Alphotographic

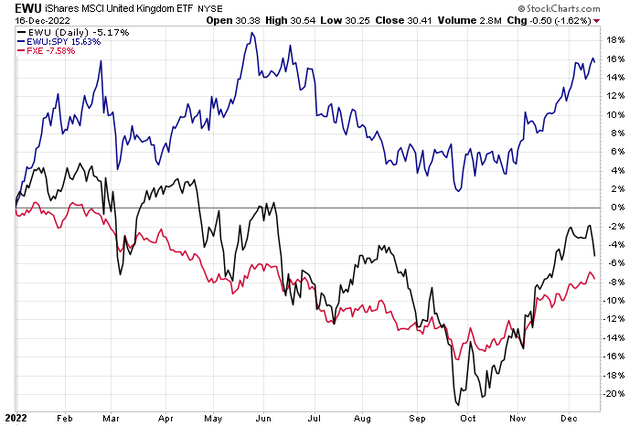

European equities have been on the relative rebound to US stocks in the last few months. A break lower in the US dollar and a rallying euro have helped the region, specifically the UK. The iShares MSCI United Kingdom ETF (EWU) is down just 5% on the year, far outpacing the S&P 500. One retailer domiciled in the UK has also seen a fresh wave of buying. Is there more upside in store for Burberry (OTCPK:BURBY)? Let’s take a look.

Look at You, UK!

According to Fidelity Investments, Burberry Group plc, together with its subsidiaries, manufactures, retails, and wholesales luxury goods under the Burberry brand. The company operates in two segments, Retail/Wholesale and Licensing. It provides womenswear, menswear, childrenswear, beauty, eyewear, shoes, and accessories, as well as leather goods, such as bags. The company also licenses third parties to manufacture and distribute products using the Burberry trademarks.

The UK-based $9.7 billion market cap Textiles, Apparel & Luxury Goods industry company within the Consumer Discretionary sector trades at a near-market GAAP price-to-earnings ratio of 17.3 and pays a slightly higher than average 2.4% dividend yield, according to The Wall Street Journal.

The stock had been hit hard earlier this year amid turmoil in overseas markets, including China, but a massive rebound in the last three months briefly put the stock at its highest marks since Q1. For Burberry specifically, the firm beat on its H1 2023 earnings estimates back in mid-November. Just last week, the firm then declared a $0.1908 dividend. Importantly for investors, the stock is ranked first in its industry by Seeking Alpha.

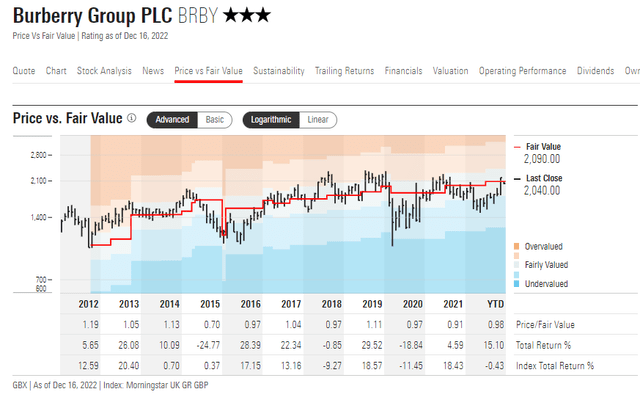

According to Morningstar, Burberry posted solid first-half results along with new goals and strategies for the business under a new management team. Shares rose to Morningstar’s fair value and are hovering there. The company reported 5% growth in comparable retail store sales, helped by fewer lockdowns in China.

On valuation, while the stock trades at decent earnings multiple, the forward PEG ratio, which I use to gauge valuation relative to future growth prospects, is not particularly impressive at 1.4, slightly above the sector median. Moreover, the price-to-sales ratio is high at 3.0 – significantly above the sector median of 0.8 and Burberry’s 5-year average of 2.5. On the upside, though, is that the company has good cash flow as evidenced by a 12.3 price-to-cash flow ratio. Overall, the stock seems a bit expensive to me – perhaps wait to see how the new sales strategy goes is warranted.

Morningstar: BUBRY Rated 3-Stars, Shares Near Fair Value

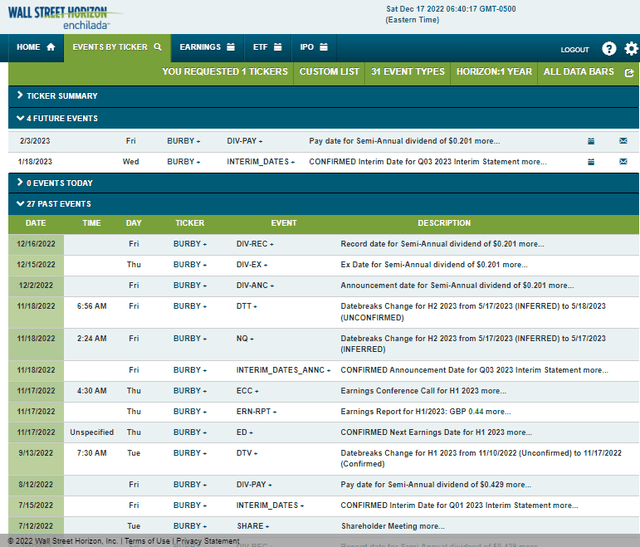

Looking ahead, corporate event data from Wall Street Horizon show a confirmed interim sales date of Wednesday, January 18 and there is a dividend pay date slated for Friday, February 3. No other volatility catalysts are expected on the calendar, though.

Corporate Event Calendar

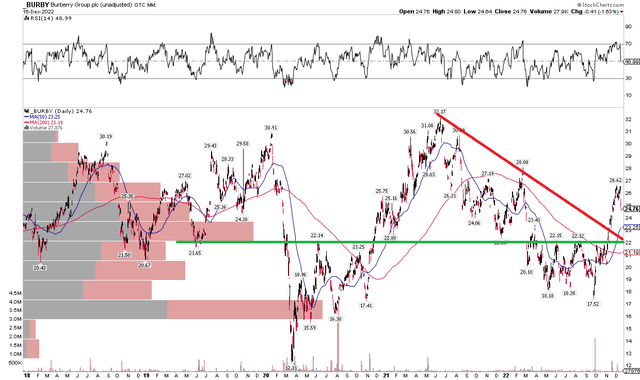

The Technical Take

BURBY had been mired in a steep downtrend off its mid-2021 peak above $32, eventually notching a low under $18 in late September of this year. In the last three months, however, shares are up huge, rising above both the 50 and 200-day moving averages. In fact, the 200-day has just turned positive in its slope.

I see support at $22 – notice how there is a high amount of volume by price there as well as it being a key pivot spot dating back to 2019. There’s also confluence with the downtrend support line off the 2021 peak. That could be a great buy-the-dip spot. Longer-term support is seen in the $16 to $17 range. I’d take profits on a move to the low $30s.

Burberry: Shares Break Out, Now Pulling Back

The Bottom Line

I would wait for a pullback on Burberry. The stock, while ranked highly in its category and with a recent break from a downtrend, is not all that cheap, and macro risks are still prevalent. Moreover, uncertainty in China is another wild card.

Be the first to comment