alvarez

Overview

The Global X Robotics & Artificial Intelligence Thematic ETF (NASDAQ:BOTZ) provides exposure to companies that are involved in industrial robotics and automation, non-industrial robotics, and autonomous vehicles.

The fund was created in 2016 and has a total expense ratio of 0.68% (4th cheapest among similar ETFs). Wisdom Tree and iShares provide similar offerings in the robotics and AI space with cheaper expense ratios.

Fund performance

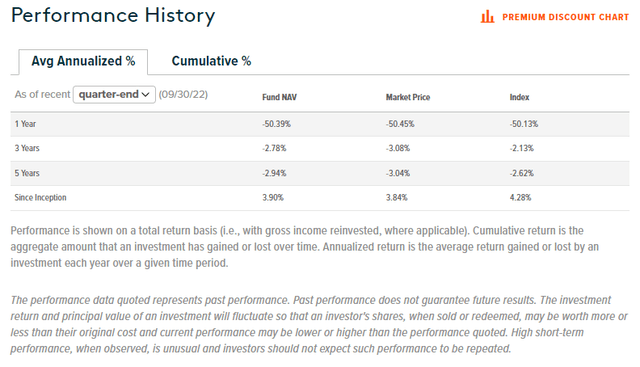

The fund has returned 3.84% per annum since inception, with an index tracking error of 0.44%. BOTZ is down more than 50% this year, suffering from sharp drawdowns in 2022 owing to rising rates and previously high valuations.

However, the sharp decline offers investors the opportunity to build long-term exposure in the robotics and AI thematic.

The fund’s performance can be seen below:

Portfolio

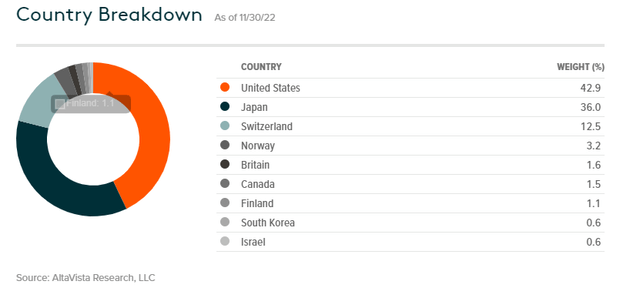

The fund is heavily weighted towards the United States and Japan, which represent 78.9% of the portfolio exposures.

On the other hand, the fund has no exposure to China, which has been the world’s largest industrial robot market since 2013 and accounted for 44% of total robot installations in 2020.

At the same time, the lack of China exposure hedges the fund against the intense technology war between the U.S and China.

The increased polarization between these two countries has created serious geo-political risks, which could significantly impact the fund.

For those interested, I recently wrote an article that covers the geo-political risks between the U.S and China in more detail.

The fund’s country breakdown can be seen below:

Global labor shortages driving automation

Global labor shortages are becoming an economic challenge for many developed and developing economies.

According to Korn Ferry, we can expect a talent deficit of 85.2 million workers across global economies by 2030.

The global labor shortage translates into $8.4 trillion of unrealized annual revenues – equivalent to the combined GDP of Germany and Japan.

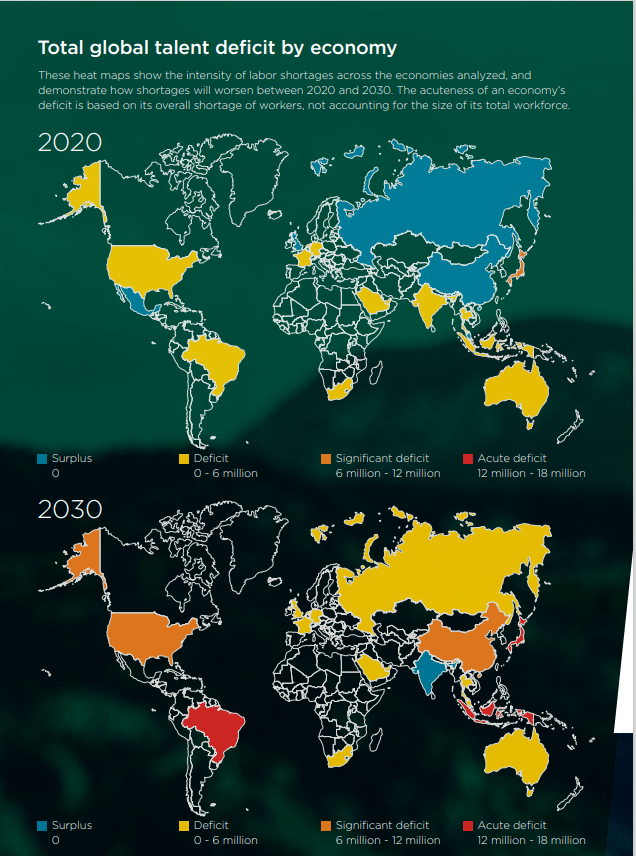

The maps below show the total global talent deficit by economy for 2020 and 2030:

Korn Ferry

The United States is expected to have a significant deficit of workers by 2030, whereas Japan is forecasted to have an acute deficit of workers.

These labor deficits will accentuate the need for robotics and automation in these countries, which will be beneficial for the fund.

India is the only country analyzed that can expect a talent surplus, driven by a growing working-age population.

Multiple catalysts for the robotics market

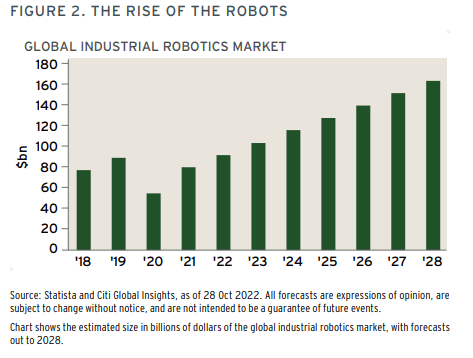

According to Citi, the global industrial robotics market is expected to double in size from 2021 to 2028 reaching $165.3bn in market size.

Citi

There are multiple catalysts behind the growing robotics market, including:

- Global labor shortages: The global shortage of workers will be a key driving force behind the adoption of robotics and artificial intelligence as discussed above.

- Geo-political risks between the U.S and China: A greater separation between the U.S and China is encouraging the onshoring of U.S manufacturing activity. Robots are the only solution to minimize the costs of relocating production facilities from a low-wage to a high-wage country.

- Wage inflation: The upward pressure on wages from high inflation will encourage the trend towards automation. Companies will be keen on integrating robotics into their business to reduce costs and to improve productivity.

- COVID-19 pandemic: The pandemic has highlighted the overdependence of supply chains on human labor. The pandemic has triggered a global transformation of supply chains to avoid future disruptions from pandemics or other global crises.

Conclusion

The BOTZ fund is ideally positioned to benefit from the rising adoption of robotics and automation due to a mixture of economic challenges such as global labor shortages, geo-political risks, wage inflation, and supply chain risks.

The sharp decline in the BOTZ fund offers investors the opportunity to build long-term exposure in the robotics and AI thematic.

I say BUY.

Be the first to comment