martin-dm

Booking (NASDAQ:BKNG) is proving that it is a force to be reckoned with in the travel industry, and so far it seems to be the only company being able to give Airbnb (ABNB) some real competition in the alternative accommodation market.

Booking delivered solid Q3 results, with its customers booking 240 million room nights during the quarter, roughly 8% higher than in Q3 2019. The travel recovery continues around the world, with room nights in Asia surpassing 2019 levels for the first time in September. In particular, the company saw very strong average daily rate ADR growth, which helped drive a 27% increase in global gross bookings in the third quarter, or 41% on a constant currency basis, compared to Q3 2019. Importantly, despite the strong pricing environment the company reported that it has not seen evidence of its customers trading down to lower hotel star ratings or reducing the length of their trips. This resulted in excellent profitability for the company, with the third quarter being the first time that adjusted EBITDA surpassed pre-pandemic levels and also a new record for the company.

Other highlights for the quarter include the growing importance of the mobile apps, with about 45% of room nights booked through one of its apps in the third quarter. This is over 10 percentage points higher than in 2019. Another part of the business growing in importance is alternative accommodations, which saw room nights grow about 11% when compared to 2019, and now represents ~30% of Booking.com’s total room nights.

The company is also growing its competitive moat by implementing its own payments platform, and now ~40% of Booking.com’s gross bookings are processed through its own payment platform. This gives more control of the complete booking experience to the company, and might provide some profitability benefits in the future, although for the time being it is being run at about breakeven.

Q3 2022 Results

Revenue for the third quarter exceeded $6 billion, up ~20% versus 2019 and up about 34% on a constant currency basis. Adjusted EBITDA was $2.7 billion in the third quarter, about 7% above 2019.

Non-GAAP net income was $2.1 billion, which translates into non-GAAP earnings per share of about $53, up ~17% versus Q3 2019. On a GAAP basis, the company delivered operating income of $2.6 billion in Q3.

Financials

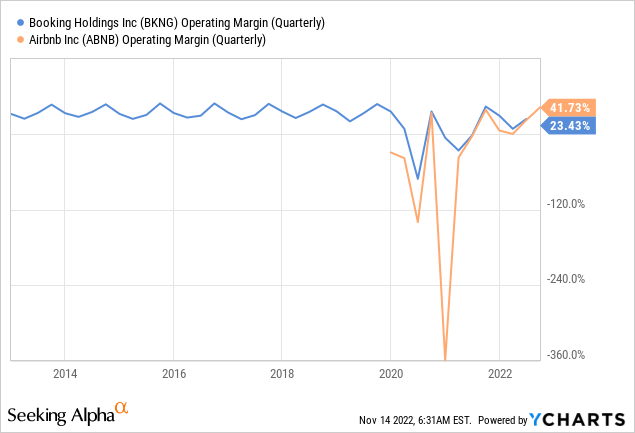

One thing we particularly like about Booking is that about two thirds of its expenses are variable, which gives the company a lot of room to adjust during downturns. For example, the company’s operating margin deteriorated a lot less during the worst part of the Covid crisis when compared to rival Airbnb.

Alternative Accommodations

Talking about Airbnb, the two companies are on a collision course, as Booking is increasingly adding alternative accommodation supply to its platform. It considers that offering all the different types of accommodations is an advantage, as some people could be looking initially for a hotel and end up reserving a home, and vice versa.

CEO Glenn Fogel has this to say during the recent earnings call with respect to alternative accommodation supply on the platform:

[…] more supply is better and it’s always the consumer’s choice of what they want to stay, where they want to stay. They want to stay in a home or villa, apartment or a hotel, that’s it. So in terms of overall, we do need to continue working hard at getting more supply of all types. I’ve talked many times in the past about our need for the single property, the home specifically that we need to build. I talk geography. I’ve always talked about we need to build in the U.S. even better. And one of the things is creating a better onboarding experience for people who own these properties, improving the payments for these people, coming up with ways they feel better about having some may stay in their property with an insurance type property. These are something that we have been working on that we brought out, and we’re going to continue to roll things out down the road to make it better for the owners and the managers of these properties to be willing to put it up on our platform.

Now I believe the — and this is what we’ve seen over many, many years is that as we bring more and more supply in, that will help us build the business. And I absolutely think that this is something that is not some is going to require some rocket science or some great thing that can’t be invented. People are doing this. We just need to continue to work on it, put people to work, create the things necessary, and we will roll this out on the is taking longer than I would like, but I am very pleased with where we are. And I think some of the numbers that we’ve talked about are encouraging.

Balance Sheet

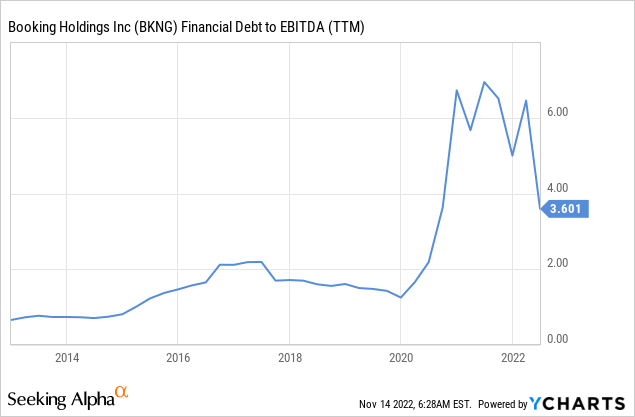

The balance sheet remains strong with plenty of liquidity, the company ended Q3 with cash and investments of $11.8 billion, down versus the Q2 ending balance of $14.2 billion. This was primarily driven by about $2 billion in share repurchases in Q3, as well as unrealized losses on its equity investments. Booking has repurchased ~$4.2 billion in the first 3 quarters of this year, and has reduced the share count by ~5% relative to the ending share count last year. With earnings and EBITDA recovering, the company’s leverage has come down significantly. The financial debt to EBITDA ratio for the trailing twelve months now stands at ~3.6x.

Guidance

Booking expects Q4 adjusted EBITDA to be over $1.1 billion. If it were not for the foreign exchange impact on earnings, the company would have expected the coming Q4 earnings to be higher than Q4 in 2019. In general the company sounded relatively optimistic during the earnings call about the booking trends it is seeing.

Valuation

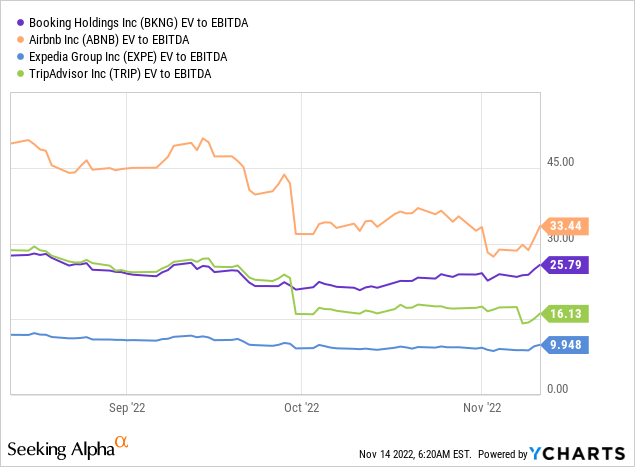

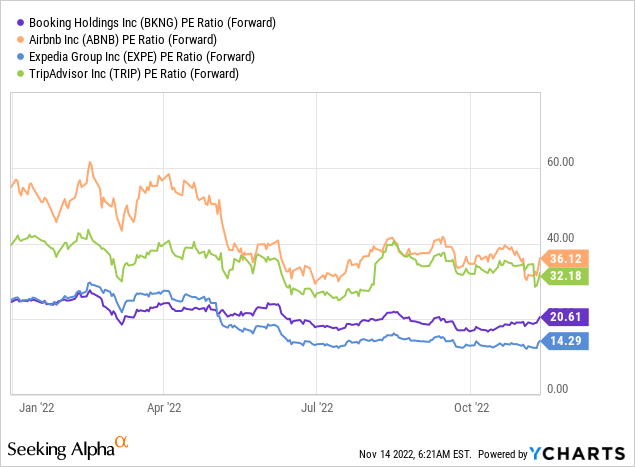

Even though Booking does not have the cheapest valuation in its industry, we believe it is one of the best investment options in the travel sector. This is a very well-managed company that is gaining market share, and it is a strong competitor in the increasingly important alternative accommodation market. Despite not paying a dividend, the company has been returning large amounts to shareholders in the form of share repurchases. In fact, over the last 5 years it has reduced the share count by ~20%. Not surprisingly, it is trading at a higher EV/EBITDA compared to Expedia (EXPE) and Tripadvisor (TRIP) , but still a lower multiple when compared to Airbnb.

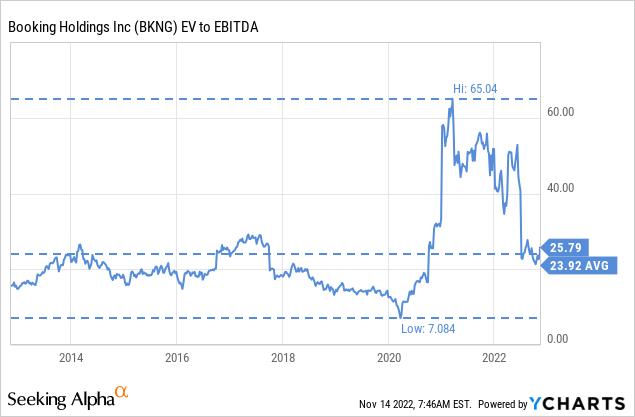

When compared to its own history, Booking is trading below its ten year EV/EBITDA average by about 10%.

In terms of the forward price/earnings ratio, only Expedia is trading at a cheaper multiple. Still, we prefer Booking given its excellent results and execution of its business plan. For comparison, Tripadvisor recently tumbled nearly 20% on a profit miss and weak guidance, while Expedia also went down significantly after falling short of expectations. We think the entire sector can benefit from the travel recovery trend, and the valuations of Expedia and Tripadvisor already appear to discount some of the problems they are facing. That said, based on the most recent results and the current valuations we like Booking the best among these four companies.

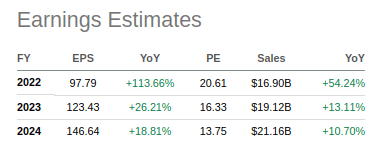

One final point on valuation for Booking. While a forward p/e of ~20x might not scream cheap, analysts expect significant earnings growth the next couple of years. Based on fiscal year 2024 earnings estimates, the forward p/e is an undemanding ~13x.

Seeking Alpha

Risks

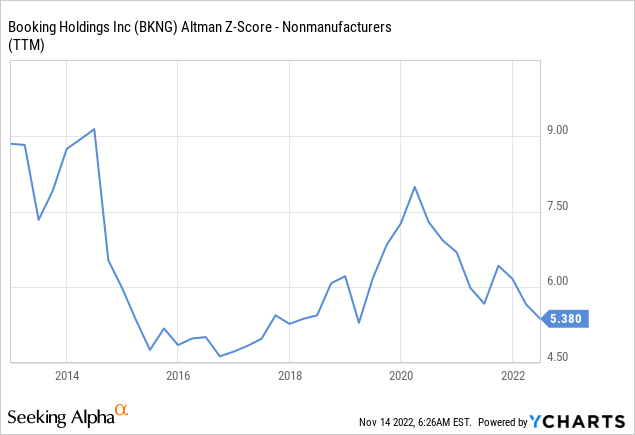

As an industry leader with significant scale and solid profit margins, we consider Booking a lower risk investment option compared to some of its competitors. Nevertheless, the travel industry is very competitive, and also significantly impacted by discretionary income. One of the easiest cuts consumers can make during a recession is on travel. Fortunately Booking has a solid balance sheet and a high Altman Z-score, which mitigate this risks and help the company weather difficult economic periods.

Conclusion

We were positively impressed by Booking’s Q3 results, and now consider the company to be the most attractive option among its competitors. It is on a collision course with Airbnb as it grows its alternative accommodation business, and it is probably one of just a few companies that can actually put a serious fight against Airbnb. The valuation looks quite reasonable, especially when looking at future earnings estimates. The company does not pay a dividend, but has been returning significant amounts of capital to shareholders in the form of share repurchases. In summary, we believe Booking to be one of the best investment options in the travel sector.

Be the first to comment