Sundry Photography

In May, Broadcom (AVGO) announced that it was buying VMware (NYSE:NYSE:VMW) for $61 Billion in cash and stock, one of the largest tech acquisitions ever. As a result, VMware is currently living in the odd wait-and-see state of a company that is in the process of being acquired. The single most significant factor that investors are betting on is whether the acquisition will be completed. VMW is also hard to value because the company has failed to demonstrate earnings growth in recent years. As a result, the stock price has been unusually range bound. Broadcom believes that there are growth synergies from the acquisition that can make WMW’s substantial portfolio of products, services, and intellectual property pay off. As the announcement states “With the combined company’s shared focus on technology innovation and significant research and development expenditures, Broadcom will deliver compelling benefits for customers and partners.” After an initial pop following the acquisition announcement in May, with the shares closing as high as $131.99, they have fallen to the current price of $118.12. The major potential blocker for the acquisition is regulatory. The current focus is on EU antitrust concerns, although there are also potential issues in the U.S.

Seeking Alpha

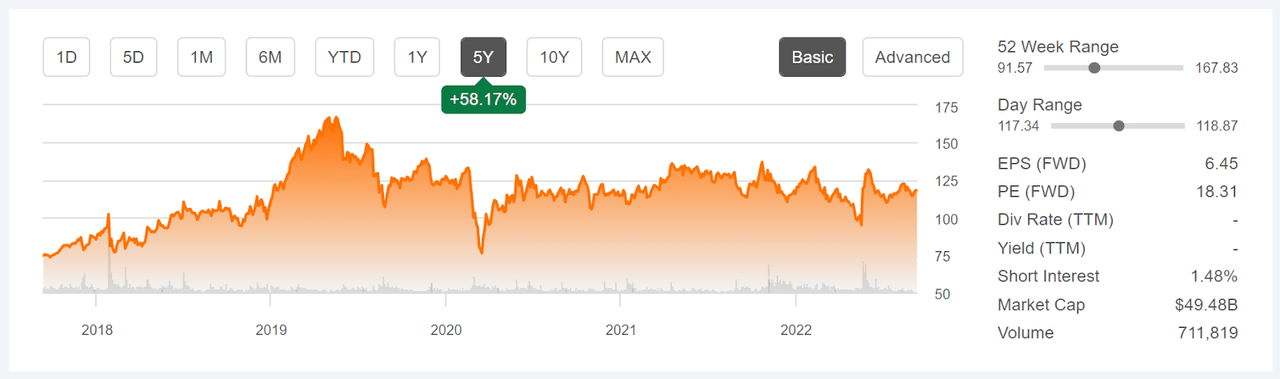

5-Year price history and basic statistics for VMW (Source: Seeking Alpha)

Under the terms of the proposed acquisition, announced on May 22nd, VMW shareholders will elect to receive either $142.50 per share or 0.252 shares of Broadcom for each share of VMW. At AVGO’s current share price of $522.40, the current market value of the share exchange would be $131.64. Broadcom has committed to closing the deal by the end FY 2023, which is the end of October of 2023, about 13 ½ months from now. VMW’s current share price is 17% below the cash offer, reflecting the market’s handicapping on the probability of the deal not going through.

ETrade

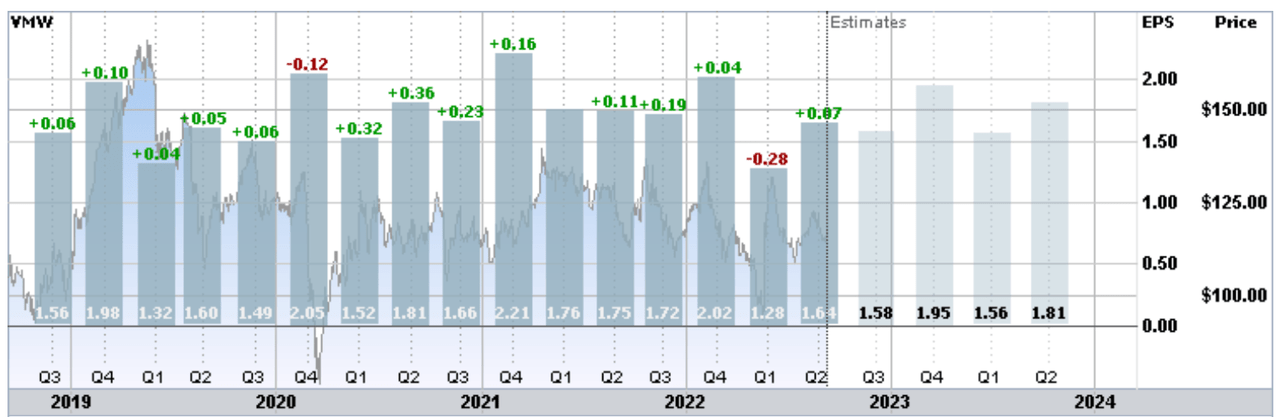

Historical (4 years) and estimated future quarterly EPS for VMW. Green (red) values are amounts by which EPS beat (missed) the consensus expected value (Source: ETrade)

VMW reported FY Q2 results on August 25, 2022, beating expectations on earnings and revenue. While the company delivered significant growth in Software-as-a-Service (SaaS) and subscription revenue, key areas for cloud computing companies, the Q2 EPS is very close to results for the same quarter in 2019 and slightly below the values for 2020 and 2021. Similarly in other quarters of the year, there is no earnings growth. This goes a long way towards explaining why the current share price is 29% below the all-time high closing price of $167.04 on May 16, 2019.

To formulate an outlook on VMW, I am relying on two forms of consensus outlooks. The first is the well-known Wall Street analyst consensus. The second is a probabilistic outlook that is implied by options prices, showing the effective consensus view from the options market. This is called the market-implied outlook. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

Readers may also be interested in my recent posts on AVGO (here and here), in which I use the same approach.

Wall Street Consensus Outlook for VMW

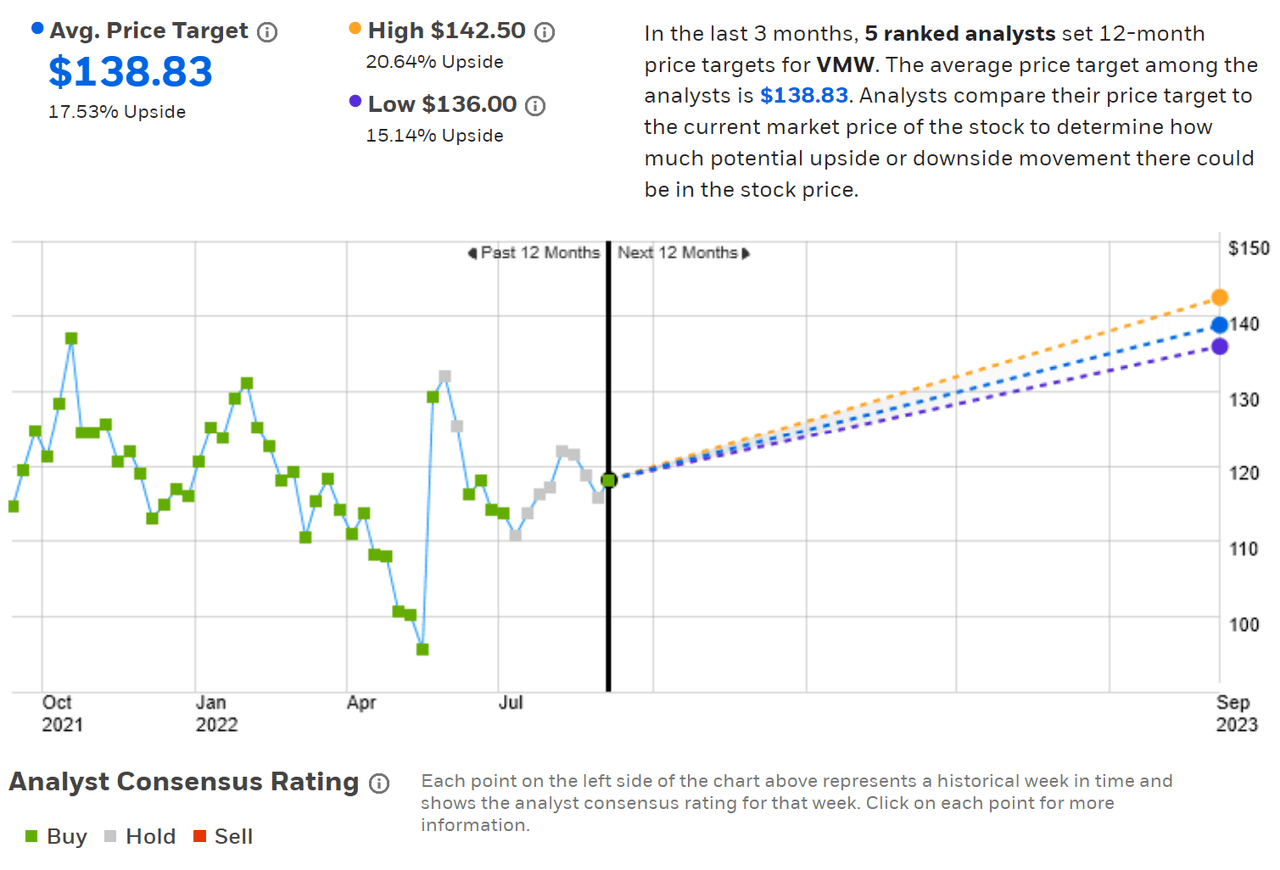

ETrade calculates the Wall Street consensus outlook for VMW by combining the views of 5 ranked analysts who have published ratings and price targets within the past 3 months. The consensus rating has recently changed from a hold to a buy. The consensus 12-month price target is $138.33, 17.5% above the current share price. This price target is a mere 3% below the proposed acquisition price. The range of price targets is very small, ranging from a low of $136 to a high of $142.50. This situation highlights one of the limitations of point forecasts (forecasts that specify a single value). The analysts are undoubtedly aware that there is a meaningful probability that the acquisition will not close, but given the option to predict just one outcome, betting on the deal being completed makes sense.

ETrade

Wall Street analyst consensus rating and 12-month price target for VMW (Source: ETrade)

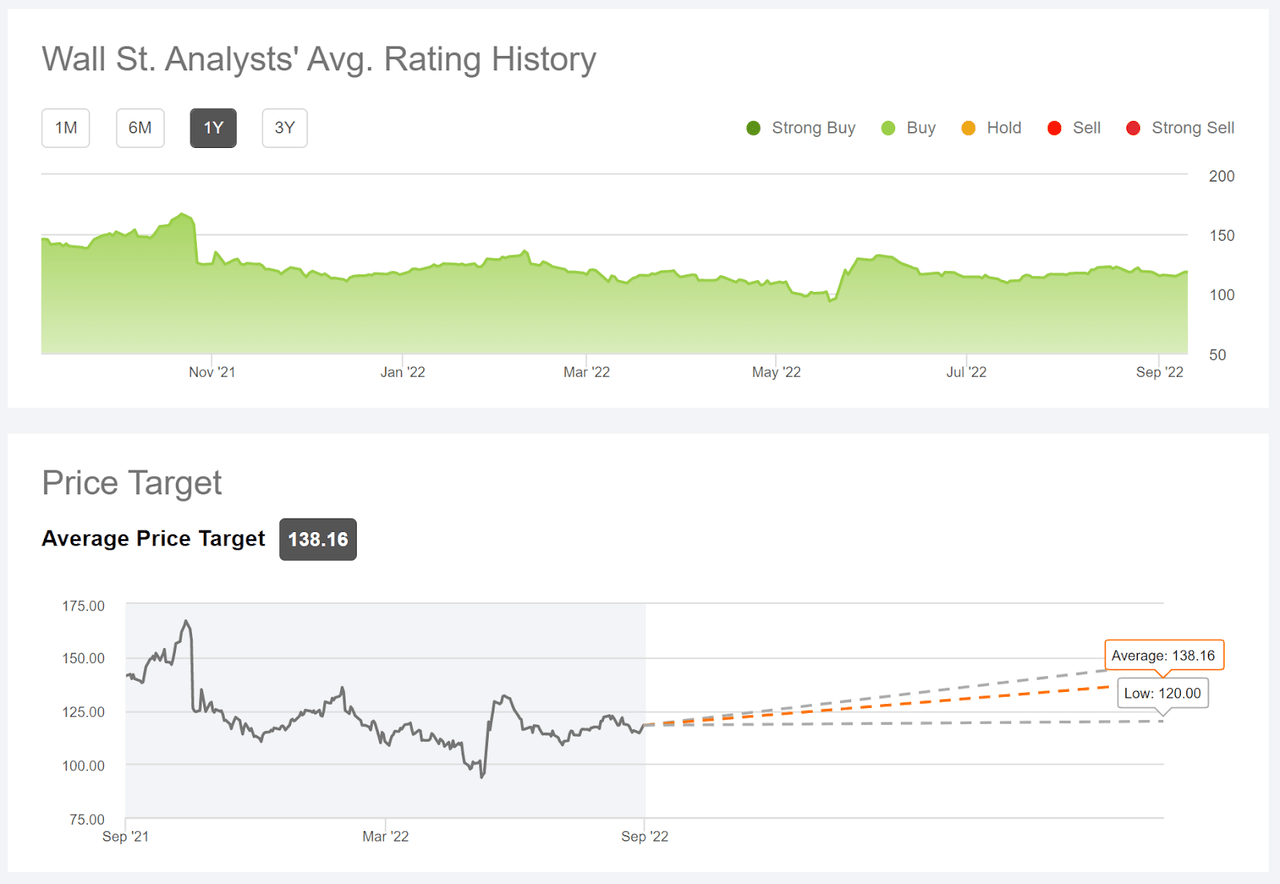

Seeking Alpha’s version of the Wall Street consensus outlook is calculated using ratings and price targets published by 21 analysts over the past 90 days. The results are very similar, although the consensus rating on VWM has been a buy for all of the past year. The consensus price target is $138.16, 17% above the current share price, and there is little spread in the individual price targets, although the lowest is $120, just above where the shares currently trade.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for VMW (Source: Seeking Alpha)

The level of confidence in this acquisition closing, as reflected in the consistency among analyst price targets, can be appreciated by looking at two other companies that are also in this process. One is Elon Musk’s contested acquisition of Twitter (TWTR), which I wrote about in mid-July. Mr. Musk is trying to back out of the deal so, unsurprisingly, there is far less certainty and the spread in the price targets is much higher. Microsoft’s pending acquisition of Activision (ATVI) looks far more likely, and the spread in analyst price targets back in May (when I last analyzed ATVI) was very low, similar to the range currently seen for VMW. Back then ATVI was trading at $78.20 and the highest and lowest 12-month price targets from ETrade were $95 and $100, so the spread was 6.4% of the share price at that time ($5 / $78.20). For VMW, this spread is 4.7% of the current share price ($6.50 / $138.33).

Market-Implied Outlook for VMW

I have calculated the market-implied outlook for VMW for the next 4.3 months, using the prices of call and put options that expire on January 20, 2023. I would have preferred to also look at options expiring further into the future, but the open interest and trading levels of the longer-dated options is too low to make market-implied outlook meaningful.

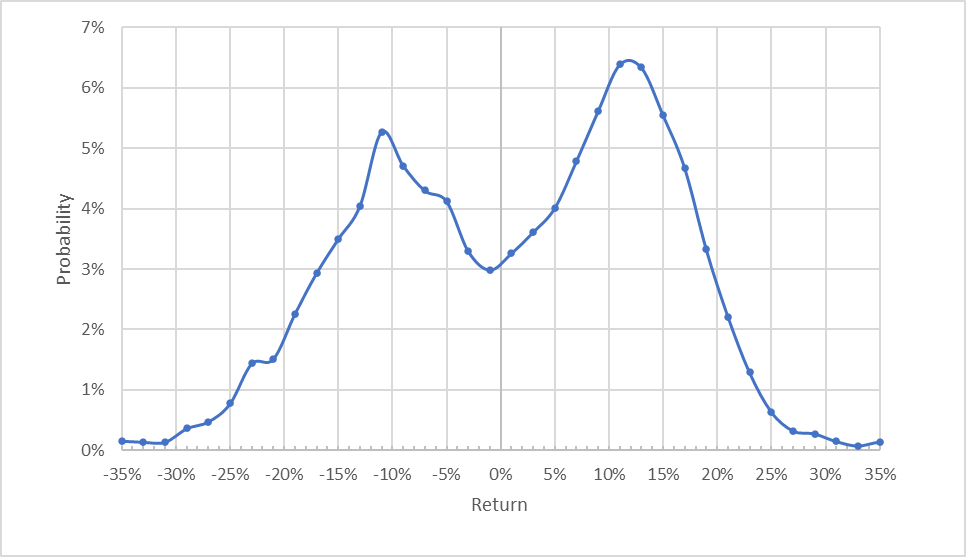

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for VMW for the 4.3-month period from now until January 20, 2023 (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook for the next 4.3 months is bi-modal, indicating that there are high probabilities of either a significant gain or a significant loss and that the probability of ending up in the middle of these is lower. This form of the market-implied outlook is consistent with other cases of pending acquisitions that I have analyzed (see this analysis for Twitter and this one for Activision-Blizzard). I have never gotten this kind of bi-modal market-implied outlook other than for stocks of companies being acquired.

I interpret this outlook as indicating that the positive mode (with a peak in probability corresponding to an 11% gain over the next 4.3 months) represents the deal continuing to work its way forward, and the negative mode (with peak probability corresponding to -11% return) represents a drop in share price if the deal is blocked. Based on this outlook, there is a higher probability of the acquisition continuing to move forward (the probability is higher for the positive mode). The options prices show that there is substantial risk of the deal falling apart, however. The expected volatility calculated from this outlook is 37.4% (annualized).

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias reinforces the conclusion that the options market is signaling favorable odds of this acquisition being completed.

Summary

Broadcom is growing at a healthy rate, with expectations for future gains. I recently reiterated a buy rating on AVGO, based on earnings growth and favorable Wall Street consensus outlooks and a bullish market-implied outlook. The expected volatility was 35% (annualized). This, in turn, indicates that the prevailing view from the analysts and the market does not see untoward risks for AVGO, which includes the current pending acquisition of VMW. This is a favorable result for VMW.

Looking at VMW, the acquisition makes sense. The company is moving in the right direction, with increased focus on SaaS, but recent years’ results indicate that the company is not successfully growing overall earnings. As a result, the VMW has been range bound for years. The tie-up with Broadcom has the potential to unlock the value in VMware’s products and IP. The prevailing view from Wall Street analysts is favorable and the consensus 12-month price target is very close to the acquisition price, indicating low probability of the deal falling through. As a rule of thumb for a buy rating, I want to see an expected return that is at least ½ the expected volatility (37% from the market-implied outlook). Taking the consensus price target at face value, with expected return of 17.25% (averaging the results from ETrade and Seeking Alpha), VMW is just below this threshold. The market-implied outlook for VMW to the start of 2023 is also bullish, with options prices favoring the probability of share price gains, consistent with the acquisition moving ahead. I am assigning a buy rating on VMW.

In my recent article on AVGO, a reader asked if I thought that it made more sense to buy AVGO or VMW. This comment inspired me to write this analysis of VMW. The answer to the question is nuanced. The bi-modal probabilities of outcomes for VMW (substantial gain if the deal goes ahead and a drop of the deal falls through) is quite different from the value proposition from being long AVGO. Buying VMW come with a significant level of regulatory risk, which creates the somewhat binary outcomes. AVGO is more inherently diversified, without this high level of single-source risk that is largely outside of either company’s control. I interpret these results as suggesting that being long AVGO provides a more favorable balance of risk and return, even though VMW has the potential to provide a substantial gain if the acquisition proceeds.

Be the first to comment