Tassii/E+ via Getty Images

A Quick Take On Bruush Oral Care

Bruush Oral Care (BRSH) has filed to raise $15.3 million in an IPO of its units consisting of common stock and one warrant, according to an F-1 registration statement.

The firm develops and sells electric toothbrushes to consumers primarily in the United States and Canada.

Given management’s excessive valuation expectations and potential for sales headwinds going into an economic downturn, I’m on Hold for the Bruush IPO, although in the short term, it may attract day-traders seeking volatility.

Bruush Overview

Vancouver, Canada-based Bruush was founded in 2018 to develop electronic teeth brushing devices and a related product subscription business.

Management is headed by founder and CEO Aneil Manhas, who has been with the firm since inception in 2018 and was previously CEO of Surface 604, an electric bicycle company, and previously worked at Credit Suisse and Onex Corporation.

The company’s primary offerings include:

-

Electric toothbrush

-

Brush heads

-

Charging stand

-

Travel case

Bruush has booked fair market value investment of $13.2 million as of October 31, 2021, from investors, including Yaletown Bros. Ventures, Prodigy Capital and founder & CEO Manhas.

Bruush – Customer Acquisition

The firm sells its products in the U.S. and Canada through its own website and through Amazon and other retail distribution points.

The company’s website accounts for the majority of its sales and the United States for the majority of sales by country.

Advertising and Marketing expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

|

Advertising and Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Nine Mos. Ended October 31, 2021 |

142.8% |

|

FYE January 31, 2021 |

296.3% |

|

FYE January 31, 2020 |

405.9% |

(Source – SEC)

The Advertising and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Advertising and Marketing spend, rose to 0.4x in the most recent reporting period, as shown in the table below:

|

Advertising and Marketing |

Efficiency Rate |

|

Period |

Multiple |

|

Nine Mos. Ended October 31, 2021 |

0.4 |

|

FYE January 31, 2021 |

0.3 |

(Source – SEC)

Bruush’s Market & Competition

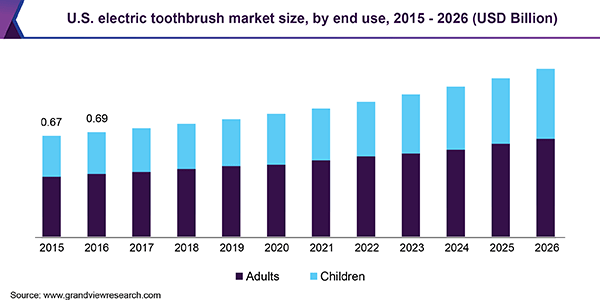

According to a 2019 market research report by Grand View Research, the global market for electric toothbrushes was an estimated $2.5 billion in 2018 and is forecast to reach $3.9 billion by 2026.

This represents a forecast CAGR of 5.8% from 2019 to 2026.

The main drivers for this expected growth are growing awareness of the importance of oral health and increasing availability of innovative products at reasonable prices.

Also, below is a chart showing the historical and projected future growth trajectory of the U.S. electric toothbrush market from 2015 to 2026:

U.S. Electric Toothbrush Market (Grand View Research)

Major competitive or other industry participants include:

-

Colgate-Palmolive (CL)

-

Philips (PHG)

-

Procter & Gamble (PG)

-

FOREO

-

Den-Mat Holdings

-

SONIC

-

Water Pik

-

Burst

-

Goby

-

Moon

-

Quip

Bruush Oral Care Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increasing gross profit but reduced gross margin

-

Variable operating loss

-

Reduced cash used in operations

Below are relevant financial results derived from the firm’s registration statement. Note: the partial year period for period ending October 31, 2021, is not directly comparable to the previous same period, due to an accounting year-end change:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Nine Mos. Ended October 31, 2021 |

$ 1,965,441 |

— |

|

FYE January 31, 2021 |

$ 901,162 |

334.5% |

|

FYE January 31, 2020 |

$ 207,404 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Nine Mos. Ended October 31, 2021 |

$ 987,198 |

— |

|

FYE January 31, 2021 |

$ 609,967 |

333.2% |

|

FYE January 31, 2020 |

$ 140,808 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Nine Mos. Ended October 31, 2021 |

50.23% |

|

|

FYE January 31, 2021 |

67.69% |

|

|

FYE January 31, 2020 |

67.89% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended October 31, 2021 |

$ (4,169,264) |

— |

|

FYE January 31, 2021 |

$ (8,360,642) |

-927.8% |

|

FYE January 31, 2020 |

$ (1,377,379) |

-664.1% |

|

Net & Comprehensive Income (Loss) |

||

|

Period |

Net & Comprehensive Income (Loss) |

Net Margin |

|

Nine Mos. Ended October 31, 2021 |

$ (4,211,271) |

— |

|

FYE January 31, 2021 |

$ (8,890,431) |

-452.3% |

|

FYE January 31, 2020 |

$ (1,378,860) |

-70.2% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended October 31, 2021 |

$ (671,169) |

|

|

FYE January 31, 2021 |

$ (4,052,350) |

|

|

FYE January 31, 2020 |

$ (1,459,556) |

|

(Source – SEC)

As of October 31, 2021, Bruush had $14,530 million in cash and $5 million in total liabilities.

Free cash flow during the twelve months ended October 31, 2021, was negative ($677,370).

Bruush Oral Care IPO Details

Bruush intends to raise $15.3 million in gross proceeds from an IPO of its units consisting of common stock and one warrant, offering approximately 2.47 million units at a proposed midpoint price of $6.20 per unit.

The units, consisting of common stock and one warrant to purchase one share of common stock at an exercise price equal to the IPO price, also have other features for large holders of the units.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $29.3 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 40.58%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

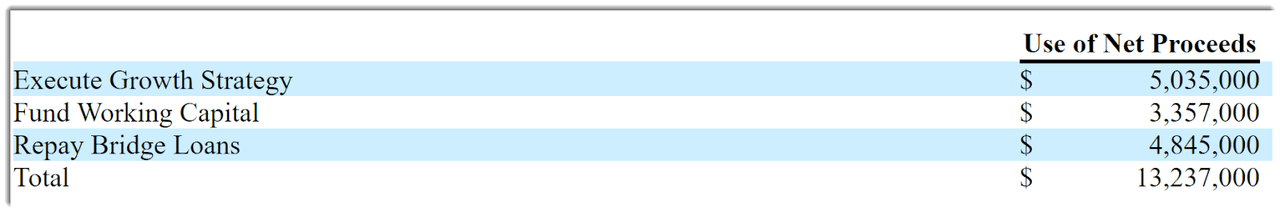

Management says it will use the net proceeds from the IPO as follows:

Proposed Use of Proceeds (SEC EDGAR)

Management’s presentation of the company roadshow is available here until the IPO is completed.

Regarding outstanding legal proceedings, management says there are ‘no material proceedings to which any director or officer is a party that is adverse to the Company…’

The sole listed bookrunner of the IPO is Aegis Capital Corp.

Valuation Metrics For Bruush

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$37,722,362 |

|

Enterprise Value |

$29,342,976 |

|

Price / Sales |

19.19 |

|

EV / Revenue |

14.93 |

|

EV / EBITDA |

-7.04 |

|

Earnings Per Share |

-$0.65 |

|

Operating Margin |

-212.13% |

|

Net Margin |

-214.27% |

|

Float To Outstanding Shares Ratio |

40.58% |

|

Proposed IPO Midpoint Price per Share |

$6.20 |

|

Net Free Cash Flow |

-$677,370 |

|

Free Cash Flow Yield Per Share |

-1.80% |

|

Debt / EBITDA Multiple |

-0.01 |

|

CapEx Ratio |

-108.24 |

|

Revenue Growth Rate |

118.10% |

|

(Glossary Of Terms) |

(Source – SEC)

Commentary About Bruush’s IPO

BRSH is seeking U.S. public investment capital to fund its further commercialization efforts for its toothbrush product and related subscription service and pay off some debt.

The company’s financials have produced increasing topline revenue, higher gross profit but reduced gross margin, fluctuating operating loss and lowered cash used in operations. (Note: the partial year period is not directly comparable to the previous same period, due to an accounting year-end change.)

Free cash flow for the twelve months ended October 31, 2021, was negative ($677,370).

Advertising and Marketing expenses as a percentage of total revenue have dropped as revenue has increased; its Advertising and Marketing efficiency multiple rose to 0.4x in the most recent reporting period.

The firm currently plans to pay zero dividends on its common stock and intends to retain future earnings, if any, for its expansion initiatives.

BRSH’s CapEx Ratio is relatively high, which indicates it is currently spending very little on capital expenditures as a percentage of its operating cash flow.

The market opportunity for electric toothbrushes is relatively large and expected to grow at a moderate rate of growth over the coming years.

Aegis Capital Corp. is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (78.1%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is supply chain inflation and a looming macroeconomic slowdown in North America, which may reduce discretionary spending by consumers and lower the firm’s growth trajectory while increasing costs.

As for valuation, management is asking investors to pay an EV/Revenue multiple of nearly 15x at IPO.

For comparison, a basket of publicly held consumer electronics companies as of January 2022 as compiled by noted valuation expert Dr. Aswath Damodaran indicated that consumer electronics companies had an average EV/Sales multiple of only 1.55x, so BRSH is asking investors to pay roughly 10x that at IPO.

Given management’s excessive valuation expectations and potential for sales headwinds going into an economic downturn, I’m on Hold for the Bruush IPO, although the stock may see day-trader volatility in the short term.

Expected IPO Pricing Date: To be announced.

Be the first to comment