Khosrork

Bridgford Foods Corporation (NASDAQ:BRID) manufactures, and sells biscuits, sandwiches, snack, and deli foods since 1932. The company also reports a considerable amount of cash, from the recent closing of the sale of real property. BRID reports stable FCF margins, and has potential opportunities in the international markets. Under my DCF model, Bridgford Foods could be worth $19 per share. Even with risks from changing consumer trends and a controlling shareholder, the stock appears quite undervalued.

Bridgford Foods

Headquartered in Dallas, Texas, Bridgford Foods has a significant amount of know-how accumulated and relationships with clients.

Bridgford Foods has five production facilities all over the U.S., giving the company national presence. As a result, I believe that supply chain issues may be a bit less meaningful for Bridgford Foods than other food manufacturers.

We believe that our manufacturing flexibility, national presence, and long-standing customer relationships should allow us to compete effectively with other manufacturers seeking to provide similar products to our current large food service end purchasers.

-Source: 10-k

Source: Company’s Website

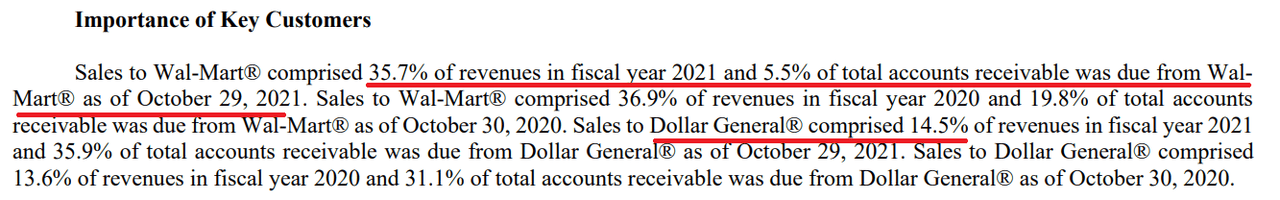

In 2021, the company reported that two large retail chains and smaller independent operators were customers of Bridgford Foods. Considering large existing customers as well as the fact that the products were sold for a long time, I wouldn’t expect large revenue volatility. In sum, I believe that the business has been sufficiently tested.

Source: 10-k

Healthy Balance Sheet

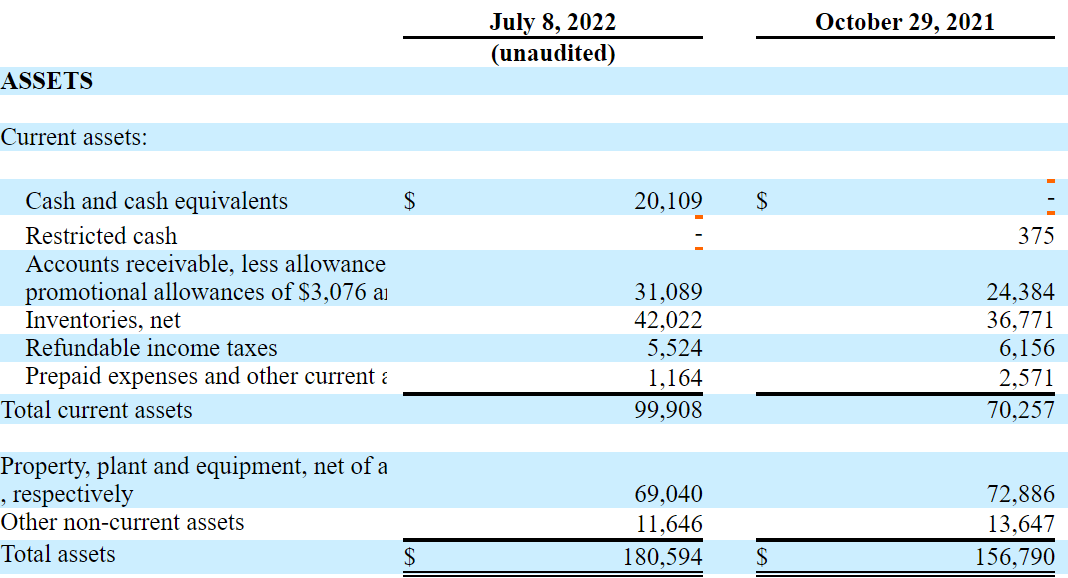

As of July 8, 2022, Bridgford Foods reported cash and cash equivalents of $20.109 million. In 2022, Cash in hand increased because of the sale of property in Chicago.

We received $55,388 in net proceeds on June 1, 2022, from the closing of the sale of real property located at 170 N. Green Street in Chicago pursuant to the terms of the Purchase and Sale Agreement dated March 16, 2020, as amended, between Bridgford Food Processing Corporation and CRG Acquisition, LLC.

-Source: 10-k

Considering that the total amount of assets is more than two times the total amount of liabilities, in my view, Bridgford Foods carries a considerable amount of liquidity.

Total assets stood at $180.594 million, including property, plant and equipment of $69.040 million, and other non-current assets of $11.646 million and the asset/liability ratio stands at 2.8x, which suggests that the balance sheet is in very good shape.

Source: 10-Q

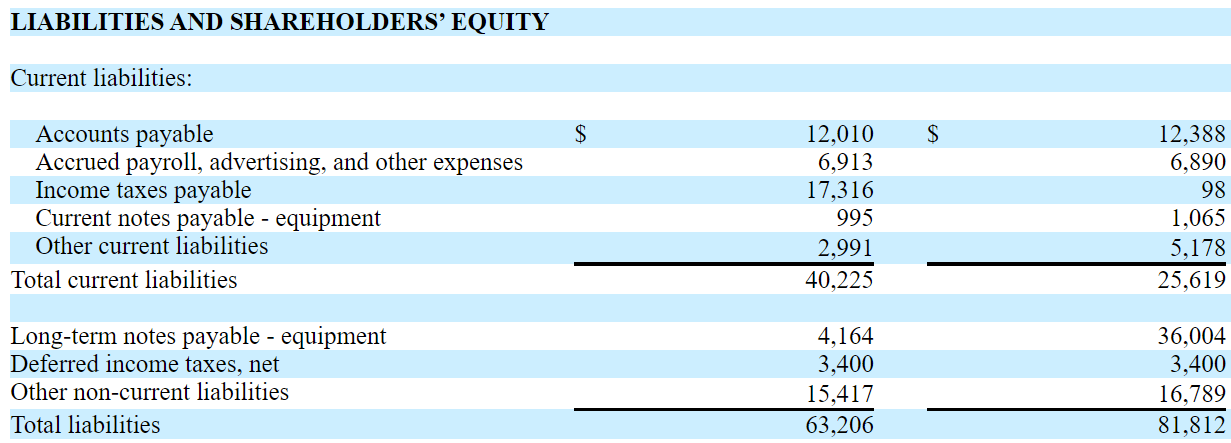

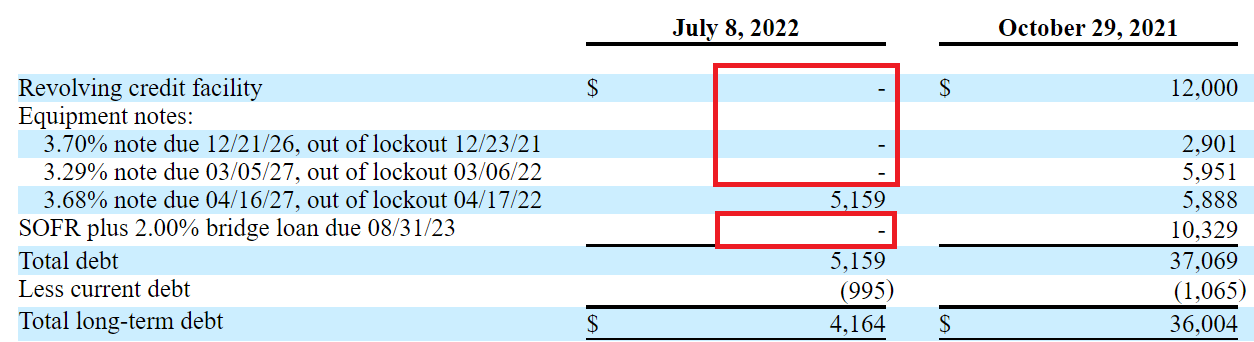

The liabilities of Bridgford Foods include accounts payable of $12.010 million, accrued payroll of $6.913 million, and inventories taxes payable worth $17.316 million. Besides, with long term notes of approximately $4.16 million and deferred income taxes of $3.4 million, total liabilities stand at $63.206 million. I really don’t believe that investors will be worried about the total amount of liabilities.

Source: 10-Q

Stable Positive Net Income And Stable Financial Figures

I couldn’t find many analysts covering the stock, however Bridgford’s financial figures seem very stable. In my view, making forecasts about future financials may not be difficult.

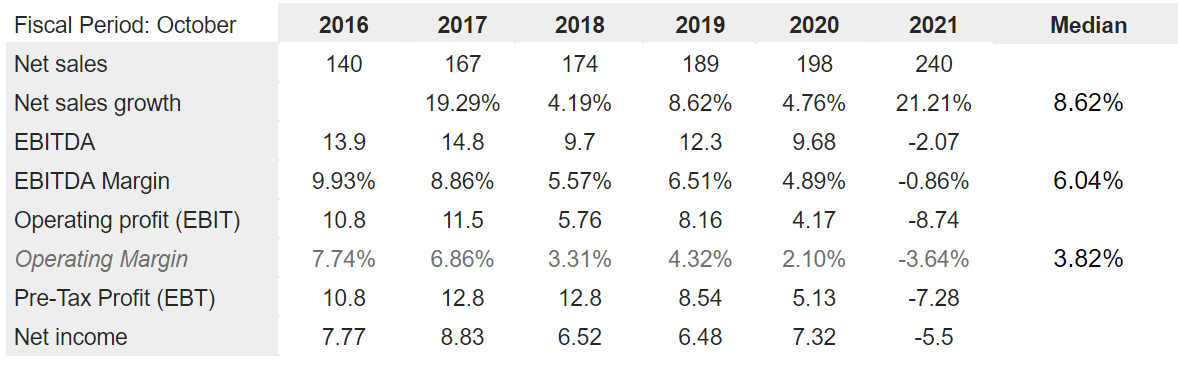

In the past, Bridgford Foods reported a median net sales growth of 8.62% and median EBITDA margin close to 6.04%. Besides, the company’s median operating margin would be 3.82%. I tried to use some of these figures for my financial models.

Source: Marketscreener.com

Base Case Scenario: Accumulated Know-how, Some Internationalization, And Less Concentration Of Clients Could Imply A Valuation Of $19 Per Share

Considering the company’s business history, Bridgford Foods knows well how to define the price of products and design the supply. It is also well aware of the distribution of products. I believe that Bridgford Foods knows how to manage shipping costs. With this in mind, under the base case scenario, I would be expecting stable free cash flow margin or even growing margins.

The factors that contribute to higher or lower margins generated from each method of distribution depend upon the accepted selling price, level of involvement by our employees in setting up and maintaining displays, distance traveled, and fuel consumed by our company-owned fleet as well as freight and shipping costs depending on the distance the product travels to the delivery point. Source: 10-k

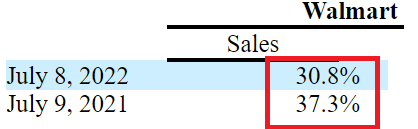

I am quite optimistic about the recent decrease in client’s concentration. In the last quarterly report, management reported less revenue related to a large retailer. I believe that more clients will likely be appreciated by the market. As a result, the demand for the stock may increase, which may lead to lower cost of equity. The fair price may also increase.

Source: 10-Q

With regards to the distribution of food, I don’t see why management doesn’t try to internationalize the sale of frozen food. Latin America could welcome the know-how accumulated by Bridgford. The company appears to have sufficient liquidity and balance sheet stability to go abroad. In my view, a larger target market may increase future revenue growth.

Our frozen food business covers the United States. In addition to regional sales managers, we maintain a network of independent food service and retail brokers covering most of the United States. Brokers are compensated on a commission basis. We believe that our broker relationships, in close cooperation with our regional sales managers, are a valuable asset providing significant new product and customer opportunities.

-Source: 10-Q

Finally, let’s note that Bridgford Foods is mainly financing its operations thanks to cash received from the sale of products. The company does not seem to need financing from banks. As a result, I believe that the company’s WACC, in the future, would most likely be limited.

The principal source of our operating cash flow is cash receipts from the sale of our products, net of costs to manufacture, store, market and deliver such products. We normally fund our operations from cash balances and cash flow generated from operations.

-Source: 10-Q

Let’s note that the reduction of notes in 2022 was quite extraordinary. Under the base case scenario, I don’t believe that investors will worry about the company’s financial obligations.

Source: 10-Q

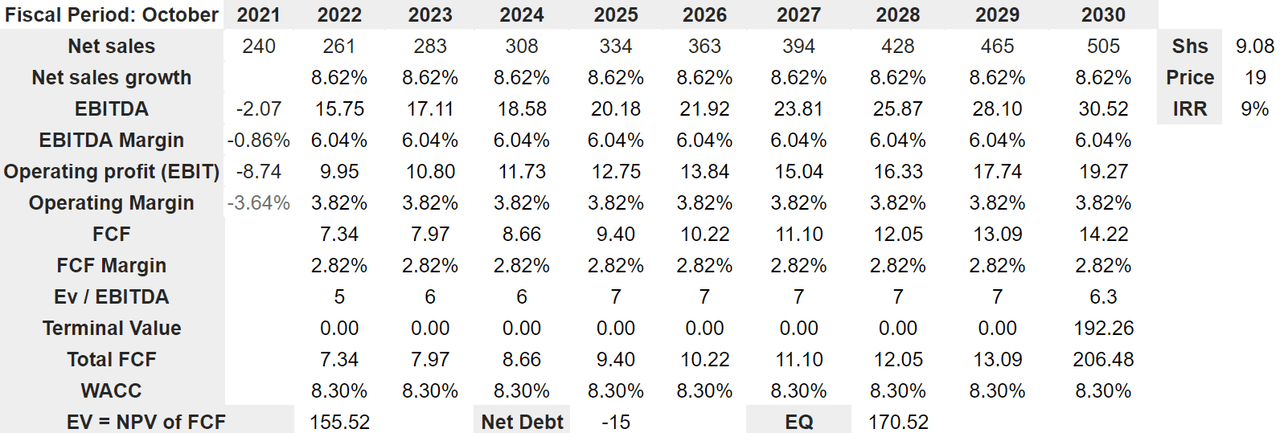

Under the base case scenario, I estimated 2030 net sales of $505 million assuming net sales growth of 8.62%, EBITDA of $30.52 million, and an EBITDA margin of 6.04%. Also, with an operating profit of $19.27 million and an operating margin of 3.82%, I assumed 2030 FCF of $14.22 million and 2030 FCF margin of 2.82%.

Source: Author’s DCF Model

If we use an EV/EBITDA multiple of 6.3x, the implied terminal value would be close to $192.26 million, and 2030 total FCF would be close to $206.48 million. Total 2030 FCF is the sum of the terminal value, and the free cash flow in 2030, which is $14.22 million. Besides, with a WACC of 8.30%, the implied enterprise value would be $155.52 million, and the equity valuation would be $170.52 million. Finally, the fair price would stand at $19 per share, and the IRR would be 9%.

Bearish Case Scenario, And Risks: Changing Consumer Trends, And The Risk From A Controlling Shareholder Imply A Valuation Of $9.5 Per Share

Under my bearish case scenario, Bridgford Foods may suffer from changing consumer trends and food inspection by authorities. Consumer product liability claims could also damage the company’s brands, which may lower future revenue growth. As a result, management may suffer significant deterioration in the stock price.

The food industry, and the markets within the food industry in which we compete, are subject to various risks, including the following: evolving consumer preferences, nutritional and health-related concerns, federal, state, and local food inspection and processing controls, consumer product liability claims, risks of product tampering, and the availability and expense of liability insurance.

-Source: 10-k

Considering the recent food inflation, Bridgford Foods may have to increase the prices of its products, which could damage the revenue line. If clients decide not to pay for the products, the number of products sold would likely decrease. Management noted these risks in the last annual report.

Our operating results are heavily dependent upon the prices paid for raw materials, as well as the available supply of commodities. The marketing of our value-added products does not lend itself to instantaneous changes in selling prices. In addition, if we increase prices to offset higher costs, we could experience lower demand for our products and sales volumes. Conversely, decreases in our commodity and other input costs may create pressure on us to decrease our prices. Changes in selling prices are relatively infrequent and do not compare with the volatility of commodity markets.

-Source: 10-k

The fact that some shareholders own a significant portion of the share may not be appreciated by certain investors. In my view, the Board of Directors may take actions that may go mainly in the benefit of the controlling shareholders.

Members of the Bridgford family beneficially own, in the aggregate, more than 80% of our outstanding stock. In addition, four members of the Bridgford family currently serve on the Board of Directors.

-Source: 10-k

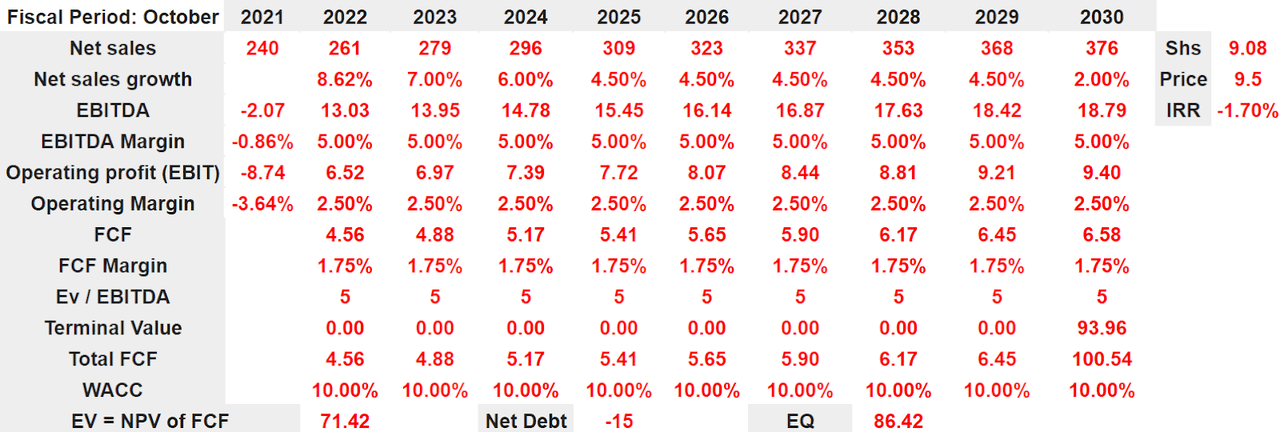

Under my bearish case scenario, I assumed 2030 net sales of $376 million with net sales growth of 2%. I also included an EBITDA of $18.79 million, together with an EBITDA margin of 5%. 2030 operating profit would be $9.40 million with an operating margin of 2.50%. 2030 FCF would be close to $6.58 million with the FCF margin of 1.75%.

Source: Author’s DCF Model

Assuming a EV/EBITDA multiple of 5x, I obtained a terminal value for BRID of $93.96 million. In addition, the total FCF would be close to $100.54 million. If we also use a WACC of 10%, the implied enterprise value would be $71.42 million, and the equity valuation would stand at $86.42 million. Finally, the implied fair price is close to $9.5 per share.

Takeaway

Bridgford Foods reports stable free cash flow generation, manufacturing facilities all over the country, and network of brokers and distributors. In my view, considering the know-how accumulated for many years, the sum of future free cash flow could imply a valuation of $19 per share. Even taking into account future risks from changing consumer preferences and controlling shareholders, in my view, the stock appears quite undervalued. I would expect significant stock price appreciation in the coming years.

Be the first to comment