Paul Morigi/Getty Images Entertainment

Warren Buffett is buying oil and gas stocks. According to Berkshire Hathaway’s latest 13F filing, he recently purchased approximately $26B of Chevron (NYSE:CVX) shares and $13B of Occidental Petroleum (NYSE:OXY) shares. As of the end of March, Berkshire owns about 24% of the outstanding shares of OXY and 8% of CVX.

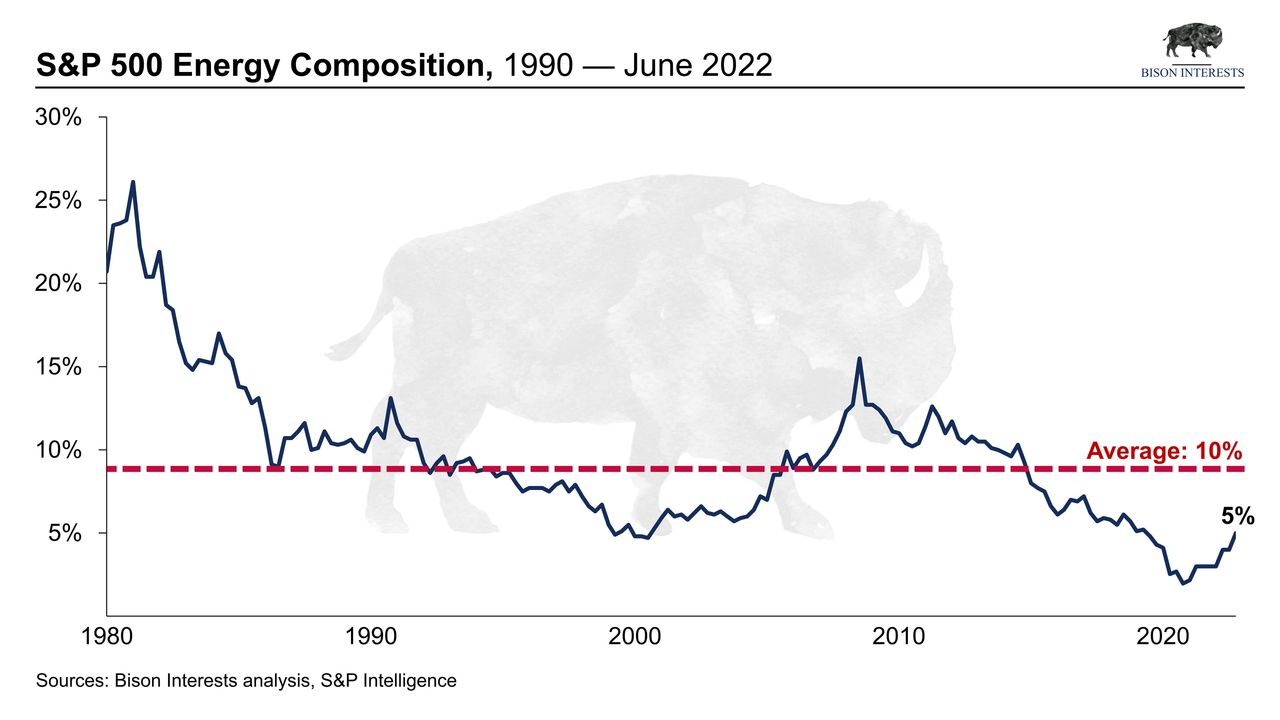

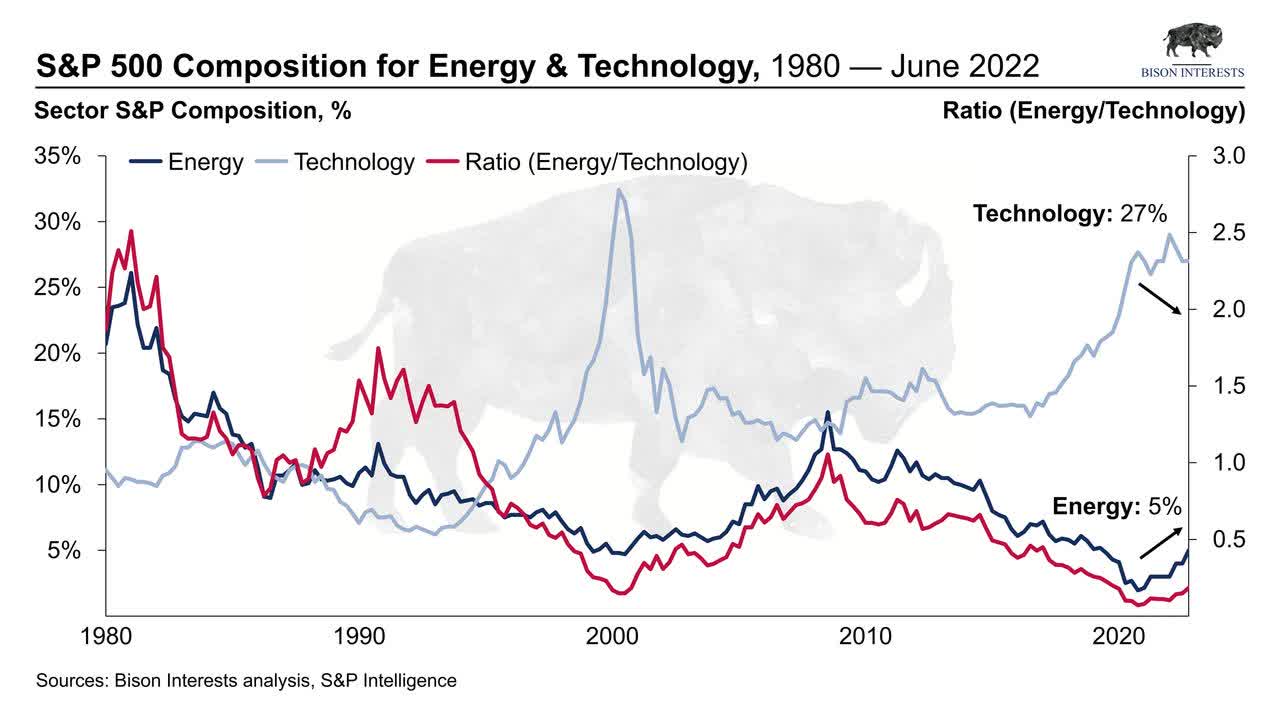

These aggressive purchases of major stakes in large oil and gas companies indicate Buffett’s view on the sector and are meaningful in the face of lagging sentiment and positioning in this oil bull market. This is seen in energy’s small portion of the overall equity market versus historical levels, especially in the context of substantially higher energy sector earnings at $100+ oil and $7+ natural gas:

Bison Interests

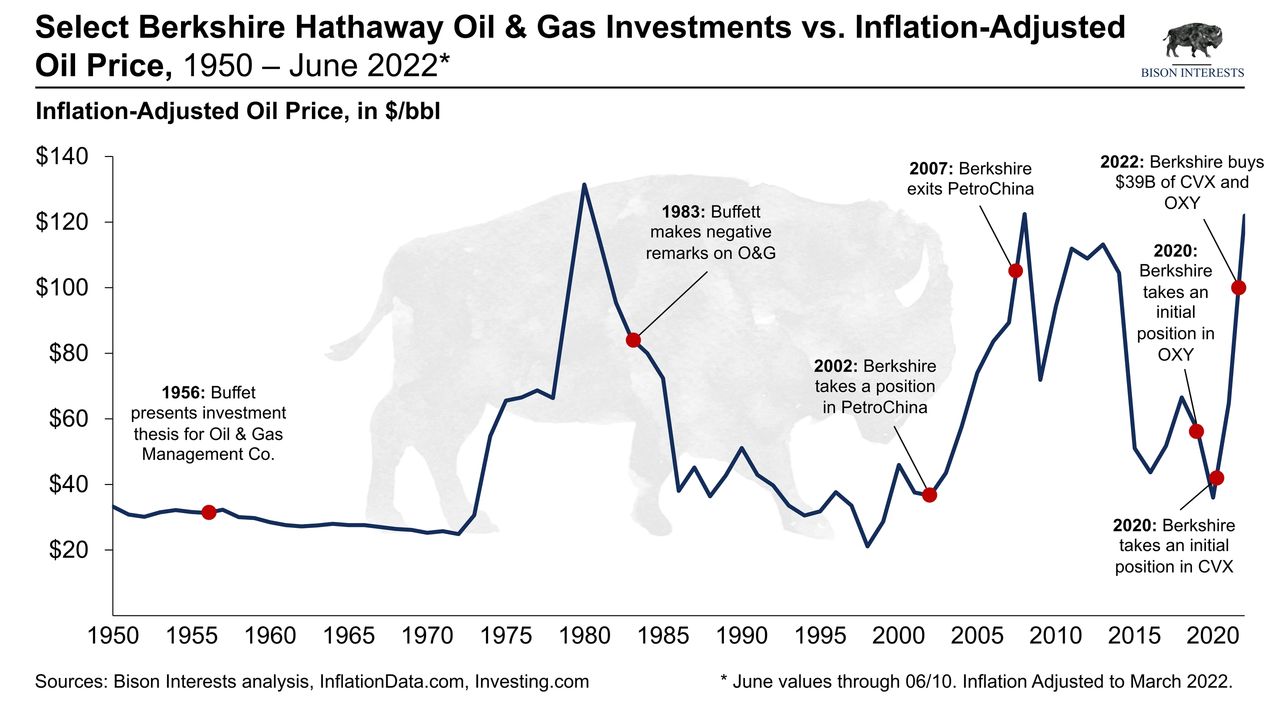

Buffett is not known for cyclical investments. Over time, he has repeatedly stated his preference for investments that have stable, predictable, and growing cash flows—the opposite of the peaks and troughs of cyclicals. And yet, Buffett has intermittently owned and done well with oil & gas equities—particularly in inflationary periods much like the present. Buffett is known as a fundamental value investor, but on closer examination of his historical investments and track record, he has also been an excellent market sector timer and cyclicals investor, as can be seen below:

Bison Interests

Buffett’s reputation as a brilliant fundamental value investor and excellent market timer is a result of a successful investing track record over several decades: he reportedly bought his first stock in 1941, when he was just 11 years old! Since gaining control of Berkshire Hathaway, Buffett has successfully navigated through several market booms and busts. Consequently, Berkshire shares have achieved a compounded annual return of 20.1% between 1964 and 2021, nearly double the 10.5% return for the S&P 500 over the same period.

Given this impressive track record, the timing of Buffett’s oil and gas purchases is worth examining in detail. Buffett initiated positions in OXY and CVX in 2019 & 2020, respectively, in smaller size and at much lower prices. In late 2021 and early 2022, Buffett has “averaged up” on these oil and gas positions, which are trading near 15-year highs, during an oil bull market. Despite the prior run-up in the price of these shares and the sector, Buffett clearly sees the most value in oil and gas in the current market environment: nearly 70% of the $51 billion of Berkshire’s stock purchases in Q1 2022 were shares of CVX and OXY!

We explore Buffett’s history in oil & gas investments below, use them to contextualize his recent oil company stock purchases and find commonalities with Bison’s assessment of the oil and gas space, as previously discussed in the Golden Age of Oil and Gas and elsewhere.

Buffett’s Writings And Oil & Gas Investments

As can be seen in the chart of Buffett’s historic oil and gas share purchases above, in some cases Buffett buying has historically been followed by a rise in oil prices. And in other cases, where oil prices traded sideways or declined, Buffett made money through value-oriented investments. Given this historical investment track record and recent purchases of oil and gas equities, we evaluate some of Buffett’s past oil and gas investments and their associated investment theses to identify commonalities with the recent purchases of OXY and CVX, and to see what they may imply regarding Buffett’s view on oil and gas equities today.

Oil & Gas Property Management, Inc.

In 1956, Buffett wrote a newspaper article titled: “The Security I Like Best; Oil & Gas Property Management, Inc.”, in which he laid out the value investment thesis for an oilfield management company. Buffett’s purchase of the security was not a blind bet on higher oil prices, noting the “substantial reserves of the company and illustrates the dynamic possibilities of the small issue of common stock even should no increase in oil and gas prices occur.”

Mr. Buffett approached Property Management Inc. from with a value investment framework, which allowed him to uncover an opportunity that was overlooked by the market (despite the cyclicality). Property Management’s reserves were acquired at lower oil prices, which was not well understood at the time, and the value of these reserves had increased materially by 1956. While many investors were discounting or avoiding the stock due to its large debt burden, Mr. Buffett observed: “The net reserves for stock and debentures reflect the reduction from gross reserves of amounts sufficient to retire oil payments and loans.”

And while Buffett saw value in Property Management Inc. in particular, he also recognized at the time that oil and gas businesses would be an excellent hedge against inflation: “Should inflation continue [Oil & Gas Property Management, Inc.] may well be the vehicle to give the investor the same super-charged performance that highly leveraged investment trusts and warrants did in the early 1940’s.”

Buffett estimated that this inflation hedge would return 400% if oil prices increased 50 cents, and therefore concluded that a “small investment in O&G should do the job that a many times larger investment in a non-leveraged oil holding would do while exposing the holder to a much smaller maximum loss.” Oil prices subsequently increased to $3.14 in 1957 from $2.94 in 1956, making Property Management Inc. likely one of many successful Buffett investments.

Negative Comments On Oil & Gas

In his 1983 Berkshire Hathaway shareholder letter, Buffett argued against businesses which require high rates of re-investment, such as natural resources businesses, and dismissed the broad consensus that these would be the best hedges against inflation at the time. He contended that these natural resources businesses were not earning excess returns; as such, he forecasted that they would see share prices burdened by higher required re-investment, and limited ability to pass on these cost increases to consumers.

It is important to note that this 1983 letter came after the peak of the 1970’s commodities bubble—Buffett was effectively identifying the limited available value in the oil & gas (and the entire natural resources!) sector at the time, encouraging his readers to look beyond commodity producers for inflation hedges. This displayed his market timing prowess, as it avoided substantial losses that may have been incurred in oil & gas equities, with oil prices falling nearly 60% from 1983 to their bottom in 1998. A “lost decade” and a half was avoided by valuation sensitivity and cyclical awareness!

PetroChina

In 2002, Buffett bought 1.3% of PetroChina (PTR), China’s largest oil producer, for $488MM. He faced pushback at the time given his proverbial “buy what you know” investment mantra. Some opined that Buffett was out of his depth buying Chinese equities, observing that he had historically stayed away from overseas investments due to regulatory and geopolitical risk. Others cited depleted reserves, mature fields, and an overly encumbered cost structure as potential issues.

Buffett approached PTR using his proven value investment framework, deeming that the security was “too cheap to ignore”. At the time of his investment the market cap was $37B, but Buffett estimated the value of the equity was closer to $100B—implying a nearly 3x return from the current share price. The fact that PetroChina was netting $12B a year, with production equal to 3% of global oil reserves, and paying out a substantial portion of free cash flow to investors supported his view. For a cash flow yield-focused investor like Buffett, PTR was very compelling: “In the annual report, they say something which very, very few companies do say, but which I think is actually fairly important. They say they will pay out about 45% of the amount they earn. […] So, if you can buy it at three-times earnings, what turned out to be three times earnings, and you get 45%… you’re getting a 15% cash yield on your investment.”

Buffett’s investment in PTR was partially a bet on valuation: at a 15% cash yield, he could realize a meaningful return even if oil prices didn’t move much. It didn’t hurt that oil prices increased nearly 300% after his purchase through their peak in 2008. And it helped that PetroChina made several major oilfield discoveries. PTR soon became one of Buffett’s best investments to date. Berkshire sold PTR in 2007, when the market cap was 275B, realizing a $3.6B gain. This amounted to a 720% return over his 5-year holding period, or 52% annualized. Value motivated Buffett’s decision to sell PetroChina as well, noting that he “sold based on price […] it was 100 percent a decision based on valuation.”

Purchases Of CVX & OXY

The lessons from Buffett’s past purchases of oil and gas companies, such as Property Management, Inc. and PetroChina, and his aversion to natural resources companies in his 1983 shareholder letter, tie together with his recent purchases of Chevron and Occidental shares. Buffett found value and inflation upside in Property Management, Inc.’s reserves, and in PetroChina’s mature fields and exploration program. Both companies’ shares offered compelling free cash flow yields and commodity price upside—value with inflation protection. And in 1983, in an environment likely without similar available free cash flow yields and with more inflation “priced in” to natural resources equities—limited value with sub-optimal inflation protection.

Today, Chevron and Occidental are generating enormous free cash flow, have upside to higher commodity prices, offer inflation protection, and are returning part of their free cash flow to shareholders via buybacks and dividends. These companies generated strong cash flow in 2019 and 2020, when Buffett initially bought preferred shares of OXY and common stock of CVX. By the time Buffett added massively nearly 40B to these positions, making oil & gas one of the largest positions on the Berkshire book, their free cash flow yields had increased substantially.

In the past, Buffett saw oil and gas businesses as beneficiaries of inflation, subject to attractive valuations, at times where he saw very few other similar opportunities in the market. Buffett appears to have the same approach this time around, buying inexpensively while embracing inflation protection from oil price exposure, stating that these purchases are “a bet on oil prices over the long term, more than anything else.”

And in contrast to the prevailing green transition narrative, Buffett’s partner, Charlie Munger, made his view on oil clear in their most recent shareholder conference in Omaha: “I like having big reserves of oil. If I were running … the United States I would just leave most of the oil we have here and I would pay whatever the Arabs charge for their oil, and I’d pay it cheerfully and conserve my own. I think it’s going to be very precious stuff over the next 200 years.”

Free Cash Flow And Inflation Upside: Small-Cap E&Ps Offer Considerable Torque

We see that Buffett is buying Chevron and Occidental for their free cash flow and inflation upside, and that he recently expressed the view that these purchases are “a bet on oil prices over the long term, more than anything else.” And Charlie Munger’s recent comments on oil put him far into the long-term oil bull camp “I like having big reserves of oil.” What if there was an even better way to get exposure to the views of these two super investors, for the next leg up of this oil and gas bull market?

Chevron and Occidental stock are inexpensive when compared to large companies in other sectors, and they would generate even more cash flow at higher oil prices. And we agree that the strategy of buying and holding shares of poorly understood, undervalued companies with quality assets and management teams is a powerful driver of the sort of outsized returns Berkshire Hathaway has generated over decades. We discussed the current compelling opportunities in the oil and gas space along these lines in The Golden Age of Oil And Gas Producers.

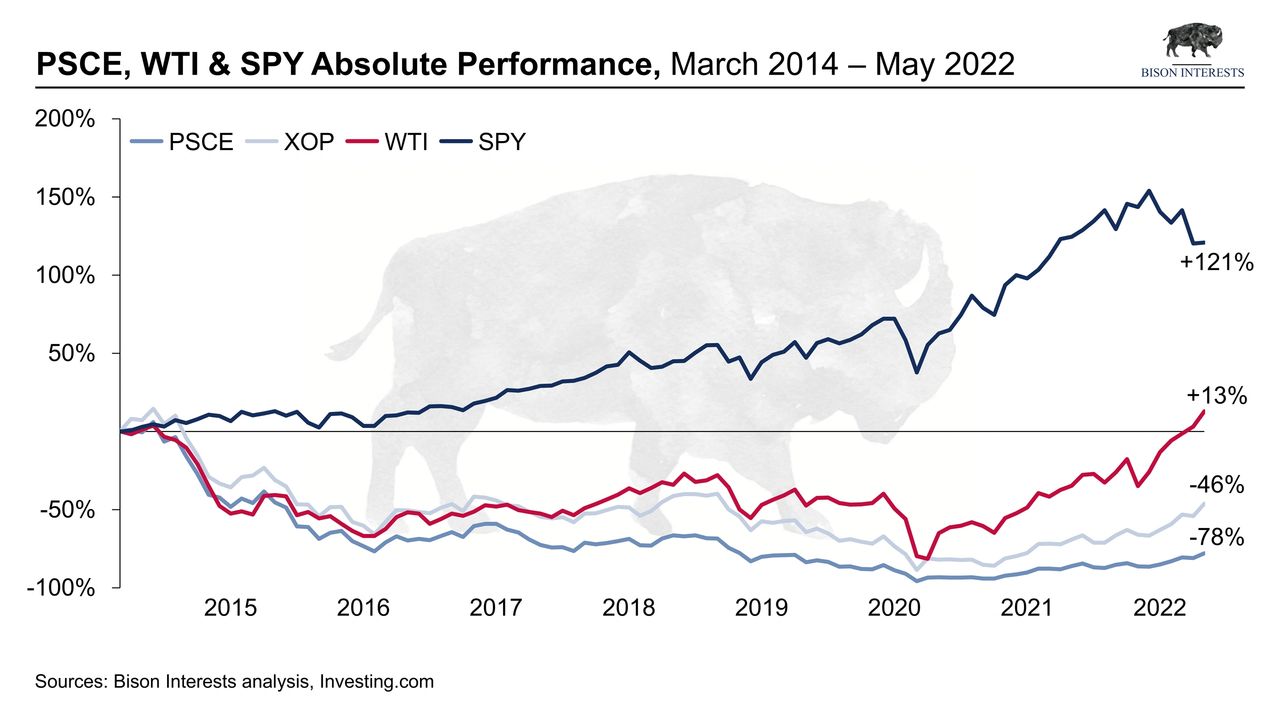

However, Buffett has said repeatedly that if he were managing $50 or $100 million and not Berkshire’s hundreds of billions of dollars, he would invest in different companies and earn higher returns. We agree, and we see additional upside from smaller cap oil and gas companies shares. Buffett is likely correct that oil majors and other large cap oil & gas producers’ share prices will be bolstered by higher oil prices and healthy free cash flows. This performance may be eclipsed by much less expensive smaller producers with higher free cash flow yields and more oil and gas price upside. As discussed in Small-Cap E&Ps: Compelling Opportunity, smaller oil and gas producer equity share prices have materially lagged larger caps and the broader market, while the smaller cap producer multiples have essentially compressed as fundamentals improve faster than share prices:

Bison Interests

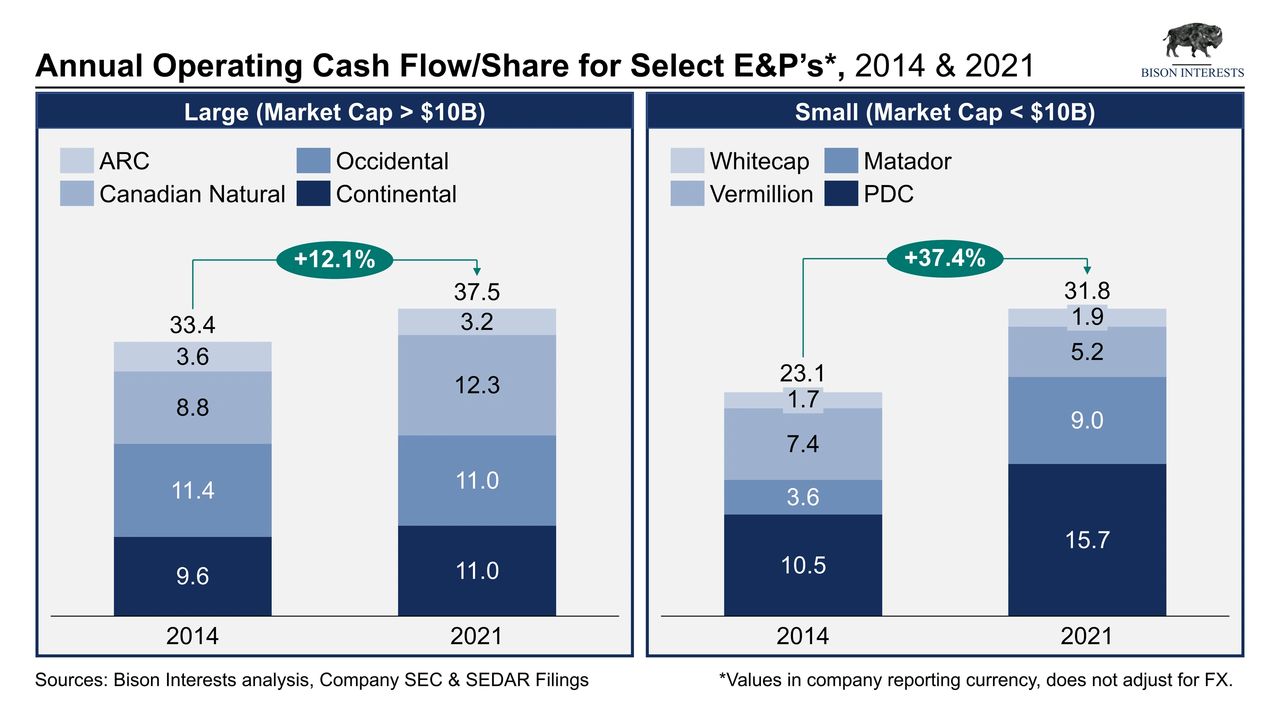

The multiple compression effect is amplified for small caps—due to operating and financial leverage—resulting in larger increases in cash flow as oil market prices rise. Improved cost structures since the end of the prior oil bull market have already translated into larger improvements in smaller cap companies operating cash flows per share, as can be seen below, before the benefit of higher oil and gas prices:

Bison Interests

Companies with similar fundamentals should command similar multiples, adjusted for risk and other factors. While smaller companies may trade at a discount in bear markets due to the negative effects of operating and financial leverage in a low-price environment, they should trade at a premium in bull markets for these reasons. Additionally, nimbleness and ease of growing with a smaller “base effect” historically has been awarded premium valuations in prior bull markets. As these top and bottom-line effects play out over multiple quarters, this reversion from discounted to premium valuations for smaller cap producers may progress, as in past cycles. And if not, more free cash flow and inflation “protection” per dollar invested is compelling!

On Oil Market Timing And The Equity Bear Market

Buffet’s recent oil and gas purchases, along with rapidly improving oil and company fundamentals, are positive signals for oil & gas equity investment. And within the oil and gas universe, small-cap equities are particularly compelling—we are confident Mr. Buffett would agree, albeit with limitations from Berkshire’s large size!

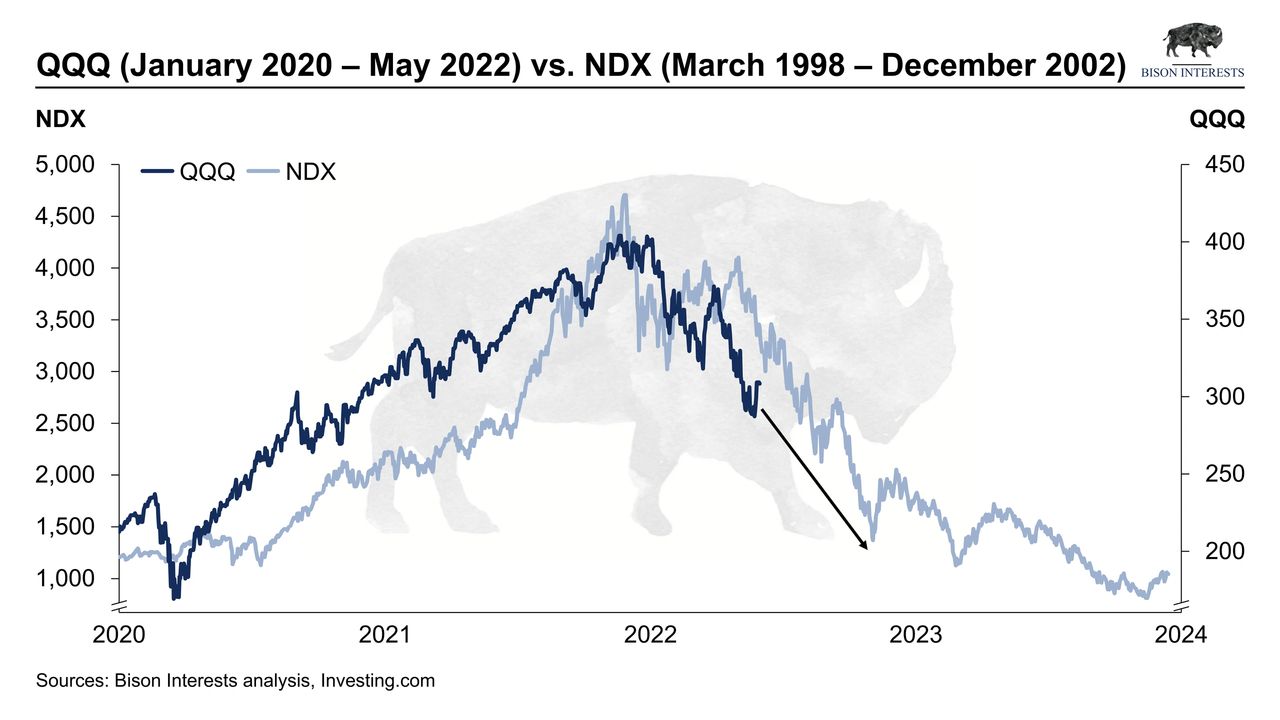

However, there are challenges holding investment back that merit addressing in the context of Buffett’s recent substantial O&G equity sector investment. These include investors’ reluctance to buy cyclical equities that have already materially outperformed, and widespread bearishness amidst an equity bear market, significant broader economic uncertainty, and market volatility. Inflation is reverberating across the economy, driving higher prices for consumers and deteriorating fundamentals for many companies. Interest rates are rising, certain sectors’ shares are crashing, and trillions of market capitalization and face value of other assets have vanished. And the Federal Reserve’s post-covid regime of rapid expansionary monetary has rapidly changed course, with interest rate increases and quantitative tightening underway and more potentially to come.

As we have previously discussed, higher equity valuations increase share price sensitivities to interest rates. While many of the most overvalued equities have shed more than 50% of their market values in response to the shifting monetary regime, there may still be a long way down, similar to prior shifts:

Bison Interests

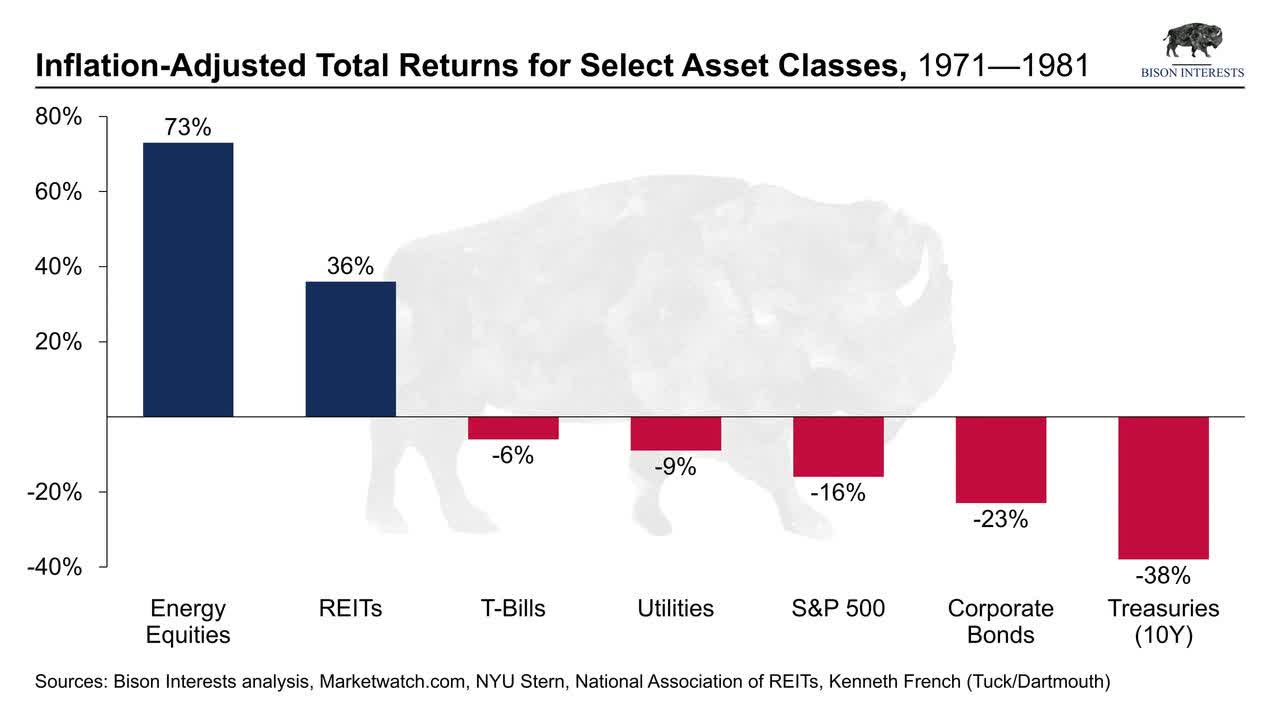

Inflation is roaring, with gasoline prices rising to their highest levels in nearly 15 years, along with surges in other prices. This may exacerbate the economic slowdown and imply more downside for the broader market. Unresolved supply chain issues are also driving higher input costs for many businesses, while revenues are suffering from slowdowns in consumer spending as the wealth effects from monetary stimulus and booming stock/cryptocurrency markets roll over. This economic outlook is concerning.

However, continuing strong oil fundamentals are supporting high oil prices. This bolsters our view that 1970’s style stagflation is a likely scenario, echoed in analysts’ comments on Buffett’s purchases of oil and gas equities and sales of bank stocks. For reference, in the last stagflation environment in the US, oil and gas equities performed exceptionally well:

Bison Interests

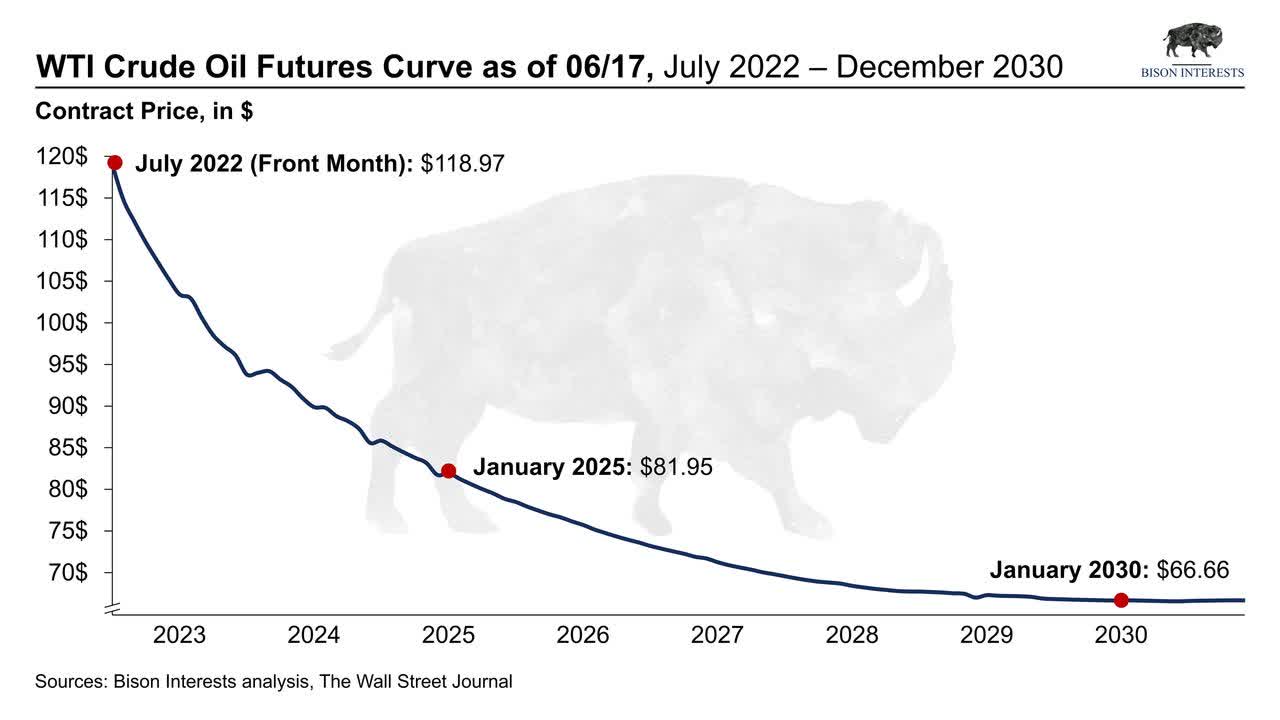

The broad, negative outlook for the economy appears to be baked into oil and gas equities, despite this history and current strong fundamentals. Specifically, oil and gas equities are “pricing in” much lower prices—more in line with the oil market’s backwardated futures forward curve. This is poorly understood, attributed to a variety of factors like forward economic indicators turning negative, short-term catalysts dampening demand, and the green transition narrative. In reality, it is reflective of a tight physical market incentivizing oil out of storage.

Bison Interests

If a negative economic outlook is fully priced into equities, and with oil prices strong despite a broad market downturn, there should be meaningful price upside to positive data in the future. Therefore, from a timing perspective, oil and gas equities may be compelling today as more economic malaise is priced in—potentially a factor considered by Buffett in his recent OXY and CVX purchases.

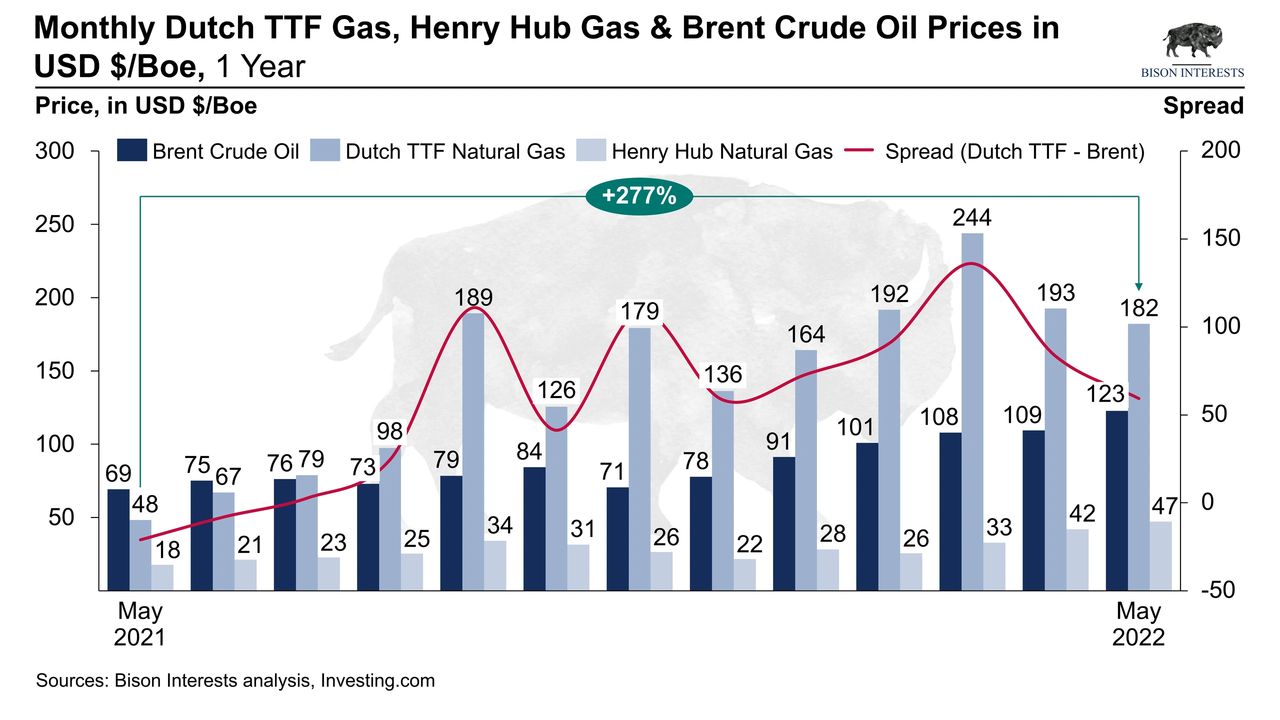

Additionally, there are other short-term catalysts likely to lift E&P share prices. The Chinese Communist Party is slowly lifting the brutal, months long lockdowns in many cities in China, which should unlock material oil demand as economic activity picks up. The green transition is floundering, with bad economic policy encouraging divestment from fossil fuels and investment into less reliable renewables driving higher prices, as they have already in Europe. Ironically, this may incentivize the burning of comparatively cheaper oil and coal for power generation, which may push prices even higher:

Bison Interests

As interest rates rise and tech stocks continue to crater, we may see an acceleration of the rotation out of growth stocks and into value stocks as investors’ speculative appetite wanes. Note that this rotation is already underway, as investors pile into comparatively safe “value” stocks with high cash flow yields, of which oil and gas equities are leading the pack! This trend can be observed below, and we expect the ratio of energy to technology may continue to mean revert from here:

Bison Interests

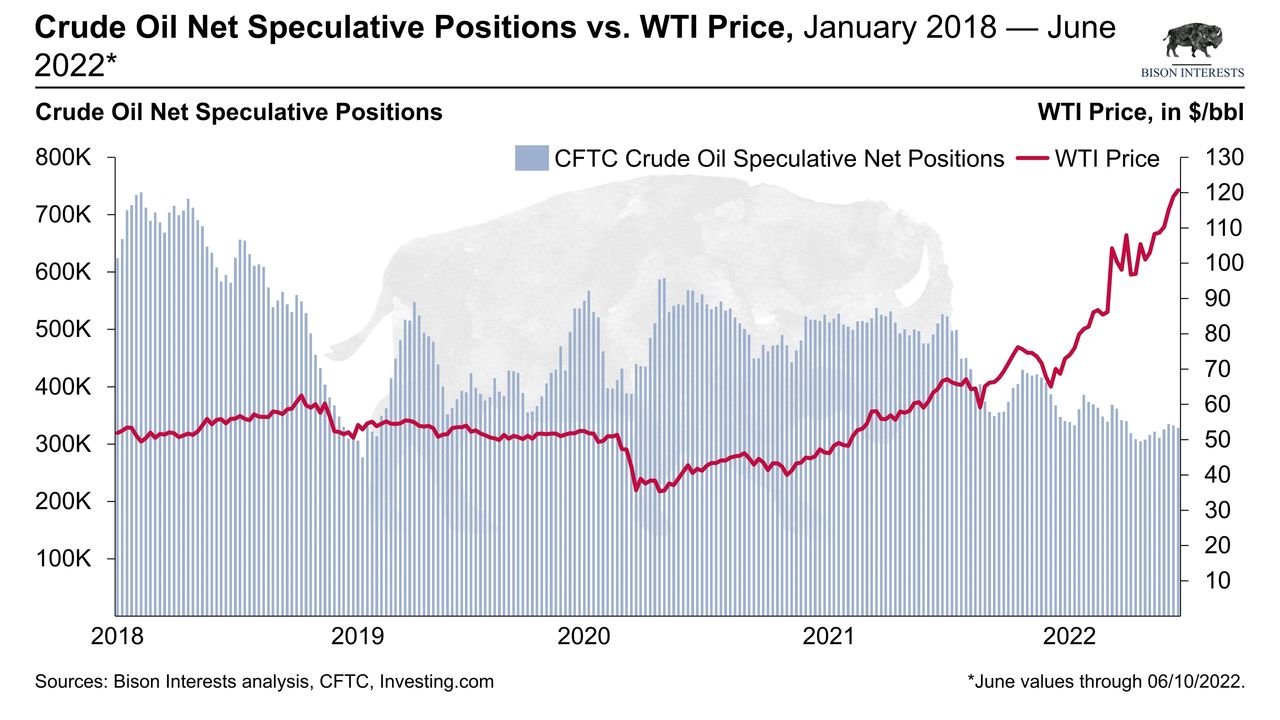

And even despite the ongoing rotation catalyzed by strong oil market fundamentals, several quarters of positive oil and gas company earnings and strong buy signals from Warren Buffett and other prolific investors, oil and gas investment interest remains comparatively low. This is indicated by declining long speculative interest in oil futures, and may suggest oil prices have more upside as speculators take notice and enter the market:

Bison Interests

We hope we have helped illustrate what Buffett may be seeing that brought him into substantial recent investments in the oil and gas sector. While we can’t know for certain what he was thinking, by observing his past behavior over decades, we have a good idea of how these investments fit into his historical patterns.

We see an opportunity to potentially do even better by imitating a younger Buffett, prior to size constraints, buying off the run smaller cap companies shares that have lagged and have more operating and financial leverage to higher oil and gas prices. When we wrote The Golden Age of Oil and Gas, and when our CIO went to Omaha for Berkshire’s annual meeting this year, we had no idea Buffett had made such a large, concentrated bet on the sector. And based on his track record, perhaps the best is yet to come for the oil and gas industry!

Sources

Berkshire Hathaway 2021 Annual Letter

Warren Buffett, PetroChina and the Margin of Safety

European Union Pledges to Curb Oil Purchases From Russia

Buffett on Inflation – 1983 Berkshire Hathaway shareholder letter

Grahamian Value Week in Review ― November 27, 2020

CL.1 | Crude Oil WTI (NYM $/bbl) Front Month Contracts – WSJ

Buffett says has sold entire PetroChina stake

Warren Buffett: 15 Suncor Energy transactions (Berkshire Hathaway)

Buffett says Occidental Petroleum investment is a bet on oil prices over the long term

Berkshire-Led Group to Buy MidAmerican Energy

Buffett: ‘I have no compunction about owning Chevron’

Warren Buffett explains why he’s making a bet in the energy industry

Warren Buffett’s Berkshire buys Dominion Energy natural gas assets in $10 billion deal

Warren Buffett’s Berkshire Hathaway Sharply Boosts ConocoPhillips Stake

Buffett Partnership Letters 1957 to 1970

Be the first to comment