THEPALMER

Published on the Value Lab 15/9/22

BRP Inc. (NASDAQ:DOOO) is a company that we’ve been following for a while. While things seem to be getting better for them despite the current economic environment, with supply chain issues slowly resolving and revenues coming in, we do worry about consumer discretionary spending after the release of the pent-up demand. Moreover, due to hedges in place the margin expansion opportunities are more limited in what might be the last year for a while of favourable industry conditions. This is a top-quality stock, but it’s about as discretionary as it gets, so we’d be careful.

BRP Inc. Q2 Results

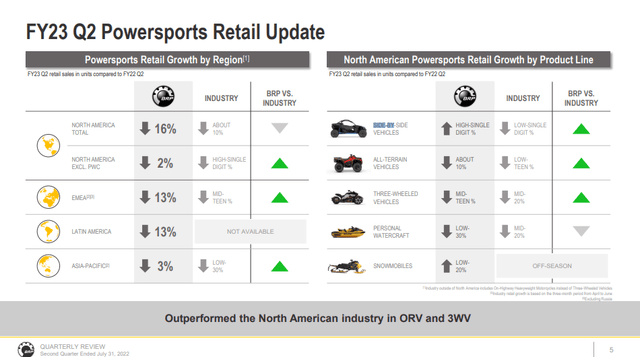

DOOO did well where it matters. Side-by-side and three-wheelers were growing in the mix, lending a hand with pricing effects to revenue growth. But volumes were generally a lot better too, and better than the broader industry. Semiconductor inventory isn’t quite as hard to come by anymore, and that has meant speed up in retrofit sales with clusters and gauges coming in more rapidly now, as well as the ability to stack more, albeit still limited inventory, with dealerships to create more velocity in sales.

Market Highlight (Q2 2023 Pres)

The supply chain releases have helped the company a lot, and came at a good time where catch-up on the component supply side could be achieved while factories were non-operational due to the cyber-attack this quarter.

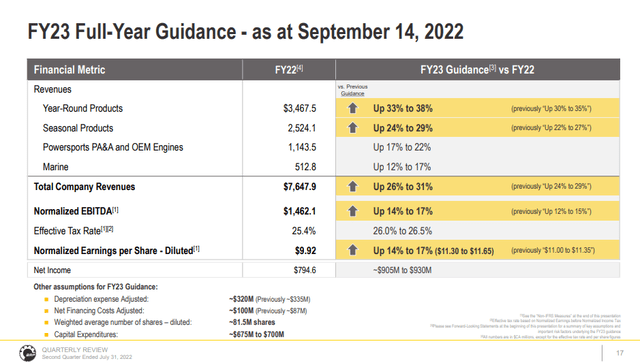

Revenues are up 28% YoY, but normalised EPS is slightly down once walking back on FX effects that made the headline comps look very favourable. Considering the serendipitous benefits of FX, EPS went up 20%. Unfortunately volume and pricing growth was entirely offset by inflation, so gross margins fell by about 500 bps YoY and the gross profit stayed flat. What’s more is that due to hedges in place, gross margins are unlikely to improve further into the year, despite the high season and further supply chain releases being positive profit contributors due to scale and mix. These hedges expire next year, but with the macro situation being what it is one would have hoped more levers capitalised on these strong sales results. Nonetheless, DOOO guides for about 15% EBITDA growth coming in from the OPEX side, with cost control efforts coming in.

Guidance (Q2 2023 Pres)

Remarks

DOOO is the industry champion as far as we’re concerned. They’re making their foray into electric bikes, and they continue to innovate in marine as well. While there’s acquisition this quarter that might have been worth discussing and they achieve some vertical integration, we are primarily concerned with trends in consumer discretionary.

A theme across companies right now is that Europe is a weak spot in terms of consumer confidence and retail demand. Indeed, BRP is seeing a shift of mix towards the US which has been more resilient for the time being, and management is looking at Europe, which is about 15% of revenue, as a market of some concern. We believe that a similar force could take hold in the US as well eventually, especially as rates continue to rise. For now, credit availability is not the problem in financing purchases, indeed neither is demand destruction from gas inflation or anything like that, but at some point when the retrofit sales backlog is liquidated and pent-up demand from preorders from prior, more ebullient seasons are released, we could see some issues with demand. As Howard Marks says, everything comes in cycles, especially consumer discretionary. Believing we’re in some new normal for powersports is a mistake. It is levered to macro.

The company is still cheap trading at 6x EV/EBITDA, but on a LTM basis. LTM figures across markets are likely to be higher than forward figures, especially in consumer discretionary, and especially for DOOO which relies on scale benefits that can be rolled back and operating leverage. We believe we might be seeing benefits of pent-up demand right now and not necessarily a reflection of faltering consumer trends, while already bad in Europe, are also visible in many markets, especially consumer tech, in the US. Consumer confidence is low. We just don’t think that DOOO is a particularly safe spot in the market, especially when it is still in the trading range of its highs. Great company but pass until the cycle paints a better picture.

Be the first to comment