nielubieklonu/iStock via Getty Images

Investment thesis

Borr Drilling Limited (NYSE:BORR) is a highly-levered offshore driller which was facing a major refinancing milestone by June 30. The company appeared confident in the refinancing during the last several months and the stock price benefited from the strengthening jack-up rig market in which Borr participates as drilling contractor.

However, on June 30, the company announced that the discussions weren’t complete and a two-week covenant waiver was granted by the relevant lenders in order to get more time to agree on the refinancing terms. Since this announcement, the stock has tanked leading up to the press release from July 14 that refinancing has been agreed to, but with the caveat in a second press release from the same date stating that this will involve raising up to $250 million in additional equity in August. Given the current market cap of about $380 million, this could be a massive dilution event, and the stock tanked -26% on July 14 alone.

So on the surface things look quite bad and could possibly get worse. However, I see two positive sides to the recent events:

- The strong downward price action over the last two weeks may have already adjusted the market expectations of the dilution to a worst-case scenario.

- Part of the $250 million can also be raised through asset sales and BORR obtained excellent pricing on its prior divested assets earlier in June.

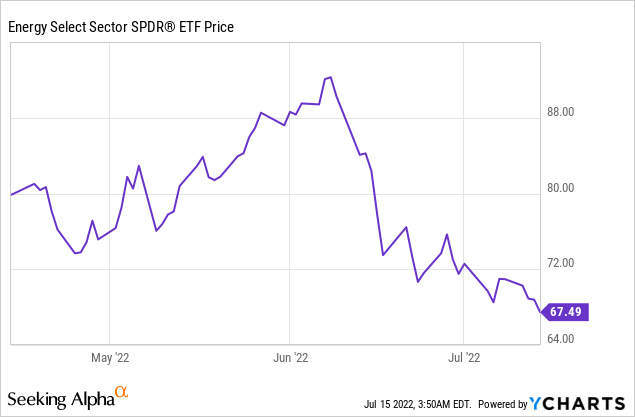

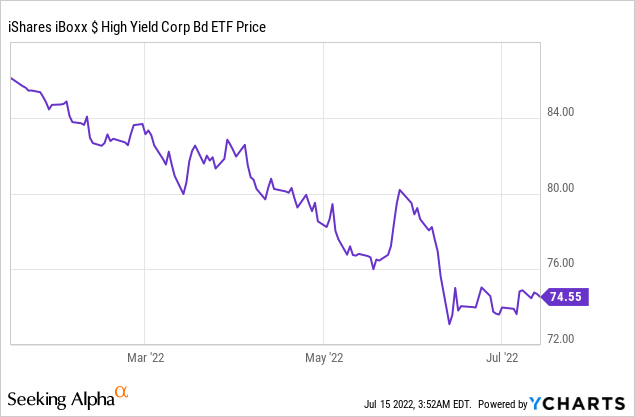

Macro risks remain though as the broader selloff in energy equities may continue. BORR is also going to be adversely affected if credit spreads widen further due to Fed tightening.

Background

BORR owns and operates modern and high-specification jack-up rigs suitable for drilling in water depths up to 400 feet. BORR has now a fleet of 22 rigs plus 2 under construction; 3 further rigs also under construction were sold very recently and another rig will be divested too. Borr Drilling was started by Norwegian tycoon Tor Olav Troim and was initially listed over-the-counter in Norway in 2016, following listings at the Oslo Stock Exchange and eventually NYSE.

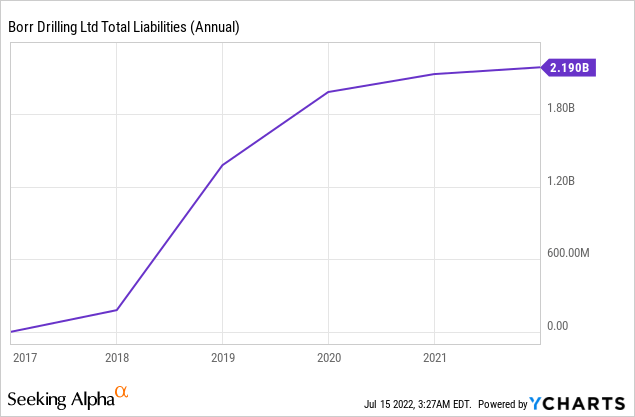

The company largely grew by acquisitions and asset purchases from Paragon, Transocean (RIG), Hercules and the Keppel FELS Limited and PPL Shipyard Pte Ltd shipyards in Singapore. The 2016-2020 years weren’t great for drillers so much of this growth was funded by debt, most of it from the shipyards themselves:

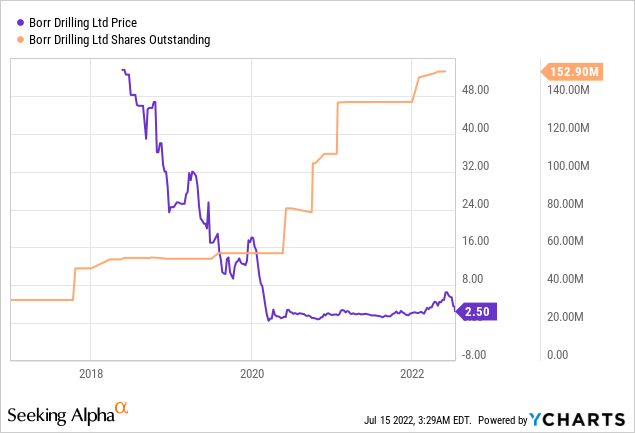

Equity was also diluted through issuances:

After the slide on July 14, BORR has about $380 million in market cap, $1.9 billion of debt and $50 million in cash. Currently, there are about 152.9 million shares outstanding.

BORR’s problem wasn’t just the amount of debt but also maturities falling in 2023, which effectively meant bankruptcy. A big step towards solving the problem was the December 2021 agreement with the shipyards to defer $1.4 billion in payments from 2023 to 2025. However, the big caveat was that BORR would have to renegotiate the borrowings from its non-shipyard creditors to have maturities falling after the new shipyard maturities in 2025. If no agreement was reached by June 30, 2022, then the shipyard repayments would still be due in 2023, which would put the company into a very difficult position; hence the importance of the June 30 date.

Throughout 2022, management appeared confident things would go well, including as recent as the earnings call at the end of May:

Our refinancing process is ongoing, and we are in discussions with our lenders with a view to complete the refinancing before the end of the second quarter. Given the strong market fundamentals, multiple options are currently on the table in order to address the maturity profile of our debt position and provide a long-term financing solution.

Some of these options include straight debt solutions, while others involve certain asset sales, of which there is ample interest in our fleet at attractive prices. We are currently working to improve on all refinance conditions given that the market is rapidly and positively evolving and believe a solution is achievable in the coming weeks.

That is likely why the market reacted so negatively when nothing happened by June 30, and instead we were hit with the notice of a two-week extension followed by the dilution announcement.

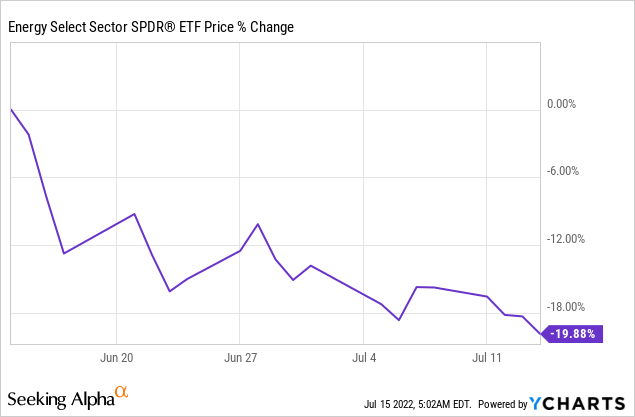

One possibility in my view is that the refinancing discussions ran into the macro headwinds. To say energy equities (XLE) haven’t done well since June 8 would be a huge understatement:

High-yield spreads (HYG) have also been widening (bonds falling) as money is becoming tighter across the financial system:

This may have changed the position of the non-shipyard creditors, who through a syndicated loan include Danske Bank (OTCPK:DNKEY), DNB Bank ASA and Citigroup (C).

Whatever the reason, the situation now appears to be as follows:

- Agreements “in principle” are reached with most of the secured creditors to extend the majority of secured debt to 2025

- After the agreements are in place, Borr will have long term financing of approximately $1.4 billion plus long-term financing on the 2 new builds with the shipyards for $ 260 million.

- Select assets will be sold and additional equity for “up to $250 million” will be raised in August

Given the current debt of about $1.9 billion, the math does seem to check out as total targeted debt reduction is indeed about $250 million.

The jack-up market is strong

Despite the macro headwinds, the underlying fundamentals for BORR have been quite strong lately. This is supported not only by dayrates and contract lengths, but also by the price achieved in rig sale transactions. Here are some examples:

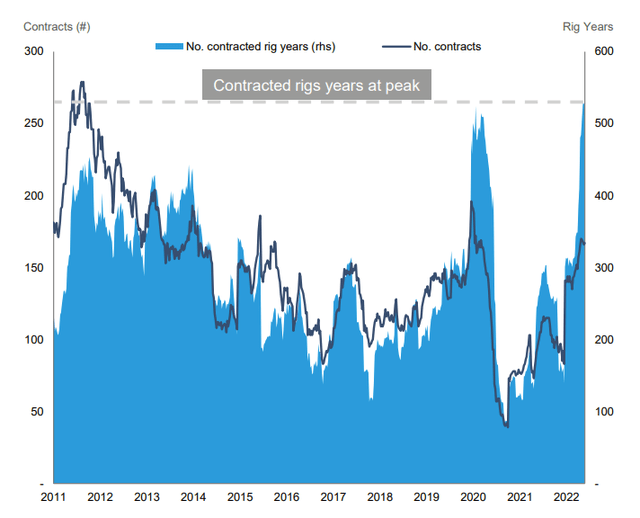

Contracted rig years are at all-time high:

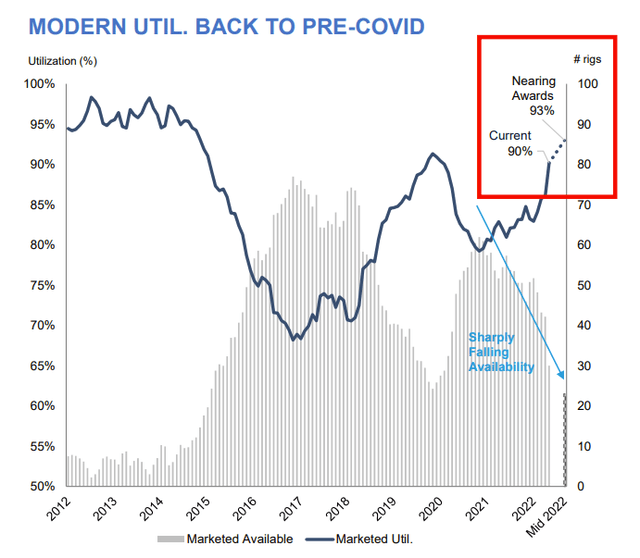

Utilizations are up, driven by demand in the Middle East including Aramco (ARMCO), as Gulf producers start executing plans to expand capacity:

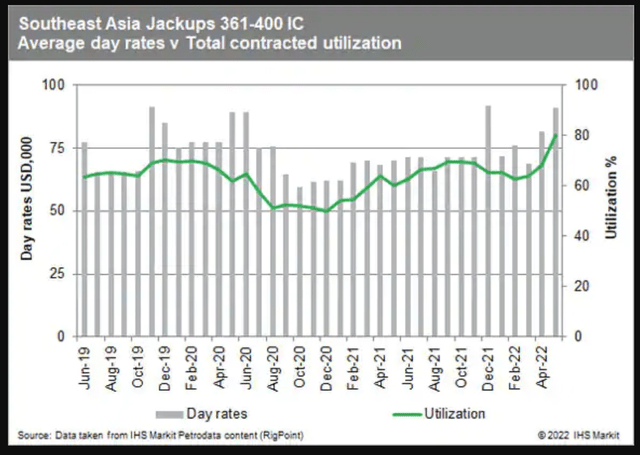

Dayrates are approaching $100,000 for the broader jack-up market:

BORR just announced too a binding letter of intent for its premium jack-up “Mist” from Mubadala Petroleum in Thailand for an estimated contract duration of 210 days and contract value of $25.2 million; this implies a $120,000 dayrate. BORR’s dayrates should exceed the market average due to the premium nature of its rigs.

Earlier in June, a deal was announced between BORR competitors Shelf Drilling NorthSea, a subsidiary of the UAE-based offshore drilling contractor, Shelf Drilling, and Noble Corporation (NE) for Shelf Drilling to acquire five jack-up rigs from Noble. This sale was prompted by UK anti-trust concerns in regard to Noble’s merger with Maersk Drilling and the rigs in question are older than BORR’s. Nonetheless, the implied $75 million value per rig shows a nice floor even when the seller is compelled to divest the rig.

BORR itself signed a letter of intent this June for the sale of 3 high-specification units, “Tivar”, “Huldra” and “Heidrun”, which are currently under construction with the Keppel shipyard, as part of the refinancing efforts. The total consideration of $320M, which will cancel the obligations to the shipyard, implies a value of about $105 million per rig.

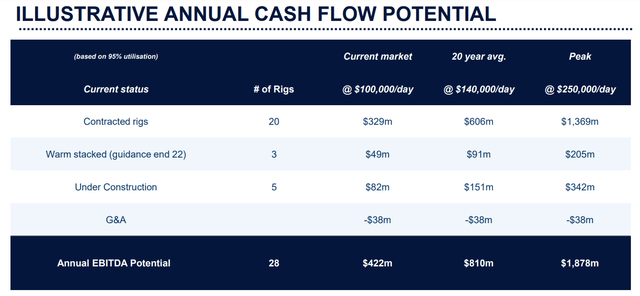

A strength of BORR is that its fleet is very new and boasts high specifications, so dayrates of $100,000+ are likely to be sustainable. From company perspective, this likely means a long-term annual EBITDA of $400 to $800 million:

At an enterprise value of about $2 billion, we are looking at quite cheap EV/EBITDA multiples of 3x – 5x.

The enterprise value also looks discounted from a liquidation perspective, if we assume the average rig can fetch $100 million. At 22 + 2 rigs after the refinancing, that should be somewhere north of $2 billion as well.

So what to make of the dilution?

I will reiterate that, as a headline, the dilution announcement looks very bad. How bad though? On the surface, the company has $380 million market cap now and will potentially issue $250 million in new equity in August. If I put an economist hat on, I would argue, ceteris paribus, the issuance of new shares won’t change the market cap as it doesn’t change the value of the assets. So the currently outstanding $152 million shares will need to adjust to a total value of $380 – $250 = $130 million to accommodate the newly issued shares. This suggests the shares should be worth about $0.85, a massive drop indeed from the $2.50 close on July 14.

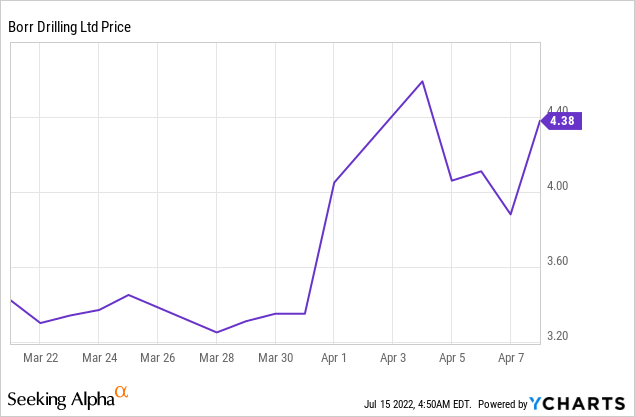

The market of anticipates the dilution though. Let’s take the June 30 announcement of the 2-week delay as starting point for the market repricing. While the final announcement came out on July 14, from following BORR over time, I feel that strong price action does precede major announcements by a few days. Look for example at the April 4 very bullish announcement of a several new contracts:

You can see that most price action happened before April 4. To be clear, I am not trying to imply there was trading on insider information. However, it is possible the contracts were already announced publicly a few days before, but the official press release didn’t hit the wires read by global investors until April 4.

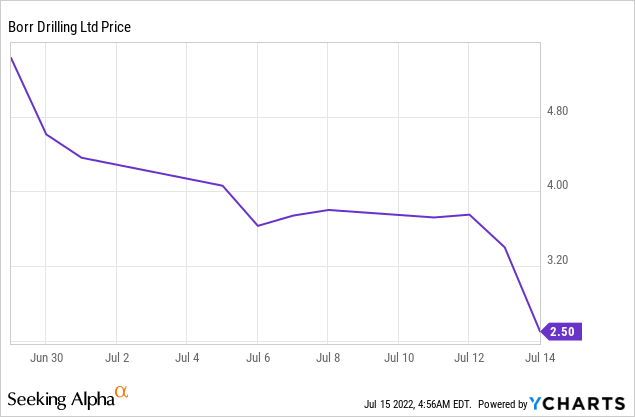

Anyway, coming back to the point, I find it reasonable to assume that the last price untainted by the dilution announcement is from June 29, before the delay announcement, whereas the July 14 close reflects the full absorption of the information by the market:

So we went from $5.43 to $2.50. I won’t bore you again with the dilution calculation, but if I repeat my math above, if the price was $5.43 before any hint of the equity offering, the implied share price when we found out $250 million of new equity will be issued should be $3.80. Therefore, you could even argue we have overcorrected already for the dilutive event.

I prefer not to go that far because the energy sector and oil prices (CL1:COM) also declined over this two-week period, so part of the adjustment was likely to reflect BORR’s perceived worse business prospects, not the dilution itself:

But based on this analysis, I don’t think it is farfetched either to say that at $2.50 the market has priced fully a $250 million offering.

The second important point here is that the $250 million offering announcement states “up to” the said amount. Asset sales are also on the table and, as I have shown, we have some very favorable recent comps. BORR doesn’t really have unencumbered rigs (i.e., not pledged already as collateral) to spare, but the recent comps suggest the value for which the rigs can be sold at the market significantly exceeds the collateralized loan amounts.

For example, as of December 31, 2021, jack-up rigs Saga, Skald and Thor were pledged as collateral for the $195 million Hayfin Loan Facility, one of the smaller loans subject to the refinancing discussions. If these rigs are sold for $100 million a piece, that could repay the facility and leave $100 million extra on the table. In divesting assets BORR will indeed be impairing its long-term EBITDA potential, but I think we are talking about only 1 or 2 rigs here out of 22 remaining in place plus 2 new builds still to be delivered.

Conclusion

Borr Drilling has been “living on the edge” due to its high leverage and near-term maturities. I expect the stock to remain very volatile as we get hit by company-specific news on the re-financing and equity offering progress over the next couple months. The macro headwinds aren’t helping either as even much better capitalized energy companies than BORR lost 30% of their market caps over the last month.

However, as it comes to the equity offering news, I would contend that the worst case is already reflected in the $2.50 price. In my view, further price drops from here could be justified by the macro environment worsening even more for energy (which is not my base case), so I am not calling a bottom by any means, but I do think the opportunity is already asymmetric to the upside.

Be the first to comment