lechatnoir/E+ via Getty Images

Brixmor Property Group, Inc (NYSE:BRX) is a real estate investment trust (“REIT”) that owns one of the largest open-air retail portfolios in the U.S, comprised primarily of community and neighborhood shopping centers that are geographically dispersed with an expansive tenant list that includes some of the most successful retailers, such as The TJX Companies (TJX) and The Kroger Company (KR), to name a few.

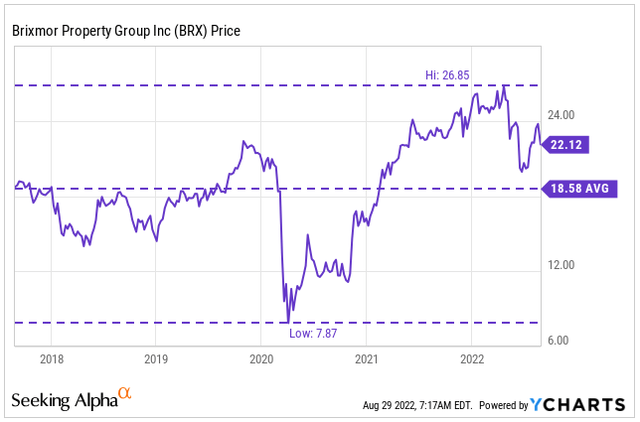

Since the lows last reached during the early months of the COVID-19 pandemic, shares have been on a steady rally, hitting a high of nearly $27 in the earlier half of 2022, before settling to its current range in the low $20s, which is not too far off their trading levels at the end of 2019. Then, shares were trading at about 11.5x forward funds from operations (“FFO”) and an implied cap rate of about 7.5%, on par with current trading levels.

YCharts – BRX’s Recent Share Price History

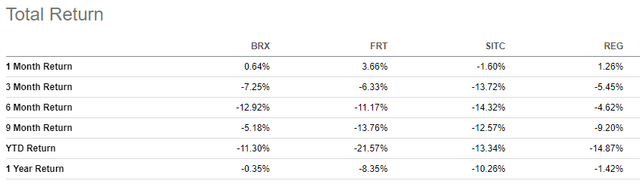

BRX has also fared better than several of their related peers in total returns. While the stock is essentially unchanged over a one-year time frame, similar sized Federal Realty Investment Trust (FRT) and SITE Centers (SITC) are down over 8% and 10%, respectively.

BRX does trade at a discounted pricing multiple to both FRT and Regency Centers (REG), who command multiples in the 16x range. But both these companies are larger S&P 500 components with better dividend histories.

Seeking Alpha Peer Comparison Tool – Total Returns of BRX Compared to Related Peers

With current valuations more-or-less the same as pre-pandemic levels and comparable to SITC, a smaller, but closely related peer who has been significantly outperformed, the upside opportunity in BRX appears limited.

An appreciation of the quarterly dividend payment back to their early 2020 payout levels is one possibility that would represent nearly 20% upside in the dividend. But the 5% implied yield may not be enough for yield-hungry investors. Ample prospects for internal growth, such as their significant pipeline of pending lease commencements, also may not be enough to significantly move the needle. Though BRX is a quality REIT with a favorable outlook, there are more lucrative opportunities elsewhere in the space.

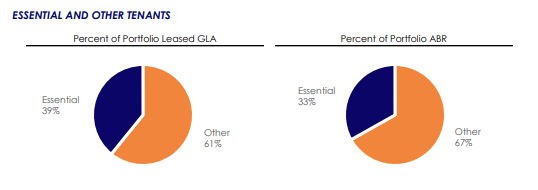

A Portfolio Of Essential And Value-Oriented Retail Centers

BRX owns a portfolio of over 350 geographically dispersed properties that are heavily tenanted by essential and/or value-oriented retailers. Moreover, over 70% of their centers have a grocery-anchored component. In recessionary business cycles, this provides durability to incoming cash flows as these tenants are among the least likely to face financial hardship.

Q2FY22 Financial Supplement – Breakout of Portfolio Composition Between Essential and All Other Tenants

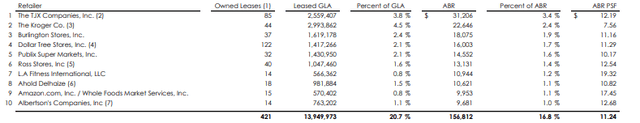

In addition, their value-oriented retail centers provide consumers with an attractive discretionary option in the current macro environment. This provides additional confidence of long-term operator stability. Among their top five tenants, for example, are TJX, Burlington Stores, Inc (BURL), and The Dollar Tree, Inc (DLTR), who in total accounted for approximately 7% of total annualized base rents (“ABR”) as of June 30, 2022.

Overall, their top ten tenants accounted for less than 20% of total ABR. And out of 5,000 tenants, no single tenant accounted for over 5% of total ABR. This level of diversification minimizes the risks associated with individual tenant losses.

Q2FY22 Financial Supplement – Summary of Top 10 Tenants

Attractive Rental Mark-Up Opportunities

Collectively, their top ten tenants had an average ABR of $11.24/psf. This is nearly $5/per square foot (“psf”) below their current in-place ABR, which increased to a post-IPO record of $15.90/PSF in Q2FY22. This gap should provide BRX with a continuous source of internal growth in the coming periods.

In fact, in the current period, BRX signed almost 2M square feet of new and renewal leases at a blended spread of 14.6%. This includes over 850k/sqft of new leases at a comparable spread of 34%.

The growth in base rental rates drove Q2 FFO and net operating income (“NOI”), with same property NOI up 6.7%, owing in part to 430 basis points (“bps”) of contribution from base rental growth.

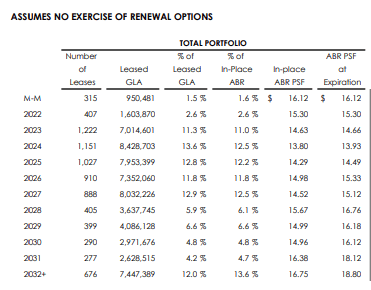

Looking ahead to upcoming expirations, the schedule is comprised of expiring ABR/PSF that is significantly lower than current market rates. This not only provides a further runway for rental growth, but it also highlights the value proposition of BRX’s properties, which serves as a competitive advantage in attracting and retaining tenants.

Q2FY22 Investor Supplement – Lease Expiration Schedule

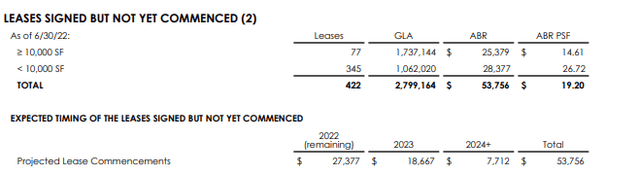

Significant Pipeline Of Pending Commencements

Strong leasing volumes at competitive rates has continued to improve occupancy levels on both a sequential and YOY basis. Through the first half of the year, overall occupancy grew to 92.5%, which is just 30bps shy of their all-time record. Meanwhile, their small shop occupancy rates continue to hit new records, coming in at 87.7% during the current quarter.

Weighing on occupancy is their value-added and development pipeline, which is currently dragging on overall occupancy by 150bps. As this pipeline stabilizes, however, occupancy is likely to hit new records. Timing wise, this should begin to materialize over the next two years at an estimated ABR of +$53.8M at a blended rate of $19.20, which is over 20% above current rates.

Q2FY22 Investor Supplement – Summary of Pending Lease Commencements

The spread between billed and leased occupancy also remained at 350bps in the current period. This is up from 300bps in the same period last year. This provides strong visibility to BRX’s future growth prospects, particularly with their small shop tenants and for spaces less than 10k square feet, which should benefit from ongoing efforts to improve the quality of their anchor tenancy.

Some Relevant Threats To Future Earnings Growth

BRX continues to benefit from a favorable leasing environment marked with robust demand and sticky cap rates. This is enabling the company to drive rents higher in each reporting period. With the economic outlook increasingly growing more uncertain, however, BRX’s portfolio may be at greater risk than some of their peers.

The average household income in BRX’s markets, for example, is just over $100K. While this is a significant improvement from the $80K reported at the end of 2015, it trails both FRT and SITE, whose averages are $151K and $110K, respectively. The lower incomes in BRX’s operating regions could weigh on their tenants if there is a pullback in customer traffic levels. This could result in pushback on further rental hikes in future negotiations.

BRX is also more heavily indebted than both FRT and SITE, with a net debt multiple above 6x versus a few turns below that in both their peers. Though the gap isn’t significant, it still requires the use of more resources to debt servicing costs than either of their peers.

Granted, BRX still has an investment-grade credit rating from all three rating agencies, with a positive outlook from Standard & Poor’s. Additionally, they have over +$1B in liquidity with no significant near-term maturities. But, nevertheless, the greater debt load still serves as a barrier relative to peers.

A Safe Dividend But Not Enough For Yield-Hungry Investors

Management did note on the current earnings call that BRX would be net sellers for the remainder of the year. This will add to their existing dry powder to be used for opportunistic acquisitions in later periods, debt paydown, or dividend growth.

With pending commencements expected to drive EBITDA growth over the next two years, leverage should naturally begin to decrease. In addition, the company is generating strong free cash flows, which is being used to fund the majority of their redevelopment efforts. With funding for debt servicing and acquisitions largely accounted for, the dividend payout is next in line for consideration.

On this, there is room for growth, as the quarterly payout is still approximately 20% below pre-pandemic levels. At a payout ratio of less than 50%, BRX does have the flexibility to enact further increases.

Most recently, the payout was increased by 11.6% in 2022. And a similar sized increase in 2023 is likely as well, given current operating trends. That would take yields to about 4.8% at current trading levels, which is respectable for a high-quality REIT such as BRX. But it may not be enough to satisfy yield-hungry investors who demand a greater offset to the impacts of inflation on nominal receipts.

A Quality Shopping Center REIT Best Left On Hold

BRX is a quality REIT with one of the largest portfolios of open-air shopping centers tenanted by a large base of non-discretionary essential and value-oriented retailers. This provides downside protection to the portfolio, as these centers have proved more durable through challenging operating conditions.

Investors that bought in to the company during the early months of the COVID-19 pandemic would have been handsomely rewarded with significant share price appreciation, along with the partial restoration of the dividend payout.

With the current dividend still nearly 20% below former levels, there is still strong upside to be had. For yield-hungry investors, however, the appreciated 5% implied yield may not be exciting enough, considering close peer, SITC, would yield approximately 6% at pre-pandemic payout levels.

Given current outperformance and valuations, material upside in the stock also appears to be limited. BRX does have numerous catalysts for internal growth, but it may not be enough to convince a herd of investors, especially on current daily volumes.

Household incomes in their markets that are generally lower than their peer set is one risk that could negatively impact their operators in the event of a prolonged pullback in consumer spending. In addition, though their current debt load is within targets, it is still higher than both FRT and SITC. Not only does this create a drag on earnings, but it may also limit their capacity for external growth.

While BRX makes for a solid long-term portfolio holding for existing shareholders, new investors may be better off deploying capital to more lucrative ventures.

Be the first to comment