Jan Hetfleisch

Thesis

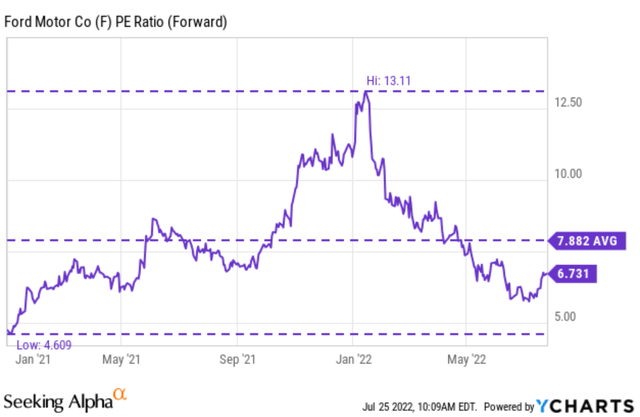

We have a young kid and have created a small UTMA (Uniform Transfers To Minors) account for him. We have set some buy limit orders for Ford (NYSE:F) in this account at $11 (corresponding to an FW PE of about 6.2x only as you can see from the chart below). And over the past few weeks, these orders have been triggered and we’ve accumulated some shares.

And this brings me to the thesis of this article – the developments that have compressed F’s prices to as low as $11. There are indeed some headwinds, rather strong headwinds, on the horizontal. And you will see that the challenging environment in China is a top one, followed by raw material costs and global supply chain disruptions. Also, there is also the possibility of an 8k layoff as mentioned in a Bloomberg report (unconfirmed by F though). These are things that I will be eager to hear management’s perspectives during the Q2 report.

However, for accounts (like our UTMA account) that can wait out these short-term issues, F’s current conditions will provide favorable return potential even if losing half of its earnings, as discussed immediately below.

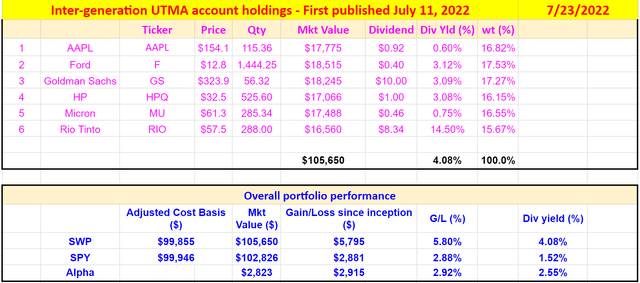

Our UTMA account holdings

More details of our UTMA can be found in our recent article or on this page from Fidelity (where our account is). In case it is of interest to you, the key considerations for us to have such an account boil down to 3 buckets. First and foremost, provide a nest egg for our son. Second, use it as an educational tool for him to learn investing and financial responsibility (it is a wish and we will see how it goes when he is old enough). And finally, it offers some tax advantages and the time horizon to accommodate more aggressive investment ideas. Our current holdings are listed below. A few notes:

- Due to the relatively small size of our account and the time horizon, we hold an even more concentrated portfolio than our other accounts. You should tailor your diversification and exposure accordingly.

- For performance tracing purposes, I used the prices on July 11, 2022 (the date I first published this portfolio) on SA as the entry price. So, it’s easier for readers to verify and track its performance even though I’ve been holding some of the stocks for a while. It is leading SPY by a small margin of 2.9% since then adjusted for dividends.

- Our actual portfolio size is substantially smaller and the $100k starting size for this model portfolio is just to simplify the math and suppress the role of rounding off errors.

Ford Q2 earnings: China and layoff in focus

Both the management and the market have already been concerned about the China front. As an example, the following Q&A exchange during its Q1 earnings reflected these concerns (abridged and emphases added by me):

Question from Mark Delaney (Goldman Sachs): … we’ve had unfortunately the war and also the new COVID restrictions pop up in China. I’m hoping to better understand how Ford is still managing to that 10% to 15% growth?

Answer by Jim Farley (F CFO): It really comes down to the commodities — semiconductor-related commodities that have been hamstringing us. We, obviously, are spending a lot of money on premium freight and other things to work around COVID escalations in China.

Answer by Hau Thai-Tang (Chief Industrial Platform Officer): In terms of China, we’re scaling the Shanghai area. We have about 50 Tier 1 suppliers there. Our focus is on our profit pillar vehicles, and as Jim mentioned really leveraging expedited freight. We’ve secured fast maritime shipment as well as airlift capacity to protect our suppliers. And then they’re just starting to have a white list process to allow suppliers to resume production. So we’re working with our teams on the ground in China to help those suppliers get partially operational.

However, despite management efforts, the most recent results from Ford China turned out to be even worse than anticipated. It reported the worst ever quarter since Q1 2020 (the peak of the COVID pandemic in China) with a 22% drop in vehicle sales. It sold only 120K vehicles in Greater China due to COVID-induced lockdowns and ongoing global supply chain problems.

Meanwhile, a Bloomberg report recently mentioned that F could cut as many as 8,000 jobs in the near future. Citing the comments provided by people familiar with the plan, the report further commented that the motivation for the layoff is to boost profits to fund its push into the electric-vehicle market.

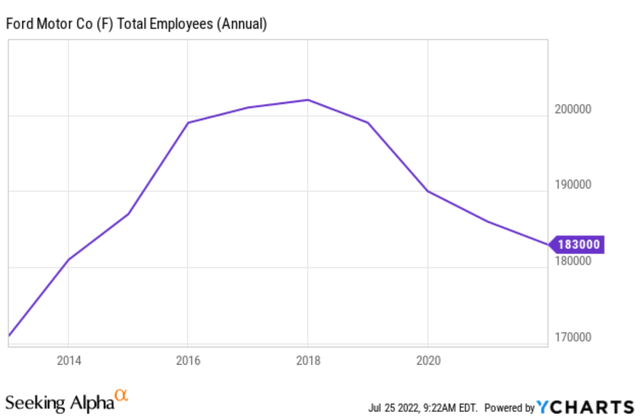

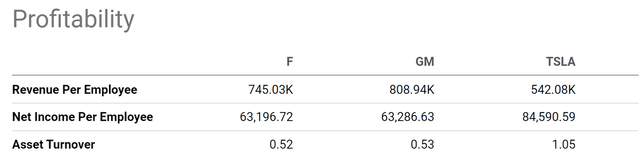

I will be of course eager to hear management’s comments on such a plan during the Q2 report. If the plan is confirmed, I feel sorry for the people who are about to be laid off. However, for the business itself, I won’t be too concerned as a long-term investor. As you can see from the following chart, for such a large business, its headcounts fluctuated by a few thousand routinely in the long term. And 8K is about 4% of its average headcounts. Furthermore, in terms of profitability metrics per employee, F indeed can use some efficiency improvements. As you can see from the second chart when compared to its peers, its revenue per employee is below GM and its net income for employees is below Tesla by quite a bit.

Product lineup

After the bad news, now some good news. I am impressed by F’s impressive product lineups – an important consideration in my investment thesis. A number of its recent launches have enjoyed huge success, including new iconic such as the Bronco, Bronco Sport, Maverick. At the same time, it boasts a robust EV lineup too including the Mustang Mach-E, E-Transit, and F-150 Lightning. Consumers are loving these products. For example, F-150 just began full production and has received more than 200k reservations. As another example, Consumer Reports picked the Ford Mustang Mach-E as a top EV pick for replacing Tesla Model 3.

Ford stock – Valuation and expected return

Onto valuations and expected returns. As detailed in our earlier article, in the long term,

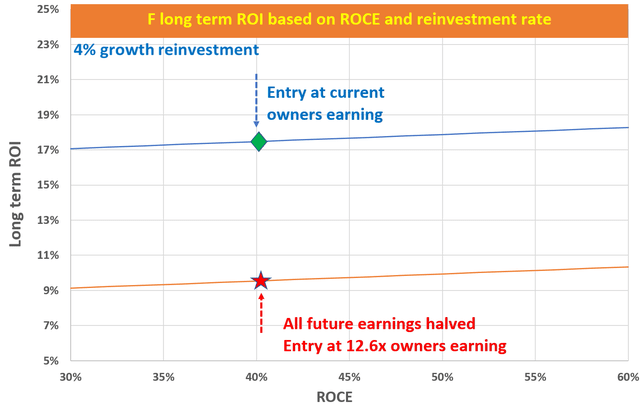

The ROI for a business owner is simply the summation of two things: A) the price paid to buy the business and B) the long-term growth rate of the business. More specifically, part A is determined by the owner’s earning yield (“OEY”) when we purchased the business. And Part B, the long-term growth rate, is governed by ROCE (return on capital employed) and the Reinvestment Rate.

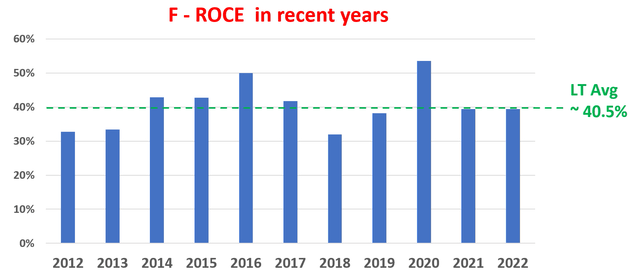

F’s ROCE is on average 40.5% as you can see from the first chart below. And as aforementioned, its current FW PE is only about 6.7x. Using its FW EPS as an approximation for its owners’ earnings, its OEY is more than 14.9%. Assuming a sustainable 4% reinvestment rate, the long-term growth rate would be about 1.6%. This is the real growth rate, and the nominal growth rate would be higher by the inflation escalator. So the total return in the long term at the current valuation would be around 17% as shown by the blue line and green symbol in the second chart below. The red line in the chart shows the case where F loses ½ of its earnings permanently. Now the OEY will be halved to 7.4%. Adding the new OEY to the growth rate would still give us a long-term return in the double-digit.

Final thoughts and other risks

For F, the gap between its long-term prospects and current valuation is too large to ignore. Admittedly, there are indeed some speedbumps in the near future. But for accounts that can wait out the short-term fluctuations, it is a good investment that offers favorable odds for double-digit return even if losing half of its earnings.

Back to the near term, besides the challenges in China and the layoff plan, there are a few other risks that I would pay special attention to during Q2. A key assumption in F’s guidance involves the pent-up demand beyond its order bank. It is a key assumption that needs to be rechecked given the new developments in macroeconomics over the past few months. The next one is commodity pricing and inflation. F expected commodity to cause a headwind of about $4 billion in Q1. As inflation showed no sign of relenting in Q2, it is another assumption that needs to be rechecked in Q2.

Be the first to comment