Imgorthand

By Brian Nelson, CFA

Retirement is on the minds of everyone these days. From the Financial Independence, Retire Early [FIRE] movement that has become popular with millennials to the long-time saver in their 60s and 70s that has amassed enough to live comfortably, everyone is hoping to sleep well at night while enjoying the things that matter.

At Valuentum, we’re huge believers that markets are inefficient – how could we see the big swings in meme stocks, if they weren’t? – and we also believe that through prudence and care and by paying attention to the markets, individual investors and financial advisors can deliver fantastic long-term income growth with a tilt toward capital preservation along the way. Living a wonderful retirement without too-much concern about the markets is attainable to everyone, in our view.

REITs and High Yield Dividend Payers Have Underperformed

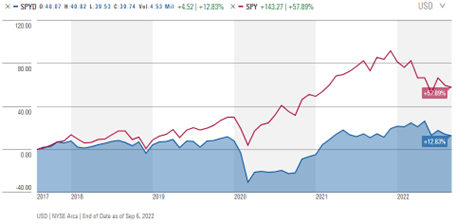

One of the biggest pitfalls that investors succumb to, however, is being overly exposed to one strategy or theme. If you are fixated on real estate investment trusts (REITs), for example, you may not know that REITs, as measured by the Vanguard Real Estate ETF (VNQ), have underperformed a simple market ETF such as the S&P 500 sector SPDR (SPY) the past five years – by a huge margin, more than 40 percentage points according to data from Morningstar.

The underperformance of real estate investment trusts (REITs) during the past five years. (Image Source: Morningstar)

A similar level of underperformance during the past 5 years came from just investing in some of the highest-yielding companies in the S&P 500 such as the SPDR Portfolio S&P 500 High Dividend ETF (SPYD). As investors, if we’re only looking at a specific theme or focused only on the dividend of the company, we can miss the big picture, and one needs to see the big picture to better position a portfolio during retirement, especially if one’s retirement years can span 10, 20 years or more.

The underperformance of the highest-yielding stocks in the S&P 500 during the past five years. (Image Source: Morningstar)

Understanding the Dividend Yield in Total Return

There are two traps that do-it-yourself retirees tend to fall in. First, they believe that the dividend is an incremental source of total return relative to capital appreciation. This isn’t the case. The dividend is paid out of the cash balance of the company, and the company’s share price is reduced by the amount of the dividend per share every time it is paid. As investors, we already own the cash the company owns (via ownership of the stock), so we can’t fall into the trap of thinking that just because we receive that cash as a dividend that we are wealthier. Let’s view what happens to a company when a dividend is paid, as in the example of Cracker Barrel (CBRL), for example.

This figure illustrates how the dividend is a component of capital appreciation that otherwise would have been achieved had the dividend not been paid. Such a situation applies to both regular and special dividends. (Value Trap, through TradingView)

Do you see the step down in the price to account for the payment of the dividend in this example? A company is worth more because its operations generate more free cash flow, not just because it may or may not pay an increasing dividend. In an extreme case, receiving a dividend payment can be largely described as getting paid with your own money because that dividend you just received had already been reflected in the price of the stock you already owned prior to the dividend payment (as with all assets of the business, shareholders already have a claim on the cash dividend they receive, even before its paid). We can still love dividends, of course, but we must know what they are, so we can think more logically about investing and the drivers behind returns.

Why the Confusion?

There are a few reasons investors have been confused by the dividend. First, the late Jack Bogle explained returns of the stock market on three factors: the dividend yield at the time of initial investment, 2) the subsequent rate of growth in earnings, and 3) the change in the price-earnings ratio during the period of investment. Though this is one of many ways to look at the market, it has the unintended consequence of causing investors to seek out high yielding stocks as they believe that the yield is incremental to total return. After all, it’s part of the equation.

But that’s not how the market works – refer to Cracker Barrel example above. Total return may be the sum of the three factors the late Jack Bogle described, but total return cannot be augmented just by seeking the highest dividend yielding stocks. The reason? The dividend is capital appreciation that otherwise would have accrued to the shareholder had the dividend not been paid. Think again of the example above. Cracker Barrel’s share price would not have been adjusted downward had it not paid that special dividend (its capital appreciation would have been sustained at that higher level).

Here’s another example to really hit this point home. Let’s just say that a company yields 5% at the beginning of an investment period and the expected function of earnings growth and the expected change in the P/E ratio adds another 7% for an expected total return of 12% per annum over the investment period (5% + 7%). For those that may think the dividend is incremental to total return, one might think the expected total return will fall to 7% (12% – 5%) if a company were to cut its dividend yield to 0%. But again, that’s not exactly how the market works.

Total return expectations shouldn’t necessarily change in this case, provided there is not a major disruption in the marketplace and with a long-enough time horizon. Whether the dividend yield is 1% or 3% or 8%, the total expected return should still be 12% because the balance that would have come from the dividend yield would instead come from capital appreciation, leaving the total expected return unchanged (think again of the Cracker Barrel example). Though often presented as such, the dividend is not incremental or a driver of total return, but rather the dividend is capital appreciation that otherwise would have accrued to the shareholder had the dividend not been paid.

Where Else Is Confusion Coming From?

As explained, part of the confusion regarding the dividend may arise from broad generalizations about expectations of long-term returns that break total return into a dividend and capital-appreciation component. Also contributing to the misunderstanding is an investor’s use of the P/E ratio, where in applying a multiple to earnings, it makes the dividend, itself, look like it’s incremental, as the stock price is capitalized based on earnings, irrespective of changes on the balance sheet. But we know that the stock is reduced by the amount of the dividend, and we know that the company is worth less after the payment of the dividend (the stock price is adjusted lower).

What’s more, in the dividend discount model, when the dividend is applied as the driver behind an estimate of intrinsic value, an understanding of what actually drives a company’s value, and therefore, its total return almost entirely becomes lost. In a paper, The Dividend Disconnect, Samuel Hartzmark and David H. Solomon define the situation of many investors viewing the dividend as separate from the price appreciation of the stock as the “free-dividends fallacy.” The duo even found that when investors tend to choose stocks just for their dividends, it could cost them as much as 2%-4% less per year than what otherwise might have been expected. With all this now understood about the dividend, let us now move on.

Stocks May Not Be As Risky as One Thinks

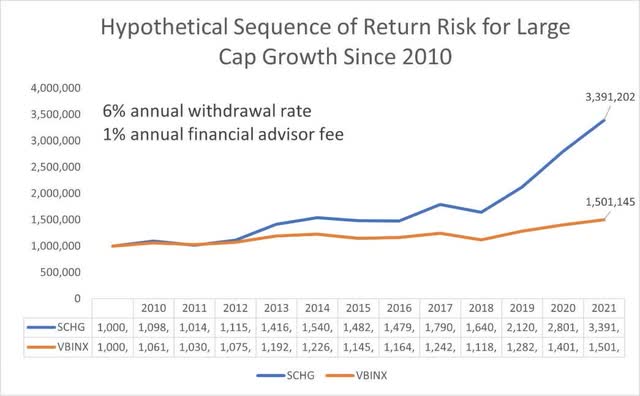

A myopic focus on REITs and the highest-yielding stocks, ignoring the importance of total return as in the broader S&P 500, is one trap that retirees fall into, but there’s also another concern. As retirees are living longer and as many seek to pass on their wealth to the next generation, the time horizon for their money is often not years, but rather decades. Many studies have shown that the longer one’s time horizon, the lower the probability of actually losing money in the stock market. Recent analysis has also revealed that sequence-of-return risk may be overblown when it comes to worrying about equities. Bear markets and exogenous shocks tend to be brief (there wasn’t even a blip in 2020 given an annual withdrawal rate, as revealed in the analysis below).

The Hypothetical Sequence of Return Risk for Large Cap Growth Since 2010. Past results are not a guarantee of future performance. Stock investing is inherently risky. The study in this analysis discusses backtested information. The hypothetical illustrations are not exact representations of any particular strategy or investment and do not represent actual trading. Actual results may differ from simulated information, results, or performance being presented. (YahooFinance Annual Returns. Disclosure: Brian Nelson and Valuentum own SCHG.)

In the example above, we used large cap growth, as measured by the Schwab Large Cap Growth ETF (SCHG) as a proxy for a hypothetical all-equity portfolio and the 60/40 rebalanced stock/bond portfolio as a proxy for hypothetical asset allocation. We assumed a 6% annual withdrawal rate and a 1% annual financial advisor/planner fee for both portfolios. We find that given these conditions, a hypothetical $1 million starting all-equity portfolio in 2010 advanced to ~$3.4 million by 2021, paying out more than ~$1.1 million in distributions to the retiree. A hypothetical $1 million starting 60/40 rebalanced stock/bond portfolio in 2010 advanced to ~$1.5 million by 2021, paying out more than ~$836k in distributions to the retiree.

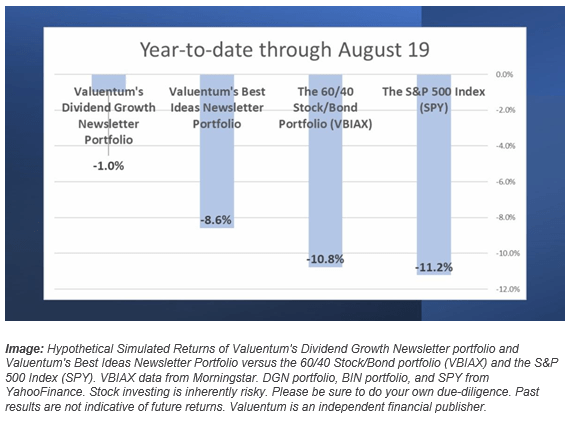

The hypothetical all-equity portfolio’s ending value was more than double that of the 60/40 rebalanced stock/bond portfolio, even as it paid out significantly more in distributions. We found both hypothetical portfolios were sufficient to sustain a 6% annual withdrawal rate and 1% annual financial advisor/planner fee during the time period of the study. Equities are certainly risky, but perhaps not as much as people think, assuming that prudence and care with respect to diversification is pursued. But even if one believes that stocks are random throws of the dice, diversification into bonds, for example, may not pan out as expected as what has happened in 2022 with the 60/40 stock/bond portfolio.

The 60/40 Stock/Bond portfolio hasn’t lived up to the hype. (VBIAX data from Morningstar. DGN portfolio, BIN portfolio, and SPY from YahooFinance. Stock investing is inherently risky. Please be sure to do your own due-diligence. Past results are not indicative of future returns. Valuentum is an independent financial publisher.)

To a large degree, many investors don’t know what they don’t know, and many retirees that are only focused solely on REITs or the highest-yielding dividend equities may be missing out on the big picture, and this could hurt them tremendously as they encounter the latter years of their retirement or if they are planning on gifting their wealth to the next generation.

Please always work with your own personal financial advisor that knows your goals and risk tolerances, of course, but a three-pronged equity portfolio may be a happy medium for some retirees, in our view. One half of the portfolio may seek high yield dividend ideas, one quarter of the portfolio may seek dividend growth, while the balance may seek long-term capital appreciation. Let’s discuss the merits of each of the three individual portfolio components (sub-portfolios), and list some ideas within them.

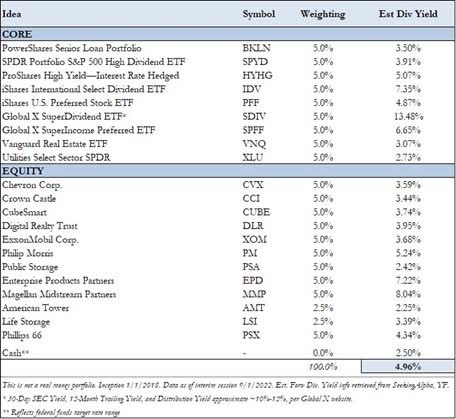

High Yield Dividend Newsletter Sub-Portfolio (50% Allocation)

High Yield Dividend Newsletter Portfolio (Image Source: Valuentum. This is not a real money portfolio.)

The first thing that most retirees may need is a steady stream of income. In the Ultimate $2 million Retirement Portfolio, allocating 50% to the High Yield Dividend Newsletter sub-portfolio, as shown above, translates into a stream of roughly $50,000 per annum on a forward estimated annualized basis. Included in the portfolio is a good balance of broad-based ETFs, as well as some of the strongest equity REITs. Exxon Mobil (XOM) and Chevron (CVX) fit the mold, while we like tobacco and tower stocks as well as self-storage REITs and several top-notch midstream pipelines.

A focus on high yield doesn’t always mean that ideas will be the best long-term considerations for price appreciation. What a company pays out today as a dividend/distribution relative to its price today has little, if anything, to do with its long-term intrinsic value calculation, which is based on balance sheet health and future forecasts of free cash flows. The recent rise in short-term interest rates has only complicated the high-yield investing landscape, too. As interest rates rise, for example, the demand for high-yielding equities (and their prices) may fall, as investors opt for “riskless” Treasury assets with secured yields rather than “risky” equities that are exposed to gyrating market forces.

In the event that a high-yield equity idea comes under suspicion of a dividend cut, its price may experience a considerable decline in advance of the dividend cut, resulting in not only capital impairment but also reduced income if the dividend cut happens. Many of these securities are riskier than the average equity due to their capital market dependence, too (they often need continuous access to capital from the debt and equity markets) – after all, that’s one of the reasons why they have a high yield in the first place. But the risk of any one idea doing permanent damage to the High Yield Dividend Newsletter sub-portfolio is mitigated to a large degree via holding a basket of payers within the portfolio context.

Dividend Growth Newsletter Sub-Portfolio (25% Allocation)

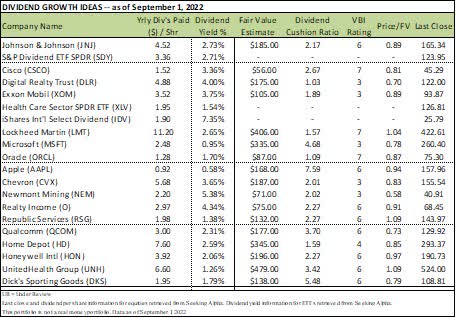

Dividend Growth Newsletter Portfolio. (Image Source: Valuentum. This is not a real money portfolio.)

The second prong of the Ultimate $2 million Retirement Portfolio is targeted towards dividend growth. Johnson & Johnson (JNJ) and the S&P Dividend ETF SPDR (SDY) headline this sub-portfolio. There may be some overlap in the holdings of the Dividend Growth Newsletter sub-portfolio and the High Yield Dividend Newsletter sub-portfolio, but there’s some flexibility to move things around in the context of the entire Ultimate $2 million Retirement Portfolio (which includes all three prongs). For example, because Exxon Mobil and Chevron are included in both the High Yield Dividend Newsletter sub-portfolio and Dividend Growth Newsletter sub-portfolio (they are also included in the Best Ideas Newsletter sub-portfolio below, too), they can be omitted from this sub-portfolio or not.

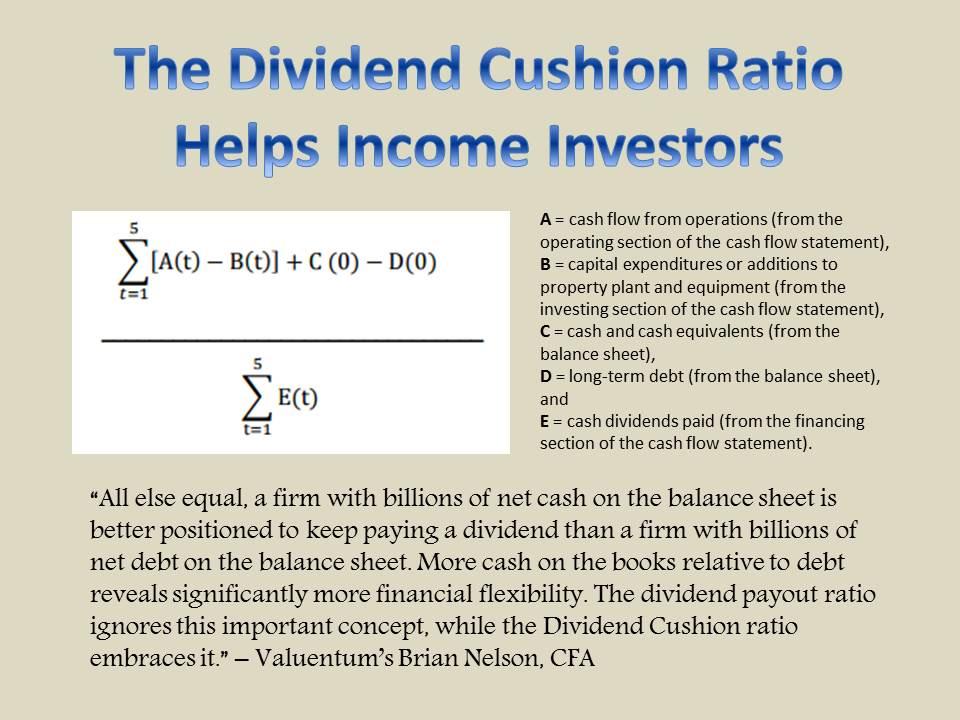

Regardless, a focus on dividend growth will help to ensure that the retiree is generating income growth along with the current yield from the High Yield Dividend Newsletter sub-portfolio such that over a long-enough time horizon, overall portfolio income continues to expand at a nice pace. Where many of the high yield dividend stocks may not experience a breakneck pace of dividend growth in the coming years (several may be pushing the upper limit with respect to their payout), many considerations in the Dividend Growth Newsletter sub-portfolio might, and eventually become high yielders themselves in 10, 20 years or longer, while providing a nice yield on cost in time. For reference, this is how we calculate the Dividend Cushion ratio for each company, as shown in one of the columns in the image above.

The Dividend Cushion Calculation (Image Source: Valuentum)

In our view, the Dividend Cushion ratio is one of the most powerful financial tools an income or dividend growth investor can use in conjunction with qualitative dividend analysis. The ratio is one-of-a-kind in that it is both free-cash-flow based and forward looking. Since the development of the Dividend Cushion ratio, it has forewarned of the dividend cuts of approximately 50 companies (meaning it highlighted significant risk to these stocks’ dividends before they slashed them). Among some of the high profile dividend cuts were: StoneMor (STON), Mattel (MAT), Exelon (EXC), BHP Group (BHP), Kinder Morgan (KMI), ConocoPhillips (COP), General Electric (GE), Seadrill, JC Penney, among dozens of others.

Best Ideas Newsletter Sub-Portfolio (25% Allocation)

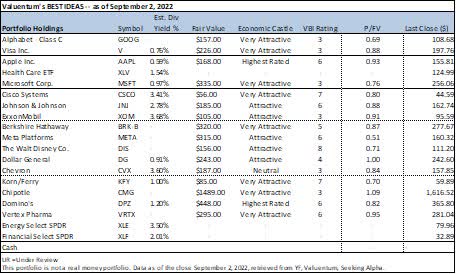

Best Ideas Newsletter Portfolio (Image Source: Valuentum. This is not a real money portfolio.)

The third prong of the Ultimate $2 million Retirement Portfolio is capital appreciation potential. This is what’s missing in many income portfolios these days. Where a retiree may only focus on REITs or the highest-yielding stocks, this could be detrimental to the longevity of the retirement portfolio over the duration of one’s retirement years. For example, REITs and the highest-yielding stocks have underperformed the S&P 500 by a huge margin the past five years. Having a decent percentage allocation to capital appreciation potential allows the retiree to keep building their portfolio during retirement, helping to offset the recurring withdrawals.

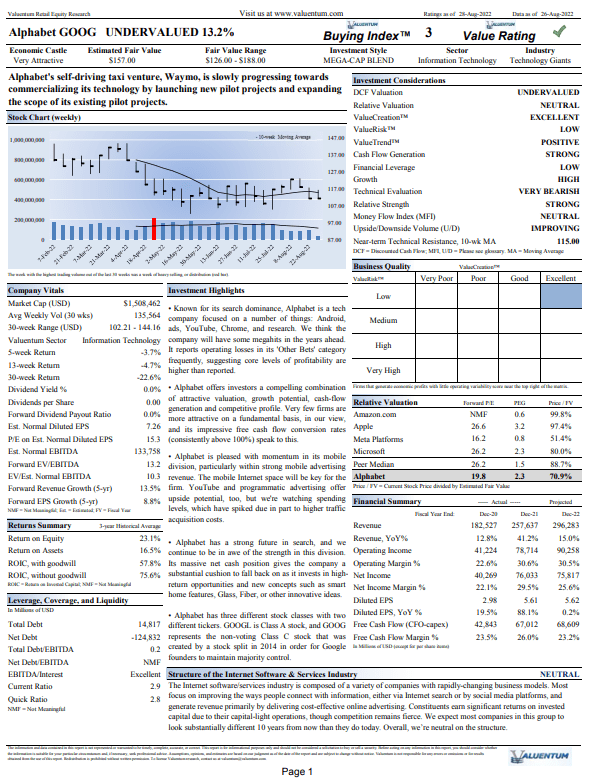

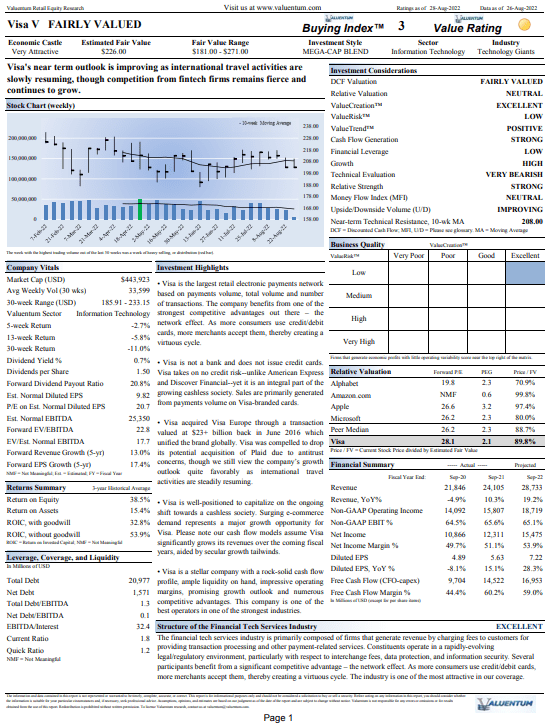

As in the case of the Dividend Growth Newsletter sub-portfolio, there is some overlap in the Best Ideas Newsletter sub-portfolio versus the other two sub-portfolios as well. The retiree can consider swapping out names or double up on some of the ideas that are in all three portfolios to gain greater exposure to their favorite ideas. We think it is better to own the greatest stocks, instead of trying to find a lesser, different idea that may not pan out as great as the original one. Alphabet (GOOG) (GOOGL) and Visa (V) are our two favorites in this area, and page one of their 16-page stock reports are provided below.

Alphabet is significantly undervalued, in our view. (Image Source: Valuentum) Visa has an impressive business model, in our view, and it is one of our favorite capital-appreciation ideas. (Image Source: Valuentum)

Concluding Thoughts

The Wall Street Journal recently showed what it looks like to retire with $2 million these days, and many have been enjoying the fruits of their life-long work. It’s important to strike a balance with any retirement portfolio, and for retirees that may live 10, 20 years during retirement or those seeking to pass on wealth to the next generation, an allocation between the High Yield Dividend Newsletter sub-portfolio, the Dividend Growth Newsletter sub-portfolio, and the Best Ideas Newsletter sub-portfolio may make a lot of sense. Whatever you do though, stay diversified, and focus on the finer things in life during your golden years. Thank you for reading!

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice. The information contained in this article does not constitute any advice, especially on the tax consequences of making any particular investment decision. The material on this website is not intended for any specific type of investor and does not take into account an investor’s particular investment objectives, financial situation or needs. Information and content in this article is not intended as a recommendation of any securities highlighted or any particular investment strategy. Readers should perform their own due diligence, and if necessary, seek professional advice from a personal financial advisor.

Be the first to comment