Petr Smagin/iStock via Getty Images

Published on the Value Lab 27/3/22

BRP Inc. (NASDAQ:DOOO) is a company we’ve followed a while now as one of the many unexpected beneficiaries of the post-pandemic era. Powersports have grown massively, reflecting in BRP’s results, despite supply side constraints, with the outlook positive in the topline, although more muted in the bottom line due to inflation pressures. While inflation and supply side issues are going to continue to be an issue, the market is growing, and BRP is taking advantage of its various trends including EV. The valuation continues to be attractive, and the capacity expansions have taken effect. If the growth in the industry can hold, BRP is a buy, but we’re tentative due to the complexity of its headwinds and limited profitability growth in the outlook.

A Look at Q4

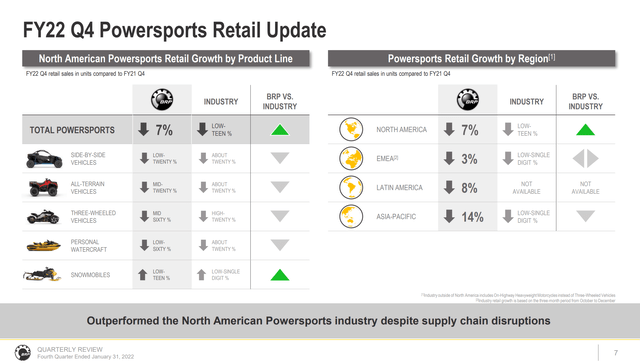

The retail sales continue to fall as dealership velocity is affected by supply side shortages. All products except for snowmobiles, which were in season, saw lower retail sales at dealerships.

Retail Situation (Q4 2021 DOOO Press)

Activity in Q3 for snowmobiles looked to lag the industry at first, contrary to BRP’s leading industry position in the segment, but a robust orderbook and modularity in product designs made it possible to prioritize snowmobiles with the scarce semiconductor components when the time came, allowing for retailers to take off and turnover more units.

While retail sales were down for the Q4, also partially due to unearned revenue due to the non-recognition of units sold for later retrofit, the company actually grew revenue this quarter unlike last quarter, which saw modest declines in sales and much more substantial declines in EBITDA.

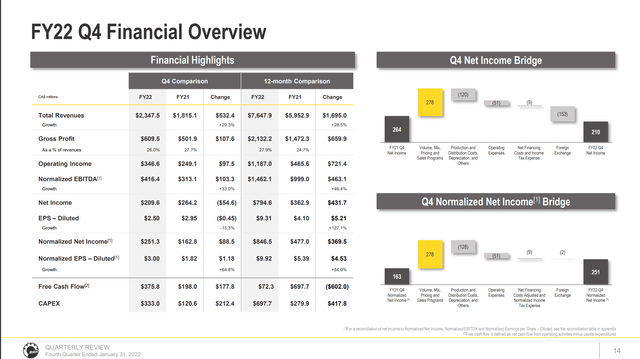

Year round products like ATVs and SSTVs grew by 12% YoY in the Q4, and seasonal products, i.e. the snowmobiles, rocketed with a gain of 56%, showing that chips were placed on seasonal products in order to capitalize on consumer interest in the seasonal moment. With a larger product base on the market, OEM revenues have also been rising nicely by 21%, indicating strength in a more recurring segment, and marine was up modestly by 6% due to counter seasonality but probably also due to the high aluminum prices disincentivising production. The overall financial performance is shown below with a 29% increase in sales and a 33% increase in EBITDA YoY for Q4. The FY results were even better thanks to the less harangued environment at the beginning of the year.

Full Financial Highlights (Q4 2021 DOOO Pres)

The great success of this quarter is that they are continuing with retrofit sales, meaning some units are sold before revenue can actually be recognized, meaning that revenue is slightly understated. Another big factor is the Juarez facilities that they have in Mexico where they manufacture these products. In Q3, there was a fire at the facility that destroyed some units and components, and slowed down production, really hurting EBITDA in particular as inventory needed to be written off. Not only has the company fixed the facility damages, they also have concluded the capacity expansions of 30% and 50% at their two facilities, which they are already seeing the benefits of in this quarter thanks to lower costs and greater scale. This rapid comeback is part of the rosy reception of the results by investors, where the price has gone up 11% on earnings day with the post market included.

What Comes Next for DOOO?

The outlook does spell a little bit of trouble. While this quarter was a comeback, and BRP are managing things probably as well as it is possible, the outlook does show that there are going to be a couple of issues. The company has told us that in order to maintain revenue growth, and keep growing share beyond the newly achieved 30% mark, the level of inventories required are actually not as high as they were able to hold before the supply side shortages. So a major restocking event expected next fiscal year, which accounts for about a quarter’s worth of inventory under the old supply regime, has enabled the company to guide for excellent sales growth.

On the restocking opportunity, there’s a big opportunity for BRP to just replenish the inventory. Obviously, the industry has grown – our market share has grown as well. But to put it in simple terms, when I look at the restocking opportunity, it’s about a quarter’s worth of wholesale revenue.

Sebastien Martel, CFO of DOOO

However, the outlook for EPS growth is not very good. They’re guiding for between 24%-29% revenue growth for the next fiscal year driven by year-round products, which is great, but for declines in the next Q1 in EBITDA, and pretty weak EPS growth for the next fiscal year. They expect a 40% decline in EBITDA for the next quarter on a YoY basis as supply side pressures are worked through. Moreover, they state that for the full year, while partially mitigated by scale effects thanks to the completion of the facilities, that the margin impact from supply pressures was about 2%, bringing the EBITDA overall down to 17% for the year. The EPS growth is guided between 8-12%, which is not great given the massive revenue growth expected.

Supply side issues in aluminum for marine products, chemical products for kevlar belts, the price of stainless steel being affected by nickel prices increasing and even a potential rubber shortage, on top of oil and industrial prices increasing, just means that the capacity to grow profits has been harangued. This is even with a 4% price increase that the company expects to make to combat inflation. They could not pass on the input price increases to the consumer, and the growth in profits is probably mostly driven by industrial improvements related to capacity expansion. Needing more semiconductor supplies might have hamstringed the company a bit with the procurement prices.

However, there’s also the announcement of the EV bike opportunity. Unfortunately for Volcon (VLCN) which is barely a post-revenue company, BRP is deciding to get involved in the opportunity. They give a early stage market size of about 600,000 units in their market based on combustion motorcycles today. At a $10k retail estimate, based on Volcon’s first unit prices, this would be a $6 billion TAM for the company. DOOO is early to the party, so with a good market share around 15%, we might be looking at almost a $1 billion revenue opportunity for the company, so not irrelevant. Of course this all depends on electrification trends persisting, which has certainly seen a setback with energy prices being the way that they are.

Conclusions

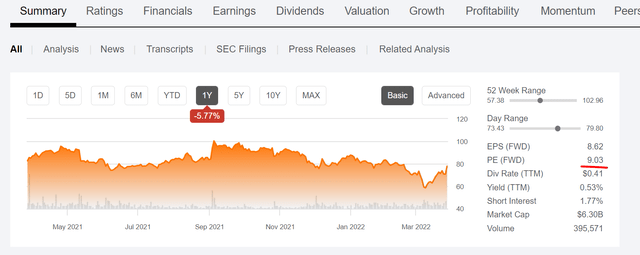

DOOO trades really cheaply, at only a 9x PE. And based on the FY outlook of DOOO, the EPS should get to be around $11, so higher than the given figure below, meaning a much lower PE of around 7.2x.

Price Data DOOO (Seeking Alpha)

Considering that the company is going to grow meaningfully according to management, and even grow profits nicely, albeit not by much relative to sales, a multiple like that is pessimistic on either execution prospects or on the state of the powersports market. The reality is that consumer interest continues to grow according to the company’s figures, with pre-sales still growing fast despite managing to keep up with demand and deliver growth. Also once a unit is sold, it’s sold, and those owners remain in the OEM market on an ongoing basis. However, while the company has managed the situation well, there are lots of factors related to the supply environment that are out of their control. I don’t think the commodity environment is going to let up very soon, so higher costs relative to the old normal could persist longer than investors would care for. Also we’re seeing a boom in the industry, and everything runs in cycles so a bust is possible. Also consumer interest might not materialize if people’s economic fortunes change, and with the world economy on shaky ground with stagflationary effects already rearing their heads in several industries, that’s certainly a possibility. So while there’s a margin of safety in the valuation, and things are probably not going to go bad, we are tentative to invest due to those headline and real risks related to the supply environment. We’d rather put money elsewhere in safer and equally cheap opportunities.

Be the first to comment