Hirkophoto

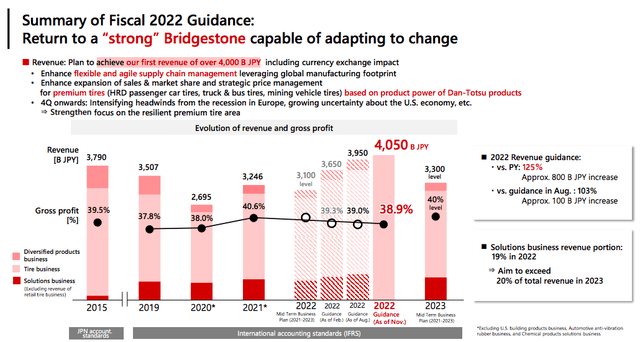

Thanks to our deep dive analysis into the tires segment, here at the Lab, we provided various follow-up notes on the main players within the industry. We were more cautious about Continental Aktiengesellschaft and Bridgestone (OTCPK:BRDCY), so we decided to provide initial neutral rating targets for both companies whereas Michelin has always been our sector pick. So far, it was a good call, the French tire manufacturer’s stock price (Fig 1) outpaced Bridgestone’s financial performance (Fig 2). Last time, we concluded that we were looking at the Japanese tire manufacturer for ‘a show me story’, and after its Q3 results, the company decided to increase its mid-term business plan guidance, providing higher estimates and accelerating its transformation plan called “2030 Long-term Strategic Aspiration“.

(Fig 1)

Bridgestone Releases Its New 2030 Plan

Source: Mar Evidence Lab’s previous publication (Fig 2)

Q3 results and 2030 plan

Starting with the business plan update, Bridgestone decided to increase its Fiscal Year 2022 outlooks to ¥4.05 trillion in turnover (from a previous number set at ¥3.95tn) with higher operating profit to ¥470 billion from ¥450 billion. However, looking at the detail, adjusted operating profits are growing thanks to the positive effect of its currency evolution. The company foresees single-digit growth sales for its PSR/LTR tires as well as for TBR tires. Regarding the Q3 results, while Bridgestone’s sales significantly grew by 28.4% over the past nine months, driven primarily by favorable pricing, product mix, and sales developments, operating profit increased by 18.6% in abs value, reducing its return on sales to 11.5%. On a quarterly basis, Bridgestone delivered a turnover of ¥1.09 trillion up by 35.1%, and an adjusted operating profit of ¥135.6 billion up by 27.7%, so it is clearly accelerating quarter-on-quarter. Cross-checking Wall Street analyst consensus estimates, the company recorded a broad-based beat and raised its profit guidance above equity research analyst expectations. On a negative note, Bridgestone disclosed how competition in the North American area tire aftermarket is heating up, despite the possible change in market conditions, we positively view these results and the company’s higher guidance.

Bridgestone financials in a snap

Source: Bridgestone Q3 results presentation

Regarding tire development, global tires were up by almost 8% on a yearly basis, with stagnant growth for bus radial and truck and an acceleration in light truck and passenger. Off-road tires continue to rebound as well as sales with high-rim diameters which grew by more than 15% on a yearly basis. Concerning the geo area, the EMIA region strongly grew; however, as disclosed by the company, Russian plant interruption is negatively impacting the business. The company reported a negative one-off of 13.4 billion yen (91 million euros)

As reported by Bridgestone, the interruption of production in the Russian plant, which has been underway since March, following the war in Ukraine in Russia, is negatively impacting business data; according to the report, the write-downs already made amount to ¥13.4 billion equal to €91 million.

Conclusion and Valuation

The next company’s catalyst is expected in mid-February. However, based on the company’s higher guidance, we continue to value Bridgestone with an EV/EBITDA of 5x, deriving a target price of ¥5.000 (from ¥4.950), in line with today’s trading. For this reason, we confirm our neutral valuation. Our forecasted price is also based on a P/B of 1.2x with an estimated P/E ratio of 11x. Cross-checking Michelin’s valuation, we still prefer the French company for its lower exposure to Russia, higher discount on its historical average (now it is trading at 5.1x versus a multiple > 5.5x), no guidance changes (over the cycle), dividend commitment, and positive pricing delta evolution despite the raw material price increases. Concerning Bridgestone’s neutral target, we forecast higher risk in top-line sales in North America, further cost pressure, a slowdown in auto production, higher logistics costs & constraints as well as ¥ appreciation.

Be the first to comment