cagkansayin/iStock via Getty Images

Thesis

BlackRock Credit Allocation Income Trust (BTZ) is a closed end fund that holds fixed income instruments, with a focus on corporate investment grade bonds. The fund will invest at least 80% of its total assets in credit-related securities, including, but not limited to, investment grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds. BTZ has great 5- and 10-year total returns that sit at 8.5% and 8.3% respectively, and a good risk/return Sharpe ratio of 0.71. The fund is overweight BBB corporate bonds with a significant barbell allocation to HY that exceeds 30%. In the current interest rate environment with a hawkish Fed set to increase rates for the first time after the Covid pandemic fixed income funds are set to suffer. BTZ runs a fairly high duration of 7 years which is going to hamper its performance in a Fed tightening cycle. While the fund discount to NAV is finally showing larger figures than in 2021, it has not reached its long term average of -10%. In the next 12-months we do not expect the fund dividend yield to fully cover the losses from a widening discount to NAV and decreasing fund asset values on the back of a tightening rate cycle. We rate BTZ a Sell here with a much better entry point to be found later in the year. For the avoidance of doubt we like this fund, we believe it has great historical risk/reward metrics but we do not like to hold a security which from a total return perspective is expected to generate modestly negative figures in the next 12 months.

CEF Metrics

This section details some CEF metrics and overall fund analytics:

Leverage Ratio: 28.8%

- Average for the asset class.

Expense Ratio: 1.35%

- Average for the contemplated asset class

Manager: BlackRock

- Premier asset manager.

- Substantial research and trading resources

Yield: 7.26%

- Average for the asset class.

Discount/Z-Stat: -5.84% / -1.98

- The fund is trading at a discount.

- The discount is higher than normal on a 1-year lookback period

AUM: $1.4 billion

- The fund has a high AUM for the asset class

Holdings

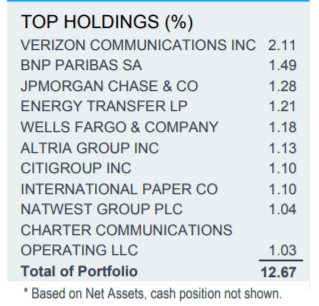

The fund’s top holdings are investment grade bonds:

Fund Top Holdings BlackRock

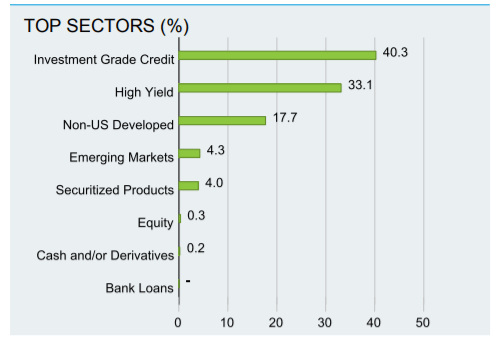

BTZ is a vehicle that generally is overweight investment grade bonds:

Top Sectors BlackRock

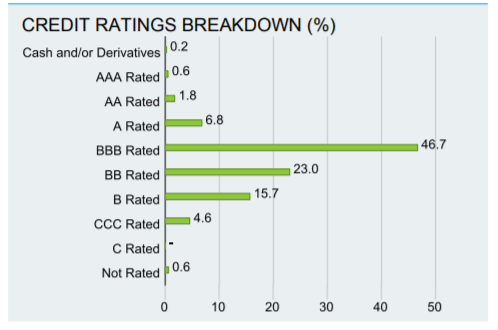

Investment grade refers to bonds rated Baa3/BBB- or better by the major rating agencies and generally have a low probability of default. BTZ focuses on BBB rated paper:

Credit Ratings Breakdown BlackRock

We can see from the above table that more than 46% of the portfolio is composed by BBB credits, with a fairly sizable allocation to HY credits as well, the total of which amounts to more than 32%.

Interest Rate & Credit Risks

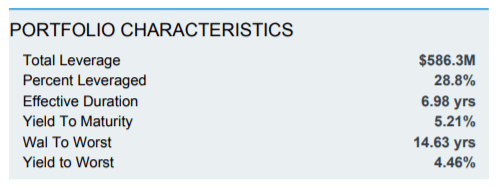

We deem the credit risk BTZ is currently running to be low given we are mid-cycle in the current macro framework. We do not expect a recessionary environment in the next 12 months and a related widening in credit spreads. The most prevalent risk for BTZ is interest rate risk, namely the negative impact the portfolio experiences as the Fed raises rates. The vehicle runs a high duration:

Duration Metrics BlackRock

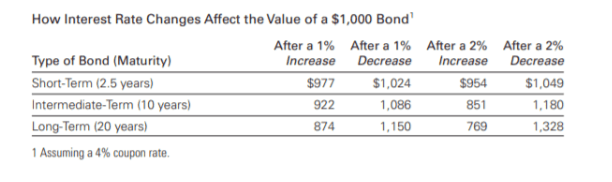

The effective portfolio duration is very close to 7 years with the weighted average life to worst maturity date being a high 14.6 years. This means that as interest rates rise, the portfolio loses value:

Interest Rate Sensitivity Vanguard

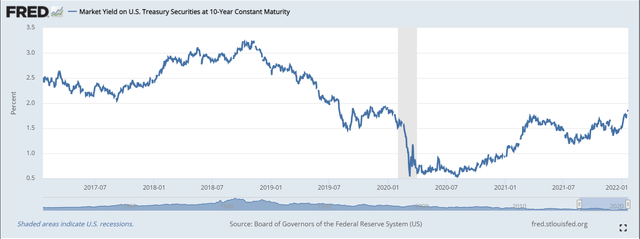

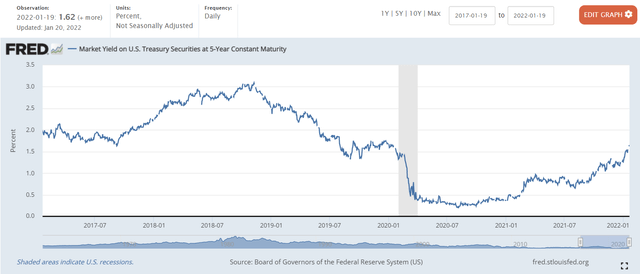

BTZ falls in the intermediate-term bond category, and we can see that a 1% rise in interest rates brings about an 8% loss in portfolio value. Rates have risen recently with the 10-year yields set to break the 2% barrier:

5-year yields have experienced an even sharper rise currently being at 1.62%:

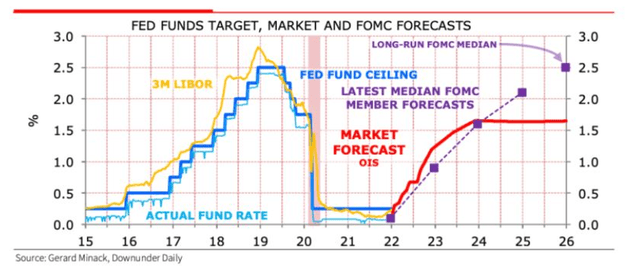

The market is currently pricing Fed hikes that will bring overnight rates close to 1% by year end:

Rate Hikes Priced Downunder Daily

Rates are set to continue to rise as the Fed policy normalizes post-Covid. While the OIS pricing is not always entirely accurate we are fairly certain overnight rates will be in the 1% overall ball-bark by year end, with the risks tilted towards an even more aggressive Fed. Being long duration is a normal status for an investment grade bond focused fund but will result in NAV depreciation as the underlying bonds are priced lower giver higher rates.

NAV Premium / Discount

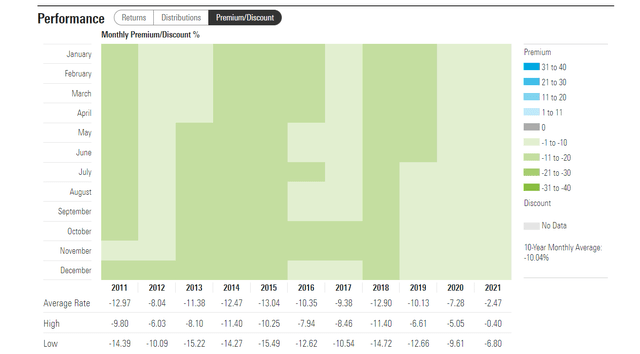

BTZ has historically traded with a discount to NAV of close to 10% outside 2021:

As the Fed normalizes its interest rate policy and the hunt for yield subsides we are of the belief that BTZ will revert to its historic norm in terms of discount to NAV. The current fund discount to NAV is 5.84% but we believe this is going to widen. We can see from the above chart that during the Fed tightening years 2013-2015 and again in 2018 the discount to NAV for the fund was higher than the historical norms. We are again entering such a cycle.

Performance

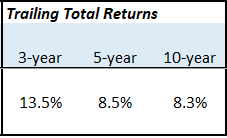

BTZ has outstanding long term returns:

Trailing Total Returns Author

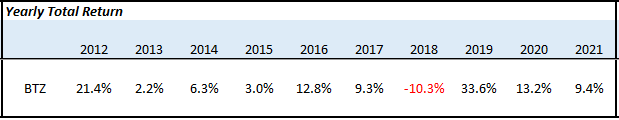

The fund also only experienced loses during 2018 on the back of a credit spread widening environment:

Yearly Total Returns Author

The fund experienced significant negative total returns in the early stages of the past tightening cycle, with the dividend yield compensating in the later stages to bring overall returns to positive territory:

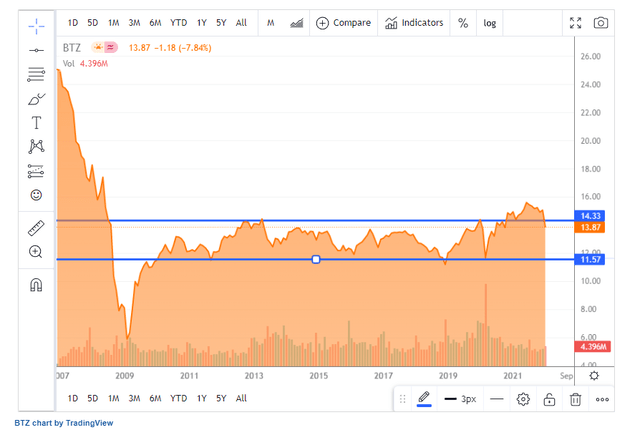

If we look at the fund performance in the past decade we can observe a nice boxed price performance:

Historical Price Seeking Alpha

The fund tends to sit in a 11.5 to 14.3 band, with tightening cycle years testing the lower band. We fully expect the fund to repeat its performance and move towards the middle of the “box” as the tightening cycle progresses.

Conclusion

BTZ is a fixed income closed end fund that is overweight investment grade bonds. The fund has great historic total returns achieved with a very good Sharpe ratio. The fund nonetheless is long duration (~7 years portfolio modified duration) which provides for a tremendous performance drag during a fed tightening cycle. While the fund has finally reverted to a discount to NAV it is not yet near the historic average of -10%. We rate BTZ a Sell here with a much better entry point to be found later in the year. For the avoidance of doubt we like this fund, we believe it has great historical risk/reward metrics but we do not like to hold a security which from a total return perspective is expected to generate modestly negative figures in the next 12 months.

Be the first to comment