simonkr/E+ via Getty Images

One of our favorite renewable energy utilities, Brookfield Renewable (NYSE:BEP), just reported results for Q2 2022 that were quite solid, with FFO of $294 million, or $0.46 per unit, a 10% increase year over year. The company commissioned an impressive 1,000 MWs of development projects, which are expected to contribute approximately $11 million of FFO annually to Brookfield Renewable. The company also closed or agreed to invest $3 billion ($650 million net to Brookfield Renewable) of new capital during the quarter.

BEP continues to expand its development pipeline, which has now reached a massive 75,000 megawatts, and which also includes approximately 8 million metric tons of carbon capture and storage. BEP continued with its strategy of doing some asset recycling to free capital, with approximately $560 million ($90 million net to Brookfield Renewable) of asset recycling activities in the quarter.

Operating Results

During the quarter, the hydroelectric segment delivered FFO of $205 million. The hydro assets continue to show their ability to capture higher power prices through inflation linked power purchase agreements and a positive merchant pricing environment. Reservoirs are approximately at long-term averages, positioning the portfolio well to capture the expected higher power prices in the latter half of the year. Wind and solar segments generated a combined $150 million of FFO. The distributed energy and sustainable solutions segment generated $38 million of FFO.

Growth

So far this year the company has deployed or agreed to deploy $4.5 billion ($1 billion net to Brookfield Renewable) of capital across a wide range of investments, including battery storage, carbon capture, distributed generation, and utility scale wind and solar.

The global distributed generation business continues to be a significant area of growth. In the past twelve months the company has grown its US distributed generation business by three times to 6,500 MWs through various organic initiatives. The company recently agreed to acquire a leading integrated distributed generation developer in the US for $700 million ($140 million net to Brookfield Renewable), with this investment, BEP further enhances its position as the global leader in distributed generation with 10,300 megawatts of operating and development assets.

The company also expanded its North American carbon capture & storage platform. Under an arrangement with the California Resource Corporation (“CRC”), the company will partner to fund the development and construction of identified CCS projects in California, with an initial goal of deploying up to $500 million of capital ($100 million net to Brookfield Renewable). The joint venture should benefit from a first mover advantage through CRC’s ownership of prospective CO2 storage reservoirs that are a critical asset for carbon capture and storage in California, one of the most desirable jurisdictions globally given the state’s Low Carbon Fuel Standards credit system. The joint venture is targeting the injection of 5 million metric tons per year, and 200 million metric tons of total carbon dioxide storage development, which if reached, could result in an additional investment of approximately $1 billion ($200 million net to Brookfield Renewable).

During the quarter, the company also made an energy transition investment in a leading private owner and operator of critical power and utility assets with 1,200 megawatts of installed capacity. The investment will be used to fund both growth and decarbonization initiatives, including the implementation of a Paris aligned energy transition plan that includes a ~1,300-megawatt renewable development pipeline. BEP has committed to invest up to $500 million ($100 million net to Brookfield Renewable) through both preferred shares and a 20% stake in the common equity.

These are just some of the main growth investments the company made in the quarter. To quickly mention some of the others, in Brazil the company signed an agreement to acquire a high quality 600-megawatt greenfield solar project in late-stage development. In India, it signed an agreement to acquire its first renewable energy park. Across the rest of Asia, the company agreed to acquire approximately 750 megawatts of fully contracted wind assets consisting of primarily ready-to-build or under-construction projects.

The most important point for investors, we believe, is that the company is on track to commission an additional 2,800 megawatts of capacity by the end of the year, which are expected to contribute an incremental ~$40 million in annual FFO.

Balance Sheet

The balance sheet remains strong, with approximately $4 billion of available liquidity, and no material near-term maturities. Additionally, with the recent $15 billion closing of Brookfield’s Global Transition Fund, the company has access to capital to invest alongside the company. The average debt duration across the portfolio is ~13 years, with very limited floating rate debt, almost all of which is in Brazil and Colombia, where the company benefits from full inflation escalation in its contracts.

Valuation

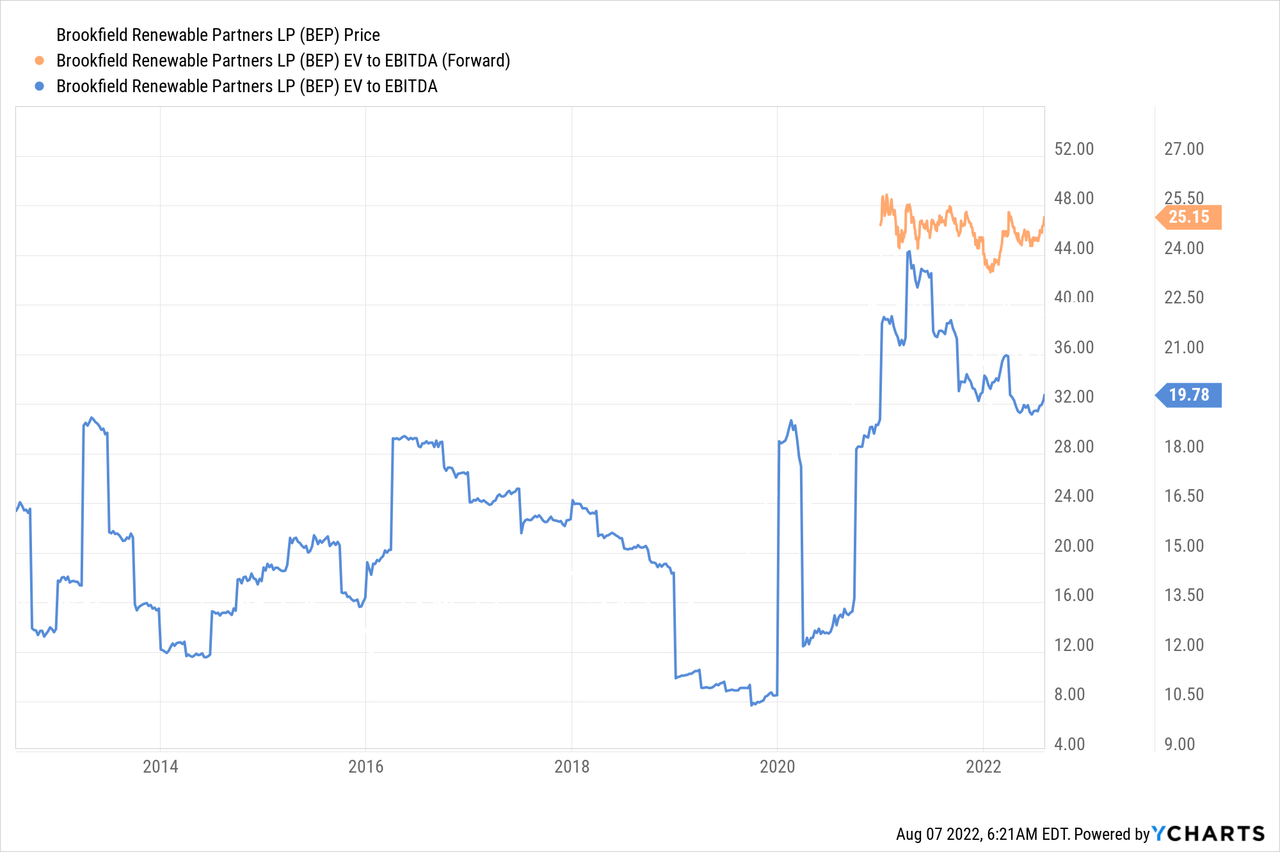

Unfortunately, shares are not currently cheap, and one has to pay for the outstanding growth and excellent management by paying an above average EV/EBITDA multiple. The days when you could invest in BEP at a 10x EV/EBITDA multiple appear to be gone. Given the growth and quality of management, we think the current multiple ~20x can be justified, but investors should be aware they are paying full price for the shares.

Looking at the Seeking Alpha valuation page for BEP, we can see that the trailing twelve months EV/EBITDA is about 44% higher than the industry average, and the forward EV/EBITDA is about 117% higher compared to the industry average.

Seeking Alpha

Thanks to its growth and management quality, BEP has tended to trade at a premium to the industry, so we find the current valuation to be high but not excessive, especially when considering that the current macro environment favors the company. We go into more details as to why BEP is relatively well protected, and might even benefit from an inflationary environment in this other article.

In summary, BEP is trading at an EV/EBITDA of ~20x, which is about a third higher than its ten-year average of ~15x, but the company is delivering significant growth and solid operating results, so we believe the valuation to be justified.

Risks

The main risk we see is that the valuation is a little above its historical averages, and other than that we believe investors should at least consider the following risks:

- Energy production: Some of the energy production assets are variable, there have been years with droughts that significantly impact Hydro production, there can be years with less wind impacting wind energy generation, etc.

- Power prices: A percentage of Brookfield Renewable energy production is sold at market prices, which can sometimes be unfavorable.

- Financing: Brookfield Renewable has significant debt, and it has the risk that it might have problems refinancing certain debt, or that it would be forced to do so at unfavorable rates.

- Low fossil-fuel prices: If fossil-fuel prices come down significantly, this could put at risk the cost advantage the company currently has and might slow the development of new projects.

Conclusion

We were very pleased with all the renewable energy projects commissioned, bought, or developed by the company during the quarter. The growth in the portfolio is impressive and should grow FFO going forward. Three areas are becoming increasingly important for the company, those are distributed energy, carbon capture and storage, and financing the energy transition. The company made investments and deployed capital in these three areas during the quarter. We believe shares are fully priced but can still offer decent returns to investors.

Be the first to comment