Tunatura/iStock via Getty Images

The bottom fishers are searching for stocks like Salesforce, Inc. (NYSE:CRM) as they approach their bottom. Portfolio managers were unloading CRM for over a year as it dropped from $312 to $130. Now it appears to be in the final stages of reaching the bottom, as executives bail out of the company. The final shoe to drop, usually creates what is called “exhaustion selling.” That happens when the last, long-suffering holders can’t take the latest bad news and just dump their shares on the market in disgust and finally move on.

Now the bottom fishers have become interested, as CRM finally hits bottom, providing a bargain price because their core business is still growing nicely. Usually as a stock hits bottom, the dead wood is gone and the successful operations are still attractive at what is now a bargain price.

What is that price for CRM? Let’s be generous and give CRM a P/E of 20 and based on next year’s projected earnings of $5.63 (listed on Seeking Alpha) that gives us a target of $113. As you can see, our calculated bottom is lower than where price is. Maybe that is why price continues to drop looking for a bottom.

The P/E of 20 is generous because CRM is not growing at 20%. The $5.63 in projected earnings by analysts is generous because of the bear market and executives exiting CRM. Usually executives stick around, if earnings are going to be great. Analyst projections usually drop during a bear market, so the projected earnings we are using may come down.

The Seeking Alpha quant ratings give CRM a “D+” rating for valuation. That is problematic in a bear market with revenue growth and earnings under pressure. For growth, CRM only gets a grade of “C” and that does not support a non-GAPP, high forward P/E of 27 vs 19 for the sector median. Revenues are projected to grow at only 11% next year. You can see that the high P/E is not supported by high growth. However, higher growth may return after the recession.

CRM only receives a “C-“ grade for momentum, but rings the bell with an “A+” grade for profitability and a “B+” for revisions. Bottom fishers will be interested in these high grades once price comes down and valuation improves. That will be the bottom for CRM. It is not there yet.

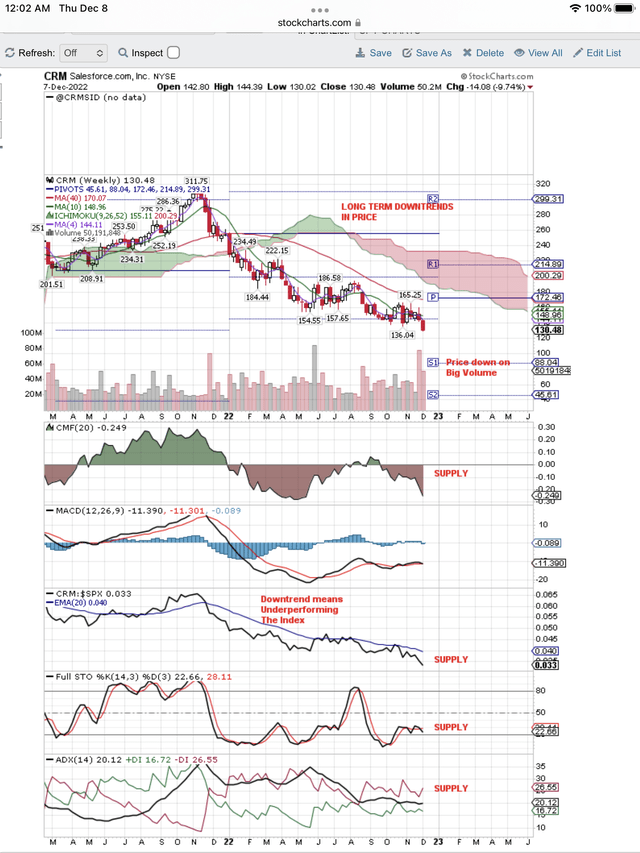

Here is our weekly chart showing all the technical sell signals. When these signals turn up, it will indicate the bottom fishers have started buying.

Salesforce Looking For A Bottom (StockCharts.com)

NOTE: Supply signals continue to take price lower until the bottom is reached. Then bottom fishing buyers come in and turn these signals up, as Supply switches to Demand readings on the chart.

Be the first to comment