sanfel

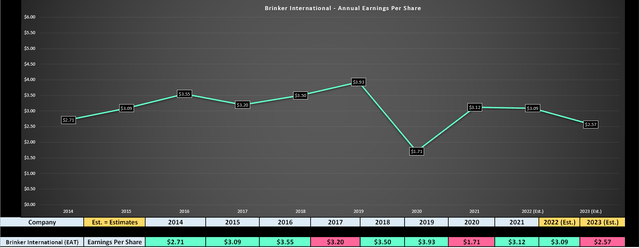

Just over six months ago, I wrote on Brinker (NYSE:EAT), noting that I was exiting my position at $34.00 given that I was less confident in an earnings beat in FY2022 (FY2022 estimates at the time were $3.45). This turned out to be the correct move. Annual EPS came in 10% below estimates. The forward earnings outlook came in much worse than expected. And the stock has seen a drawdown of 36% from my January exit at its June lows.

While there’s been a sharp increase in bullish bets recently, I still don’t see enough margin of safety just yet at $26.00 per share. This is because while the stock might look cheap relative to historical metrics, I don’t see an easy path back to pre-COVID-19 restaurant margins. Besides, this is an industry that continues to struggle from demand destruction and a tight labor market, putting upward pressure on wages medium-term. Let’s take a closer look at the fiscal Q4 results and FY2023 outlook below:

Chili’s Restaurant (Company Presentation)

Q4 Results

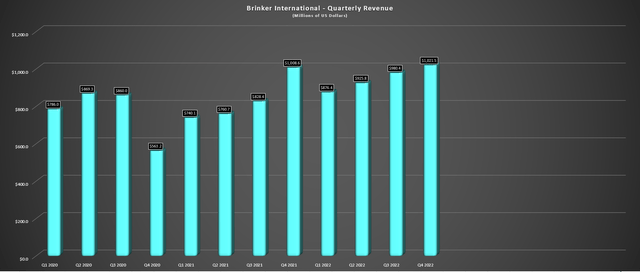

Brinker released its fiscal Q4 (CY-Q2) results last month, reporting quarterly revenue of $1,022 million, a 1% increase on a year-over-year basis. While this might appear to be a solid result given the tough Q2 for the industry with multiple headwinds from a traffic standpoint (elevated gas, grocery, and mortgage costs), the revenue growth was only made possible due to pricing, with comp sales up 3.1% year-over-year, but pricing up 5.2%. While this isn’t a huge surprise for an industry that has seen a sharp decline in traffic since Q1, this is much less attractive revenue growth, partially offset by the impact of one less operating week than last year.

Brinker International – Quarterly Revenue (Company Filings, Author’s Chart)

During fiscal Q4, Brinker reported comp sales of 3.1%, driven by 0.3% comp sales growth at Chili’s and 30.1% comp sales growth at Maggiano’s. Total company sales were ~$987 million (Q4 2021: ~$991 million), which would have been up year-over-year when adjusting for the thirteen weeks vs. 14 weeks in Q4 2021. The company noted that its virtual brands made up 6% of its business and that Chili’s off-premise sales have remained elevated, coming in at 34% of sales in the period despite a return to more normal dining.

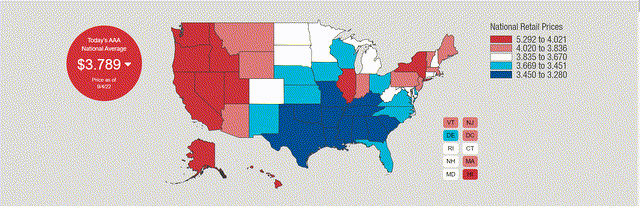

From a traffic standpoint, the industry-wide traffic trends have not been pretty, and Chili’s wasn’t immune from this despite its strong value proposition relative to other casual dining brands. Consistent with industry-wide trends, Brinker noted that its lower-income customer has started to visit less often, which isn’t surprising given that they’re being hit from all angles, with the two more extreme changes being higher gas prices and higher grocery costs. Fortunately, gas prices have pulled back considerably from their highs, providing some relief and translating to a better August from a traffic standpoint for the industry.

Retail Gas Prices (AAA Gas Prices)

In the prepared remarks, Brinker noted that it’s looking at reducing discounting to focus instead on sustainable traffic. Still, it must be careful not to price low-income guests out of casual dining. This could be achieved by better communicating its value proposition in Kevin Hochman’s DNA, formerly leading Pizza Hut US and being Chief Concept Officer at KFC in the quick-service industry. The good news is that it hasn’t seen any real trade-down to date, which would be a double whammy if it were to see more affluent guests manage checks while low-income guests reduce the frequency of their visits.

On a higher level, Brinker’s new CEO, Kevin Hochman has a team focused on driving sustainable and profitable sales, while the other team focuses on simplifying operations to improve the guest experience. Early initiatives to benefit the latter and cut costs look to be a simplification, such as reducing redundant SKUs, taking out unneeded processes, and simplifying Maggiano’s virtual SKUs while reducing food waste in its new It’s Just Wings business. Other opportunities include technology with new kitchen equipment, which is expected to allow the kitchen to be faster and more consistent with reduced cook times, potentially improving table turns and boosting dining room sales.

Chili’s Menu (Company Presentation)

Although it’s positive to see a plan to turn things around, this does not appear to be an easy turnaround, and the FY2023 outlook left a lot to be desired. For starters, the company expects low single-digit negative traffic for Chili’s and further in food and beverage costs after lapping a nearly 200 basis point increase year-over-year in FY2022. Meanwhile, revenue is expected to be up only slightly to $3.95 billion at the mid-point on a year-over-year basis, while annual EPS is forecasted to decline at a double-digit pace to $2.65 in FY2023 (FY2022: $3.09). Current annual EPS estimates are lower than the mid-point at $2.57, which, if correct, would be a 17% decline year-over-year. Let’s look at Brinker’s margins and earnings trend below:

Margins & Earnings Trend

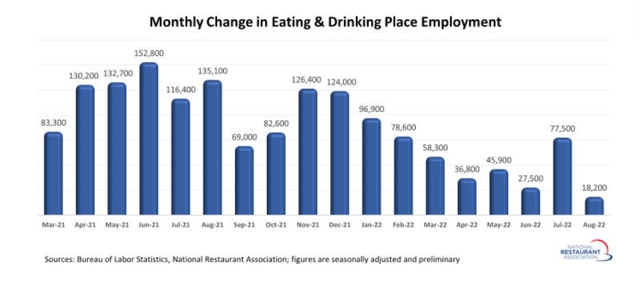

Brinker is having a difficult enough time with sales due to a weakening American consumer and is still seeing issues from a staffing standpoint, with turnover being well above pre-COVID-19 levels. The silver lining is that it’s not having difficulty from a hiring standpoint. Still, with elevated turnover, training costs can add up quickly and impact profitability, and productivity can also be impacted with less experienced staff. This is an opportunity to improve margins from a labor standpoint over time. However, with limited job growth in restaurant employment and larger retail/restaurant names continuing to raise wages (creating competition), I don’t see this issue going away immediately.

Restaurant Jobs – Monthly Changes In Employment (National Restaurant Association, BLS)

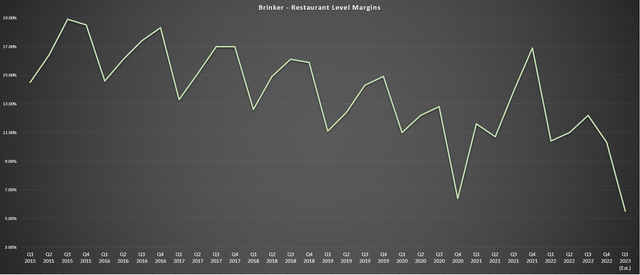

From a food cost standpoint, it isn’t getting any help here either, with poultry continuing to be one area where we’re seeing significant inflation and this protein making up a very high mix across Brinker’s menus. The result of higher labor costs and a more expensive market basket was that restaurant margins dipped to just 10.3% in fiscal Q4 2022 and are expected to slide to below 6% in fiscal Q1 2023, a massive decline from 11.1% in Q1 2019 and 14.5% in Q1 2015. While there was an 80 basis point impact in the fiscal Q4 results from lapping the 53rd week, this is still very significant margin erosion, and the trend was already declining pre-COVID-19.

Brinker – Restaurant Level Margins (Company Filings, Author’s Chart)

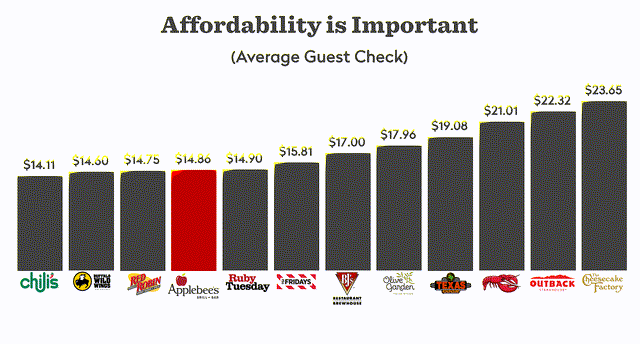

Brinker noted that it plans to take pricing to help combat these inflationary pressures, with Chili’s expected to be at 8% pricing for FY2023, with Maggiano’s closer to 7%. While this will help to reduce the impact of inflationary pressures, it’s less clear whether restaurant brands will have the pricing power they did last year when confronted with a much weaker consumer, potentially backfiring if the situation worsens. The only silver lining is that Chili’s has some of the lowest average checks and is a more iconic brand than Red Robin (RRGB) on the low end of the average guest check industry-wide. So, even if Chili’s raises prices and reduces discounting, it still stacks up very well relative to the competition.

Average Guest Check – Casual Dining Brands (Dine Brands Presentation)

Finally, looking at the earnings trend below, estimates have continued to weaken, with FY2023 annual EPS estimates sitting at $2.57, down 34% from the FY2019 peak ($3.93), impacted by Brinker’s operator model vs. mostly franchise models like Restaurant Brands International (QSR) with more defensive positioning (fast food vs. casual dining) that continue to grow annual EPS. In my view, companies in the fast food segment are a far better bet if one is interested in exposure to the space. This is because fast food and pizza tend to hold up much better in a recession, and many of these names benefit from highly franchised models. For example, RBI is ~99% franchised, meaning it’s seeing minimal pressure from a margin standpoint. Let’s look at Brinker’s valuation below to see if the challenging year ahead is priced into the stock:

Brinker International – Annual Earnings Per Share (YCharts.com, Author’s Chart, FactSet)

Valuation & Technical Picture

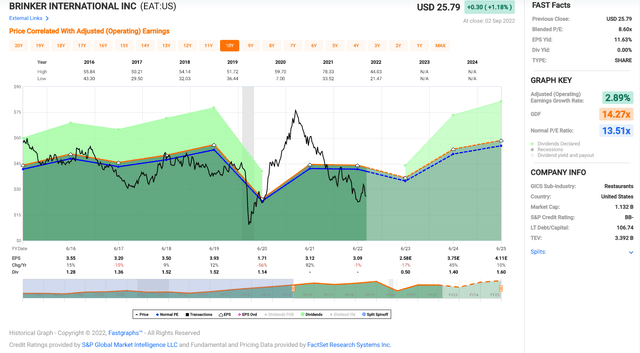

Looking at Brinker’s historical multiple, the stock has traded at an average of 13.5x earnings (10-year average). However, this was in a period when the company was growing annual earnings per share [EPS] and when we did not have near unprecedented headwinds. Given the unfavorable setup currently and the fact that Brinker’s annual EPS is well below pre-COVID-19 levels (FY2019: $3.73), I think a more fair multiple for the stock is 11, especially given the steady margin erosion. Based on FY2023 annual EPS estimates of $2.57, this translates to a fair value for the stock of $28.30, suggesting the stock is not as cheap as some analysts have suggested.

Brinker – Historical Earnings Multiple (FASTGraphs.com)

While this figure points to a nearly 10% upside from current levels, I prefer a minimum 30% discount to fair value to justify entering new positions in small-cap names. This is especially true when it comes to non-industry leaders like Brinker. After applying this discount to bake in an adequate margin of safety, the buy zone for Brinker would come in at $19.80 or lower, requiring another 20% drop from current levels. Obviously, this may not occur, but this is where the stock would at least become interesting and justify some of the risks by betting on a turnaround here for a business with consistent margin erosion.

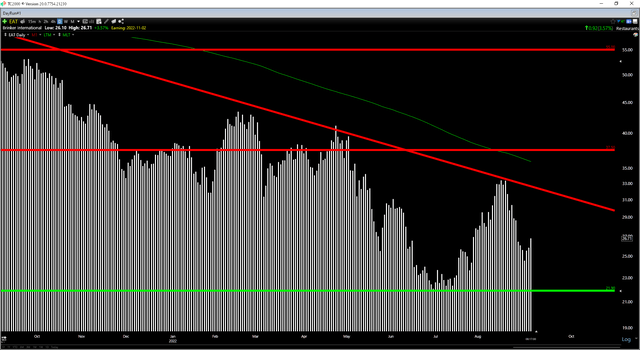

EAT – Daily Chart (TC2000.com)

From a technical standpoint, the picture is improving a little, with EAT’s next resistance levels coming in at $31.30 (downtrend resistance) and $37.50. If we compare this to what appears to be strong support at $21.90, the stock has $4.10 in potential downside from a current share price of $26.00 and $5.30 in potential upside to resistance. This translates to a reward/risk ratio of 1.30 to 1.0. However, in cyclical bear markets for the S&P 500 (SPY), I prefer to buy at support or on undercuts of support. Hence, I would not get interested in the stock from a technical standpoint until at least $21.90.

Summary

Brinker appears confident in its ability to significantly improve earnings in the back half of fiscal 2023. If successful, the company should be able to generate at least $2.60 in annual EPS this year. However, I don’t see a valuation of 10x earnings being that cheap for a company with ~6% operating margins, especially in an industry that continues to face considerable challenges – from a challenging staffing environment to a weaker consumer with multi-year low personal savings rates.

So, while the stock is getting closer to support after its recent 30% retracement, the buy zone from a technical standpoint wouldn’t come in until $21.90 or lower. To summarize, I don’t see Brinker as attractive yet from a fundamental or technical standpoint. In fact, given that many investors might be anxious to exit at break-even after suffering drawdowns, I would view rallies above $31.50 before November as profit-taking opportunities. For investors looking for value, I prefer Agnico Eagle (AEM), trading at ~16x FY2023 earnings estimates with much higher margins with no demand destruction.

Be the first to comment