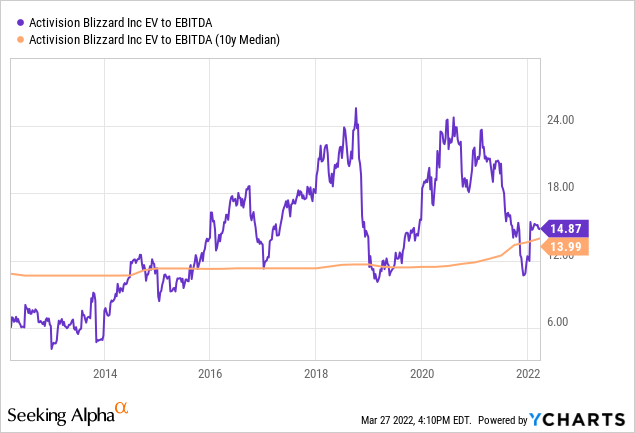

Finally, Activision’s enterprise value total could fall from $61 billion using today’s setup to something closer to $50 billion on a failed deal and sub-$70 common equity quote. Such a scenario would put EV to EBITDA readings under 12x, which has proven the low-water mark for a valuation several times since 2016.

YCharts

And a potential 12x multiple would compare quite favorably with the gaming only companies available to retail investors. Below is the current graph of EV to EBITDA for peers.

YCharts

Final Thoughts

Activision CEO Bobby Kotick has been under fire because of employee working-condition complaints. A failed deal may be enough of a blow to owners that a leadership change could be pushed by remaining stakeholders.

A refreshed management lineup, better working conditions for women and minorities, a company flush with cash, a low valuation, and a top position in the rapidly-growing gaming industry could open a terrific buying opportunity.

That’s why I am watching the regulatory saga closely. Without more information on final approval, alongside an inflated price on the deal math (somewhat above-normal valuation) with limited upside to Microsoft’s $95 bid, I am not very interested in either owning or shorting Activision Blizzard shares. I have a Neutral rating, with a wait-and-see outlook.

Assuming a management reshuffle will follow the FTC blocking this deal, a $2-3 billion breakup fee is due, and I can purchase shares under $70, a Buy rating could be approaching in the spring or summer months.

Be the first to comment