vitpho

Investment Thesis

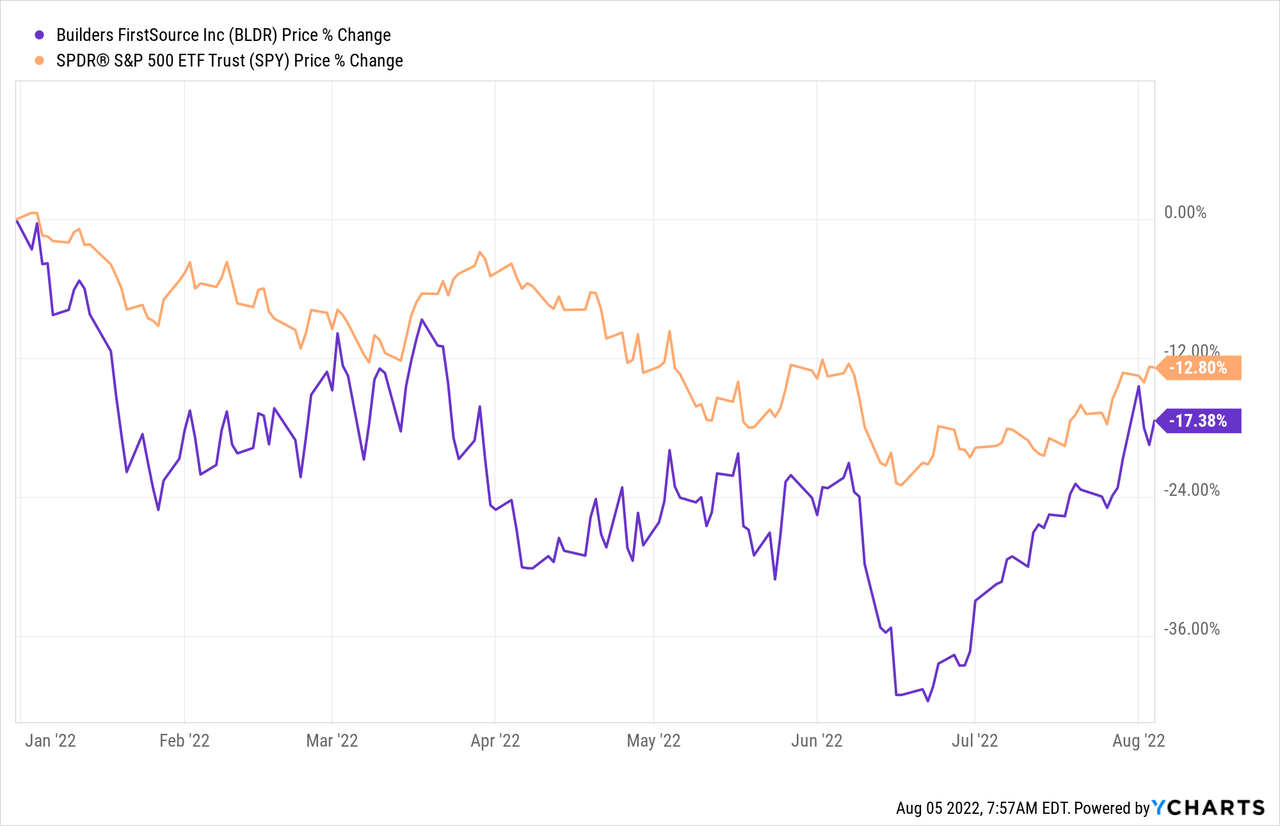

In my last article about Builders FirstSource, Inc. (NYSE:BLDR), we explored how the company’s growth initiatives and the overall housing market conditions provide significant upside potential for the stock. Today’s analysis is an update on my investment thesis, where I maintain my long position due to the stock’s potential for higher earnings returns despite a slowing housing market. Regardless of the stock market’s gloom in the year’s first half, BLDR is catching up, following the latest earnings announcement smashing analysts’ estimates.

Builders FirstSource’s Record Second Quarter Results

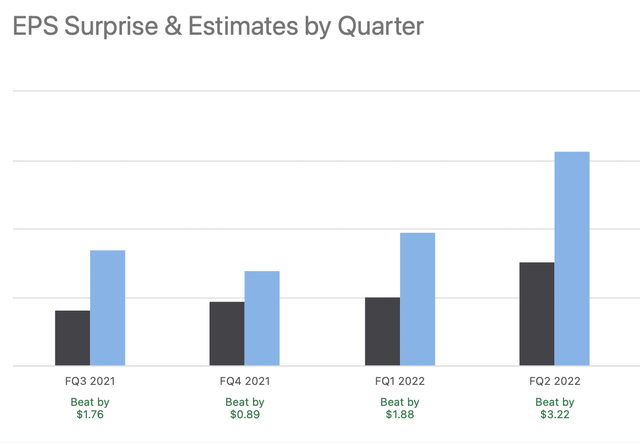

BLDR reported record second quarter results, surpassing earnings estimates on every front. The company reported net sales of $6.9 billion, a 24.2% YoY increase, and Adj. EBITDA of $1.5 billion, a staggering growth of 80.3% YoY. Adj. EBITDA margins grew by 680 bps, and the Adj. EPS reached $6.26, an increase of 126.8%. A free cash flow of around $900 million was generated in the quarter. The management also revised its 2022 outlook upwards and now expects 2022 adjusted EBITDA margin to grow by 120-160 bps, compared with 90-110 bps in the previous target, and free cash flow to be $2.5-$3.0 billion compared to the previous estimate of $2.0-$2.4 billion.

The strong second-quarter results came in when the company faced headwinds from the slowing industry and challenging macroeconomic environment. This is a testament to BLDR’s growth strategy. I expect the company to continue performing well in the foreseeable future, although not as exceptionally well as in Q2, despite the headwinds expected from the slowing housing market.

BLDR Beats Earnings (seekingalpha.com)

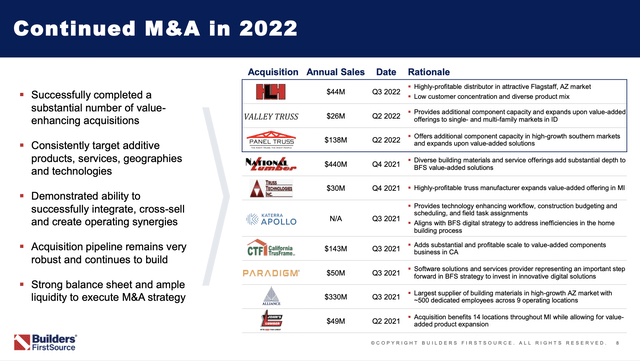

Growth Through Strategic Acquisitions

The company continues to invest in growth through strategic acquisitions, thereby gaining market share and growing faster than the market. So far this year, the company has spent approximately $230 million on M&A, and the management expects to invest at least $500 million in 2022, taking advantage of the low valuation environment. The focus of this M&A strategy is to expand value-added offerings, invest in digital transformation, and scale BLDR’S distribution network. As a result, these acquisitions continue to increase the proportion of value-added offerings in BLDR’s revenue mix.

M&A Activity 2022 (investors.bldr.com)

The company expects 49% of sales to come from value-added products by the end of 2022, compared to the 43% figure in 2021. This increase in the value-added mix will help maintain high margins and increase sales for the company while making it less and less exposed to volatility in the commodities space.

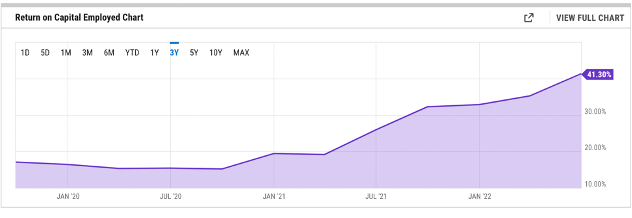

But, again, another valuable aspect to observe is the ROCE of the company to examine whether M&As are adding value or if the company is overpaying for acquisitions with little returns. Remarkably, the company’s ROCE currently stands at 41.30%, which is well above its 10-year WACC, proving the management’s intelligent capital allocation performance and shareholder value creation in the long run.

BLDR’s ROCE (ycharts.com)

Housing Market Will Slow Down

There has been a lot of doomsday calling regarding the housing market. People are drawing parallels between the current slowing down of the housing market and the housing market crash during the financial crisis. But, as we already know, the 2008 housing market crash occurred in the context of subprime mortgages held by financial institutions.

This time, lending standards are tighter due to new regulations following the 2008 crisis; therefore, mortgages are less likely to default. For reference, in Q4 2021, there was more than $1 trillion in new mortgage originations, with 67% of those mortgages going to borrowers with credit scores exceeding 760. In addition, only about two percent of newly originated mortgages were originated to subprime borrowers, compared to the 12% average seen between 2003-2007. As a result, experts say that a gradual slowdown in the increase in home prices is more likely, rather than a bubble bursting all of a sudden.

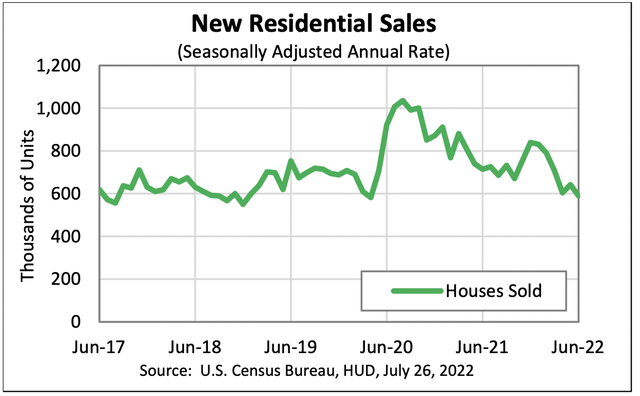

We have already started to observe a slowdown in the housing market. As mortgage rates have risen due to Fed’s aggressive rate hikes, new residential sales have declined over the last few months. U.S. 30-year mortgage rate went up till 5.81% in June, although now dropped back to 4.99%. Therefore, home buyers find it hard to borrow money to buy homes.

July Residential Sales (www.census.gov)

On the other hand, the long-term demand environment for housing is different this time. According to BLDR’s CEO (emphasis added):

the demand picture is extremely different than it was during the downturn. But maybe even more importantly than that, over the last 12 years, this industry has been under-built by somewhere between two million and six million single-family housing units. So pick the middle of that about four million. So if the industry — if you believe the industry has been under built over the last decade or so by four million, at last year, single family starts number which was about 1.1 million units, it would take the industry about a decade to clear off that backlog.

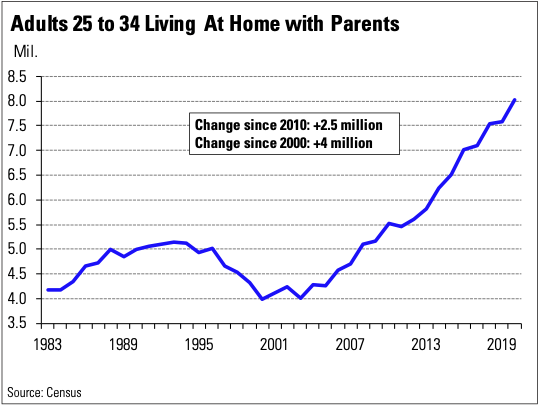

Millennials have been driving growth in the housing market. Precisely, in the coming years, the unprecedented high number of Millennials that live with their parents will eventually convert into homebuyers sooner or later, supporting a healthy housing market in the years ahead. Therefore, I expect the consumers to get used to the higher rates, mortgage rates adjusting to the slower demand, and home prices coming down a bit, but not too much, due to prices of raw materials such as lumber normalizing. Overall, the market will reach a sort of equilibrium without the bubble bursting.

Rosen Consulting Group (National Association of REALTORS®) (cdn.nar.realtor)

Concluding Thoughts

Even in a recessionary environment, the housing market is expected to survive without crashing. Hence, no panic situation is expected that could significantly cause a downturn in the company’s performance. On the contrary, BLDR’s operating performance is producing solid results, and its current attractive valuation supports my buy rating for the stock.

Be the first to comment