halbergman/iStock via Getty Images

Investment thesis

Brandywine Realty Trust (NYSE:BDN) has a stable business model, the company is working on several new developments in low vacancy areas and its tenants are dependable. In addition, REITs are resilient to inflation thanks to the ability of most REITs to be able to raise their rent significantly. My biggest concern with BDN is its upcoming financing problem that can cause share dilution and shareholder value erosion not to mention the rise in the cost of financing that will result in decreased FFO figures.

Business Model

BDN is a full-service real estate investment, development, and management company. The company is 111th among the 170 publicly traded U.S. REITs based on market capitalization. BDN fully owns 74 properties with 4 new developments or redevelopments totaling approximately 13 million square feet as of the end of the second quarter. In addition, the company has numerous 55%/45% ownership in several new joint developments with other real estate companies. BDN’s largest tenant is IBM (IBM is responsible for about 5% of BDN’s total yearly rental income) and its top tenants include Spark Therapeutics, Comcast, and FMC Corporation.

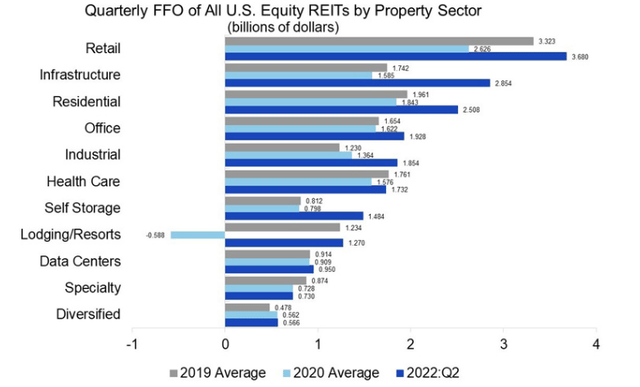

External and internal trends

Investors should be mindful of the fact that the outlook for the REIT industry, specifically the office REIT industry, and the cost of funds can have a material impact on the performance of the stock. The market has changed rapidly during the pandemic and I see no sign that it will return to pre-pandemic behavior. Permanent work-from-home trends have been forming since and although many companies returned to their offices the general trend is that work-from-home options remain for a relatively wide range of workers in several industries. BDN develops and rents out specialized buildings where work from home is not an option such as in pharmaceutical office spaces. I am happy with the company’s rental income, rent distribution among tenants, the quality of tenants, and the possibility of rental rate increases.

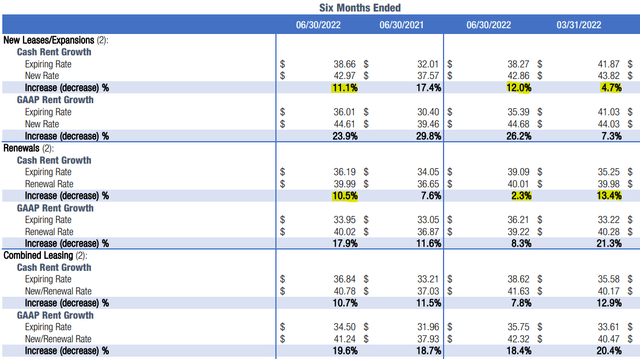

BDN’s top twenty tenants represent 38% of their rental income and the rest comes from smaller tenants so investors can safely say that the tenant income is well diversified and does not lean into one or two major tenants. The management could raise the rental rates above inflation. Of course, the renewal rental rates increased significantly less than the new leases in the second quarter and I expect this trend to continue throughout the rest of the year. I also expect that the company will be able to raise rental rates above the inflation especially if the inflation has topped in June at 9.1%. The lease expirations are also distributed well within the upcoming years and the average weighted remaining lease term is 89 months which is great.

According to Mizuho’s analysis when vacancy rates rise above 10-11%, commercial real estate operators lose pricing power. BDN’s new development is in sectors that have an average vacancy rate of 1-3%. However, their current occupancy rate of the core portfolio is around 90% but I do not feel that the company is losing its pricing power. Mainly due to the type of offices they rent out and because of the recent rental rate increases. Altogether, BDN is a stable office REIT for income-seeking investors at the moment. The management will also likely generate additional cash by selling a couple of assets that they are marketing for price discovery at the moment. My concerns with BDN are related to its refinancing and its long-term valuation.

Valuation and risks

Brandywine Realty Trust has underperformed the market so far this year by quite a hefty margin, the question that comes to investors’ minds is: what’s next for the stock? I strongly believe that this current price is justified and the stock will stay between the $7 – $10 price range. Let me explain why:

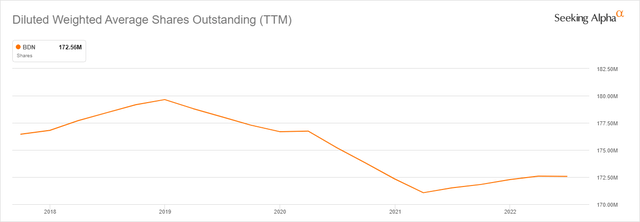

The company has a significant portion of its debt due early next year and in 2024. The company is more leveraged than its peers. With a 55% debt ratio, the company is much higher leveraged than the office REIT sector average of 35%. Since the pandemic, almost all of the REITs issued shares, refinanced debt, and issued new bonds at much lower interest rates than before while BDN’s management did not do any of that.

At the time it was not necessarily a bad decision but as interest rates started to rise significantly and I am not sure how the management is planning to refinance its debt obligations. Looking at the best-case scenario the current bonds are coming off just below 4% and they will be able to get new financing a bit above 5%. However, no one anticipated a year ago that within half a year the Fed will raise the interest rates by 200 basis points. The time is against the management to find a good but more importantly shareholder friendly solution. The top management has already claimed that: “at current levels, there will be some dilution” – Tom Wirth – EVP and CFO.

My biggest concern is that this mistake in late refinancing will cause a CAD decline simply because there will be less money for shareholder distribution. The company has great development projects some of them are already pre-leased but if the financing is not sorted out properly the gain realized on those developments could be jeopardized by the increase in the cost of capital. That is why I expect FFO to remain around the same levels as we saw it in the last 2 quarterly results.

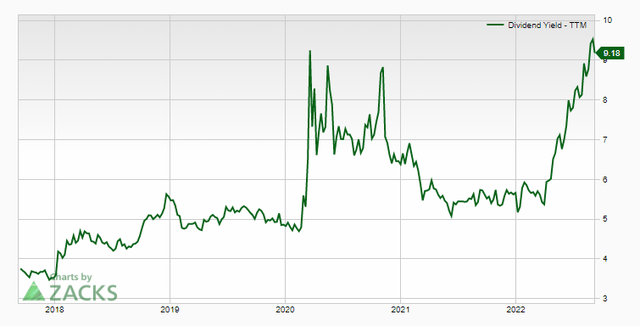

In technical terms, the stock seems undervalued with Price/Book ratio, Price/Cash Flow, Price/rental revenue, and other traditional valuation metrics approximately 40-50% below the sector median. Its dividend yield has never been higher in the last 5 years. But because of the above-mentioned issues under the surface, I believe that the stock is fairly valued and until these problems have been dealt with there is not much upside potential.

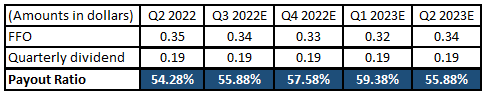

My take on BDN’s dividend

Brandywine Realty is a reliable dividend payer and could be a great addition to any income investor’s portfolio. The management has been keeping its dividend stable for years and has been paying dividends consecutively for 14 years. The company’s FFO and AFFO payout ratios are healthy, the FFO payout ratio is approximately 55% while its AFFO payout ratio is between 75-85%. BDN can fully fund its current dividend without diluting shares but this might change in the future. It highly depends on how the company can refinance its current debts within the next 2 years. As I mentioned before even the CEO and top management believe that there might be some unavoidable share dilution. At the moment, the dividend is stable and secure for the next 2-3 years in my opinion.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

BDN is a great office REIT with a stable business model and great tenant figures. In my opinion, the company could be an ideal choice for income investors looking to get exposure to Philadelphia office spaces via an equity REIT. The record dividend yield and stable AFFO payout ratio will bear fruit for income investors. However, keep in mind that there might be significant issues in terms of refinancing and there might be share dilution in the upcoming years. But if you are willing to take this risk, BDN can be a good fit in an income portfolio.

Be the first to comment