RapidEye/iStock via Getty Images

Investment Thesis

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is continually exposed to elevated geopolitical risks, significantly worsened by the recent Chinese chips ban. The stock has been drastically corrected to its pre-pandemic prices and P/E valuations decimated to its historical 10Y ever lows. Even the stellar FQ3’22 earnings call is no longer enough to save its plummeting stock, with a tragic -11.09% plunge since 13 October 2022 and -52.76% YTD.

It is evident that Mr. Market is aggressively punishing most Chinese stocks, as President Xi Jin Ping claims his unprecedented third term in the recent re-election, despite TSM’s excellent forward guidance through 2023. Many other Chinese stocks also similarly suffered the geopolitical ailment, with Alibaba (BABA) plummeting -43.09% YTD, JD.com (JD) -38.42%, Baidu (BIDU) -43.53%, Nio (NIO) -67.70%, and finally, XPeng (XPEV) -83.71%. Market analysts are now projecting a 2027 target for the “Taiwan invasion,” fueling more FUD for TSM, triggering a moderate retracement ahead. Ouch.

Nonetheless, we expect to see reduced geopolitical risks from 2024 onwards, with TSM’s newly established global presence in the US and Japan. Incidentally, we expect the macroeconomics to improve at the same time, with the elevated inflation rates tamped down to approximately 2% then, based on analysts’ estimates. Since the stock market is always forward-looking, we expect to see TSM’s stock valuations recover by early H2’23, if not earlier, assuming a fair-weather geopolitical situation. This naturally depends on the results of Biden’s and Xi Jin Ping’s upcoming meeting in November 2022. We’ll see.

TSM Continues To Impress In Its Key Performance Metrics

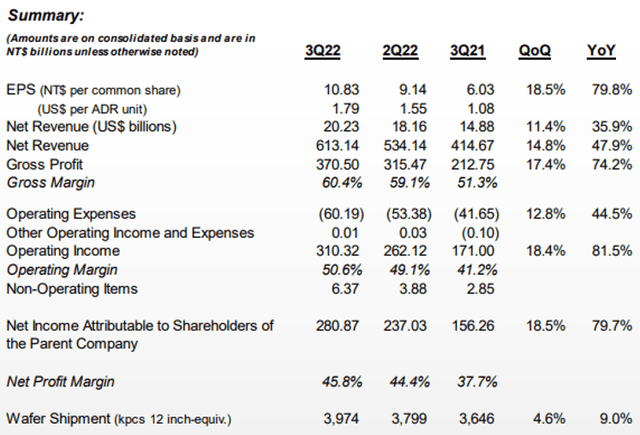

TSM Performance In FQ3’22

TSM continues to report excellent growth thus far in FQ3’22, notably accelerated top and bottom-line QoQ growth. In the latest quarter, the company reported exceptional revenue QoQ growth of 14.8%, EPS of 18.5%, and shipment of 4.6% compared to FQ2’22 levels of 8.8%, 16.9%, and 0.6%. In addition, its gross and profit margin continue to improve to 60.4% and 45.8%, respectively, indicating the company’s mastery of global supply chain issues. With this stellar growth attributed to the robust industry demand for 5nm technologies, we are not surprised to see TSM report exemplary growth ahead, once the inventory adjustment is concluded by H2’23.

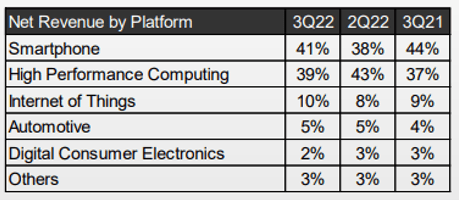

TSM Revenues by Platform

Seeking Alpha

The extreme fears about the PC destruction of demand are also overblown, since the digital consumer electronic segment forms a minuscule portion of TSM’s revenues at 3% in FQ2’22 and only 2% in FQ3’22. Though analysts were concerned about the reduced demand for mid-tier smartphone segments, as previously reported by Qualcomm (QCOM), we are not overly concerned given the strength of Apple’s (AAPL) premium tiers products such as iPhone 14 Pro and Pro Max.

The capital expenditure growth for data centers is robust as well, with the world’s three largest cloud providers, Amazon (AMZN), Alphabet (GOOG), and Microsoft (MSFT), expected to report elevated YoY growth in spending by 13.81% to $118.27B in FY2022 and 4.04% to $123.05B in FY2023. The global data center is also expected to grow by $615.96B through 2026 at an impressive CAGR of 21.98%, while the IoT market will reach $2.46T by 2029 at an accelerated CAGR of 26.4%.

Thereby, we expect to see continued strength in TSM’s high-performance computing and IoT moving forward, with the pace of digital transformation picking up again once the global economic sentiment improves and consumer demand returns by H2’23.

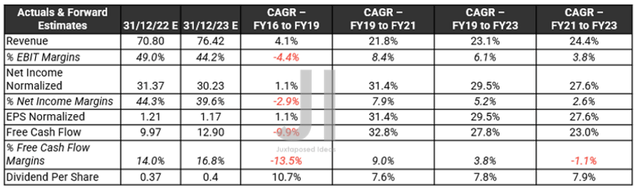

TSM Projected Growth Through FY2023

If we were to study the above table, it is evident that Mr. Market is still quietly optimistic about TSM’s forward performance. Consensus estimates remain relatively in line since our last analysis as well, while slightly moderated by -5.31% and -4.39% from May 2022 levels. Though its FQ4’22 performance will likely be flattish as per management guidance, its normalized growth post-hyper-pandemic is still astounding, since individual performance metrics continue to show accelerated growth through 2023, despite the recessionary fears.

Furthermore, TSM’s FY2023 projections look stellar, with impressive YoY growth in revenue by 7.93% and Free Cash Flow by 29.38%, despite the rising inflationary pressures on its profit margins. Its adj EPS of $1.17 still represents a massive expansion from FY2019 levels of $0.44 and FY2021 levels of $0.83. Naturally, the deceleration in growth warranted a slight discount to its previously inflated pandemic valuations. However, we reckon that the correction thereafter is overly drastic, triggering its current undervaluation sans the geopolitical risks. Therefore, investors should continue to monitor the plunge and load up according to their risk levels.

In the meantime, we encourage you to read our previous article on TSM, which would help you better understand its position and market opportunities.

- Taiwan Semiconductor: Peak Fear, Uncertainty, And Doubt Is Here

- Taiwan Semiconductor Has War-Deterrent Silicon Shield – Still A Buy

So, Is TSM Stock A Buy, Sell, or Hold?

TSM 10Y EV/Revenue and P/E Valuations

TSM is currently trading at an EV/NTM Revenue of 3.75x and NTM P/E of 9.76x, lower than its 10Y mean of 6.65x and 19.56x, respectively, with the latter trading at its lowest point ever. The stock is also trading at $60.84, down -58.04% from its 52 weeks high of $145.00, nearing its 52 weeks low of $59.51. Nonetheless, consensus estimates remain bullish about TSM’s prospects, given their price target of $306.33 and a 399.80% upside from current prices.

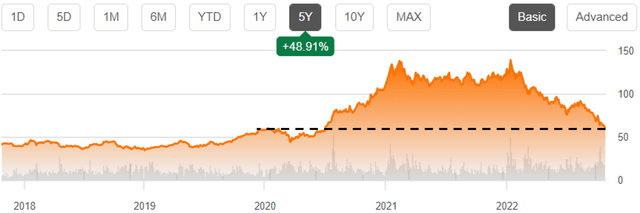

TSM 5Y Stock Price

Combined with the worsening macroeconomics as the Feds aggressively hike interest rates through 2023 to combat the rising inflationary pressures, we expect more extreme pain ahead. The September CPI/ PPI/ US labor market continues to show surprisingly sticky inflation rates, with the recessionary chances already upgraded to 100%. The Feds may have to raise their terminal rates to over 5% as well, beyond the original projection of 4.6%. Thereby, triggering more uncertainty and fear in the stock market in general, as Mr. Market continues to worry about the destruction of consumer demand.

Therefore, we are sticking to our previous price target of $50s, given the improved margin of safety it offers. Even then, with little catalysts for recovery, things are unlikely to improve in the short term, with some bears suggesting a $40 price target. Gasp! That is catastrophic indeed. Though TSM remains one of the most important companies in the world, it is apparent that its stock valuation is already decoupled from its fundamental performance due to the massive geopolitical risks. As a result, investors would be well advised to size their portfolios accordingly in the event of massive volatility.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment