ipopba

A Quick Take On Bright Health

Bright Health Group (NYSE:BHG) went public in June 2021, raising approximately $924 million in gross proceeds from an IPO that was priced at $18.00 per share.

The firm is building a national, integrated healthcare system via telehealth, in-person care clinics, and value-based care provider partners.

Until we see performance improvements show up in financial results and a meaningful turn toward operating breakeven, I’m cautious on BHG.

My outlook on the stock for the near term is a Hold.

Bright Health Overview

Minneapolis, Minnesota-based Bright Health was founded to develop an optimized healthcare service delivery platform via integrated personal care programs.

Management is headed by President and CEO G. Mike Mikan, who has been with the firm since 2019 and was previously Chairman and CEO of Shot-Rock Capital and interim CEO of Best Buy.

The company’s primary aspects/offerings include:

-

Local care partner alignment

-

BiOS – care optimization system

-

Patient care financing

The company pursues relationships with physician groups who can serve either commercial or Medicare Advantage patients.

Bright Health’s Market & Competition

According to a 2017 market research report by LEK Consulting, the U.S. market for Medicare Advantage is advancing toward a 70% penetration rate among seniors by 2040.

This represents an expected average rise of 1.5% per year from 2010 to 2040.

The main drivers for this expected growth are predictability, more benefits, care coordination, and lower annual healthcare costs.

Also, the federal government encourages the plan because it focuses on cost trend management and not fee-for-service.

Major competitive or other industry participants include:

-

Aetna

-

Cigna

-

Anthem

-

Centene

-

Humana

-

UnitedHealthcare

-

Blue Cross Blue Shield licensees

-

Kaiser Permanente

-

Agilon Health

-

ChenMed

-

Iora Health

-

Oscar Health

-

Oak Street Health

-

OptumHealth

-

VillageMD

Bright Health’s Recent Financial Performance

-

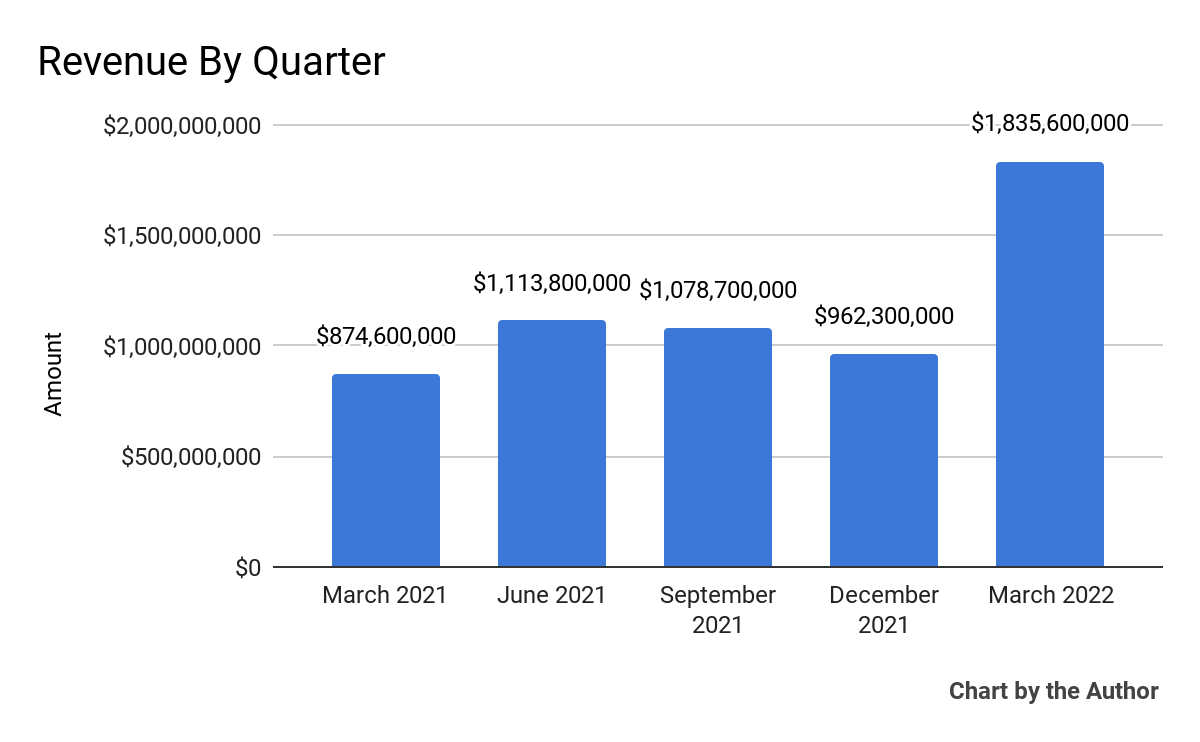

Total revenue by quarter has grown markedly in recent quarters, although it is subject to seasonal variation:

5 Quarter Total Revenue (Seeking Alpha)

-

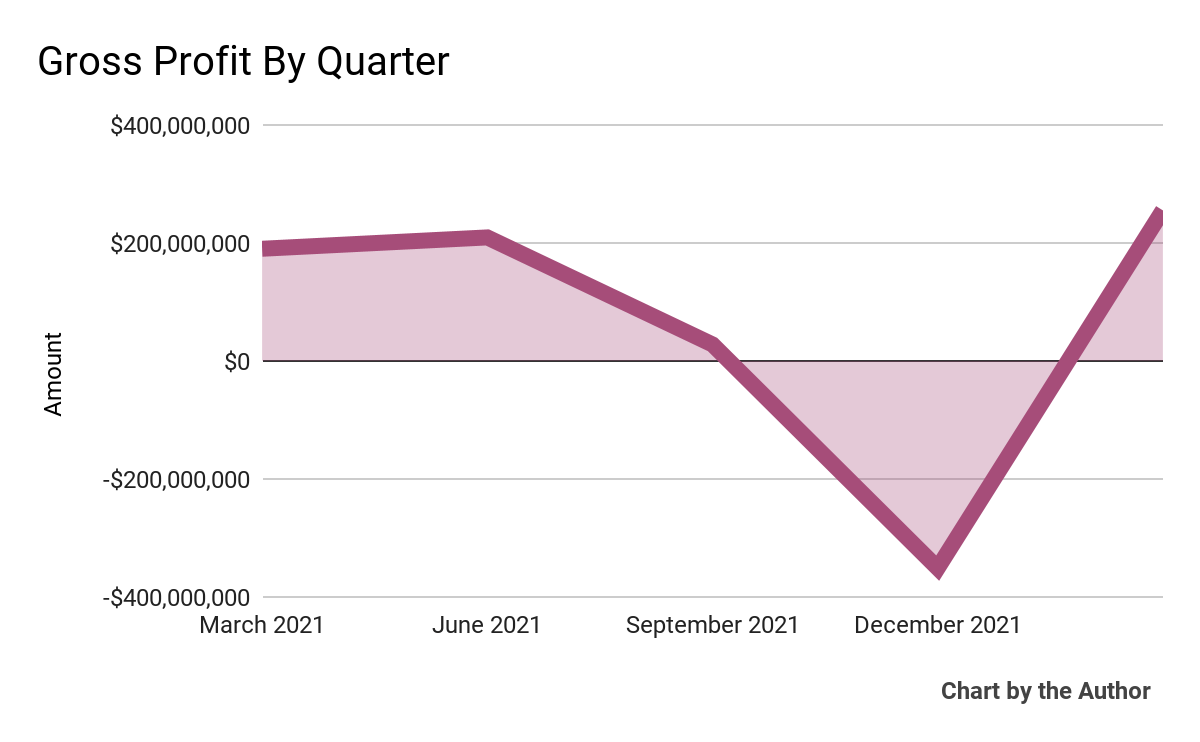

Gross profit by quarter has fluctuated materially:

5 Quarter Gross Profit (Seeking Alpha)

-

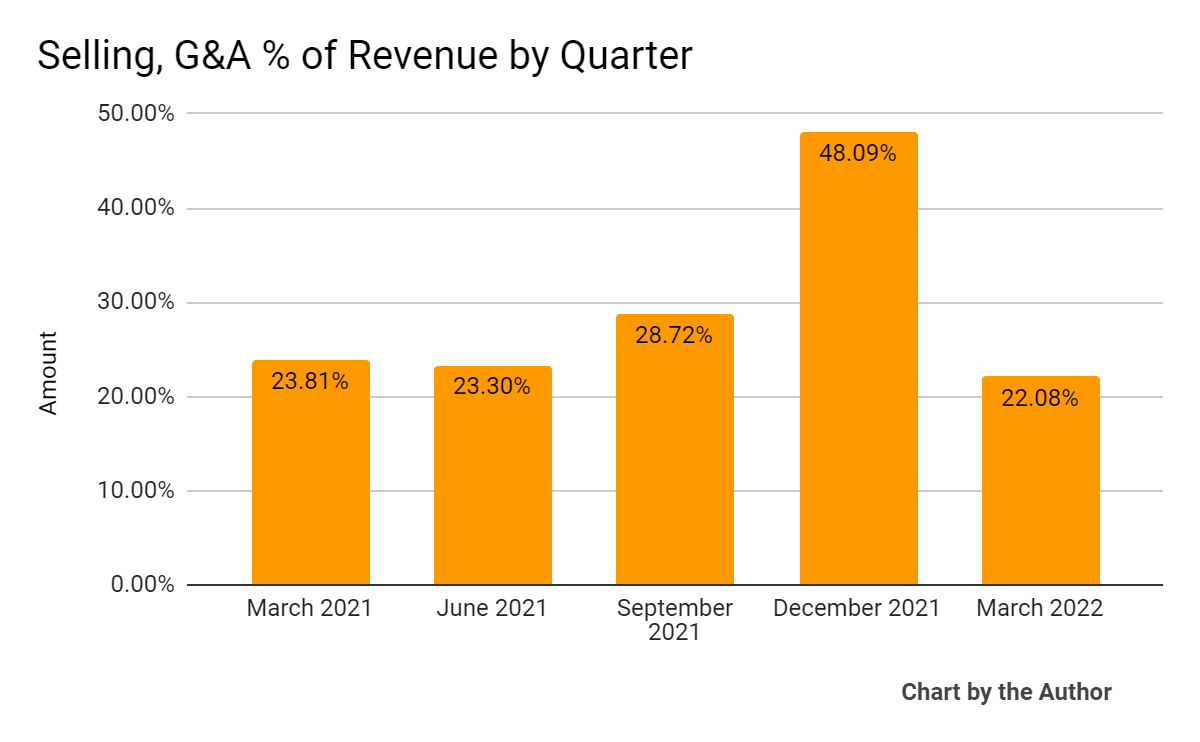

Selling, G&A expenses as a percentage of total revenue by quarter have generally remained within a range, despite its predictable Q4 2021 spike:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

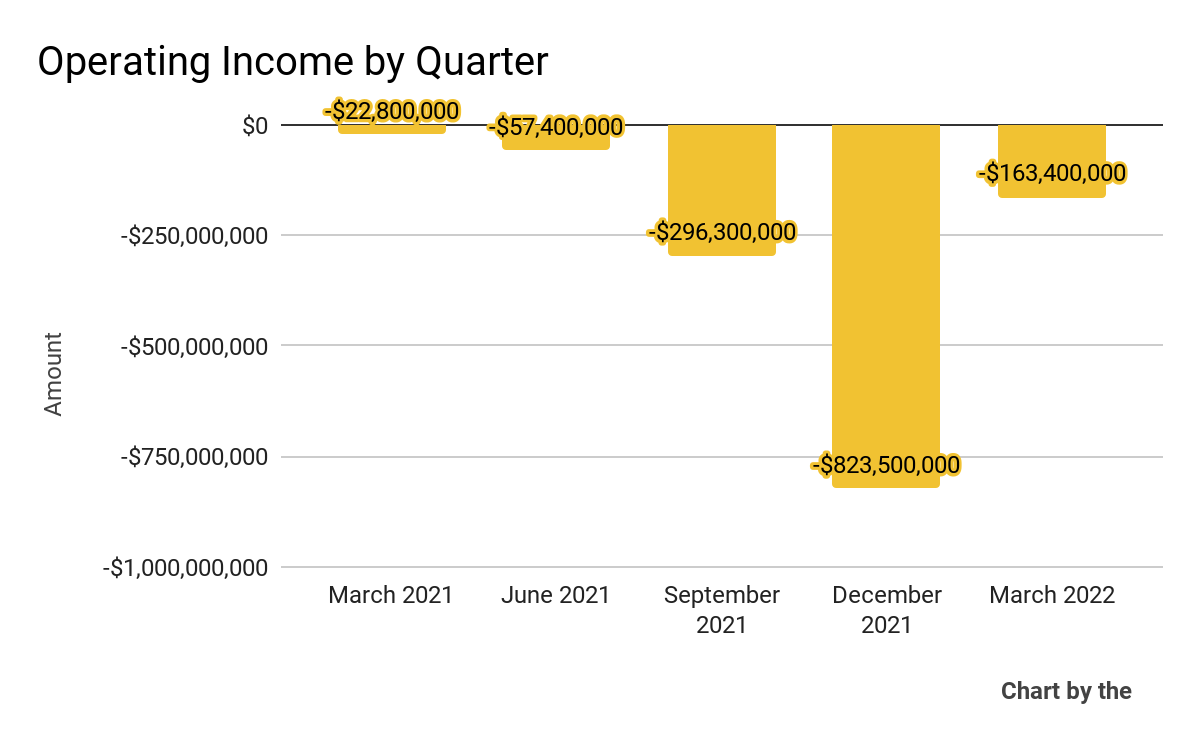

Operating losses by quarter has varied greatly:

5 Quarter Operating Income (Seeking Alpha)

-

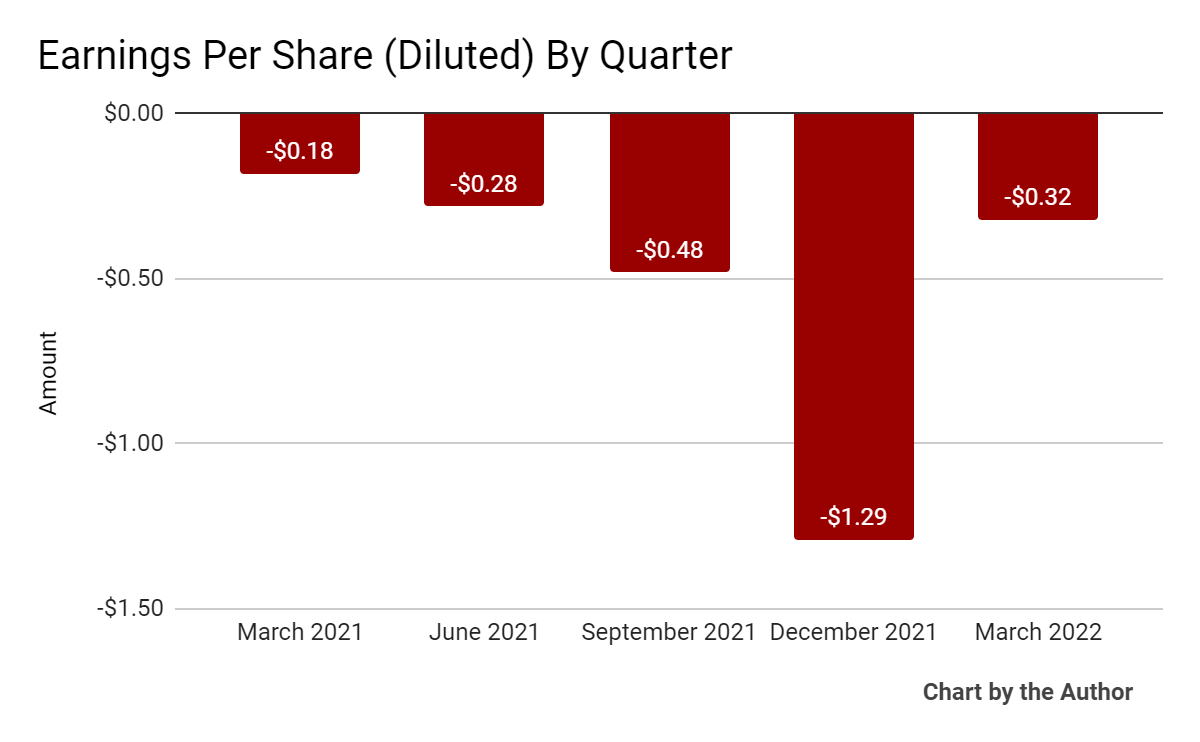

Earnings per share (Diluted) have remained negative over the past 5 quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

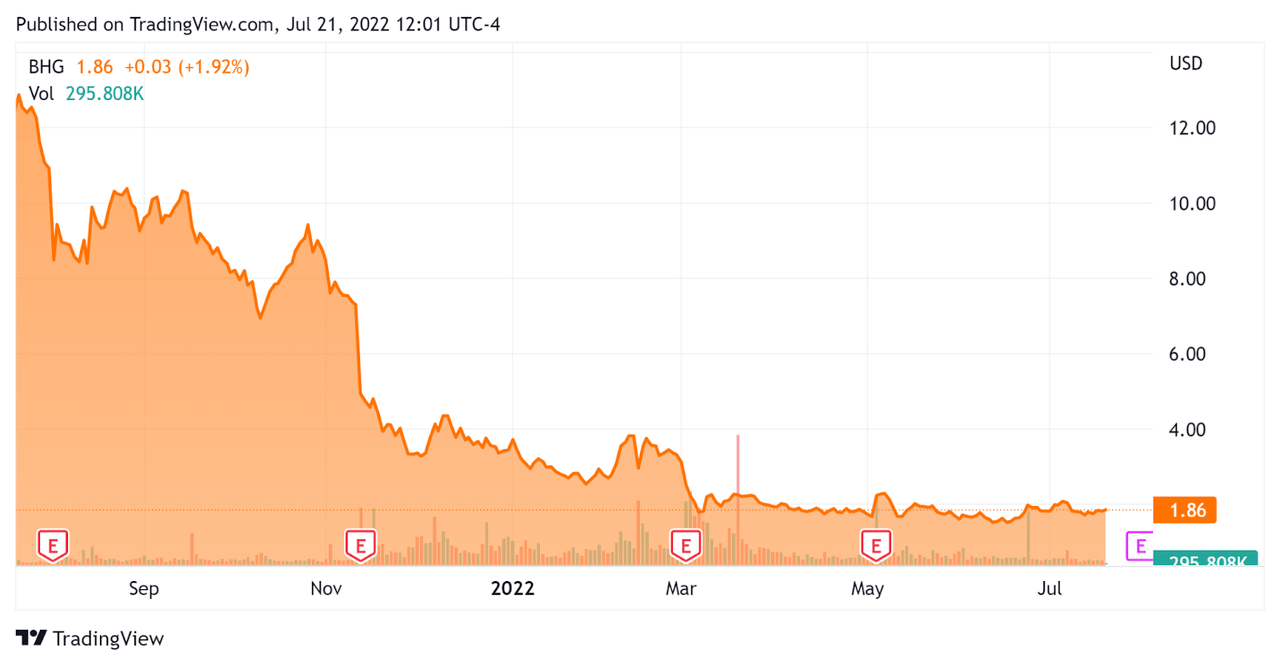

In the past 12 months, BHG’s stock price has fallen 85 percent vs. the U.S. S&P 500 index’ drop of around 8.9 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Bright Health

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$576,970,000 |

|

Market Capitalization |

$1,150,000,000 |

|

Enterprise Value / Sales [TTM] |

0.12 |

|

Price / Sales [TTM] |

0.19 |

|

Revenue Growth Rate [TTM] |

164.98% |

|

Operating Cash Flow [TTM] |

$223,210,000 |

|

CapEx Ratio (Op C.F./CapEx) |

88.15 |

|

Earnings Per Share (Fully Diluted) |

-$2.37 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Oscar Health (OSCR); shown below is a comparison of their primary valuation metrics:

|

Metric |

Oscar Health |

Bright Health Group |

Variance |

|

Enterprise Value / Sales [TTM] |

— |

0.12 |

|

|

Price / Sales [TTM] |

0.43 |

0.19 |

-55.8% |

|

Operating Cash Flow [TTM] |

$63,410,000 |

$223,210,000 |

252.0% |

|

Revenue Growth Rate |

265.4% |

165.0% |

-37.8% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Bright Health

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its intention to stop expanding into new markets and focus on its existing market footprint.

The company serves over 1.1 million patients, with its NeueHealth serving 530,000 people under its value-based care contract approach.

Management has focused on net pricing structure in core markets along with unit cost and medical management efforts to reduce its cost structure.

Notably, the company will be exiting its commercial offerings in six states, Illinois, New Mexico, Oklahoma, South Carolina, Utah, and Virginia, and will be discontinuing its employer group business as it seeks to pursue capital efficient growth and target adjusted EBITDA breakeven in 2024.

As to its financial results, total revenue increased 110% year-over-year, while gross margin was $255 million.

Still, operating losses remained high despite COVID costs being down 50% year-over-year.

For the balance sheet, the firm finished the quarter with more than $355 million in ‘non-regulated liquidity’ and $2.6 billion in cash as ‘short or long-term investments held by our regulated insurance subsidiaries.’

Looking ahead, management reiterated its full-year 2022 guidance with revenue to be around $6.95 billion at the midpoint and adjusted EBITDA loss to be around $650 million at the midpoint.

As BHG seeks to right-size its business, it will take some time to reduce operating costs, exit low-performing states and businesses, and improve its medical cost management.

Until we see performance improvements show up in financial results and a meaningful turn toward operating breakeven, I’m cautious on BHG.

I’m on Hold for BHG for the near term.

Be the first to comment