designer491

Investment thesis

Brookfield Asset Management Inc. (NYSE:BAM) has a very good track record of using economic cycles to its advantage. The current economic downturn is no different. The company is waiting to deploy its record-high level of cash to quality, cash-generating companies that will earn significant cash flow for BAM and its investors in the next 5-10 years. The upcoming 6-9 months will be challenging for BAM (despite its spinoff) but in the long term, I believe the management is capable of generating tremendous value for shareholders.

Looking back to 2008-09

Before diving into BAM’s quarterly results and what I expect in the following quarters let’s have a crystal clear idea about the company’s core values and how they operate during economic downturns. BAM is an asset manager focusing on real estate, renewable power, infrastructure, venture capital, and private equity assets. But the most important part is its long-term approach. They are long-term value investors who prefer high-quality, resilient businesses with great cash flows. According to their managing partner Anuj Ranjan “there cannot be a better time to be a value investor”. Bruce Flatt, the CEO said the same in the most recent earnings call. They are well-positioned to thrive in the current environment and during economic difficulties.

The company has a record level of investable capital of over $125 billion and more importantly the skills to navigate these types of markets and execute transactions. I emphasize the skills because if we look back to the 2008-09 financial crisis and look at the management’s decisions we can say without a doubt that the skills are there. By the third quarter of 2008, the stock price tanked by 40% YTD, and financial turmoil was unfolding everywhere. At the same time, the company was sitting on a great deal of cash and was ready to invest it in long-term undervalued, high-quality companies. In the letter to shareholders they published:

“…we have ±$20 billion of permanent capital. In today’s environment where many companies are without access to financing, this is a tremendous advantage. This capital does not come due, it has no margin calls, and whether it trades for less in the market due to external factors has very little effect on it…we currently have over $3.5 billion of cash, financial equivalents, and undrawn committed lines of credit to help ensure that we can withstand even extreme events should something occur, and if not, hopefully, use this capital to pursue some great opportunities…”

A year later in the third quarter of 2009 when the stock price started to recover and the next phase of the economic cycle was coming (recovery) the management was deploying capital heavily.

“Our liquidity position is strong and we have continued to deploy capital into investments which we believe will generate above-average returns over the long term. Our stable operating performance and strong liquidity, in addition to the recovering capital markets, means that we have been able to focus in recent months on numerous investment opportunities.”

This has proven to be the case. In 2008-09 they made several of their best long-term investments. I strongly believe that the current situation is very similar. The company has excessive free capital and due to the economic downturn and because asset prices are under pressure, high-quality cash flow-generating businesses can be bought at discounted prices.

Brookfield Asset Management third quarter results

The next 6-9 months will be difficult for BAM and for the overall economy as well but it will not make a huge impact looking back from 2030. BAM generated $2.16 billion cash from operations in the third quarter, down by 31% Q-o-Q and down by 3% Y-o-Y. However, they slightly exceeded (by 1.3%) third-quarter FFO per share estimates. The company also reported great revenue figures, the total revenue was up by 2.2% Q-o-Q and up by 22.3% Y-o-Y.

In terms of the asset manager spinoff, the management received the necessary shareholder approval to move forward. For every four shares of BAM today, investors will receive one share of the newly listed manager company. A new name and ticker will also be introduced, the current company will trade under the symbol BN and the new asset manager will be under the BAM symbol. The core principles will not change; long-term value investing will remain the main focus. The management expects that the new manager will double its fee-bearing capital over the next five years.

I expect a strong and steady rebound of BAM’s share price from the current levels (both BAM and BN later on) due to its strong capital position and future investments. The management follows the well-established path as they did in 2008-09. They will deploy capital to high-quality, resilient businesses with great cash flows which will do great in the upcoming years. Even if the asset prices remain at lower levels the cash flow generation will compensate.

The risk I see in BAM besides its share price fluctuations for short-term traders and investors is its long-term debt, which adds a level of risk due to the leverage. They increase their long-term debts by 39% in the last 9 months. Of course, if we take into consideration the $125 billion investible capital this does not look so bad.

BAM Valuation

I strongly believe that valuing BAM in the short term is a mistake because they have always been focusing on long-term goals. 20-25% stock price fluctuations do not mean anything to the management and investors should be aware of that. Thus why my intention is not to value the company with short-term valuation metrics but to give my long-term view on it.

I like to look at the market cap to AUM ratio when determining the long-term value and potential growth of an asset management company. The industry average is around 2.5-6% which means that the average valuation in the market of an asset management company is 2.5% of the client assets that it manages. Larger asset managers tend to have lower ratios because it is harder to grow an already large client base while smaller companies have higher market cap/AUM ratios. BlackRock, Inc. (BLK) has a ratio of 1.4%, and T. Rowe Price Group, Inc. (TROW) has a ratio of 2.19%. BAM has a great 9.4% ratio which indicates the management’s goal is realistic to double the fee-bearing assets within the next 5 years of the asset manager. It also indicates that the company is not under earning. (Of course, asset managers that oversee more equity portfolios vs. fixed income portfolios tend to trade at a higher ratio because equity assets have a higher fee schedule than fixed income.)

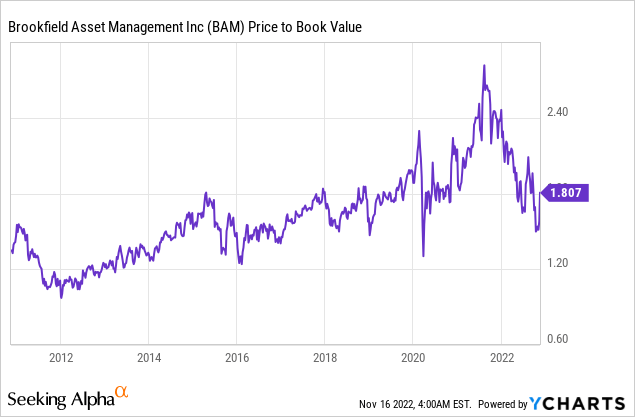

The company trades at attractive P/B valuations even with a 1.8x book value. Over the last 10 years the cash flow from operations more than tripled, the NAV grew significantly and the total revenues almost quadrupled so the book value has been steadily growing. I expect this trend to continue over the next 10 years and the current 1.8x looks attractive. (Just as the P/B of 1.2x looked attractive in 2012).

Dividend

The company has been paying dividends for 22 consecutive years. The dividend is well covered; the payout ratio usually stands between 19-29%. Over the last 12 months, the company’s share buybacks totaled 626 million; and if we combine it with the regular and special dividends, BAM returned over $1.5 billion of capital to the shareholders. There will be some changes in the dividends due to the asset manager spinoff. However, if an investor keeps both of the shares of the newly formed two companies the dividend will remain almost the same for now. The new manager has a target to pay out 90% of its earnings so the payout ratio will be around 90% of its distributable earnings. I expect the new BAM to have a more attractive dividend policy than the “old” BAM due to its fee-related earnings structure. Possibly the best idea for investors to keep both of the companies if they want to achieve the true long-term potential of BAM’s value investing strategy.

Summary

BAM is ideal for investors looking at a 5-10-year trajectory with great management. I believe that the company’s well-positioned investable cash and its strong focus on high-quality, resilient businesses with great cash flows will be proven to be a winner once again in the next 5-10 years.

Be the first to comment