ipopba

A Quick Take On BTRS Holdings

BTRS Holdings Inc. (NASDAQ:BTRS) reported its Q2 2022 financial results on August 13, 2022, missing expected revenue and EPS estimates.

The company provides a range of B2B payment processing and services to companies worldwide.

With a slowing global economy, a strong U.S. dollar producing FX headwinds, no apparent cost-cutting efforts by management and continued high operating losses, my outlook on BTRS is a Hold for the near term.

BTRS Holdings Overview

Lawrenceville, New Jersey-based BTRS (Billtrust) was founded in 2001 to provide a variety of B2B payment software and related service options to organizations.

The firm is headed by founder, Chairman and CEO, Flint Lane, who was previously Chairman and President of Paytrust, and EVP R&D at Logic Works.

The company’s primary offerings include:

-

Business payments network

-

Credit

-

eCommerce

-

Invoicing

-

Payments

-

Cash application

-

Collections

-

Services

The firm acquires customers via direct sales and marketing efforts and through partner referrals.

BTRS has employees in 7 countries and serves over 40 industry verticals.

BTRS Holdings’ Market & Competition

According to a 2022 market research report by IMARC Group, the market for B2B payments was an estimated $943 billion in 2021 and is forecast to reach $1.56 trillion by 2027.

This represents a forecast CAGR of 8.3% from 2022 to 2027.

The main drivers for this expected growth are increasing demand for automated and more efficient payment processing between businesses amid a rise of e-commerce activities worldwide.

Also, small and medium-sized enterprises are seeking to take advantage of improved payment options to lower costs and increase flexibility.

Major competitive vendors include:

-

PayPal (PYPL)

-

Global Payments (GPN)

-

Square (SQ)

-

Visa (V)

-

ACI Worldwide (ACIW)

-

Jack Henry & Associates (JKHY)

-

Paysafe Group

-

Naspers Limited (OTCPK:NPSNY)

-

Others

BTRS Holdings’ Recent Financial Performance

-

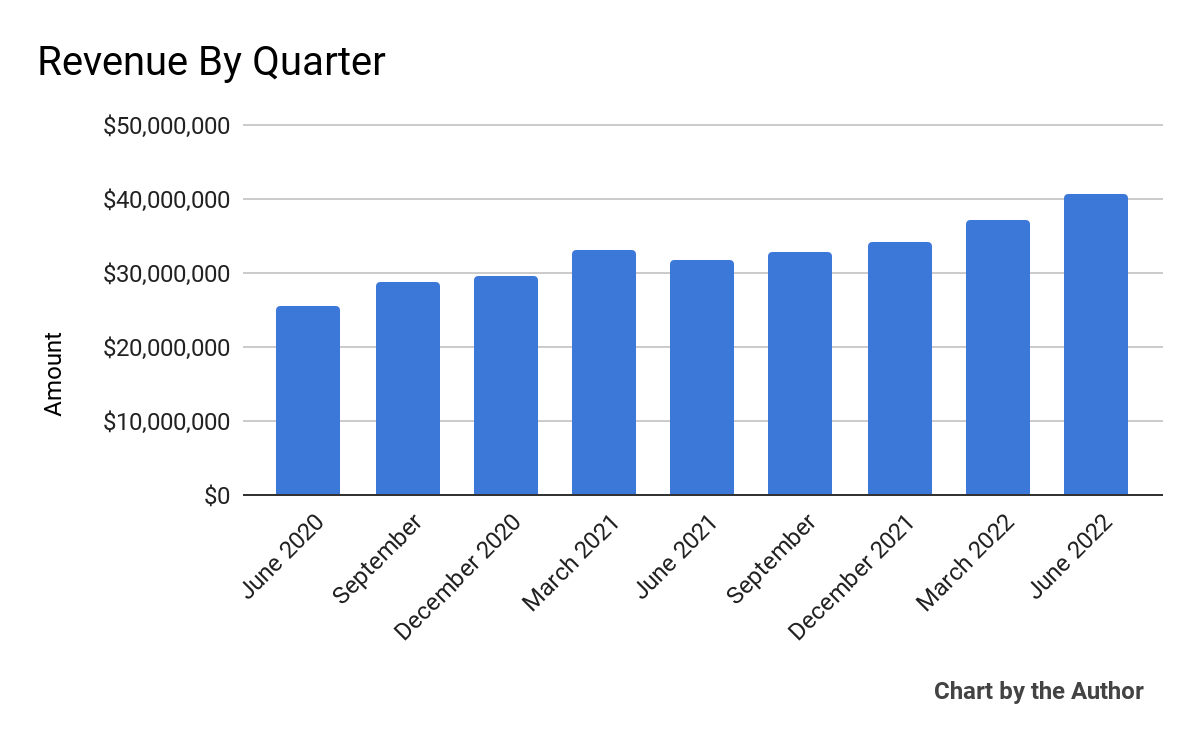

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

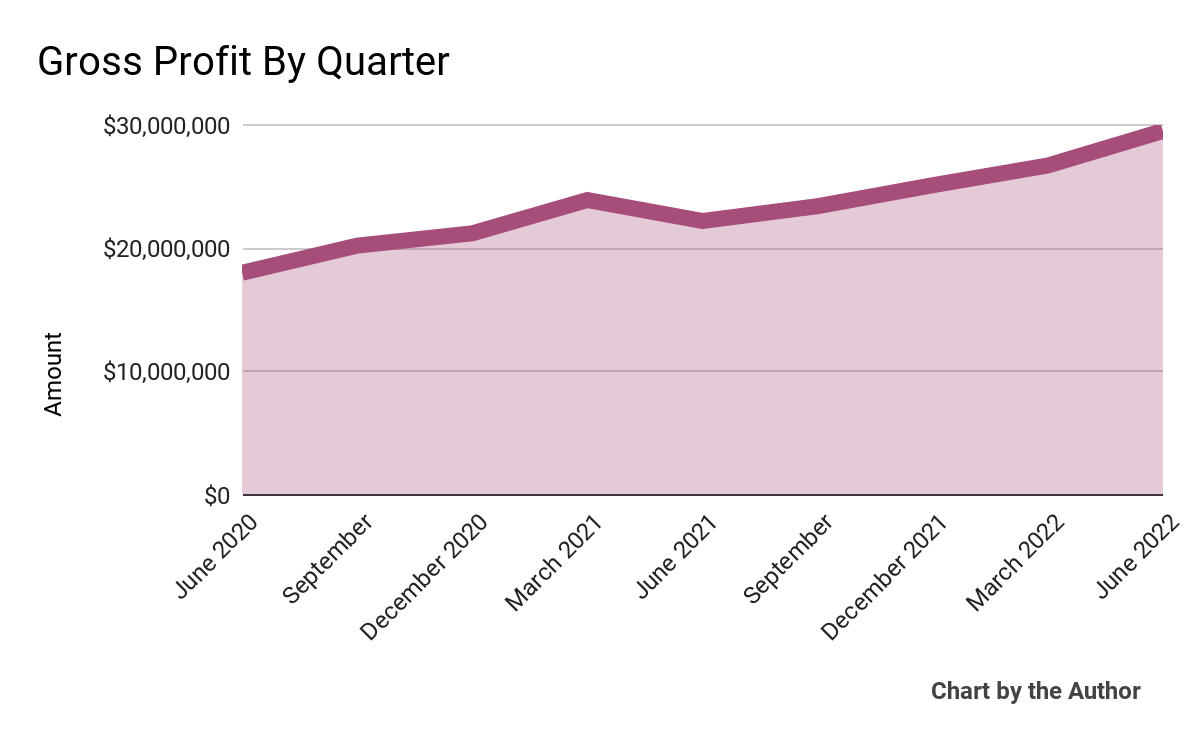

Gross profit by quarter has also grown accordingly:

9 Quarter Gross Profit (Seeking Alpha)

-

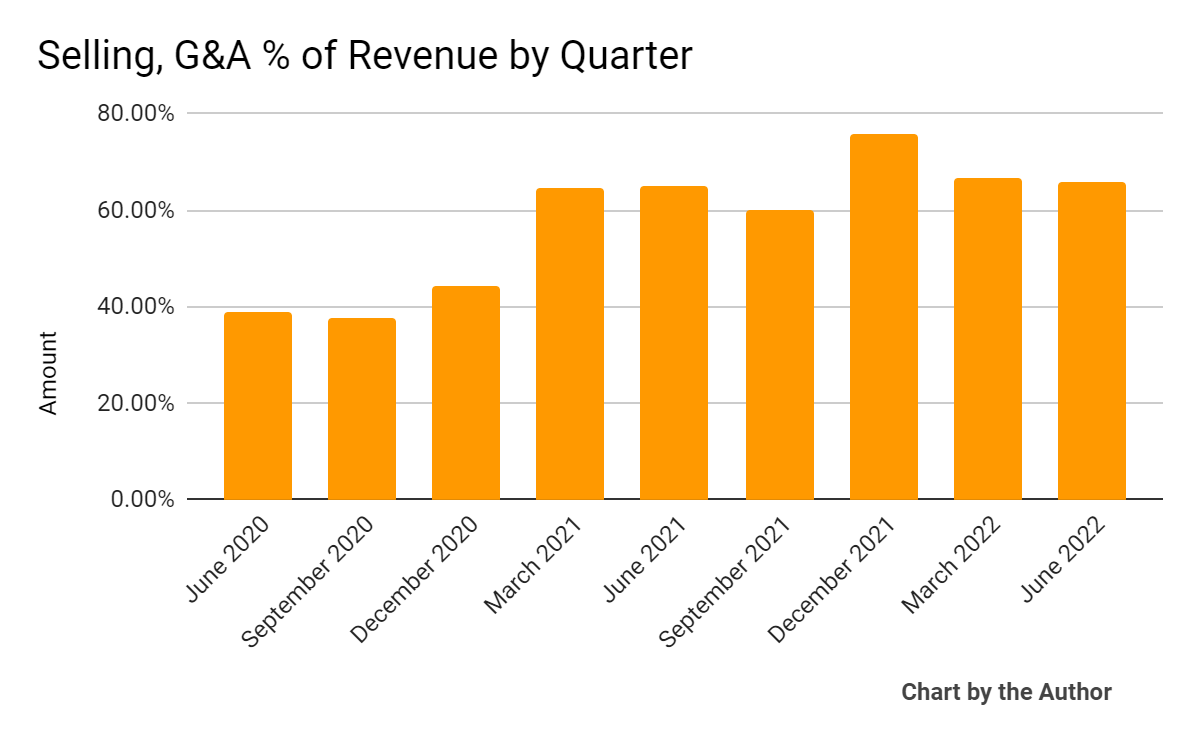

Selling, G&A expenses as a percentage of total revenue by quarter have grown as revenue has increased:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

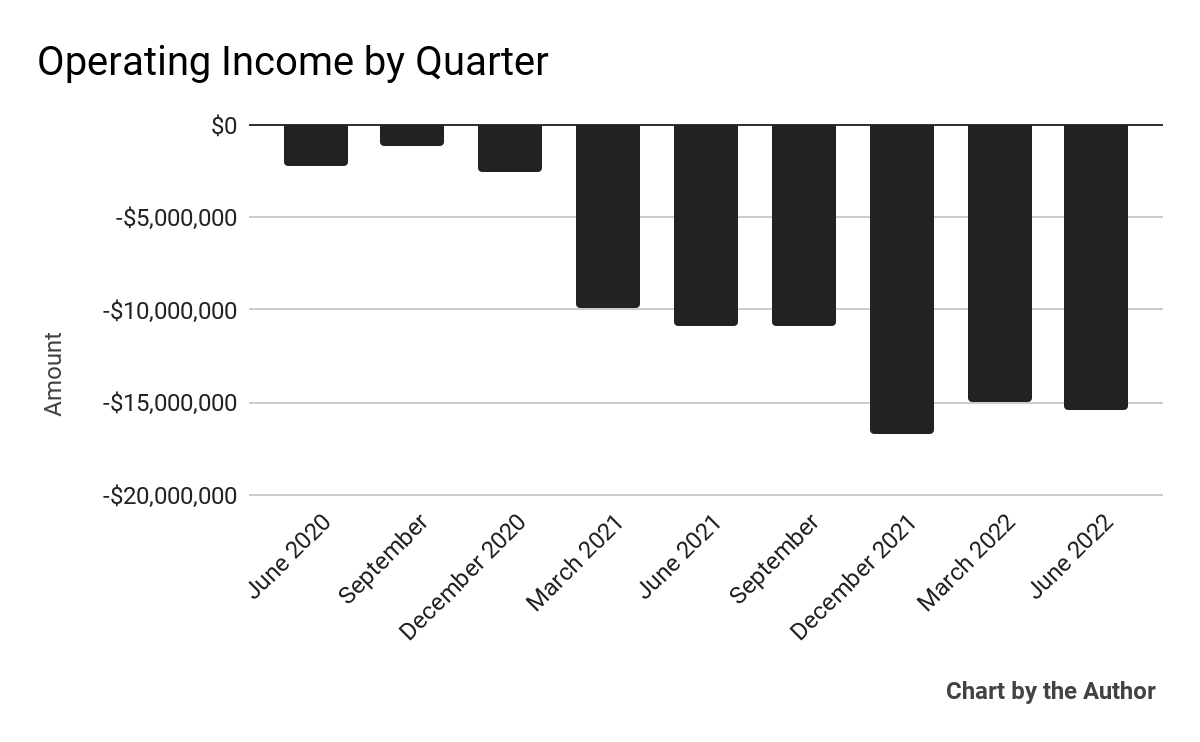

Operating losses by quarter have increased markedly in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

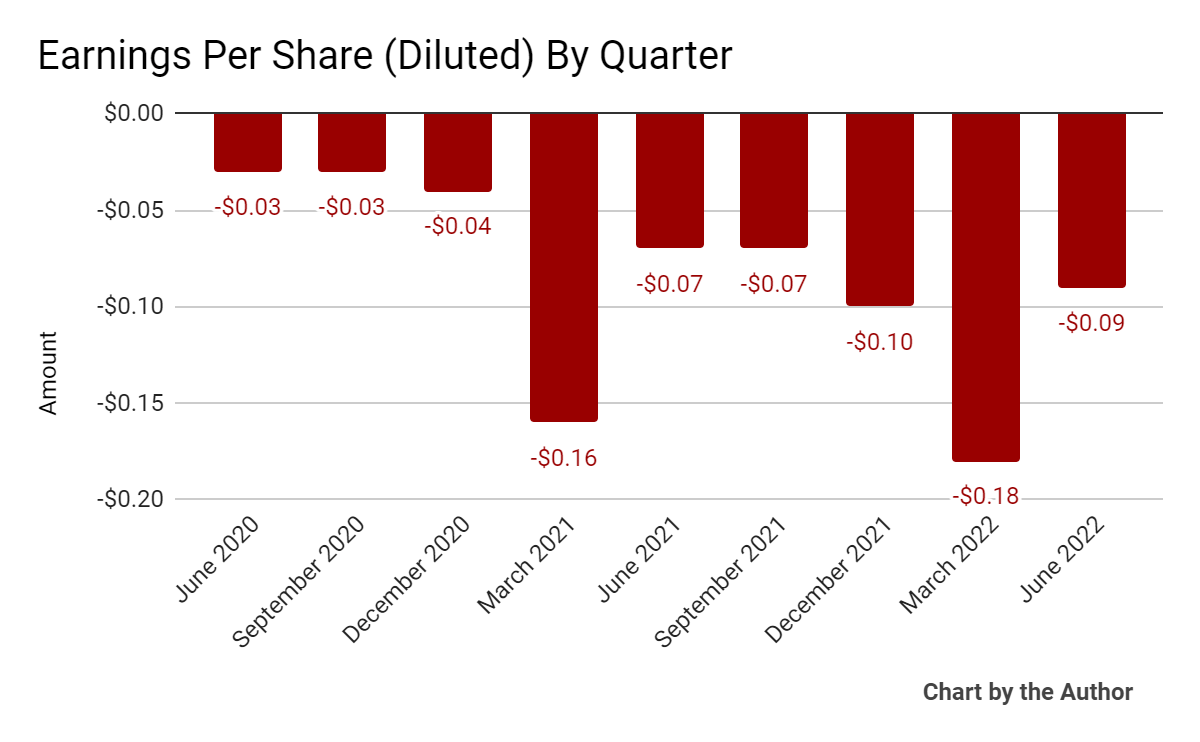

Earnings per share (Diluted) have also become increasingly negative of late:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

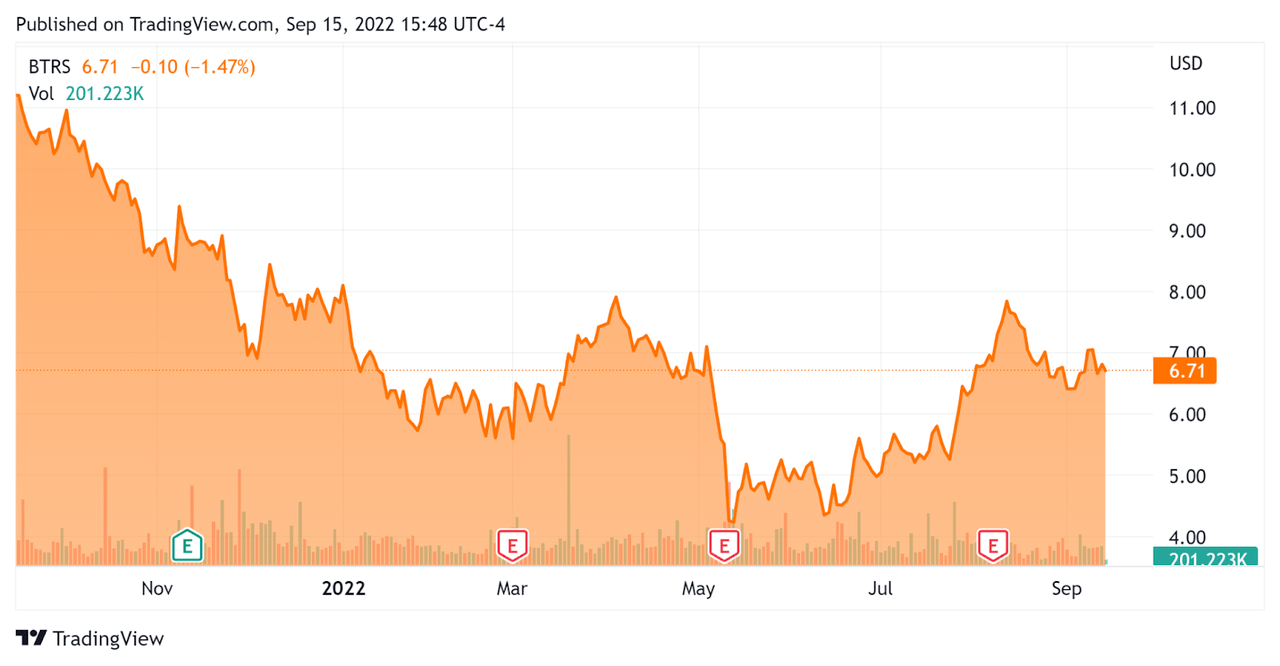

In the past 12 months, BTRS’s stock price has fallen 39.8% vs. the U.S. S&P 500 Index’s loss of around 12.3%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For BTRS Holdings

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

6.95 |

|

Revenue Growth Rate |

17.4% |

|

Net Income Margin |

-49.8% |

|

GAAP EBITDA % |

-36.1% |

|

Market Capitalization |

$1,120,000,000 |

|

Enterprise Value |

$1,000,000,000 |

|

Operating Cash Flow |

-$24,500,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.44 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

BTRS’s most recent GAAP Rule of 40 calculation was negative (18.7%) as of Q2 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

17.4% |

|

GAAP EBITDA % |

-36.1% |

|

Total |

-18.7% |

(Source – Seeking Alpha)

Commentary On BTRS Holdings

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted a recent partnership deal with Procede Software in the commercial truck dealer management industry, as an example of its integration efforts.

A significant growth area for the firm is its Business Payments Network, of which its digital lockbox feature, which automates receipts of various payment types, is what it calls a “must have for any AR department.”

However, management has noticed a more difficult macroeconomic environment but believes that in such environments, CFOs have even greater incentives to increase efficiency efforts across their enterprise.

As to its financial results, net revenue rose 28.5% year-over-year, while adjusted gross margin hit 74.1%, which was 2.41% higher than in Q2 2021.

Management did not disclose the company’s net dollar retention rate, but noted that its customer retention rate was in the “high 90s.” The firm’s Rule of 40 results have been distinctly sub-par.

SG&A expenses as a percentage of total revenue remained elevated, and there was no discussion by management of reducing headcount or cutting costs elsewhere.

As a result, operating losses remain high with no obvious path to profitability, especially as the firm continues its international expansion efforts.

For the balance sheet, the firm finished the quarter with $148 million in cash and equivalents and no debt.

Over the trailing twelve months, BTRS has used $25.9 million in free cash.

Looking ahead, for the full year 2022, management raised slightly the lower end of expected revenue to $168.5 million at the midpoint of the new range, while adjusted gross profit is expected to be $124.5 million at the midpoint, or 73.9% adjusted gross margin.

Regarding valuation, the market is valuing BTRS at an EV/Sales multiple of around 7.0x.

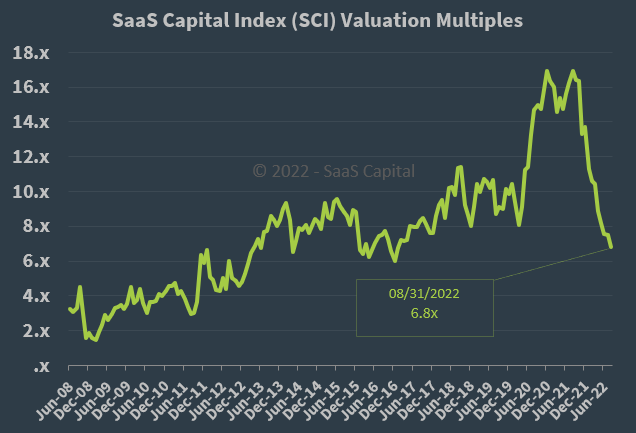

The SaaS Capital Index of publicly held SaaS (software as a service) software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, BTRS is currently valued by the market at an equal level to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

With a slowing global economy, a strong U.S. dollar producing FX headwinds, no apparent cost-cutting efforts by management, and continued high operating losses, my outlook on BTRS is a Hold for the near term.

Be the first to comment