Dzmitry Dzemidovich

One of the more interesting diversified REITs on the market today is Brandywine Realty Trust (NYSE:BDN). Although the business may be viewed as stable because of its diverse portfolio of assets that includes office properties, medical facilities, residential assets, and mixed-use properties, it has faced issues of stability in recent years. Most recently, shares have taken a beating, but this has occurred at a time when the company is finally showing strong signs of stabilizing. Between shares falling and operations stabilizing, the company now looks to be a fairly attractive prospect for investors who like the office space category. Because of these changes, I have decided to increase my rating on the company from a ‘hold’ to a ‘buy’.

The situation is improving

the last time I wrote an article about Brandywine Realty Trust was back in early November of 2021. At that time, I recognized that shares of the company were trading at pretty cheap levels. I even went so far as to say that it likely offered attractive upside as a result. At the same time, however, I said that the company needed stability from an operating perspective in order to justify that upside. And until that stability formed, I could not consider it anything other than a highly speculative play and a ‘hold’ prospect at best. Since the publication of that article, a lot has changed. Concerns over the near-term outlook for the economy seem to have helped to push shares of the company down, resulting in investors who had purchased the stock at the time that my last article was published being down by 34.7%. That compares to the 12.2% decline experienced by the S&P 500 over the same timeframe.

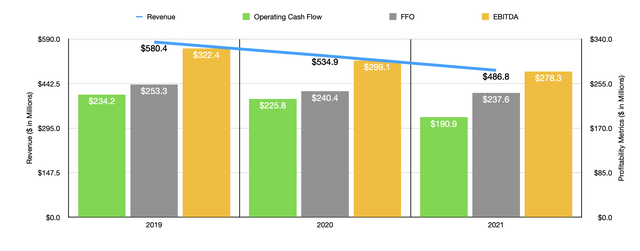

Based on this disparity between the market’s return and the return seen by Brandywine Realty Trust, you might think that the fundamental performance of the company was worsening. But that’s not really the case. Before we get into the most recent data, however, we should touch up on how the company finished its 2021 fiscal year. This goes a long way toward demonstrating the lack of stability that led to my initial ‘hold’ rating. Sales for that year came in at $486.8 million. That’s down from the $534.9 million reported for the 2020 fiscal year and compares to the $580.4 million seen in 2019. Operating cash flow dropped from $225.8 million in 2020 to $190.9 million last year. FFO, or funds from operations, fell from $240.5 million to $237.6 million. And EBITDA dropped from $299.1 million to $278.3 million.

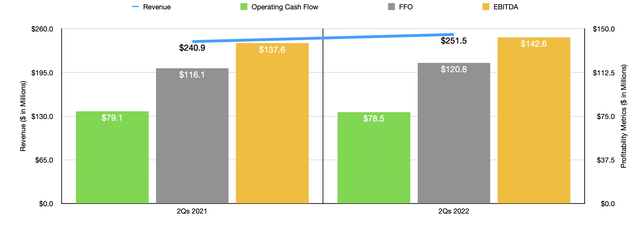

Fortunately for investors, the picture has shown signs of improvement. To see what I mean, we need only look at financial results covering the 2022 fiscal year so far. For the first half of the year, revenue for the company came in at $251.5 million. This represents a slight improvement over the $240.9 million generated the same time last year. This increase came even as the square footage of the company remained virtually unchanged and as the occupancy rate at its properties declined from 89.9% to 89.4%. This rise, instead, was driven by multiple factors. For instance, the company benefited to the tune of $2.3 million because of a development property in Texas there’s placed into service in the third quarter of 2021. The company benefited to the tune of $2.2 million on the top line thanks to a recently acquired or completed property. $2 million worth of an increase related to the residential and hotel components at the FMC Tower that the company has thanks to higher occupancy as COVID-19 pandemic restrictions were lifted. And the company benefited to the tune of $1.4 million because of the commencement of operations of a life science incubator lab in its Philadelphia CBD segment.

Profitability for the company also seems to be showing signs of stabilization. Operating cash flow in the second quarter came in at $78.5 million. That’s down barely from the $79.1 million reported one year earlier. FFO increased from $116.1 million to $120.8 million. In addition to that, we also saw an improvement in EBITDA, with that metric rising from $137.6 million to $142.6 million. When it comes to the 2022 fiscal year as a whole, management has not provided much in the way of guidance. But one thing they did say is that FFO per share should be between $1.36 and $1.40. At the midpoint, that should translate to FFO of $236.6 million. That roughly matches the $237.6 million reported for the 2021 fiscal year. Given how close these two numbers are together, and since we don’t have guidance covering the other profitability metrics, I will assume that both operating cash flow and EBITDA roughly match what they were in 2021.

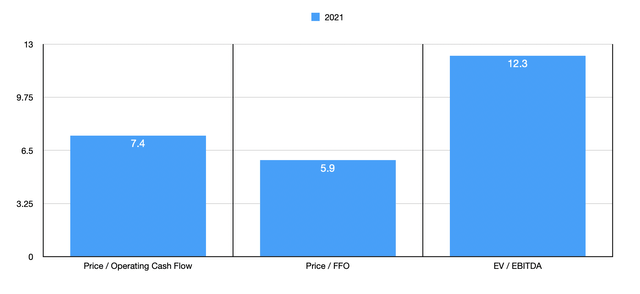

So long as this kind of performance remains the case, the company has satisfied my standard that the business stabilized. But now the question is what kind of upside, if any, the company might offer. If we were to price the company based on results from 2021, the firm would be trading at a price to operating cash flow multiple of 7.4. The price to FFO multiple would be 5.9, while the EV to EBITDA multiple would come in at 12.3. As part of my analysis, I did compare the company to five similar firms. On a price to operating cash flow basis, these companies range from a low of 4.1 to a high of 17.2. In this case, three of the five companies were cheaper than Brandywine Realty Trust. Using the price to FFO approach, the range is between 3.6 and 24. And when it comes to the EV to EBITDA approach, the range is between 9.4 and 25.9. In both of these scenarios, only one of the companies is cheaper than our prospect.

| Company | Price / Operating Cash Flow | Price / FFO | EV / EBITDA |

| Brandywine Realty Trust | 7.4 | 5.9 | 12.3 |

| Veris Residential (VRE) | 17.2 | 24.0 | 25.9 |

| Piedmont Office Realty Trust (PDM) | 6.5 | 6.1 | 14.8 |

| Paramount Group (PGRE) | 6.7 | 7.5 | 14.5 |

| Easterly Government Properties (DEA) | 13.0 | 13.7 | 18.9 |

| Office Properties Income Trust (OPI) | 4.1 | 3.6 | 9.4 |

Takeaway

So far, the fundamental picture for Brandywine Realty Trust is looking up. The business has stabilized and shares have fallen enough to make the stock look undervalued both on an absolute basis and relative to similar players. Due to these factors and so long as pricing remains appealing and fundamentals remain at least stable, I have no reason to rate the company as anything other than a ‘buy’, reflecting my belief that it will likely outperform the broader market for the foreseeable future.

Be the first to comment