RHJ/iStock via Getty Images

Brilliant Earth Group Inc. (NASDAQ:BRLT) is an organization that has built a strong reputation in the jewelry industry since its inception in 2005. It has gained extensive appeal and increased consumer appetite through its unique approach to all facets of making jewelry. Foremost in its brand values is incorporating ethics into making jewelry that appeals to the masses.

Brilliant Earth delves into both natural and lab-created diamonds for jewelry. The former are predominantly sourced from Namibia and Botswana, while the lab-created diamonds emanate from Canada. Other materials used, such as Sapphires, are sourced from Australia, while gold and silver are mainly recycled materials sourced from organizations that delve in them extensively and are responsible miners.

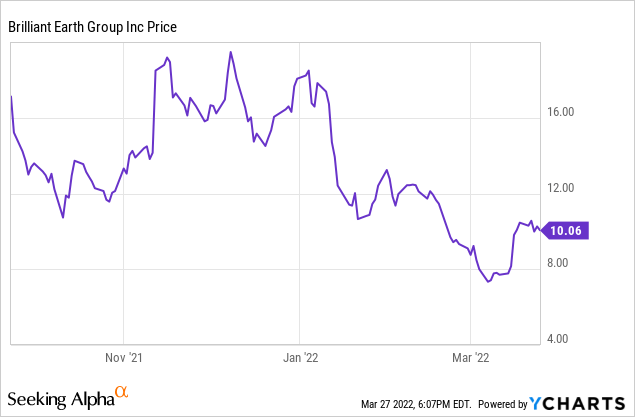

ycharts.com

The market has experienced a sizeable shift in consumer demand leading to many organizations such as Brilliant Earth capitalizing on the rise in orders to make additional revenue.

Covid-19 and Its Relationship With Jewelry

At the onset, the measures in place regarding Covid-19 did not directly impact the jewelry industry. As the pandemic continued and lockdowns were imposed, there was a substantive shift in the effect of the pandemic on the industry. Jewelry organizations are predominantly brick and mortar stores, and there is only so much of the assembling and creation of pieces that can be done remotely.

Due to this, many organizations, including Brilliant Earth, had to close their doors and wait for reprieve as all other companies within or outside the industry were doing during that period. It led to a halt in production and general business. For this reason, Brilliant Earth, together with other organizations, had to find ways to reduce their costs extensively, which meant lowering wages for many of its employees coupled with a general shutdown in operations. Unfortunately, their values change drastically within the market, as the prices of diamonds, sapphires, gold, and silver have been volatile.

A wedding during the pandemic became an elaborate and, in some cases, impossible affair. Obtaining a marriage license was significantly tricky, and it involved processing it online, from paperwork to trying to get virtual appointments. Often, periods of stress have been known to push people towards marriage. The pandemic had an emotional effect on many individuals, more so the realization that time is limited; it is best to enjoy and seize moments to be happy as much as possible. A growth in engagements was exhibited, with over 80% of individuals living together hoping to get married once the pandemic was over.

The emotive reaction within and outside the United States saw many consumers increase the purchase of engagement and wedding rings. Gifting equally gained traction that saw a heightened increase in purchases of all forms of jewelry, be it rings, necklaces, bracelets, and earrings. The restrictions imposed during the pandemic equally restrained many consumers from having their weddings or celebratory functions. The backlog leads to many weddings, engagements, and celebratory functions, leading to more consumers purchasing jewelry, including those made Brilliant Earth. In the third quarter of 2021, the organization raked in a high sales volume, growing it by 100%.

Implications of the IPO

Brilliant Group Inc raised around $115 million in its initial public offering and is currently trading globally. The organization remains steadfast in combining the aesthetics market, especially jewelry, with ethics and inclusivity. Previously, jewelry was seen to be a Veblen good, and it still is but not one for consumption through the e-commerce market. The market felt consumer heavy and privy to all, in contrast to the depiction of the jewelry market. Brilliant Earth is one of the organizations within the jewelry sector to incorporate e-commerce in its trade by offering consumers a unique experience of creating their own jewelry.

There are two main functions of the organization’s IPO offering: fundraising and publicity. One of the many advantages of an IPO is money. Often, the amount of funds provided through an IPO is high and can quickly transform an organization. The proceeds of the IPO were slated at $115 million, which is an amount that the organization can utilize in its expansion and increased investment in research and development.

Brilliant Earth aims at using the funds to increase its operations of sourcing gemstones and increase its number of showrooms. The IPO resulted in a sale of over nine million shares within the Class A common stock. Publicity comes in the form of growth and increased exposure to customers. An IPO naturally thrusts an entity into the public array, and through it, an organization can substantially increase its sales from the increased brand visibility. Equally, credibility is enhanced owing to the implication that extensive scrutiny has taken place for the organization to be listed.

Financial Performance

The net sales for Brilliant Earth recorded an increase over the nine months leading to the IPO offering by the organization. This is in line with the anticipated increase that was expected growth in the market owing to the decline in the stringent rules imposed during the Covid-19 pandemic and eventual lockdown. Movement and activities were slowly resuming to normal, leading to an incline and rise in demand in the market. The organization moved in sales from $163 million to around $258 million within the same period in 2020 and 2021. There was equally a rise in the cost of materials of 20% from 2020 to 2021.

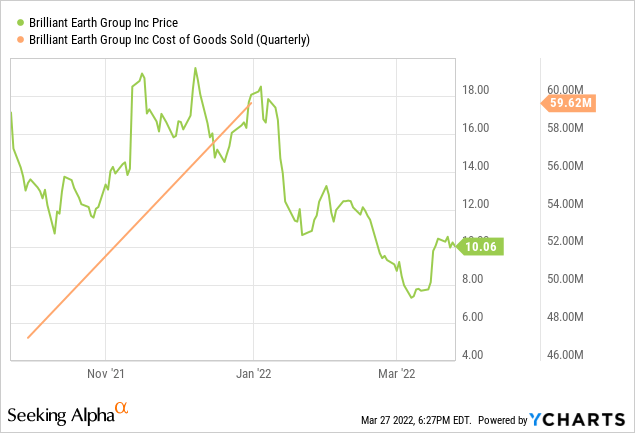

ycharts.com

The sales increased extensively to $380 million in 2021 and a consequent increase in the cost of goods from $140 million to $192 million. The cost of goods for jewelry retailers such as Brilliant Earth is mainly pegged on the prices of diamond, gold, and their respective market prices coupled with those of other precious metals and stones such as sapphires that the organization essentially uses in the production of its jewelry.

The effects of the pandemic were depicted through an anticipated rise in inflation. The strained supply chain and increase in demand for products led to inflation. To counter such incidences, Brilliant Earth should have forward contracts and options to ensure that the cost of goods sold does not erode the profits made by the organization.

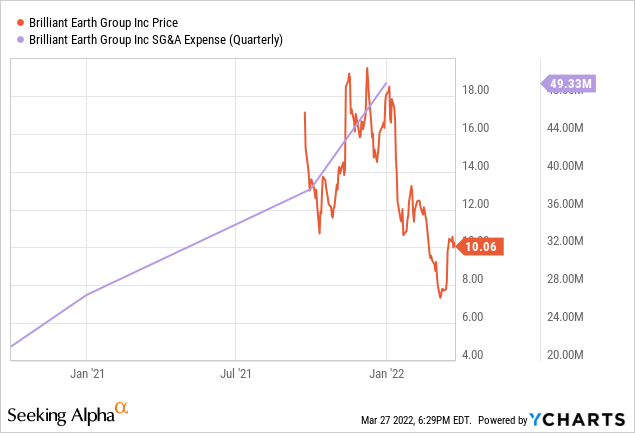

ycharts.com

Selling, General, and Administrative expenses ((SG&A)) are mainly in the form of salaries and all costs incurred in selling the jewelry. In 2021, Brilliant Earth incurred $140 million on SG&A, leading to a lower net income considering the generated sales revenue.

The jewelry industry is centered mainly on product differentiation. To gain traction and boost customer loyalty, an organization within the industry must produce unique products that appeal to its niche market. In addition to that, organizations such as Brilliant Earth make customized pieces which adds to the selling and administration expenses. The industry has shifted extensively from bulk manufacturing and taken more of a retail appeal in manufacturing its products. The component that jewelry companies such as Brilliant Earth can substantially save on costs in purchasing materials.

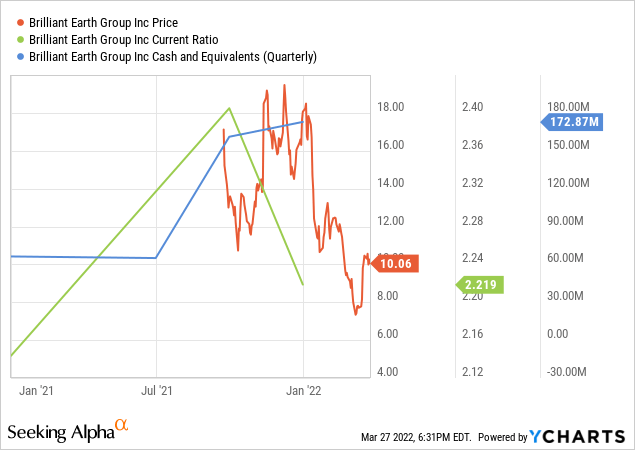

ycharts.com

The organization saw a rise in cash and cash equivalents by 143%, from $66 million to $173 million in 2020 and 2021, respectively. It can be attributed mainly to the increase in the availability of cash for operations resulting from the IPO undertaking in 2021. Its current ratio stands at 2.2. in 2021 and 1.22 in 2020. A current ratio above 1 intimates that the current assets are not fully utilized within the business to generate additional revenue.

Brilliant Earth must explore its high cash balance at the end of the year and seek ways to reduce it to generate more revenue. The organization had an extensive rise in its property, plant, and equipment PPE, from 2020 to 2021 by 201%. Brilliant Earth is seeking to expand and have additional stores spun across its key markets. The rise in PPE is most probably due to the additional stores being set up by the organization.

Future Outlook

Brilliant Earth has witnessed an upward trajectory in its sales over the last few years, with its highest growth in 2021. The change is a culmination of various factors, notably the IPO in the same year, the effects of the pandemic leading to an increase in demand for products, and lastly, increased visibility for the brand.

To thrive in the jewelry industry requires brand value. Brilliant Earth has an opportunity to increase its brand recognition through its ethical and inclusivity approach. Current and future consumers are more centered on buying products from brands that are deeply rooted in providing ethical brands and inclusive within their processes, which naturally ties to the organization’s brand values. The same cannot be said for numerous companies within the sector, leaving the playing field wide open for Brilliant Earth to acquire a sizeable market share in the future.

Be the first to comment