designer491

The Buy Thesis

Broadstone Net Lease (NYSE:BNL) is a diversified triple net REIT with steady cashflows that is freshly trading at an opportunistic price point. In analyzing its attributes, stability and forward growth I think a 14X multiple on AFFO would be appropriate but due to a recent selloff BNL can be bought at 12X AFFO. That provides about 15% upside to fair value and a greater than 6% current yield on a company that appears to be below average equity risk.

Nothing fancy here, just a clean opportunity to capture some mispricing.

A stable asset base

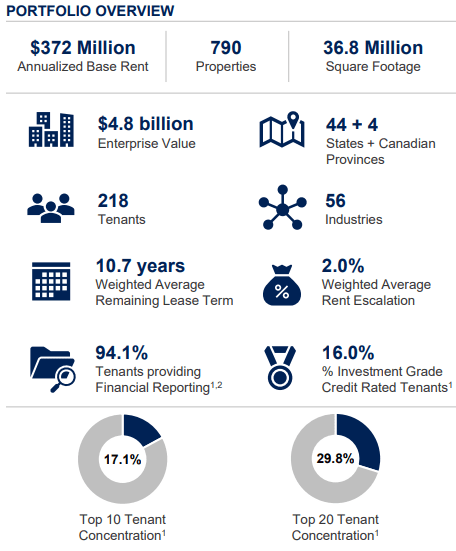

Here are the key attributes of BNL:

3Q22 Earnings slides

Many of these categories are worth looking at in a bit more depth.

Size and diversification

An enterprise value of $4.8B puts it firmly in the middle of the pack. Large enough to be efficient scale, but not so big that it needs M&A to move the needle. BNL still grows through single property acquisitions whereas larger peers like W.P. Carey (WPC) and Realty Income (O) rely on M&A. Each approach is appropriate for the given companies, but single property acquisitions give more bang for the buck as there is often a portfolio premium associated with M&A.

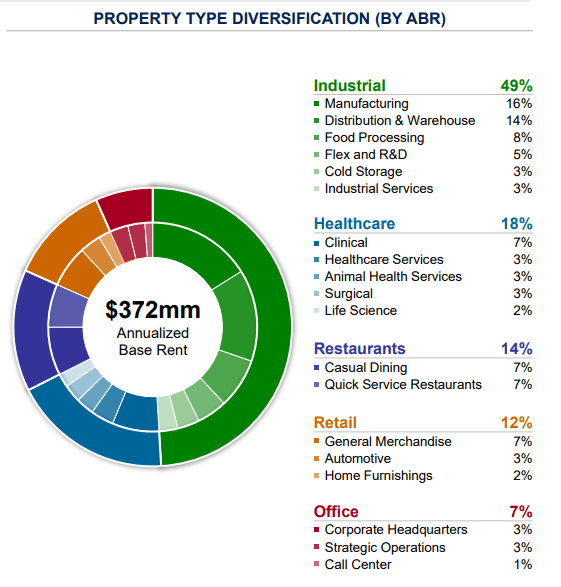

Broadstone’s asset portfolio is extremely diversified, geographically, by tenant, and by property type. This is both good and bad in that it brings stability but likely sacrifices a bit on expertise. BNL has competency in all of these asset classes with significant experience, but with this much diversification you won’t get the value creation that one gets with submarket specialists like Armada Hoffler (AHH) or property type specialists like Plymouth Industrial (PLYM).

The upside of the extreme diversification is that it allows their acquisitions team to flex to wherever there is opportunity. Using this flexibility BNL was much earlier to get into industrial assets, already having about 50% of their portfolio in what is now broadly considered to be the strongest triple net asset type.

BNL

Tenants and leases

16% of tenants being investment grade is a bit on the low side, but I have consistently thought that metric was overrated. If you are acquiring a triple net asset with an investment grade tenant it immediately shaves a significant chunk off the cap rate. I am also not convinced that investment grade tenants are that much more likely to be good rent payers. Investment grade is not a permanent attribute; a company is only investment grade until it’s not.

To determine tenant credit worthiness I prefer to look at a few other metrics.

- Occupancy – 99.3%

- Rent collection – 100%

That level of occupancy can only be maintained if the tenants are quite reliable. However, occupancy can be cheated a bit in that many triple net REITs will sell their vacant properties. Once sold, it no longer counts as a vacancy. Thus, when relying on occupancy as a testament to quality it becomes imperative to check disposition volumes and the breakdown of those dispositions.

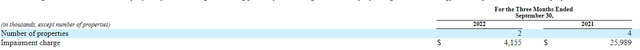

Sale of vacant property will result in an impairment charge. Here are BNL’s impairments.

10-Q

It is worth noting that the 2021 impairments came with a separately recorded $35 million lease termination fee income, so those properties were actually net profitable for BNL.

Such lease termination fee income is the result of BNL’s leases being written correctly in which a tenant has to negotiate if they want to leave before term.

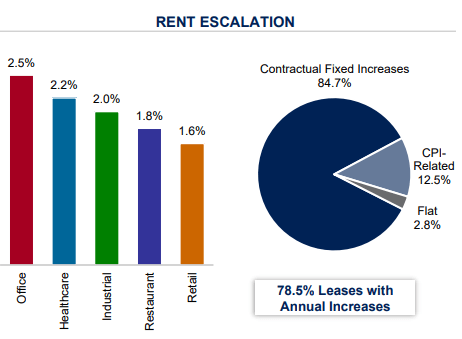

A weighted average remaining lease term of 10.7 years is on the longer end. It comes with average annual escalators of 2% which are included in FFO but not AFFO.

BNL

Thus, we can only give BNL credit for this organic growth if we are valuing it based on AFFO whereas that growth is already in the straight lined FFO.

Given the inflationary environment I see the long lease terms with few near term expiries as a slight negative. BNL will have to wait a fairly long time to be able to mark its leases to the now higher market rates.

Balancing this out is the fact that Broadstone has also termed out its debt with fixed rates and swaps/hedges to fix its variable rate.

Per Ryan Albano, CFO, on the conference call

“At quarter end, our fixed rate debt was 92.5% of total debt”

Thus, BNL is in a steady state. Its revenues are locked in and slightly increasing on an organic basis and its expenses are largely locked in as well.

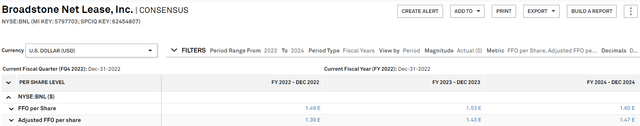

As of most recent quarter, BNL is producing runrate AFFO of $1.40 annually. Consensus estimates call for AFFO to grow at a pace of about 3% annually.

S&P Global Market Intelligence

I think that is in the right ballpark. A percent or two is built in from the organic growth and the other couple percent can come from a fairly robust acquisition pipeline.

Historically their spreads on acquisition have been north of 150 basis points, but the spreads are a bit tight right now due to the high cost of capital. That said, cap rates have risen modestly to allow them to buy at a GAAP cap rate of 7.9% per Chris Czarnecki, CEO, on the earnings call.

“On an external growth front, we invested approximately $205 million in 28 properties at a weighted average initial cash cap rate of 6.5% during the third quarter. The leases for new acquisitions include a strong weighted average lease term of approximately 21 years and solid 2% annual rent escalations, translating into a weighted average GAAP cap rate of 7.9%.”

Given the delta between cash and GAAP cap rates I would anticipate FFO/share to rise faster than AFFO/share.

Valuation

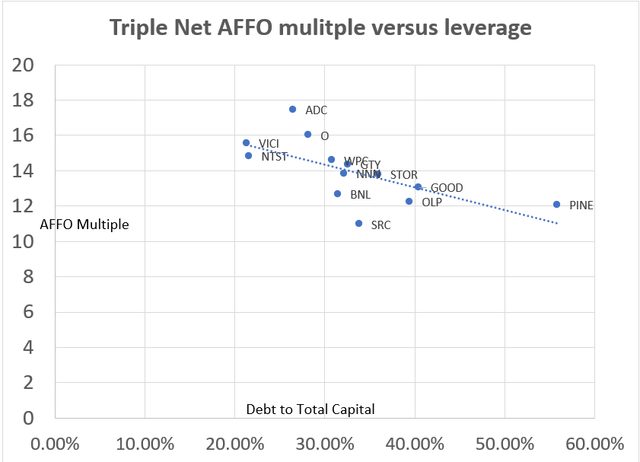

Since triple net REITs have such steady businesses, valuation at the time of purchase is a huge determinant of an investor’s rate of return. Among those that have high quality business models and reasonable leverage, the higher the going in cashflows, the greater the expected return. Here is how the sector stacks up on AFFO multiple plotted against leverage.

2MC

Ceteris paribus, a higher leverage REIT should trade at a lower multiple and based on the trendline that is indeed the case right now. On a relative basis, those below the line are likely undervalued while those above the line are likely overvalued.

It is worth noting that there is quite a bit of variance in property types among the triple nets. I personally think the industrial heavy portfolios should be valued on the higher end. That would be Gladstone Commercial (GOOD), WPC and BNL.

Retail has improved significantly and now deserves to trade in-line with the sector average while the more office focused ones should trade at a discount. Interestingly, the retail focused trade at both the highest (ADC and O) and lowest (Spirit Realty (SRC)) valuations.

Given the stability of BNL’s business I think it should trade at least in line with peers. With its fairly low investment grade leverage, that would place BNL at an AFFO multiple of 14X or a fair value of $20 using forward AFFO of $1.43.

Thus, I see about 15% upside to BNL along with its greater than 6% yield while we wait for the fair value to materialize.

Risks

While I see BNL’s overall risk as slightly lower than the average equity, I think the most likely risk is related to interest rates.

The greater than 10-year WALT (weighted average lease term) makes BNL susceptible to inflation and rising rates. I think BNL would underperform the market if the 10-year treasury gets above 4.75%. The flip side of this is that it is a disproportionate beneficiary if rates come back down.

Be the first to comment