MarsBars

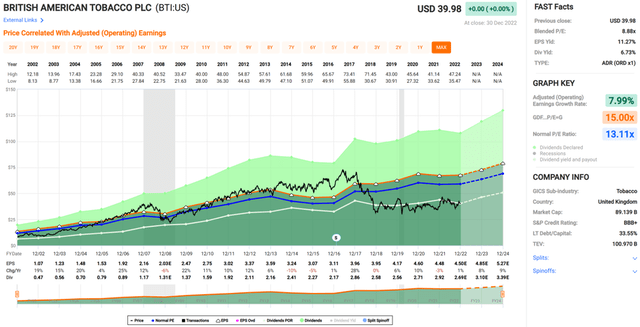

It’s simply hard to find a stock that’s well-diversified internationally, has good prospects, is cheaply priced with a high yield. Yet that appears to be the case with British American Tobacco (NYSE:BTI), which currently trades slightly under $40 and sits well off its 52-week high of $47.

High yielding investments can be great for helping to offset living expenses in an inflationary environment. In addition, tobacco is one of the most inflation resistant products on the market, and in this article, I highlight why BTI is a sound buy at present levels, so let’s get started.

Why BTI?

British American Tobacco is the largest global nicotine company in the world, with a strong presence in the U.S. and around the world. It’s home to a number of well-respected brands including Camel, Newport, Lucky Strike, and Dunhill.

It’s no secret that, BTI, like its peers Altria (MO) and Philip Morris International (PM) have faced pressure from declining cigarette volumes over many years. While the big players have proven adept at raising prices to offset to volume declines, this model may not be sustainable for the very long term. In addition, BTI faces unique risks in the U.S. due to its outsized exposure to Newport, which is popular for its menthol flavoring that’s drawn risks to a regulatory ban.

However, BTI has responded well with a strong portfolio of reduced risk products, including Velo (nicotine pouches), glo (heated tobacco), and Vuse (vaping). Impressively, Vuse is now the #1 selling vaping product in the world, and in the U.S., it took the helm from away from Juul, with a commanding 43% market share.

Moreover, BTI now has leadership in the international market (ex-U.S.) with its modern oral Velo product. All in all, BTI has grown its reduced risk product customer base to 20 million as of 1H 2022, and I would expect continued growth in the upcoming second half results.

In the medium to long-term I see traditional combustible products as being a solid bridge for BTI’s operating fundamentals as it transitions its customers to RRPs. This is reflected by respectable revenue growth of 4% YoY on a constant currency basis in the first half of 2022. Notably, BTI is demonstrating positive operating leverage, as EPS grew at a higher 6% rate on a constant FX basis. BTI continues to demonstrate high profitability, as it converts 77% of its profits into cash, due to a low amount of depreciation and other non-cash items.

Looking forward, I see plenty of growth runway for BTI in the RRP pace, with the introduction of its next generation glo device and other innovations. Management highlighted notable attributes of this device during the recent Barclays (BCS) Consumer Conference:

We have our product, glo hyper, in THP, that we are now introducing a new revamped device – it’s called X2 – with new functionalities. It’s lighter. It’s smaller. And at the same time, we are also introducing new consumables, which is much more satisfying for the consumers. So, the increased satisfaction plus a much more attractive device will give us the assurance that we are going to keep this momentum on THP going.

We are also introducing in the vapor space our first disposable – modern disposable – product. It’s called Vuse Go. We have rolled it out in France, Ireland, Spain, and Germany, and we have both plans to go even beyond Europe until the end of the year. And in terms of the modern oral (inaudible), we have introduced a new recycle cans. Also, mini pouch, that makes it much more comfortable for the users to use it. And also, different levels of strength of nicotine.

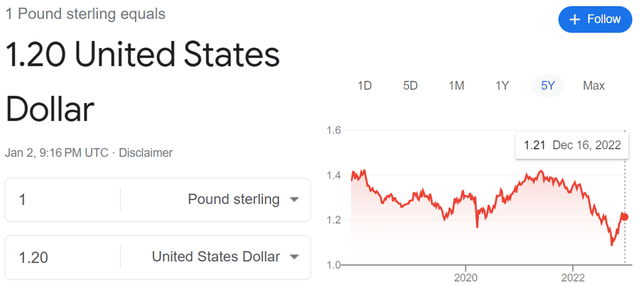

Importantly, BTI, like its tobacco peers, is known for capital returns to shareholders. This includes £1.3 billion worth of share buybacks in the first half of last year alone. BTI also pays a well-covered dividend with a 58% payout ratio as a percentage of unlevered free cash flow. It’s important to note, however, that the dividend is subject to currency fluctuations. While the British pound dropped substantially in value to the USD in the fall of last year, it’s since rebounded, which bodes well U.S. dividends.

Pound to USD Conversion (Google)

Lastly, BTI is attractively priced at $39.98 with a forward PE of just 8.6, sitting far below its normal PE of 13.1. I find this discount to be unwarranted, considering BTI’s BBB+ rated balance sheet, aforementioned progress in new product offerings, and sound operating fundamentals. Analysts have a consensus Buy rating on the stock with an average price target of $51.40, implying potentially strong double-digit total returns for shareholders.

Investor Takeaway

British American Tobacco is a leading tobacco company with a strong portfolio of reduced risk products. It has demonstrated solid progress in transitioning its customers to RRPs and possesses sound operating fundamentals. Management is committed to capital returns to shareholders in the form of buybacks and dividends. The stock is attractively priced at 8.6x forward PE, providing investors with potential double-digit total returns from present levels.

Be the first to comment