Leon Neal/Getty Images News

News travels around the world very differently today than in the past. With a 24 hours news cycle, numerous social media outlets, and many major financial markets open nearly 24 hours a day, headline risk often gets priced into risk assets very quickly.

The Russian invasion of Ukraine created a lot of volatility in markets in general, and in particular for companies such as BP p.l.c. (NYSE:BP), aka “Beyond Petroleum,” which has more exposure to Russia than most of the company’s peers because of the company’s sizeable position in the Russian oil company Rosneft.

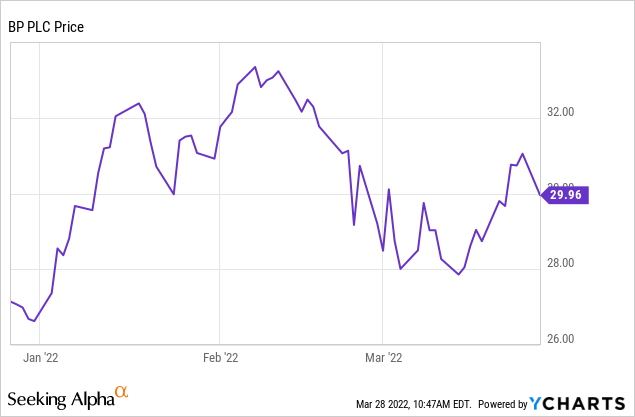

Beyond Petroleum’s stock sold-off hard after the Russian invasion of Ukraine in February.

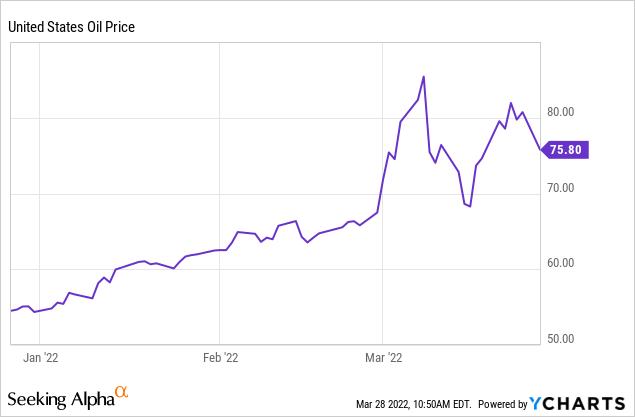

Bp’s stock has sold off nearly 10% since the Russian invasion of Ukraine just over a month ago. Well, normally, a 10% sell-off would seem reasonable since BP has a significant stake in the Russian oil company Rosneft, oil and gas prices have also risen significantly since late February.

Commodity prices can obviously be volatile, but the price of oil is up nearly 15% since the Russian invasion of Ukraine, and we are soon going to be entering peak demand months as we move into the summer in countries such as the U.S. China is also yet to open their economy as part of the country’s zero tolerance policy towards Covid. Natural gas prices have also risen significantly since late February as well.

BP’s exposure to Russia because of the company’s position in Rosneft is not small, but the company’s exposure to Russia should be more than manageable. Rosneft has made up around 10% of BP’s profits and 12% of BP’s cash flow over the last 5 years. BP had a 19.75% shareholder interest in Rosneft that the company plans to exit. The exact details of how BP will divest from this position and what if any compensation BP would receive from Rosneft or the Russian government is not clear right now.

BP is a long-time operator in Russia, and the company has developed very strong relationships in Russia over a long period of time, so Rosneft and the Russian government will likely offer BP some compensation. Oil and gas prices also remain at very high levels, and despite the recent sanction imposed on Russia, Russian oil companies are having no problem finding new deals with countries such as China and India, so BP will likely receive compensation eventually for the divestiture of the company’s stake in Rosneft.

Still, given that Rosneft has accounted for approximately 10% of BP’s profits over the last 5 years, the recent sell-off seems excessive, especially since oil and gas prices have risen dramatically since the Russian invasion of Ukraine in late February. Both Morgan Stanley and RBC have also recently upgraded BP to a buy since the sell-off, with both analysts arguing that Russian counter party risk is priced in. Morgan Stanley also noted that the current sell-off doesn’t take into account BP’s significant $4 billion dollar buyback plan which isn’t in jeopardy.

BP is very strongly positioned right now, and the company’s dividend and buyback plans should be fine despite the company’s planned divestiture from Rosneft. BP has said that $60 oil is necessary for maintaining the dividend and continuing the $4 billion dollar buyback plan. Even with the company divesting from Rosneft, Brent oil prices are at $112 dollars a barrel today, and prices have remained well over $100 a barrel for over a month now. Natural gas prices have moved up significantly in recent months as well.

BP’s balance sheet and cash flow are also very strong right now. BP has $30.9 billion in cash, or $9.46 per share, and the company’s target for the dividend is a conservative payout ratio of 60%. The company’s net debt is just under $40 billion. BP prepaid $10.9 billion in debt in 2021, a year in which the company saw record free cash flow. These numbers were before the significant recent move up in oil and gas prices as well. BP is also planning to keep capital expenditures steady at $14-16 billion a year through 2025, so cash flow should be very strong once again this year. BP should have no problem maintaining current dividend payouts and the buyback in the current operating environment even with the situation in Russia.

BP’s stock also looks cheap compared to competitors using several metrics. BP trades at .9x enterprise value, 1.32x book value, just 6x forward earnings estimates, and 4x cash flow. Industry averages in the oil and gas industry are for companies to trade 2x book and 7x cash flow. Even though BP’s operating margins have been below industry standards recently since the company depends more on downstream operations than many oil majors, the company’s downstream operations should recover nicely as demand for diesel and jet fuel is supposed to rise as countries such as China come out of Covid. BP’s downstream operation accounted for 30-440% of EBITDA from 2015-2019. Well, BP’s stock has underperformed most of the company’s peers over the last several years as the company has put issues such as the Deepwater Horizon spill and the Texas City Refinery fire behind the company, the future looks bright.

The Russian invasion of Ukraine showed the need for the West to be energy independent, and well clean energy is a nice idea, the Russian invasion showed the necessity of oil companies such as BP. The US and Europe recently announced a major new Gas deal as part of the US led effort to make Europe energy independent of Russia, and Europe currently relies on Russia for nearly 40% of the continent’s oil and gas needs. With oil and gas prices rising, Europe focused now more than ever on energy independence, and BP’s balance sheet as strong as ever, Beyond Petroleum is a buy.

Be the first to comment