Roman Didkivskyi/iStock via Getty Images

The Bronte Amalthea Fund is a global long/short fund targeting double digit returns over the long term, managed by a performance orientated firm with a process and portfolio that we feel is genuinely different. Objectives include lowering the risk of permanent loss of capital and providing global diversification without the market/drawdown risks typical of long-only funds. We believe a highly diversified short book substantially reduces risk and enables profits to be made in tough markets

|

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

FYTD |

|

|

FY13 |

5.4% |

1.3% |

6.8% |

||||||||||

|

FY14 |

6.0% |

-2.5% |

0.4% |

3.6% |

5.7% |

4.3% |

-3.7% |

0.2% |

-2.6% |

0.9% |

3.4% |

-0.8% |

15.2% |

|

FY15 |

-0.9% |

-1.6% |

2.7% |

1.7% |

3.4% |

4.9% |

2.3% |

-0.1% |

1.7% |

-1.7% |

4.4% |

-1.7% |

15.6% |

|

FY16 |

6.1% |

0.9% |

-0.2% |

3.8% |

-1.3% |

-1.4% |

0.5% |

1.8% |

-4.1% |

-3.4% |

5.1% |

-3.4% |

3.8% |

|

FY17 |

2.5% |

-0.8% |

-2.5% |

-1.3% |

-1.5% |

6.1% |

-2.0% |

1.6% |

1.0% |

7.0% |

7.2% |

-3.7% |

13.6% |

|

FY18 |

-0.9% |

1.5% |

1.1% |

5.9% |

-1.3% |

-1.6% |

4.4% |

4.1% |

1.5% |

3.7% |

-2.0% |

2.9% |

20.8% |

|

FY19 |

0.1% |

3.8% |

-1.8% |

-0.4% |

-3.9% |

6.5% |

-3.6% |

3.4% |

0.0% |

2.2% |

0.1% |

0.7% |

7.1% |

|

FY20 |

1.5% |

-0.4% |

1.3% |

3.4% |

3.1% |

-2.1% |

4.3% |

4.2% |

11.0% |

-5.1% |

-0.1% |

-4.8% |

16.5% |

|

FY21 |

-0.1% |

-3.9% |

1.7% |

-0.7% |

-5.0% |

-5.7% |

-7.3% |

-3.7% |

8.2% |

5.5% |

3.2% |

-2.2% |

-10.7% |

|

FY22 |

9.7% |

3.0% |

-4.5% |

1.1% |

1.8% |

7.3% |

4.4% |

-5.6% |

-4.6% |

5.2% |

2.2% |

0.1% |

20.7% |

|

FY23 |

-0.7% |

-5.9% |

6.7% |

6.5% |

0.8% |

1.0% |

-1.8% |

4.3% |

4.9% |

2.9% |

-2.8% |

-1.4% |

14.7% |

|

FY24 |

2.9% |

7.3% |

-0.4% |

10.0% |

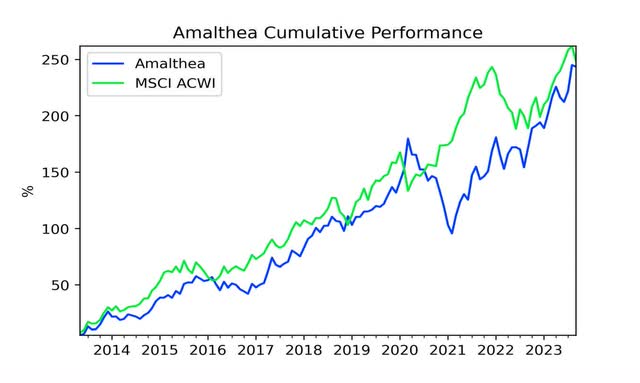

The Amalthea fund gained 9.96% last quarter (-0.44% in September) whilst the globally diverse MSCI ACWI index (in $A) was up by 0.02% (-3.70% in September). In the following pages we comment on some winners and losers. We also discuss two examples of thinly appreciated short selling pitfalls. One of which has been exposed as Europe’s largest recent stock fraud, whilst the other continues providing Bronte with lucrative opportunities, but challenges too. (see over)

|

Fund Features |

Portfolio Analytics1 |

|||

|

Investment Objective |

Maximise risk-adjusted returns with high double-digit returns over 3year periods. |

Metric |

Amalthea |

MSCI ACWI (in AUD) |

|

Min. initial investment |

$100,000 (for qualifying investors) |

Sharpe Ratio2 |

0.88 |

1.02 |

|

Min additional investment |

$50,000 |

Sortino Ratio |

1.61 |

1.74 |

|

Applications/redemptions |

Monthly |

Annualised Standard Deviation |

12.65% |

10.84% |

|

Distribution |

Annual |

Largest Monthly Loss |

-7.30% |

-8.00% |

|

Management fee |

1.5% |

Largest Drawdown |

-30.01% |

-15.97% |

|

Performance allocation |

20% |

Winning Month Ratio |

0.59 |

0.65 |

|

Administrator |

Citco Fund Services |

Cumulative return3 |

243.47% |

248.43% |

|

Auditor |

Ernst & Young |

1-year annualised return |

26.59% |

20.60% |

|

Custodians/PBs |

Fidelity, Morgan Stanley, JP Morgan |

3-year annualised return |

11.70% |

10.79% |

|

5-year annualised return |

10.69% |

8.96% |

||

|

Annual return since inception |

12.58% |

12.73% |

||

|

1Performance and analytics are provided only for Amalthea ordinary class units. Actual performance will differ for clients due to timing of their investment and the class of their units in the Amalthea fund 2Sharpe and Sortino ratios assume the Australian cash rate as the applicable risk-free rate 3Returns are net of all fees |

A high single digit return in a quarter where the major indices were down was better than we would expect. Given that we run a positive beta strategy, we would expect to lose modest amounts of money in a falling market. Making money is outperformance.

Most of this performance came from our shorts, with our average short down over 13%.

Again, this was better than we should reasonably expect – and better than our competition. Other short sellers had a hard time in July – and we – with a differentiated and diversified portfolio – avoided the problems. We are unsure what factors helped us and would like to know. If we are doing something well, we should probably be doing more of it.

Alas our long performance was mixed. European quality longs still seem to be expensive relative to lower-quality European stocks but inexpensive relative to their US peers. This gap widened during the quarter. Fund managers we respect who are focused on European quality names have had a rough time.

Follow ups from the last quarterly letter

In the last quarterly letter, we discussed the problems in our long book. These were:

- companies that sell technical products to improve the conversion of grain into meat (such as animal genetics and feed additives), and

- Regeneron (REGN), which had received a “Complete Response Letter” (an FDA rejection) for their new longer-lasting wet age-related macular degeneration drug.

The first of these problems has persisted. Grain prices remain high relative to meat prices and the stocks in question have followed their quality European peers down. The two losers in this sector are Genus (OTCPK:GENSF) and DSM-Firmenich (OTC:DSMFF).

The second of these problems has been resolved. To recap, in June 2023 the FDA issued a “Complete Response Letter” to Regeneron in relation to its higher-dose formulation of EYLEA (“EYLEA HD”). The company claimed that the rejection was solely due to a failed inspection at Catalent, their contract syringe filler, and not due to concerns about efficacy, safety, trial design, labelling or manufacturing of the drug substance. Our judgment was that the management were telling the truth, and that the issue should be resolved within a year.

The issue was resolved in 51 days. After working closely with Catalent (CTLT) and the FDA, EYLEA HD was approved on August 18th for the treatment of wet age-related macular degeneration, diabetic macular edema and diabetic retinopathy. This turnaround time from a Complete Response Letter to an approval is unprecedented. It also proves that the management team were telling the truth.

After being our biggest negative contributor last quarter, Regeneron was our biggest winner this quarter.

The State of our Short Book

There is no doubt we are facing a different environment for shorting than in previous years. In late 2020 and early 2021 we discussed what we saw as the greatest retail mania in living memory, arguably even more extreme than the dot-com bubble.

We described finding good short candidates at the time as like “shooting fish in a barrel”. It really was easy, until the fish started shooting back. Risk management and not stock identification was the name-of-the-game.

Over the last two years, this mania has dissipated to a significant extent.

For example, we finally covered our short in Faraday Future (FFIE). Faraday Future, like Nikola (NKLA), was another hyped electric vehicle company. A running Bronte joke is that this bubble will continue until the name of every giant of 19th Century science has their name besmirched. Faraday Future was the sort of rubbery company we would once have happily shorted at $300-400 million in market cap. At the height of the bubble Faraday Future (a SPACi of course) had a market cap over $5 billion. It has now fallen to a market cap of $25m with a share price down over 99.9% from peak.

This wasn’t a one-off. In 2021 it was possible to find many shorts this good – complete nonsense companies in hot sectors regularly had market caps of more than five billion dollars.

These days the opportunities for shorting are fewer. There are still many stocks worth zero trading with billion-dollar valuations– but the ridiculous five-to-ten-billion-dollar nonsense companies are scarce. Shorting is more difficult than shooting fish in a barrel. On the plus side, the fish only shoot back infrequently and with low-impact projectiles. We prefer it this way.

Real professionals talk risk management

At the end of a good quarter, it is tempting to tell you about all the stocks we got right – how we did brilliant analysis and hence made lots of money.

We did get a lot of things right – and so that would be a fun and easy letter to write. But it would be misleading because it wouldn’t explain accurately the risks we took with your money.

The real professionals in this business think endlessly about risk management and all the things that can go wrong and what to do about it. The generational mania of early 2021 was an existential event for many hedge funds. We were beat up but left well enough to recover and thrive. Other short sellers exited the business. Risk management is the single most important thing we do.

The rest of this letter is to give you some stories about risk management issues and how we think about managing these risks into the future.

The first is a story about the risk of fraudsters capturing the US Food and Drug Administration – the agency that approves new pharmaceuticals in the United States.

The second is one more step in the Wirecard (OTC:WRCDF) saga – where a stock we once thought was a simple money launderer for online casinos and similar illegal activity with fake profitability turned out to be so much more.

Sarepta risk

The FDA is widely considered to be the world’s foremost regulator of drug products, with a stringent and rigorous process for evaluating new marketing applications. Disagreements between the FDA and regulators in other developed markets (such as the European Medicines Agency or the Australian Therapeutic Goods Administration (TGA)) are rare, and when they do occur, it is usually because the FDA has taken a more critical view of the applicant’s evidence.

For a drug to be approved in the US, it must meet the statutory requirement of “substantial evidence of effectiveness” under the Federal Food, Drug, and Cosmetic Act. There are essentially three ways to meet this requirement. Normally, the FDA expects the sponsor to succeed in two “adequate and well-controlled studies”. Alternatively, the sponsor can rely on success from a single study if the results from that study are “very persuasive”, or if they are combined with some sort of independent confirmatory evidence. For the most part lobbying from the cohort of patients, the “patient voice”, has played a relatively minor role in the FDA’s decision-making process and the agency has been prepared to make tough but rational decisions when the “substantial evidence” standard is clearly not met.

However, this was not the case in 2016 when the FDA famously overruled its own review team and external advisory committee to approve Sarepta Therapeutics’ (SRPT) controversial drug for Duchenne muscular dystrophy (Exondys 51). At the time, Sarepta had completed a single phase 2 trial in just 12 patients which, per the FDA Commissioner (Robert Califf) himself, had “major flaws” in both its design and conduct. Ellis Unger, director of the Office of Drug Evaluation at the FDA, declared that the drug was a “scientifically elegant placebo”, and that patients and their families were taking on unknown risks for likely non-existent benefits.

The European Medicines Agency (EMA) had a similar view. In May 2018, they recommended that Sarepta’s marketing authorisation be refused because “the balance of benefits and risks of Exondys in the treatment of DMD could not be established”. Here is a more detailed description of the issues:

“The CHMPii was concerned that the main study, which involved just 12 patients, did not compare Exondys with placebo beyond 24 weeks, during which there was no meaningful difference between Exondys and placebo in the 6-minute walking distance. The methods for comparing results of the main studies with historical data were not satisfactory for showing that the medicine was effective. The Committee considered further data were needed to show that the very low amounts of shortened dystrophin produced as a result of Exondys treatment bring lasting benefits relevant to the patient.”

The EMA officially refused Sarepta’s marketing authorisation in September 2018. Despite its University of Western Australia origins, Exondys has still not been approved by the TGA.

The approval of Exondys by the FDA can be attributed, not to a demonstration of “substantial evidence of effectiveness”, but to the vociferous (and sometimes weaponised) support from patient advocacy organizations and a call from Janet Woodcock (then the director of the FDA’s Center for Drug Evaluation and Research) for “the greatest flexibility possible”. When the drug launched in the US, these same patient advocates lamented its $300,000 per year price tag. This is $300,000 worth of placebo per patient the American taxpayer is on the hook for.

Similarly, in June 2021, the FDA approved a basically useless drug (Aduhelm) for the treatment of Alzheimer’s Disease, thanks in large part to patient advocacy groups (led by the Alzheimer’s Association) who lobbied strenuously for the drug, and who were in many cases funded by the drug’s sponsor (Biogen). The FDA again overruled the overwhelmingly negative recommendation of its external advisory committee and many of its own officials, who were concerned about “inconsistencies in the data” and unconvinced that “substantial evidence of effectiveness” had been achieved. These concerns were even shared by scientists at Biogen. When the FDA gave them the green light, Dr. Vissia Viglietta, a senior medical director who assisted the design of Aduhelm’s pivotal studies, commented: “it defeats everything I believe in scientifically and it lowers the rigor of regulatory bodies.” In that case (and without prior precedent) Medicare minimized the damage to American taxpayers by sharply restricting coverage of Aduhelm despite approval from the FDA. Sales were de minimis.

In December 2021, the EMA issued a negative recommendation to Biogen on the basis that the Aduhelm studies were “conflicting”, “did not convincingly show that Aduhelm was effective at treating adults with early-stage Alzheimer’s disease”, and “did not show that the medicine was sufficiently safe as images from brain scans of some patients showed abnormalities (amyloid-related imaging abnormalities) suggestive of swelling or bleeding in the brain”. Biogen officially withdrew its EU application in April 2022.

In June 2023, the Australian TGA recommended rejecting Aduhelm based on “weak and uncertain efficacy data, substantial risk, and a substantial burden of treatment including infusions and monitoring requirements”.

Initially, we thought that Sarepta and Aduhelm were rare lapses in the FDA’s judgment. However, the agency’s recent public communication (such as this talkwith Robert Califf at the 2023 STAT-JPM event) and a spate of approval decisions have made it clear to us that there has been a major shift in their regulatory framework. For life-threatening diseases lacking effective treatments, the patient’s voice is now more important than the quality of the applicant’s evidence. In the last two years alone, there have been more than a few cases where the FDA has, under the pressure of patient advocacy groups, lowered its standards for life-threatening diseases to accept ambiguous, even flawed, evidence.

We are not going to name examples, but we have noticed a trend. People we regard as fraudsters – and whose usual business is stock fraud – are promoting drugs that do not work for life-threatening and debilitating illnesses with major unmet needs. That doesn’t matter as long as they do no harm but once stock-promoters organize (maybe even astroturf) a lobby group to argue for approval there is a decent chance it gets approved.

If it gets approved the costs of US medicines go up with no identifiable health benefit. Taxpayers or insurance providers – and hence future policyholders – are on the hook. The money gets transferred to former stock-fraudsters who seem to make money legitimately by selling expensive placebos.

Even if it doesn’t get approved the stock goes up in anticipation. The chance of complete nonsense getting approved is high these days.

It is not our place to make recommendations on how to improve the cost-effectiveness of US Health Care, though we will anyway. Many politicians have that as an agenda item – and they could start by firing Robert Califf and replacing him with an FDA Commissioner who acts according to the mandate and only approves drugs where the sponsor really does provide substantial evidence of effectiveness.

That said, it is our job not to be too adversely impacted when the FDA is captured by stock/drug promoters and w approves their placebos. We short biotech frauds (there are many). We now have to make sure we are not short stocks with what we have taken to calling “Sarepta Risk”. This requires us to develop new skills and maybe to watch for signs of well-organized fake grassroots campaigns for drug approvals.

The risk that you are short a GRUiii Laundromat

We found Wirecard as a short right at the inception of Bronte Capital – when we were running money only for a few friends in separately managed accounts. Wirecard was a credit card processor whose main business appeared to be clearing credit card payments for online casinos and pornographers. It was fraud adjacent as it was in the business of dealing with online casinos and pornographers. But it was not obviously itself fraudulent. John, however, thought the accounts highly suspect and investigated.

By 2012 we were sure that the company was a fraud and was faking its profits.

The problem with faking your profits is at the end of the year you have on your book cash that does not exist. (The cash is the cash you supposedly earned from your fake business.)

Auditors exist to check balances and (normally) the auditor would notice the cash does not exist and that would end the fraud.

One possible solution (from the perspective of the fraudster) is to use the fake cash to buy a fake business.

In 2012 John’s friend Alex Turnbull tried to find a recently purchased Wirecard operation in Jakarta. Alex has an edge on us as he speaks Bahasa. Alex found no substantial business operations. We concluded the Indonesian business was fake – and we told a few people.

Our credibility was shot however when Wirecard later held their investment day in Indonesia showing off their large office there. That office was almost certainly a Potemkin Village designed to fool investors.

By 2014 we had already lost money on Wirecard and had investigated the intermediaries in the Indonesian acquisition. We found some Russian links and we assumed they were mafia and looked no further. John told a journalist from the Financial Times (Dan McCrum) all this in a brief conversation at a conference in London. The memorable line was “do you want to chase some German gangsters?”.

By 2016 there was enough evidence of Russian links to be suspicious – but certainly not enough to be definitive. Alex Turnbull was the first person we heard refer to Wirecard as a GRU Laundromat – essentially a Russian State attached money-laundering service. John thought that possible but unlikely. Alex’s father (then Prime Minister of Australia) thought Alex was insane.

Wirecard has now collapsed – and the story has been well told in Dan McCrum’s excellent book (Money Men) and the Netflix documentary (Skandal). The book tells how McCrum was pursued by spies led by the former head of the Libyan Secret Service, and how a completely captured German Regulator (The BaFiniv) criminally charged him with stock manipulation for telling supposedly false (but actually true) stories about Wirecard.

We kept thinking Wirecard was just about to collapse. This stock behaved like no other fraud in our book – and it seemed to be protected at every level. The German regulators were totally in Wirecard’s camp. German Chancellor Angela Merkel (known in retrospect to be too close to Putin) also vouched for Wirecard on a State Visit to China. This company seemed too government attached to fail – and we did not understand why.

In September the level of Russian State links became clearer. The British Government charged five Bulgarian citizens with running a Russian espionage/kidnapping service in the UK. They also stated the ringleader reported to Jan Marsalek. Marsalek is a fugitive Austrian businessman who was chief operating officer and the brains behind much of Wirecard.

We thought we were short a simple credit-card clearing company with fraudulent accounts. This is the sort of short that makes sense with a $500 million market cap.

Alas, what we were short was the Russian State.

Being short the Russian State at a $500 million market cap is insane. We were destined to lose money and we did.

We do not know how to avoid being short a GRU Laundromat in the future (though we believe such things are rare). The only solution we have is mass diversification of our shorts. Then if we accidentally make a mistake like this again you won’t notice it because the position will be small.

Mistakes will happen

In a quarter with relatively few errors on our part we have to remind you mistakes will happen. Our best solution is to avoid those mistakes, and we can in some instances (like we avoid “Sarepta Risk” these days). But what really hurts is the unknown unknowns. There was no way in 2009 for us to know that Wirecard was (or at least would become) a GRU Laundromat. But that risk came back to hurt us. The best way we can avoid the “unknown unknowns” is diversification. That has worked for us so far and should continue to work in the future.

Thanks again for the trust you have in us.

the Bronte Team

Postscript: some documentaries

Because we mentioned the Wirecard documentary we are noting that there are three documentaries readily available that feature John and some of Bronte’s work.

The first is called Drug Short. It is episode 3 of a Netflix series of documentaries titled “Dirty Money” and it tells the story of how shortsellers exposed chicanery at a large American pharmaceutical company (Valeant). John takes a lot of credit here – but truthfully the main work at Bronte was done by David Sachs – our Deputy Chief Investment Officer. This was first broadcast over five years ago – and we looked a little younger then.

The second documentary is the above-mentioned Skandalalso on Netflix. John does not appear even by name – but the story starts when Dan McCrum gets a tip from an Australian fund manager. We think there is more to the story than is in the documentary or in McCrum’s excellent book – but Dan McCrum is a thorough journalist who won’t publish mere speculation – whereas we deal far more readily with very incomplete knowledge. Indeed, incomplete knowledge is the stuff of our business.

The third documentary is part of a series made by VPRO for the Dutch, French and German national broadcasters. The series is called “Planet Finance” and it describes the interaction between financial markets and ordinary people. Some of the series is excellent (for example interviewing and taking seriously Japanese women who gamble in currency markets and who are known in financial markets collectively as Mrs Watanabe). The last episode – episode 6 – is about short-selling and the meme stock mania. John is interviewed as a shortseller and describes the retail investors as treating the market as a very good casino. The episode (which you can now find on YouTube) is fun and includes video of John rafting on a river in the Tarkine Wilderness in Tasmania. There was a colourful but involuntary expletive when John hit a rock and capsized. The series also describes how John got into shortselling (with a fraud in Flanders called Lernout and Hauspie). The most interesting part of the episode is an interview with Jo Lernout and some of his many victims. The victims are paying for his rather nice Chablis.

FootnotesiA special purpose acquisition company (SPAC) is a company without commercial operations and is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring or merging with an existing company. iiThe Committee for Medicinal Products for Human Use (OTC:CHMP) is the European Medicines Agency’s (EMA) committee responsible for human medicines. iiiMain Directorate of the General Staff of the Armed Forces of the Russian Federation ivThe Federal Financial Supervisory Authority (German: Bundesanstalt für Finanzdienstleistungsaufsicht) better known by its abbreviation BaFin is the financial regulatoryauthority for Germany. Disclaimer:This report has been prepared by Bronte Capital Management Pty Limited. This report is for distribution only under such circumstances as may be permitted by applicable law. It has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. It is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the report. The report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change without notice. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. Bronte Capital Management Pty Limited is under no obligation to update or keep current the information contained herein. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realised. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment