Phil Walter/Getty Images News

BP Midstream Partners (NYSE:BPMP) is a partnership formed by oil megacompany BP. The company’s goal is the development of new pipelines for BP. These pipelines are manufactured in several different ways. BP Midstream Partners LP develops these pipelines either by owning, operating, manufacturing, or acquisition. The company primarily handles all of BP’s midstream pipelines and assets. They are an integral part of BP’s production infrastructure, providing a key service for the company and its affiliates. The company is essential to the transport of crude oil and natural gas to and from offshore and onshore production and refining. Additionally, the company is vital for transportation to distribution hubs. While the company focuses on pipeline development, they do also hold a number of assets in crude oil and natural gas production.

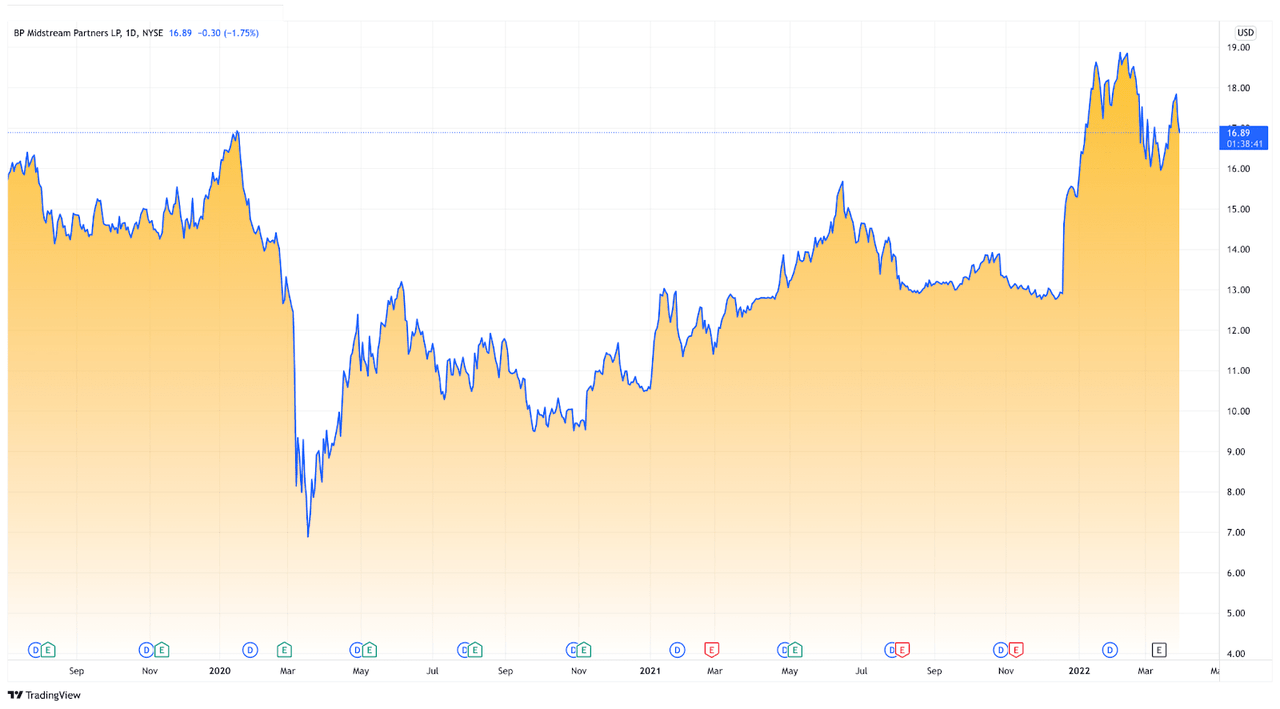

tradingview.com

In this article, I will show that despite being a smaller company under the umbrella of major oil production company BP, BP Midstream Partners LP provides solid value for investors. The reasons for this are relatively straightforward. Firstly, as an integral part of a multibillion-dollar company, there is a tremendous amount of stability in the future of this company. This affords potential investors a very low level of risk. Secondly, the future outlook for the oil industry as a whole looks extremely promising. Despite a concerted effort to decrease fossil fuel dependency in favor of green energy, the United States is consuming all-time high levels of oil. Due to these reasons, I recommend pursuing this stock with a bullish strategy.

Oil Consumption & Conflict Present Opportunity

In 2021 the US consumed a record-high amount of oil. Up about 584 million barrels from the numbers in 2020. The United States consumed an astounding 7.22 billion barrels of oil in 2021. This equates to a consumption rate of almost 20 barrels of petroleum per day. This is in the face of a concerted effort to reduce fossil fuel dependency in favor of greener, renewable energy. Demand is at an all-time high, and with oil companies tightly controlling supply, there is little to no evidence to suggest that the oil industry is in any sort of danger of a decline in the market any time soon.

The Russian invasion of Ukraine has also opened up a great deal of opportunity, particularly for domestic oil companies located within the United States. Because of Russian President Vladimir Putin’s actions and his failure to withdraw his assault on Ukraine, the United States has joined several other countries in implementing a ban on the import of Russian oil. Because of this, it has caused the price of oil to skyrocket. One of the crucial things to note is that the price of oil is traded globally. Despite the fact that the United States imports very little oil from Russia, they are still subject to the price swings of the drop in supply. This is mainly caused by European countries, which get up to 40% of their oil from Russia. Oil demand is clearly at an all-time high, and disruption of supply spikes prices.

A byproduct of all this will be a renewed demand by the American people to become an energy-independent state. There will likely be a major overhaul of the oil market. In addition, there will be a serious consideration for US oil companies to sell their oil to the US only in an effort to battle rising costs and inflation. If such a change is made, it will benefit independent oil and gas companies and large oil corporations both. In the case of BP Midstream, it will put their pipeline products in high demand, which will lead to a spike in revenues and profits moving forward.

Oil Market Overview

The demand in the oil market is at an all-time high. In 2022, that demand is expected to grow by an estimated 3.5 million barrels per day. The supply, however, is limited as it is and is expected to dwindle further. Although there is the possibility the United States will see a surge in production, there is a possibility that those barrels could be exported to help fill the void in the European countries. The result will be a slow decline in per barrel prices, but consumers will remain at the mercy of excess costs. This is ultimately favorable for the bottom line of oil companies.

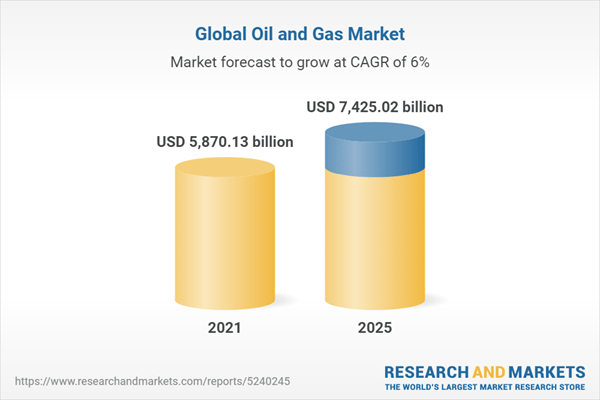

researchandmarkets.com

The global oil and gas supply market is projected to reach over $7.4 trillion in 2022. Heading in 2022 through 2025, those numbers are expected to remain climbing at a monumental CAGR of 6%. Additionally, as many developed countries lowered interest rates for borrowing in 2019, oil companies have expanded significantly, setting themselves up to continue to dominate the market. As long as the demand continues to soar, oil companies will continue to see revenues and profits at historic rates.

Financial Overview

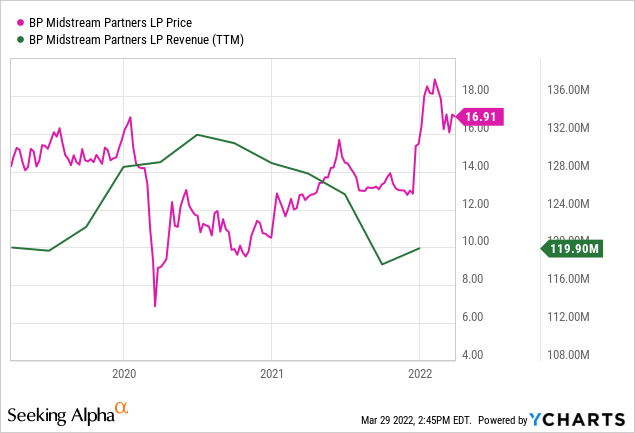

ycharts.com

Company revenues have been a bit of a mixed bag over the last four years. In 2018 the company posted $118 million in revenues. In 2019 that number rose to $128.5 million. 2020 saw another slight increase, this time to $128.9 million, while 2021 proved to be a bit of a disappointment, with revenues dropping down to $119.9 million. The profits, however, have remained remarkably consistent. In 2018 the company took home $113 million in profits. In 2019 that number saw a sharp rise to $126.7 million. The profits took a slight dip in 2020, with the company making $125.1 million. 2021 mirrored the disappointing revenues, with the company raking in just $116.5 million. The upside to this is that the company boasts a very marginal cost of revenue, with over 90% of its earnings counting as profits. This is an excellent formula for investors.

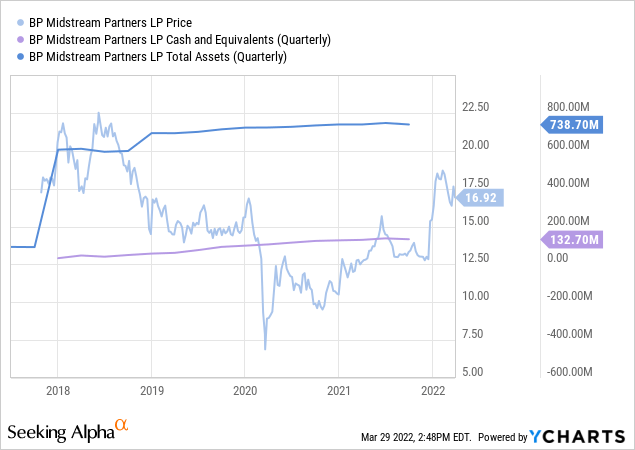

ycharts.com

BP Midstream Partners has done a great job in generating and adding to their cash in hand totals over the last four years. In 2018 the company had just $56.9 million in cash. In 2019 that number nearly doubled to $98.8 million. 2020 saw yet another rise to an impressive $126.9 million, and 2021 followed suit, closing the year with $132.7 million in cash. This pairs nicely with their hefty asset cache. In 2018 the company had a strong $693 million in assets. By the end of 2021, that number had grown to a robust $738.8 million. This gives the company flexibility and the ability to continue to grow without adding to the long-term debt totals. The end result is company stability with an eye toward growth, which bodes well for its long-term future.

The only real concern with the company’s financials comes in the form of long-term debt. While the company has done a terrific job not accumulating any more debt, they have made no effort whatsoever to pay back their existing debt. Over the last four years, the company has carried a hefty $468 million in long-term debts without accumulating more or paying a single cent back. This is a bit puzzling considering the cash stash and the fact that the company has been highly profitable. While this could point to potential mismanagement, it could also just be representative of a company that is keeping its options open. This is because the oil landscape continually shifts, and new opportunities could come available. Given the healthy nature of the rest of the balance sheet, the latter would be my honest assessment.

Conclusion

BP Midstream Partners represents what could be considered a sneaky buy. Their name implies dominance in the oil market. However, the fact that they are a smaller, independent offshoot that falls under the company umbrella gives them a refreshing amount of anonymity on the market. The political events of the invasion of Ukraine, the excess in demand coming off the Covid-19 Pandemic, and the lack of supply in comparison to the demand has created a perfect storm for massive profits. The cost of oil has spiked, leaving Americans unhappy, pushing for energy independence, and the supply is lower than the demand and cannot keep up. This will likely lead to additional oil pipelines and projects being started (very favorable for BP Midstream Partners specifically.) All of these factors add up to a profitable 2022-2023 while these issues are ironed out, and in all likelihood, that profitability will extend into the next ten years. For those reasons, I have BP Midstream Partners LP as a solid buy, and I believe investors should pursue this stock with a bullish investment strategy.

Be the first to comment