da-kuk/E+ via Getty Images

One tendency of investors in financial markets, including the income investment space, is to focus on the present and extrapolate it forever. The reality is that market and macro environments change. The problem is we don’t exactly know how they will change. This suggests that income portfolios should be somewhat diversified across a number of likely outcomes to avoid implicit bets on one particular market outcome, whether duration or credit risk or something else.

In this article, we highlight how investors can build portfolios that diversify across various potential scenarios. Doing so allows income portfolios to be more resilient over time while also allowing investors to reallocate a pool of resilient capital to more attractive opportunities as they come up.

Specifically, we take an All-Weather approach to income market investing. This term borrows from Bridgewater Associates, which thought carefully of how to build portfolios that hold a number of different assets, some of which can deliver positive performance in all reasonable market outcomes. The point isn’t to guarantee a positive portfolio return in all scenarios. Rather, it is to have a diverse set of assets in the portfolio each of which can perform well in a particular market outcome. Where we differ from the Bridgewater approach is by sourcing all of our holdings from income securities trading at 5-10% yields.

It should be said that this kind of All-Weather approach is not for tactical investors or for those investors who have a very firm view of how the future will play out. Rather, it is for those investors who want to build a portfolio that is not overly skewed to one market outcome and which has relatively resilient assets that can be reallocated to take advantage of emerging opportunities.

Thinking About Possible Market Outcomes

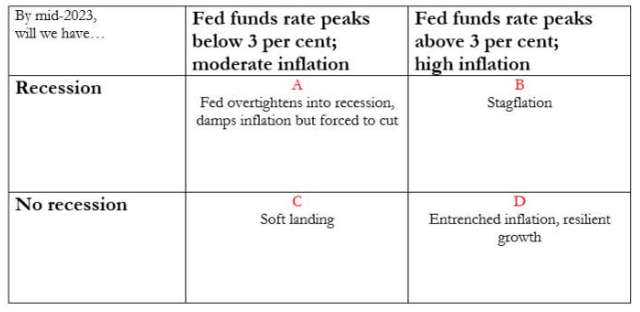

To build a relatively resilient portfolio, i.e., one that holds some assets which can perform well in different market environments, we can consider the following matrix borrowed from Columbia Threadneedle which shows a number of possible economic scenarios over the medium term as a 2×2 matrix.

Clearly, this is not an exhaustive list, but it does a reasonable job of highlighting how the next 12 months could develop across the market and the broader economy.

Scenario A – Fed Overtightens, Causes Recession

In this scenario, the Fed tightens policy too much too fast which causes demand to drop sharply, economy to move into recession and inflation to fall. If this happens, we expect Treasury yields to move back lower to a level of 1-2% and credit spreads to rise.

In this scenario, holding higher-quality long-duration low-dollar-price fixed-coupon preferred stocks such as investment-grade bank and insurance preferreds can make sense.

These stocks would benefit from the drop in Treasury yields because of their very long duration profile. They would also remain less impacted by rising credit spreads due to their higher-quality profile. Securities that trade at tighter credit spreads tend to see less widening in credit spreads than those that trade at wider credit spreads. For example, BBB-rated corporate bond credit spreads rose by 2.3% February-end to March-end 2020 while B-rated credit spreads rose by 4.7% over the same period.

Some of the securities that look attractive here are:

- Capital One Financial Corp 4.375% Series L (COF.PL), trading at a 6.5% yield

- JPMorgan Chase 4.55% Series JJ (JPM.PK), trading at a 6% yield

- Huntington Bancshares 4.5% Series H (HBANP), trading at a 6.2% yield

Scenario B – Stagflation

In this scenario, inflation remains persistent, causing interest rates to remain high while the economy enters a recession which pushes credit spreads wider as well.

In this scenario, we like higher-quality floating-rate securities such as agency mREIT and bank preferreds. The coupons of these securities will increase over time as the Fed will be forced to raise the policy rate and keep it relatively high to keep a lid on inflation. And, as in the above example, the higher-quality profile of these securities should mean they will outperform if credit spreads move sharply wider.

- mREIT AGNC Investment Corp 7% Series C (AGNCN), trading at a 7.5% yield and a 8.76% reset yield (i.e. expected stripped yield on the first call date in October 2022 based on Libor forwards).

- mREIT Annaly Capital Management 6.95% Series F (NLY.PF), trading at a 7.6% yield and a 8.4% reset yield as of its September 2022 first call date.

- Bank PNC Financial Services 6.125% (PNC.PP) – a 3m Libor + 4.07% floating-rate preferred, trading at a 5.8% yield as of today’s Libor of 1.7%, which is expected to move higher (based on today’s price) as Libor increases towards 3% if the market consensus is correct. The stock’s yield at that point will be around 7%.

- Valley National Bancorp 5.5% (VLYPO) – about to switch to a floating-rate coupon of 3m Libor + 3.578% this month, which would equate to a yield of 5.9% and which would rise above 7% at a Libor of 3%.

We also like decent-quality shorter-duration bonds which can protect against both rising interest rates and credit spreads by virtue of their relatively near maturity.

- mREIT Arlington Asset Investment Corp 6.75% 2025 bond (AIC), trading at a 6.95% yield-to-maturity

- BDC Oxford Square Capital Corp 6.5% 2024 bond (OXSQL), trading at a 7% yield-to-maturity

- Financial services company B. Riley Financial 5% 2026 bond (RILYG), trading at a 7.45% yield-to-maturity

Scenario C – Soft Landing

In this scenario, inflation keeps grinding lower, which allows the Fed to take their foot off the pedal, leaving financial conditions fairly supportive. Economic growth slows down but is not tipped into a contraction. Interest rates move lower and credit spreads range trade.

In this scenario, we like to hold medium-duration fixed-coupon securities ranging from high-yield corporate bonds to municipal bonds, depending on investor risk appetite. And because short-term rates will likely peak below the consensus level, holding bond exposure via CEFs can make sense as leverage costs will not rise to excessive levels.

- Nuveen Municipal Credit Income Fund (NZF), trading at 5.63% current yield

- Credit Suisse Asset Management Income Fund (CIK), trading at a 10% current yield

- Western Asset Diversified Income Fund (WDI), trading at 10.4 current yield

Scenario D – High Inflation/High Growth

In this scenario, inflation remains a persistent feature of the economy without causing growth to stall.

In this scenario, we expect interest rates to move higher but credit spreads to remain relatively resilient. In this market outcome, we like BDC exposure.

- Golub Capital BDC (GBDC), trading at a 9.2% dividend yield

- Carlyle Secured Lending (CGBD), trading at a 12% dividend yield

- Oaktree Specialty Lending Corp (OCSL), trading at a 10.1% dividend yield

Takeaways

The investment landscape over the medium term looks to be particularly uncertain. The global economy is still in the process of post-pandemic recovery, buffeted by continuing supply chain issues, localized lockdowns and a European conflict. To add to this, many central banks are in the process of hiking policy rates to deal with fairly persistent inflation. What the market will look like in a year’s time is impossible to predict.

This is why for some investors it can make sense to take an All-Weather approach and hold some assets that can benefit in various market outcomes. Obviously, the weightings of these outcomes don’t all have to be exactly 25% – it can make sense to tilt more to a “base case” outcome which can be different for each investor.

The other reason an All-Weather approach can benefit investors is by enforcing a measure of risk factor diversification on portfolios that are usually built bottom-up with investors acquiring assets individually that appeal to them, without regard to the likely tendency of these assets to behave in very similar ways in certain market outcomes.

Our own Income Portfolios hold securities across all these buckets with some variation due to yield constraints. This is something that has allowed us to reallocate resilient capital into more attractive securities over the past few months as markets have struggled.

Be the first to comment