ismagilov

Amalthea Fund – September 2022

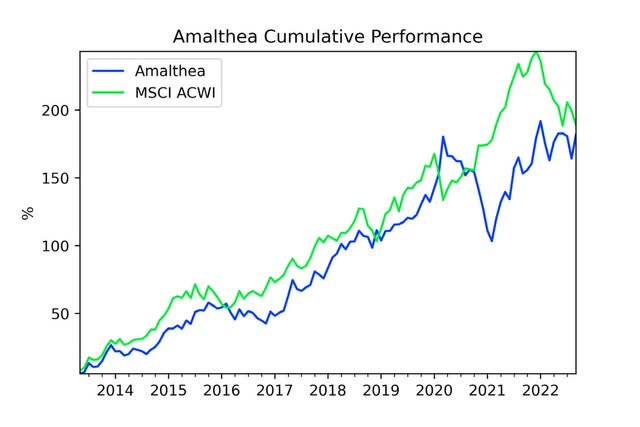

The Bronte Amalthea Fund is a global long/short fund targeting double digit returns over the long term, managed by a performance orientated firm with a process and portfolio that we feel is genuinely different. Objectives include lowering the risk of permanent loss of capital and providing global diversification without the market/drawdown risks typical of long-only funds. We believe a highly diversified short book substantially reduces risk and enables profits to be made in tough markets

|

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

FYTD |

|

|

FY13 |

5.4% |

1.3% |

6.8% |

||||||||||

|

FY14 |

6.0% |

-2.5% |

0.4% |

3.6% |

5.7% |

4.3% |

-3.7% |

0.2% |

-2.6% |

0.9% |

3.4% |

-0.8% |

15.2% |

|

FY15 |

-0.9% |

-1.6% |

2.7% |

1.7% |

3.4% |

4.9% |

2.3% |

-0.1% |

1.7% |

-1.7% |

4.4% |

-1.7% |

15.6% |

|

FY16 |

6.1% |

0.9% |

-0.2% |

3.8% |

-1.3% |

-1.4% |

0.5% |

1.8% |

-4.1% |

-3.4% |

5.1% |

-3.4% |

3.8% |

|

FY17 |

2.5% |

-0.8% |

-2.5% |

-1.3% |

-1.5% |

6.1% |

-2.0% |

1.6% |

1.0% |

7.0% |

7.2% |

-3.7% |

13.6% |

|

FY18 |

-0.9% |

1.5% |

1.1% |

5.9% |

-1.3% |

-1.6% |

4.4% |

4.1% |

1.5% |

3.7% |

-2.0% |

2.9% |

20.8% |

|

FY19 |

0.1% |

3.8% |

-1.8% |

-0.4% |

-3.9% |

6.5% |

-3.6% |

3.4% |

0.0% |

2.2% |

0.1% |

0.7% |

7.1% |

|

FY20 |

1.5% |

-0.4% |

1.3% |

3.4% |

3.1% |

-2.1% |

4.3% |

4.2% |

11.0% |

-5.1% |

-0.1% |

-4.8% |

16.5% |

|

FY21 |

-0.1% |

-3.9% |

1.7% |

-0.7% |

-5.0% |

-5.7% |

-7.3% |

-3.7% |

8.2% |

5.5% |

3.2% |

-2.2% |

-10.7% |

|

FY22 |

9.7% |

3.0% |

-4.5% |

1.1% |

1.8% |

7.3% |

4.4% |

-5.6% |

-4.6% |

5.2% |

2.2% |

0.1% |

20.7% |

|

FY23 |

-0.7% |

-5.9% |

6.7% |

-0.3% |

|

Fund Features |

Portfolio Analytics1 |

|||

|

Investment Objective |

Maximise risk-adjusted returns with high double-digit returns over 3year periods. |

Metric |

Amalthea |

MSCI ACWI (in AUD) |

|

Min. initial investment |

$100,000 (for qualifying investors) |

Sharpe Ratio2 |

0.79 |

0.97 |

|

Min additional investment |

$50,000 |

Sortino Ratio |

1.41 |

1.68 |

|

Applications/redemptions |

Monthly |

Annualised Standard Deviation |

12.77% |

10.81% |

|

Distribution |

Annual |

Largest Monthly Loss |

-7.30% |

-8.00% |

|

Management fee |

1.5% |

Largest Drawdown |

-30.01% |

-15.97% |

|

Performance allocation |

20% |

Winning Month Ratio |

0.58 |

0.63 |

|

Administrator |

Citco Fund Services |

Cumulative return3 |

171.32% |

188.93% |

|

Auditor |

Ernst & Young |

1-year annualised return |

11.37% |

-11.00% |

|

Custodians/PBs |

Fidelity, Morgan Stanley, JP Morgan |

3-year annualised return |

6.89% |

5.43% |

|

5-year annualised return |

9.73% |

8.67% |

||

|

Annual return since inception |

11.18% |

11.93% |

||

|

The fund gained 6.68% for September and lost 0.32% across the quarter. The globally diverse MSCI ACWI (in $A) lost 3.58% for the month and gained 0.17% for the quarter. For the year to date the fund is up 0.85% whereas the ACWI is down 15.83%

Our returns for the quarter were better than many alternative investments but were lower than what we hoped and expected. The problem is that whilst quality has outperformed very low-quality stocks over the quarter it was nowhere near what we would expect at this stage for a secularly weak market. (see over)

There have been some bright spots in our long book. Regeneron (REGN), a major position and a stock we wrote up in our June 2021 letter, has been one of the best performing stocks in the S&P 500 this year. Alas it has not been enough to offset some of our weaker stocks, let alone our overweight exposure to the UK (and Europe) which have suffered from both stock and currency weakness.

We do not think we are bad at picking stocks on the long side and hope – reasonably we think – for better relative results in the future. Prior to COVID, our longs were markedly better than the index. Unfortunately, if you look at our long book this quarter and since the onset of the COVID pandemic, there is scant evidence that we have added any value by picking stocks to go long.

Our short book has been good, falling farther and faster than indices to which we would compare them. The evidence strongly supports the proposition that we add value picking shorts. Moreover, with over 500 shorts our claim to be good at shorting appears statistically robust.

Disappointingly though, there are famous and honest funds pitching new-age technology stocks to retail. These funds are honestly run – but – believe it or not – these funds have underperformed an index of stocks we think are run by crooks. Shorting hype (something we do a little bit of) has been a very good trade. Shorting dishonesty (something we do a lot of) has been a less good trade. Generally, though we think we will continue outperform by shorting dishonesty, this quarter that outperformance was less than we would like.

We hope to present a long period where both sides of the book perform at least on a relative basis. We are pretty sure it will happen. Quality outperforms junk by a lot in most secular bear markets – but it has not happened thus far to the extent we would have expected.

Where we are

Markets peaked in early January and declined for some months after. There was one large retracement (roughly June 16th to August 15th) that took many markets over halfway back to the peak. But weakness returned in September, and many markets are putting in new lows. That said, most of these new lows remain well above the Covid panic-low of March 2020, when we did not think markets were especially cheap.

We are not very good at predicting ten-year returns for broad asset classes, so we position our portfolio such that returns can be adequate even if we get the broad direction wrong. This can, however, limit returns when we get the broad direction right.

Intellectually however, we are in the camp that what we are seeing is the early to middle stage of a multi-year secular bear market. It is not time to be an investment hero. Like all bear markets we expect some powerful “bear market rallies” but we think the general direction for some time will be down.

There are people with the same opinion, some who lay the case out more eloquently than we have. We recommend you read Jeremy Grantham’s “Entering the Superbubble’s Final Act,” which lays out the case based on a normal market cycle theory. Everything Grantham says about the Superbubble rings true to us. We find plenty of assets with market caps of many billions that have no real hope of returning their valuation to shareholders between now and 2060. Also, the behaviors we witness are just more extreme versions of that described in the many books on our shelves about late market cycle behavior.

During the bull market, we saw assets that basic logic indicated were ludicrously expensive. And then their prices doubled. Earnings did often grow faster than one would reasonably think. The bubble itself for instance pushed up the demand for capital equipment and the margins from selling it.

A bear market is different. At some point an asset seems unreasonably cheap, so you buy it– and it immediately drops 30 percent. Then of course the downturn drives a recession, making investment spending less attractive, and earnings drop as well. We are already seeing this with a couple of stocks in our portfolio. But for the most part we think our longs are far from cheap.

Lots of things go wrong in financial markets when a bear market sets in. Things that looked stable become problematic. Ideas that looked sound in the flush of a bull market are often shown to be deeply problematic.

Late in the quarter, one of those seemingly good but (probably) bad ideas was exposed. For those not familiar with fads in pension fund management, the fad – liability driven investment – takes a little explaining. Please bear with us because we think this reveals some more general truths about the world.

Hedging and the UK pension crunch

We run a hedge fund, and it surprises people when we say that often there is no such thing as hedging. There is just risk transformation, often to nastier risks. The example we always give is currency hedging. An extreme perspective is illuminating, namely that of a prefinancial crisis investor in Iceland.

Our well-advised Icelandic investor has a diversified portfolio, 70 percent in Icelandic assets (mostly Icelandic stocks) and 30 percent offshore in quality non-Icelandic companies like Microsoft (MSFT).

During the boom years Iceland was a very strong economy with a very strong currency. Every year the Icelandic stocks outperformed the foreign stocks because of the boom (really a bubble) and because of the strong Icelandic krona. The foreign assets looked terrible for a while, because the krona was just so strong. But being well-advised, our investor keeps rebalancing.

Then comes the crisis. The Icelandic stocks (mostly banks like Kaupthing) drop 90 percent and the krona drops two-thirds. This looks horrible, but our client is okay — measured in krona. Sure, the Icelandic assets are mostly gone, but with the krona down two-thirds the foreign assets (measured in krona) have tripled. Yes, the investor will be down a little, but the foreign assets have done their job by diversifying away some idiosyncratic country (Iceland) risk.

Now imagine an alternative reality. Our investor got sick of losing money every time the Krona appreciated, and they went to a friendly investment banker who suggested “hedging” the currency. They entered a contract that was long krona, short the US dollar to hedge their foreign stock.

Every time the krona appreciated, they lost money on their foreign holdings, but they made money on their hedges. Hedging works. Thank the Good Lord for bankers.

Not so fast though. Along comes the Iceland crisis, and the krona drops two-thirds. The krona assets as discussed above are mostly gone. And now the “hedging” contract hits with a big cash call. After all, the krona has dropped two-thirds.

The cash call is so big that the investor is forced to sell the otherwise good foreign assets to cover the debacle. The result: a wipe-out measured in krona. It is even worse measured in US Dollars.

What the hedge did is stabilise asset values in one range of circumstances (endless appreciation of the krona) but exposed the client to catastrophic margin calls and collapse in another circumstance (the crash in the krona).

“Hedging” is not the right word here. Risk transformation (in this case to a much nastier risk) is the right description. The maxim we use is that there is “no such thing as hedging”. This is obviously an exaggeration, but it is no exaggeration to say that many stupid things have been done in the name of risk reduction and hedging. Warren Buffett referred to derivatives as weapons of mass destruction (or maybe math destruction) for a reason.

This happened to several Australian entities during the global financial crisis. One major superannuation (pension) fund was enamoured of the predictable cash flows of long dated but illiquid Australian infrastructure assets. They were so enamoured of these assets that they bought similar assets in America. Alas in this case the cash flows were predictable in US dollars. They then “hedged” this currency exposure by going long Australian dollars and short the US dollar.

With the slowdown in global growth during the financial crisis the Australian dollar was very weak losing a little over a third of its value measured in US dollars.

AUD/USD June 2008–March 2009

This slide produced a major margin call for the pension fund. The pension fund was unable to sell the US dollar denominated infrastructure projects, as they were illiquid. They were forced to liquidate good Australian assets at the market bottom in 2009. Viewed from 2022, that was clearly a disaster.

Better disclosed was a debacle at QBE, a major Australian insurance company (in which we have no position). This horror story was laid out rather blandly in the Chairman’s letter in the 2009 annual report. We quote:

In early 2009, we revised our longstanding practice of fully hedging our investment in foreign operations. With over 75% of shareholders’ funds offshore from Australia, the use of forward foreign exchange contracts results in regular settlement funding and, in times of volatility, introduces liquidity risk and fluctuation of Group capital levels. Given the levels of currency volatility on our significant foreign operations, we adjusted our approach, consolidating and substantially reducing our exposure to forward foreign exchange contracts. With the Australian dollar strengthening during the year, up 28% against the US dollar and 15% against sterling, the translation of our investment in foreign operations to Australian dollars at year end resulted in a negative movement in the foreign currency translation reserve of $2.2 billion with the effect that shareholders’ funds decreased by 8% to $10,222 million.

Note what happened here. They had three quarters of their capital held offshore, mostly in US Dollars and Sterling. The Australian dollar plummeted, bottoming in early 2009. (See the graph above.)

Blandly they state: “the use of forward foreign exchange contracts results in regular settlement funding”, which really means that they had to pony up a couple of billion dollars to meet the margin calls on their “hedges”.

At some point, one that seemed to coincide closely with the bottom in the Australian dollar, they gave up hedging. Then the Australian dollar appreciated – and the shareholder funds decreased by $2.2 billion (measured in Australian dollars).

Ouch. Despite a massive bull market QBE’s stock price is a little under half the price it was in 2009. The hedges did not “hedge” risk, they simply transferred a balance sheet risk into a nastier cash-flow/liquidity risk.

This brings us to the crisis of the moment – pension funds and liability driven investment.

Pension funds have very long obligations. People will be collecting pensions in thirty years. Every time interest rates fell, especially long bond interest rates, the accounting value of those obligations increased, and the UK pension fund became just a little bit more underfunded.

And for the last 40 years or so interest rates have fallen and fallen some more. Eventually many pension funds, mostly in the UK but also some we know in America, decided to “hedge” further declines in the long interest rate. They bought swaps, swapping the duration of their portfolio to the longest bonds they could find. After all they were carrying a balance sheet risk that long interest rates would decline further (and that long bonds would appreciate further).

The problem with the hedge was that they were long very long-dated bonds (against cash) – and they were margined on this transaction. Long-dated bond prices are very sensitive to long-dated interest rates. With the sudden burst of inflation, prices of long bonds fell very substantially.

This is a price graph of a US government bond issued with a very low coupon (but at par) during 2020.

United States 30 Year Bond 1.25% May 2050

United States 30 Year Bond 1.25% May 2050

The price has fallen to 55 cents in the dollar. You lost almost half your money in a US Government Bond – what is widely regarded as a “riskless” asset.

A similar thing happened in the UK, except that the pension funds started getting huge margin calls on their “hedges”. People were talking in all seriousness of the bankruptcy of the UK pension industry.

Matt Levine wrote the following in his Bloomberg column:

I know this is bad but I find something aesthetically beautiful about it. If you have a pot of money that is immune to bank runs, over time, modern finance will find a way to make it vulnerable to bank runs. That is an emergent property of modern finance. Through the magic of derivatives you have transformed your safe boring long-term pension fund into a risky leveraged vehicle that could get blown up by market moves.

The forced selling of long bond exposure (due to margin calls) drove UK Government bonds to 25 pence on the pound. A 75 percent loss on recently issued UK Government bonds was not on our bingo card for 2022.

The Bank of England intervened by buying long dated UK government bonds (gilts). Note the beauty of this too. There is a reasonable argument that quantitative easing is a cause of recent inflation. That inflation caused interest rates to rise – and the solution is to do more quantitative easing. There is a reasonable argument that the Bank of England is putting out the fire with gasoline.

We mention all this only because weird stuff happens in markets on the way down. We own a few British shares, but only one of them (which we will not name) has a pension fund that is large relative to current profitability. We do not know whether the pension funds involved have oversized long dated gilt exposure but have been trying to find out. We are not keen to sell the stock, as it is not hugely liquid and is trading at eight times trailing earnings. It is a tiny position (well under one percent of the fund). But negative surprises are of course possible.

In a bear market lots of “surprises” like this will happen and people will start to get very scared of them.

Thus, we expect the market to trade at a lower multiple of lower earnings.

Our positioning

Despite all this bearishness, we remain beta-adjusted net long. We have explained (at length) why net short portfolios behave badly, and we do not intend to become a net short portfolio. But even in this environment we think we can find okay longs – and our shorts should remain excellent. [Also of note, the beta-adjusted net long offers us some protection in the powerful bear-market rallies that occur in all bear markets.]

Some valuation notes

Consensus longs—those stocks widely held and admired by fund managers—have recently underperformed the market. Consensus shorts have been bad shorts. We have over 500 shorts, of which a few are consensus, and we have noticed this effect.

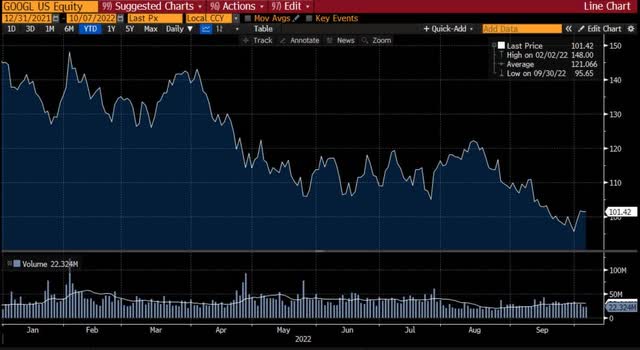

But we also own what we think is (alas) the most consensus long in this market: Google (GOOGL, GOOG). We find it hard to find any strong reason not to own it. Internet advertising is going from strength to strength and Google’s place in the market is mostly improving. Some of the other bets such as cloud services are beginning to pay off, and finally the CEO is expressing discipline on costs. (Per the consensus, the biggest problem with Google has been a lack of discipline on costs. Every time we look there are another 20 thousand employees.)

Being a consensus long, it is down hard. We did say consensus longs are not going well.

GOOGL US Price, Year to Date

The valuation now has become reasonable.

Revenue growth has slowed from a Covid-induced high of above 40 percent to its pre-Covid growth rate in the teens. It will probably slow more, but only because of the super-strong US dollar. Google earns a lot of revenue outside the US. If you take out the cash balance (which is clearly excessive) the company is trading at about 15 times current year earnings. It is not as cheap as Facebook (on which we have given up). But Facebook has large and obvious problems, and the problems at Google are far better hidden. Compared to our short book this value is positively salivating.

Most of our long book is less attractive than Google, but the big consensus longs are amongst the more attractive stocks in the market. We think there is a reasonable chance the indices behave relatively well (down, but modestly [we are still bearish]) while the dross in the market behaves truly badly, with 90 percent drops from here a common outcome. We know we are talking our book here. We are long quality and short dross. But we think the portfolio may do just fine – even in a continued bad market. And we are net long ((just)) so we should be okay (although underperforming) if the market rises.

We remain vulnerable – as always – to a market where the lowest quality stocks outperform the highest quality. This does happen periodically – but most intensely at the sharp-end of a retail gambling mania. We think we are past that point in the cycle.

Thanks again for the trust you place in us.

| Disclaimer: This report has been prepared by Bronte Capital Management Pty Limited. This report is for distribution only under such circumstances as may be permitted by applicable law. It has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. It is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the report. The report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change without notice. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. Bronte Capital Management Pty Limited is under no obligation to update or keep current the information contained herein. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment