Nomi2626

A Quick Take On Bounty Minerals

Bounty Minerals (BNTY) has filed to raise $119 million in an IPO of its Class A common stock, according to an S-1 registration statement.

The firm has acquired natural gas royalty interests in the United States.

BNTY is well-positioned to benefit from growing energy demand worldwide.

I’ll provide a final opinion when we learn more about the IPO from management.

Bounty Overview

Fort Worth, Texas-based Bounty Minerals was founded in 2012 to acquire non-producing mineral interests, primarily natural gas deposits located in the Appalachian Basin.

Management is headed by President and CEO, Ms. Tracie Palmer, who has been with the firm since 2013 and was previously at Encore Operating Company and Vanguard Natural Resources.

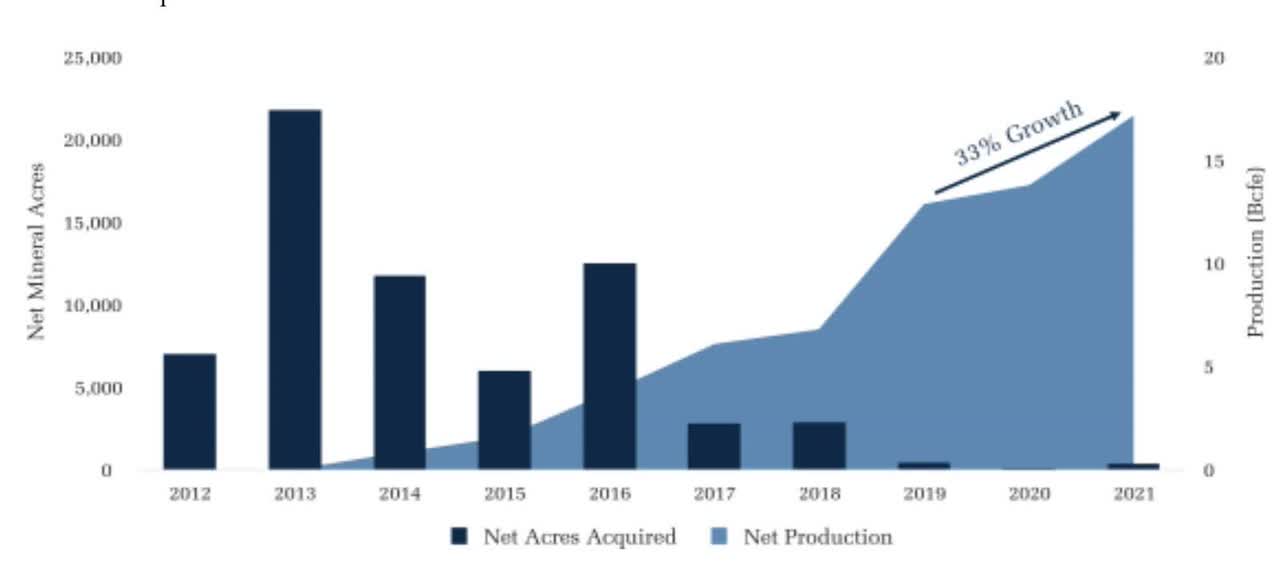

The chart below shows the company’s interest acquisition and production history:

Company Interest And Production History (SEC)

As of June 30, 2022, Bounty has booked a fair market value investment of $468.2 million from investors.

Bounty’s Market & Competition

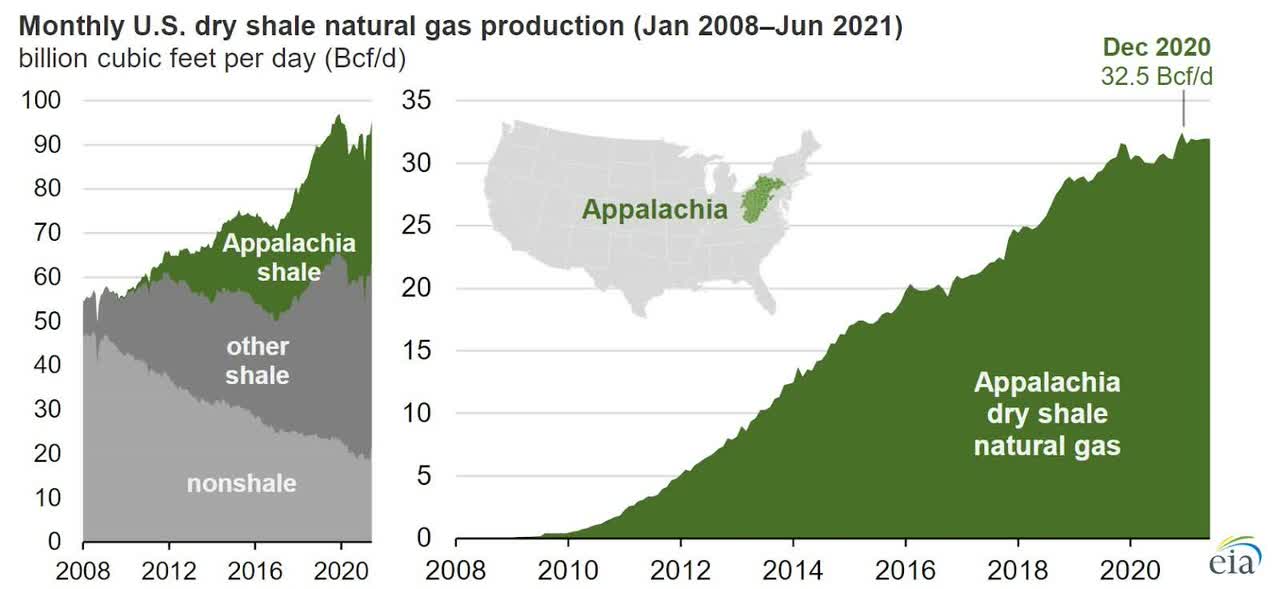

According to a 2021 market research report by U.S. Energy Information Administration, the U.S. dry natural gas production from shale formations in the Appalachian Basin has grown dramatically in recent years, as the chart shows below:

U.S. Dry Shale Natural Gas Production (U.S. EIA)

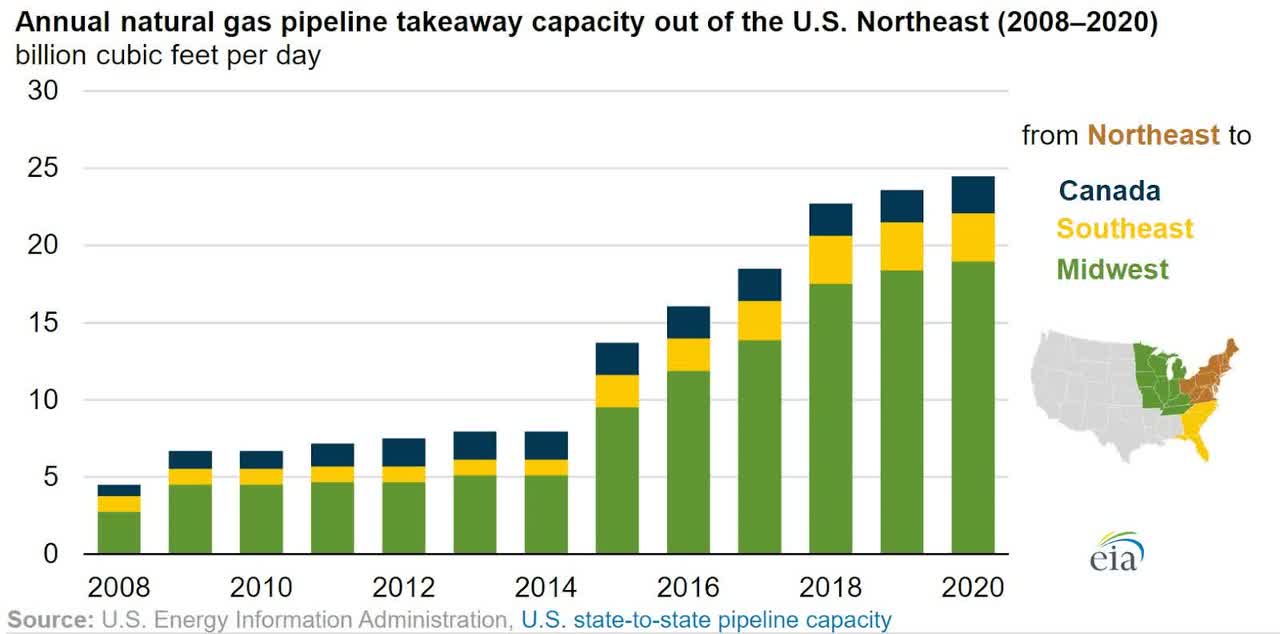

Takeaway capacity from the region has also grown markedly, as shown here:

U.S. Northeast Takeaway Capacity (U.S. EIA)

Major competitive or other industry participants include:

-

Antero Resources

-

Ascent Resources Utica

-

Chesapeake Energy

-

Chevron

-

CNX Gas Company

-

EQT Production

-

Gulfport Energy

-

PA Gen Energy

-

Range Resources

-

SWN Production Co.

-

Rice Drilling

-

XTO Energy

-

Others

Bounty Minerals’ Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increasing operating profit and margin

-

Higher cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$63,607,481 |

135.4% |

|

2021 |

$74,432,801 |

151.2% |

|

2020 |

$29,629,762 |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2022 |

$48,994,779 |

77.0% |

|

2021 |

$44,996,316 |

60.5% |

|

2020 |

$5,818,764 |

19.6% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$50,020,401 |

78.6% |

|

2021 |

$44,997,871 |

70.7% |

|

2020 |

$5,935,929 |

9.3% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$55,540,293 |

|

|

2021 |

$46,136,457 |

|

|

2020 |

$18,297,493 |

|

(Source – SEC)

As of June 30, 2022, Bounty had $27.6 million in cash and $5.7 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022 was $84.9 million.

Bounty Minerals’ IPO Details

Bounty intends to raise $119 million in gross proceeds from an IPO of its Class A common stock, although the final figure may differ.

Class A and Class B common stockholders will each be entitled to one vote per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

We intend to contribute all of the net proceeds from this offering to Bounty LLC in exchange for Bounty LLC Units. Bounty LLC intends to use (an as-yet undisclosed amount) of the net proceeds from our sale of shares to purchase Bounty LLC Units, together with an equal number of shares of Class B common stock, from the Exchanging Members (at a purchase price per unit and share of Class B common stock, based on the midpoint of the estimated price range set forth on the cover page of this prospectus, net of underwriting discounts and commissions) and (an as-yet undisclosed amount) of the net proceeds to fund future acquisitions of mineral interests; however, it currently does not have any specific acquisitions planned.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says that it is ‘remote that pending or threatened legal matters will have a material adverse impact on our financial condition.’

The listed bookrunners of the IPO are Raymond James, Stifel, and Stephens.

Commentary About Bounty’s IPO

BNTY is seeking public capital market funding to acquire additional mineral interests per its business plan.

The firm’s financials have shown higher topline revenue, growing operating profit and margin, and increasing cash flow from operations.

Free cash flow for the twelve months ended June 30, 2022 was $84.9 million.

The firm currently plans to pay dividends according to the following policy:

We expect Bounty LLC to initially pay quarterly distributions to us and the Existing Owners equal to 100% of [i] cash available for distribution and [ii] cash from lease bonus income, and that we, in turn, will pay quarterly dividends equal to the amount received from Bounty LLC net of cash taxes. From time to time, we may aim to balance the return of capital to investors with the selective allocation of capital toward acquisitions that we believe will be accretive to stockholder value while preserving a strong balance sheet through varying commodity price environments.

The market opportunity for natural gas derived from the Appalachian Basin is large, and the pricing environment is favorable due to recent natural gas market developments as a result of Russia’s war on Ukraine.

Raymond James is the lead underwriter, and there is no data on the firm’s IPO performance return over the last 12-month period.

The primary risk to the company’s outlook as a public company is the volatile nature of energy prices in recent years.

However, with the gradual reopening of the Chinese economy due to relaxed COVID-19 policies, demand for energy will likely increase in the period ahead, favoring natural gas producers and royalty companies such as Bounty.

I’ll provide a final opinion when we learn more IPO details from management.

Expected IPO Pricing Date: To be announced.

Be the first to comment