agrobacter/iStock via Getty Images

Investment Idea

A strong rebound in the travel industry will benefit the entire sector. Since Booking Holdings Inc. (NASDAQ:BKNG) has a dominant position in the online travel industry, we expect it to rebound. We like the equity story, but we would not pay for growth as their competitive advantage is currently strong in the accommodations segment and not in the new divisions the company is trying to introduce itself to by mergers and acquisitions. It is always good to remember that moats are not always company-based. Sometimes a company has excellent dominance with one of its products or segments. Still, it doesn’t mean they will deliver the same results in other new ventures, even if they are related to the firm’s primary industry.

We believe that zero percent growth is pretty valued at the current market prices, and we will always seek enough margin of safety. Our Intrinsic valuation is around USD 1,850 per share. We need to guess the execution of the current and future acquisitions, and those executions can be risky, and there are almost no assets to back up the value or any margin of safety.

So, we will look to go in once we have a desired margin of safety. We are looking at an entry price close to USD1,600 per share and an exit price of around USD 2,000 per share.

Booking at a glance

Booking Holdings is the leading provider of online travel and related services, operating in more than 220 countries and owning several fare aggregators and meta-search engines, including six primary brands.

Booking: Dutch online travel agency for lodging reservations and other travel products.

Agoda: Singaporean online travel agency for hotels, vacation rentals, flights, and airport transfers.

Kayak: American online travel agency and Meta Search engine.

OpenTable: American online restaurant reservations service company.

Priceline: American online travel agency for finding discount rates for travel-related purchases such as airline tickets and hotel stays.

RentalCar: British rental car service

Booking has three significant sources of revenue:

Agency revenues are derived from travel-related transactions and consist almost entirely of travel reservation commissions from accommodations, rental cars, and airline reservation services. Booking invoices the travel service providers for their commissions after travel is completed.

Merchant revenues are derived from transactions that facilitate travelers’ payments for the services provided, generally at the time of booking. Merchant revenues include travel reservation commissions and transaction net revenues (i.e., the amount charged to travelers less the amount owed to travel service providers), credit card processing rebates, customer processing fees, and ancillary fees, including travel-related insurance revenues.

Advertising and other revenues are derived primarily from A: revenues earned by KAYAK for sending referrals to online travel companies (“OTCs”) and travel service providers and B: for advertising placements on its platforms and revenues earned by OpenTable for its restaurant reservation services and subscription fees for restaurant management services. The last period of normalized earnings was 2019, when consumers booked 845 million room nights of accommodation, 77 million rental car days, and 7 million airplane tickets using websites owned by Booking Holdings, reporting a net income of USD 4.8 billion.

Booking primarily operates in the hotel industry, flights, rental cars, and airport taxi services. They also work in the attractions industry, offering the activities to be done in that area.

Booking came up with the digitalization of the industry and built its platform on which hotels could register themselves and offer their services, changing the whole dynamics of the industry. Now people can search and compare different hotels in terms of prices and quality of services, which can now be reached from the reviews people have given.

Booking went into this industry further and developed a strong relationship with the customers and the hotels with their loyalty and incentive programs. For some small hotel chains, BKNG is now a primary source of income, and for hotels, The company also has incentives and loyalty programs. Some years back, the company introduced the option to add your payment details on the Booking platform and pay directly from it for all the services the hotel industry has to offer; this has been a huge success which we can see from the growth in this revenue stream (Merchant revenue). The platform is now such a central piece in the hotel industry that it has gained a solid competitive advantage in this sector.

Regarding Flight operations, Booking has started to expand in this non-accommodation industry with a surprising increase in airline tickets booked, from 7 million in 2019 to 15 million in 2021. The issue with this sector is that there isn’t such a big pool available like hotels to search from. People can just directly call the agencies and have a few options available. Also, the competitors in this segment, GoogleFlights, and GotoGate, pose a real threat as Google has vast resources to expand and is already preferred by many consumers in this segment.

The main issue, in our opinion, is the lack of payment on the platform for several technical reasons. So, when you start booking a flight, Booking’s platform will reroute you to other websites two or three times before landing you ultimately on the airline’s website, which is a real deal breaker for most people. Also, when the taxes are added later, the airline ticket seems a lot more expensive than the ones initially advertised on the Booking’s platform. These are the issues that pose a real threat to Booking in flight operations.

The airport taxis and rental car services Booking provide doesn’t have a big pool to choose from compared to the Hotel industry. So, people can quickly call the agencies directly and hire them. It also depends on the preference of the consumers. People nowadays mostly prefer services like Uber, and this is a $46 billion company whose primary service is to provide means of transport. So, the competition with local service providers and other companies and the lower margins in the non-accommodations business make us a bit skeptical about the future of this segment.

The Attractions segment is where you can go on the Booking’s platform, book the activities you want, and pay directly on the platform. This is a segment where Booking has an excellent growth opportunity. GetYourGuide has shown impressive growth in this section. We expect the company to grow more in this segment.

Recently Booking has been working to achieve Connected Trips, meaning they want to have a platform where a person can book the whole trip “Airline tickets, hotels, Airport Taxis, Rental cars, Restaurants, and other attractions.” This is a long-term vision of the management, and they are working on this, as we can see from their acquisitions.

After being recently hit by Covid, Recovery in the travel industry from the low points of covid (as witnessed by SGI World Travel and Leisure Index) and in Booking is well underway. Gross bookings from reservations of room nights, rental car days, and the airline made through both of the revenue streams Agency and Merchant for Q1-22 were a record USD 27 billion & 7% up from Q1-19’s level.

M&A Discussion

We know that Booking’s growth over the years has come from acquisitions.

Booking is acquiring companies not just for growth but also for expanding into the non-accommodation business; just recently, they have spent $3.1 billion on acquisitions in two months for both of the reasons explained above. One co. is Getaroom which is a perfect example of spending for growth as booking already has expertise in this segment. The other is Etraveli which is acquired to expand into non-accommodation flight operations & achieve the connected trip vision.

Since Booking doesn’t report the valuation of targets acquired and premiums paid or the segmental data to understand better, below is a discussion of the acquisition’s “General Risks.”

Companies generally get addicted to this form of growth because it’s both an easy and fast route of growth, and because of this, companies lose internal efficiencies.

The cost of this fast and relatively easy growth route always has an extra price in the form of premiums paid in acquisitions like Booking acquired Opentable at 46% premium and Kayak at 29% premium. These are based on the day shares were bought by Booking. Based on the pre-announcement prices, these premiums would be even more.

After companies acquire at such high premiums, the question is whether there will be enough synergies. The main risk is that companies mostly have motives to overstate synergies to justify their acquisitions and expand more quickly. To achieve this, they may pay too much at the cost of destroying value.

These synergies come from economies of scale, best practices, sharing of capabilities and opportunities, and often the stimulating effect of the combination of companies. It takes only a minimal error in estimating these values to cause an acquisition effort to stumble.

Other mistakes involve Risk transfer, using your WACC when valuing an acquisition target, assuming your own business and financial risk rather than the target’s, and undermining or overstating the target’s risk profile. Another issue with external growth is the availability of funds. Sometimes the cost of equity is so high, and debt might come with too many covenants, crippling your decision-making. So, in scenarios like these growing through acquisitions might not be possible.

The issue is that we don’t know for sure that the money spent on acquisitions can create value with synergies because we don’t have any evidence from the company that this is happening and will continue to happen.

On the other hand, it is worth mentioning that the acquisition of Booking.com by Priceline group has been one of the most successful and value-creating acquisitions. Also, the acquisitions of Opentable and Kayak at high premiums mentioned that even though Booking failed to increase their operating margins significantly, they pushed Booking to a $15 billion revenue company from $9 billion in 5 years, an impressive 67% growth.

One assuring thing is that right now, Booking has a share repurchase program going on. In Q1-22, they purchased 486,112 shares for an aggregate cost of $1.1 billion, implying a per share price of 2263, and now have a $9.5 billion approved amount left for repurchase, which they plan to complete in the coming three years. Although there has been a bond covenant in place since October 2020 which restricts the company from declaring dividends and repurchasing shares before achieving certain performance obligations, Booking has been reaching those. It has been able to complete share repurchases so far. So, we don’t consider this an issue going forward either.

Financial Analysis & Valuation Angle

Comps. based valuation is not suitable for this stock as it’s a leading Company in its industry and can’t be compared to the second largest company Airbnb because of different business models, revenue streams, etc. Compared to the third most prominent company in the online travel industry, Trip.com has a market Cap diff of $56 billion, which tells a lot about the position of booking in its sector and the inappropriateness of comps. Based valuation.

Initially, we wanted to do a DCF for all of the segments individually in which booking is operating to have a better understanding because, as explained, it doesn’t have a moat in all segments, so we as value investors don’t want to pay for growth in segments where it doesn’t have a moat, Also each segment has its dynamics, different competitors, different margins, different growth rates but we were unable to find the required data as Booking is not reporting its segmental information.

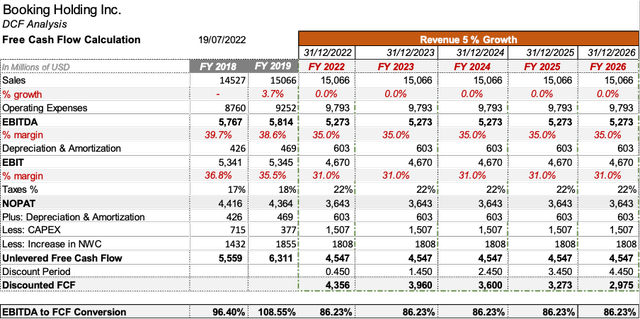

So, to deal with all those issues, we have approached this valuation using a 5-year single-stage DCF Model with 0% growth in the next five years to understand the stock value with no development implied. We can assess different scenarios using sensitivity analysis. We are using 1.9% terminal growth.

Booking has spent $873 million yearly on acquisitions for the past ten years. Considering this, our expectations for future capital expenditures, including maintenance, are at 10% of revenues per year.

One of the revenue streams of Booking is merchant revenues, in which cash payment is received in advance by the company. These advance payments help them manage their working capital, so they have had negative working capital requirements for the last 12 years, positively impacting free cash flows. Considering the average Net working worth of the normalized periods before 2020, we are using NWC at 12% of the revenues per year.

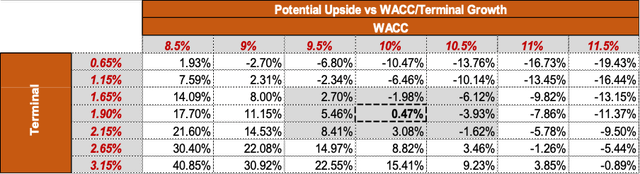

Booking has had issues maintaining operating margins from 42% in 2013 to 35% in 2019, with an average of 38% in 6 years. They have recently sold their customer care operations to their long-term partners in meeting seasonal demands “Majorel” and are now expected to save $124 million per annum, positively impacting margins.

With the increase of non-accommodation businesses like flight operations as a percentage of total trade and the fact that they have lower margins in this segment, operating margins are expected to be negatively affected. Also, to the extent that Booking is increasingly processing more transactions on a merchant basis, they incur a greater level of merchant-related expenses, negatively affecting the margins.

Considering the operating margins discussion and being conservative, we are using an operating margin of 35%. Given an inflationary Macro Environment, increase in interest rates, and current market conditions, we are using a WACC of 10%, D&A of 4% of revenue, and a tax rate of 22%.

Based on these assumptions, our equity valuation is in the region of $1,853 per share, giving a potential upside of 0.47%.

DCF table 1 – BNKG by Antonio Velardo – (Moat Investing) DCF table 2 – BNKG by Antonio Velardo – (Moat Investing)

Sensitivity analysis

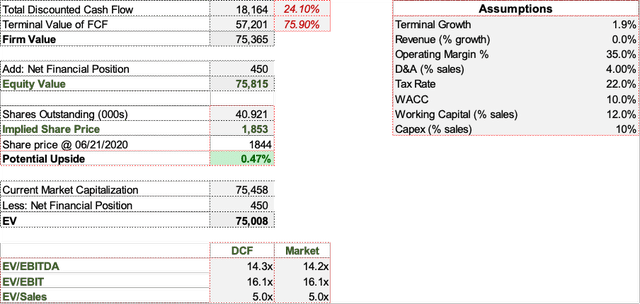

We have performed a sensitivity analysis on the primary value drivers affecting the potential upside. It is worth noting that around 78% of the equity value is based on the terminal value. Thus, our valuation is extremely sensitive to WACC and Terminal Growth changes. Also, since we are in an increasing interest rate environment, it is helpful to see the valuation under different WACC and terminal growth scenarios. The following table shows a sensitivity analysis of the potential upside and downside concerning our intrinsic equity value.

Sensitivity analysis by Antonio Velardo (Moat Investing)

Considering our Operating Margins discussion, the table below shows the sensitivity analysis, which is quite helpful in understanding this impact.

Sensitivity analysis by Antonio Velardo (Moat Investing)

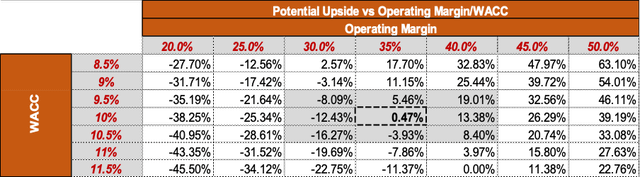

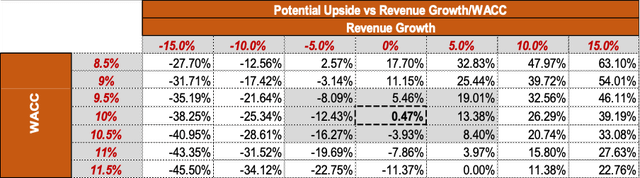

Since we assumed a zero percent revenue growth, it’s interesting to see how Booking performs at different revenue growth rates. Looking at average revenue growth rates of 18% for the past five years before Covid, the sensitivity analysis below dramatically helps to understand the impact revenue growth may have on the stock valuation.

Sensitivity analysis by Antonio Velardo (Moat Investing)

Conclusion

Our Intrinsic valuation based on the above valuation model and assumptions tells us that the stock is fairly valued at around USD 1,850 per share. We need to guess the execution of the current and future acquisitions, and those executions can generally be risky. Also, there are almost no assets to back up the value or any margin of safety.

So, we will look to go in once we have a desired margin of safety. We are looking at an entry price close to USD1,600 per share and an exit price of around USD 2,000 per share.

Be the first to comment