xavierarnau

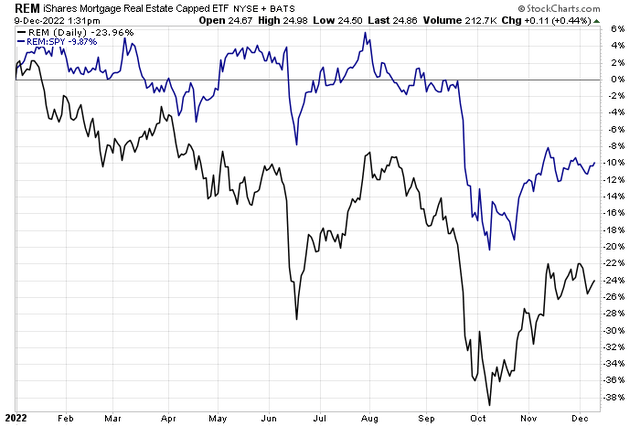

Mortgage REITs are attempting an absolute and relative comeback, but the iShares Mortgage Real Estate Capped ETF (REM) has continued to sharply underperform the broad market this year. With some signs of life due to lower interest rates, spotting bottoms in some of the industry’s stocks is worth a look, but downtrends are pervasive in the space.

Mortgage REITs Bouncing in Q4

According to Bank of America Global Research, BrightSpire Capital (NYSE:BRSP) is an internally managed commercial real estate mortgage REIT that focuses on originating, acquiring, financing, and managing a portfolio of predominantly US-based CRE debt investments and net leased properties. CRE debt investments are primarily first mortgage loans. BRSP may selectively originate mezzanine loans and preferred equity investments, often in conjunction with the origination of the corresponding first mortgages on the same properties.

The New York-based $885 million market cap Mortgage Real Estate Investment Trusts (REITs) industry company within the Financials sector trades at a low 7.3 trailing 12-month GAAP price-to-earnings ratio and pays a high 11.6% dividend yield, according to The Wall Street Journal. Back in November, the firm barely beat bottom line estimates but also increased its expected credit loss reserves in anticipation of a potentially poor credit environment. It also declared a $0.20 per share quarterly dividend.

The company offers investors exposure to the commercial real estate market, an industry that often has high expected risk-adjusted returns, but there’s heightened uncertainty in today’s market. While BRSP has improved its portfolio and transitioned to a pure-play commercial mortgage REIT, investors should expect volatility given tough credit conditions and a deteriorating real estate market.

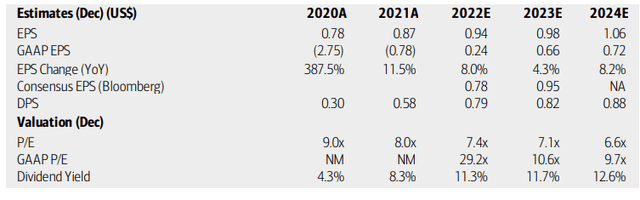

On valuation, analysts at BofA see earnings rising by 8% this year but then climbing by just 4.3% in 2023 before solid per-share profit growth in 2024. The Bloomberg consensus forecast is about on par with what BofA sees. Dividends, now at $0.80 annualized, should continue to bump up in the coming quarters. While the operating P/E is attractive, the forward GAAP earnings multiple is high. BofA recently increased its profitability outlook for BrightSpire but reduced its price target to $8. Overall, I think the valuation has come down sufficiently to up my recommendation from sell to hold.

BRSP: Earnings, Valuation, Dividend Yield Forecasts

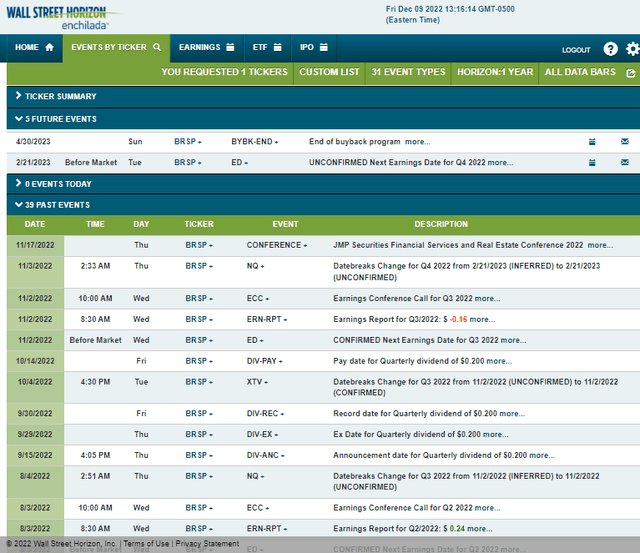

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Tuesday, February 21. Also notable is the company’s buyback plan ending on April 30 – be on the lookout for a new repurchase program announced at the next quarterly report.

Corporate Event Calendar

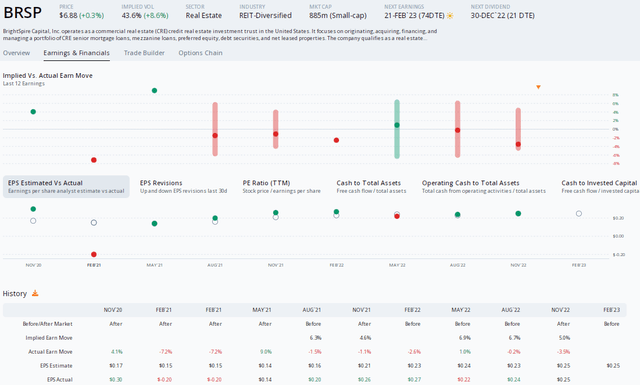

Data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.25 at the February release, which would be a slight drop from $0.27 reported in the same quarter the previous year.

A Small Per-Share Profit Decline YoY Expected

The Technical Take

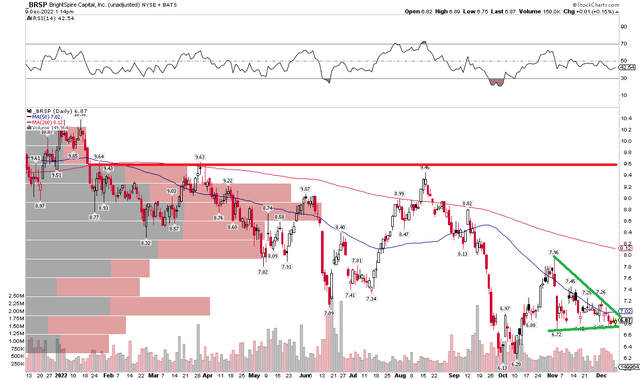

Back in July, I noted that $6 was support and $11 was resistance on BRSP’s chart. $6 indeed held on a test in early October but shares only rallied to $9.45 during its summer recovery. Overall, the trend is still lower as evidenced by a falling 200-day moving average. Also notice that shares are consolidating in a symmetrical triangle right now – A break below $6.70 would lead to a possible retest of the low $6s while a breakout above $7.30 could lead to a quick move toward $8. I see new resistance in the mid-$9s. Overall, the chart is bearish, but there are some levels to trade against.

BRSP: A Stubborn Downtrend & Key Triangle Pattern

The Bottom Line

I like BRSP’s improved valuation despite a troubled operating environment. The technical picture is not promising yet, but the fundamental case supports a hold.

Be the first to comment