bymuratdeniz

Thesis

John Hancock Financial Opportunities Fund (NYSE:BTO) is a closed-end fund focused on financial services companies’ equities:

Under normal circumstances, the Fund will invest at least 80% of its net assets in equity securities of U.S. and foreign financial services companies of any size. These companies may include, but are not limited to, banks, thrifts, finance and financial technology companies, brokerage and advisory firms, real estate-related firms, insurance companies and financial holding companies. The equity securities in which the Fund may invest are common stocks, preferred stocks, warrants, stock purchase rights and securities convertible into other equity securities. Because the Fund normally invests more than 25% of its assets in securities of issuers in the banking and thrift industry, the Fund is considered to be “concentrated” in this industry. “Net assets” is defined as net assets plus any borrowings for investment purposes. The Fund will notify shareholders at least 60 days prior to any change in this 80% policy.

Source: Annual Report

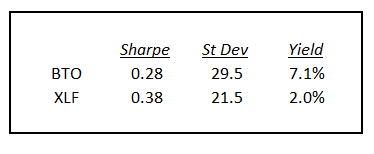

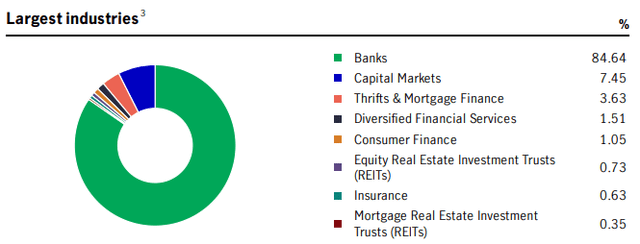

The fund is currently over 84% invested in bank equities and represents a leveraged play on financial services when compared to the unleveraged ETF Financial Select Sector SPDR Fund (XLF). BTO, however, runs only a small 17% leverage ratio. The vehicle takes more risk than XLF with a higher standard deviation, but has managed to outperform the exchange-traded fund (“ETF”) on a 10-year basis:

Analytics (Author)

We can see that BTO has a lower risk/reward ratio by looking at the 5-year Sharpe ratio and also a higher standard deviation (i.e., higher volatility). BTO has nonetheless managed to outperform XLF on a 10-year basis, with the BTO total return clocking 288% while the XLF total return was 230%. Do expect much deeper drawdowns as a BTO investor, however.

We like the fact that the CEF has managed to outperform the unleveraged ETF, especially in light of the high fees the vehicle charges. Ultimately, BTO does what it is supposed to do as a CEF – it utilizes leverage and an active management style to generate alpha in the space. The fund is currently trading at a high premium to NAV of 9.82%, which is outside its average range.

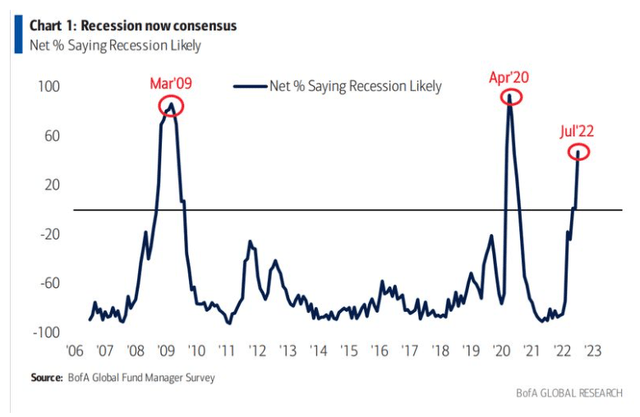

BTO represents a good leveraged play on financials and has shown its value on a very long-term basis. We believe we currently are in a bear market rally and there is more weakness to come in the space. While the yield curve has inverted again and reminds us that banks are going to have challenges in terms of net interest spread (long-term assets investments via borrowed short-term funds), we believe consumers are in much better shape than in prior downturns. Most market participants now believe a recession is imminent:

We believe a shallow recession is in the cards, and it is going to be driven by the violent rise in rates and tightening of financial conditions. The Fed is the culprit as it tries to fight inflation, but corporate and consumer balance sheets are in much better shape than in prior downturns.

We thus feel that long-term investors (5-years-plus investment horizon) can start layering into BTO, while retail investors with shorter time frames should wait for the next leg down in this market to start taking positions in the fund.

Analytics

AUM: $0.7 billion.

Sharpe Ratio: 0.28 (5Y).

St Deviation: 29.5 (5Y).

Yield: 7.11%.

Expense Ratio: 2.08%.

Premium/Discount to NAV: +9.82%.

Z-Stat: 0.14.

Leverage Ratio: 17%.

Holdings

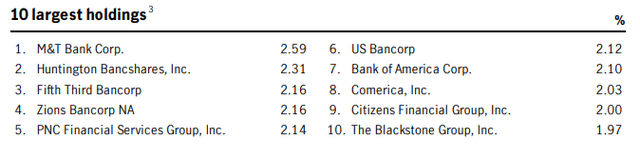

The fund is concentrated on banks:

The top holdings are reflective of the industry concentration for the fund:

Top Holdings (Fund Fact Sheet)

We like the fact that the fund is fairly granular, with no single issuer accounting for more than 3% of the fund. Also, note that the top 5 holdings are composed of regional banks, rather than the Tier 1 investment banking giants.

Performance

The fund is down -16.7% year-to-date on the back of the rates-driven market sell-off:

YTD Performance (Seeking Alpha)

On a 5-year basis, the fund is up almost +40% and only slightly underperforming the Financial Select Sector SPDR Fund:

5-Year Total Return (Seeking Alpha)

We can see from the above graph that the two instruments have similar performances up to the Covid-19 crisis, after which BTO experiences a very deep drawdown (enhanced by its leverage) but manages to outperform on the subsequent leg up.

On a 10-year basis, BTO ends up with a higher total return than the unleveraged ETF:

10-Year Total Return (Seeking Alpha)

We do not see very often CEFs that outperform the underlying index on a ten-year basis, but it is the case here. BTO outperformed during several monetary cycles, so it provides a good testament to the managers’ ability to truly identify alpha within the sector.

Premium/Discount to NAV

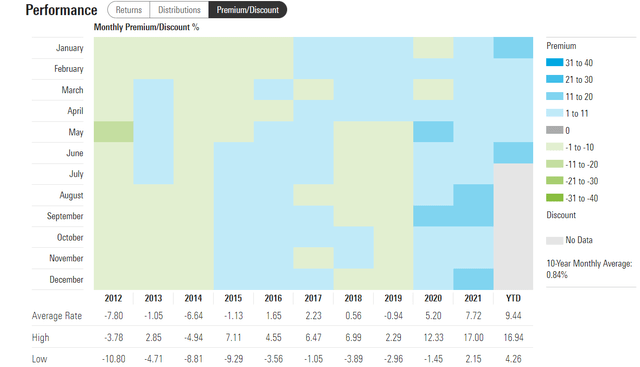

The fund is currently trading at a 9.82% premium to net asset value. We can see from the below table that the CEF has started to trade at solid premiums since 2020:

The current premium to NAV is on the high side, with the average rate being closer to 5%-7% on average. We do not feel the current level is justified, especially on the back of the current bear market trend and yield curve inversion.

Conclusion

BTO is a closed-end fund focused on financials. The CEF represents a good leveraged bet on financial companies’ equities and has managed to outperform the Financial Select Sector SPDR Fund ETF on a 10-year period. BTO has a higher volatility and deeper drawdowns than XLF with a lower Sharpe ratio and is more suitable for investors with very long investment time frames (5 years plus). The fund has a dividend yield that currently exceeds 7% but is trading at a substantial premium to NAV (9.82% currently). We believe a shallow recession is in the cards, and it is going to be driven by the violent rise in rates and tightening of financial conditions. There is more weakness to come short-term for BTO, but the fund has shown it can generate outstanding long-term results.

Be the first to comment